Good Evening,

The FOMC statement was released at 2:00 PM ET and it stated that any rate hike decision would not be dependent on the calender and would be data dependent, mostly in reference to jobs and inflation. When you add it all together, it means no rate hike at this time. The economy is too soft and the recovery is too slow to support it. In first response, the market started to move back up after some selling in the morning, but rolled over and finished lower in the afternoon. There wasn’t anything in the statement to give the market any juice. Everything remains the same. In my humble opinion, the market continued to head in the direction it was already going– down. This market was already showing signs of weakness and once it saw that there were no surprises in the FED statement, it went on about its business. Bio-techs and small caps continued to show the way down, joined by energy sensitive stocks such as airlines and retailers that were responding to higher oil prices. As usual, we’ll just have to take a look at the charts and see where this thing is going. One really has to ask themselves what the price of all this quantitative easing will ultimately be. Not to be dour, but my bet is it probably won’t be good…..

The day’s action left us with the following results. Our TSP allotment dropped -0.717% on the day. For comparison, the Dow lost -0.41%, the Nasdaq -0.63%, and the S&P 500 -0.37%. Oh well, we’ve had a good run recently and I thank God for that!

Wall St. ends down after Fed statement, GDP data

The day’s trading left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Neutral. We are currently invested at 23/C, 14/S, 63/I. Our allotment is now +5.63% on the year, not including today’s results. Here are the latest posted results:

|

TSP Share Prices

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

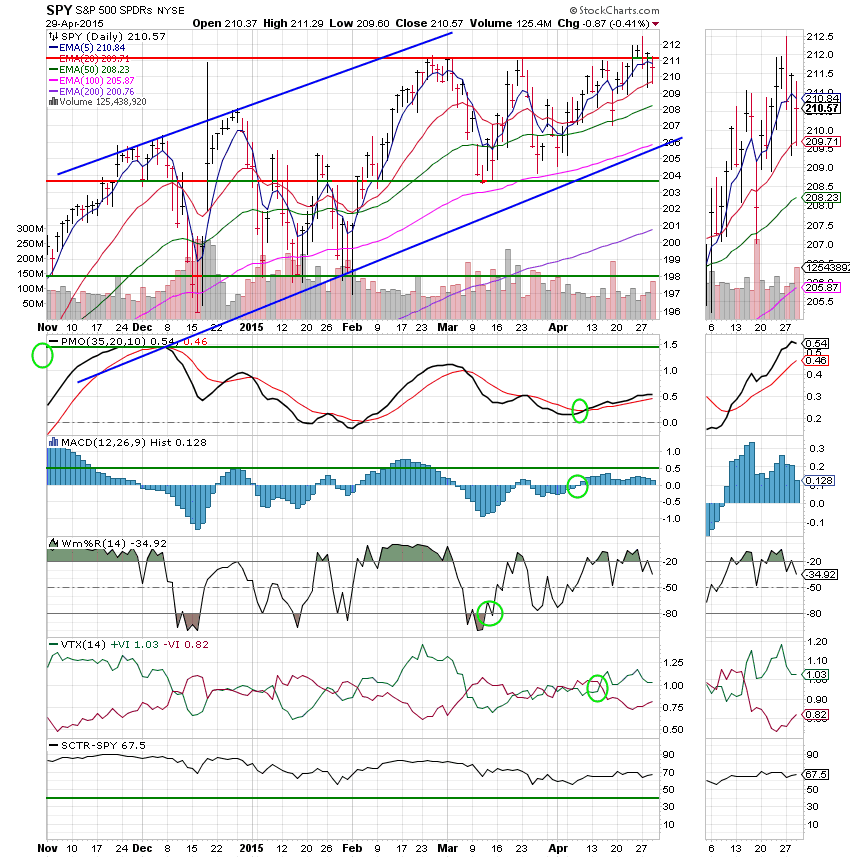

Let’s take a look at the charts: Our broad index funds really don’t reflect the underlying weakness that was present in the market today.

C Fund: The C Fund held up relatively well, although price made a moderate drop it still closed well above its 50 Day EMA (Exponential Moving Average). All indicators remain in positive configurations giving an overall buy signal for this fund..

S Fund: All signals continue to weaken for this fund. However, price is still above its 50 EMA so the signal remains at Neutral. One positive is that the Williams %R reached the bottom of its range. Each time in recent history that it has reached this level it has bounced. The S Fund led us down, now maybe it will lead us back up.

I Fund: The I fund took the biggest hit of any of our TSP Funds today although we really can’t complain as it has had such a good run in recent weeks. The chart remains strong with all indicators in positive configurations for an overall buy signal. Price is still well above support at around 66.60 and well above its 50 EMA. Most of the indicators did show a little stress today with the price drop but nothing serious yet. I’m still bullish on this fund for now!

F Fund: The F Fund continues to deteriorate as bond yields head higher in the US. Foreign bond yields particularly those in Europe are rising and our bond yields are often affected by them. It’s complicated and I’m not sure I understand the mechanics of it enough to explain it, but I know from experience that the relationship exists. However, you don’t really have to know that to see that this chart is getting weaker. Price today dropped below it’s 50 EMA with all five of the charts indicators already in negative configurations. However, the signal is still Neutral (not sell) because the 20 EMA remains above the 50 EMA. If that were not the case, this fund would be on a sell signal. We will keep a close eye on this key indicator. The best thing to do right now is to stay away from bonds. If you feel the need to protect you money put it in the G Fund.

I’m not sure if this dip is over just yet or not. Small caps are starting to get a little extended to the down side so we’ll watch them closely to see if they bounce. That would be a good sign that we’re heading back up. Until then we need to watch our charts and be ready for damage control should the market decide to take the month of May off. That’s all for tonight. May God continue to bless your trades! Have a nice evening and I’ll see you tomorrow!

God bless,

Scott![]()