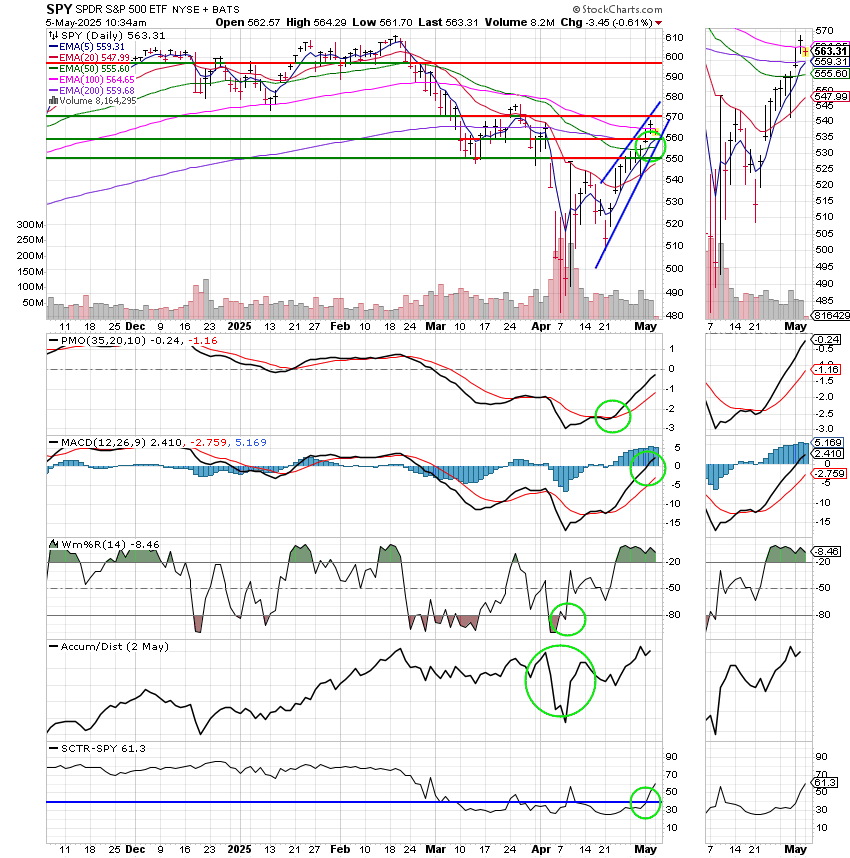

Good Morning, Inevitably, we will have a down day and today is it. Believe it or not the S&P 500 has gone up the past nine sessions and it’s been a long time since it’s done that. So a down day today is not so bad. The recent run has pretty much put things back to where they were prior to the declaration of the trade war and that’s what tariffs are….war. Especially with regard to China, but that’s another discussion for another day. The current streak puts the major indices right back square in the middle of a trading range between 5500 and 5800. That is likely where they will remain until the tariff situation is for the most part resolved. Put in simpler terms for you new investors, prices will move higher and lower within that range. When the inevitable breakout from this range will occur is anybody’s guess. So all you can do is remain positioned (invested) in order to take advantage or the uptrend that will be a result of the end of this situation. I hate to keep repeating the same thing over and over again but that’s simply what happens when the market is in a trading range. You wait patiently for it to resolve (hopefully to the up-side). So what are a few factors that could move us higher in the short or even long term? First and foremost as always is the Fed. This months meeting actually starts tomorrow and ends on Wednesday. It is widely agreed upon by investors that the Fed will hold rates steady at this meeting. There had been some speculation that they might decrease rates at this meeting but last weeks better than expected jobs report killed any chances or that taking place. Had the jobs report been worse then the Fed would have been forced to consider lowering rates to spur employment as part of their dual mandate. Such as it is though, they are in no hurry as the other part of their mandate remains somewhat of a problem with the rate of inflation remaining persistently above their preferred level of two percent. However, whenever it occurs, a drop in rates will definitely move the market. Most investors think that will occur in July, but there are no guarantees. Also worth noting is that many market players think that the tariffs will result in higher inflation and delay further rate cuts for the foreseeable future. It is important to note though that the Fed believes any such effects to be transitory. We will see. The second thing that could move us higher would be any trade agreement period. It is important to note that these things take time and while the market isn’t picky in this area it does want to see some progress. Heretofore it has had none. A trade agreement of any kind would most definitely move us higher. Lastly and related to the tariff situation are corporate earnings. Specifically the forward guidance that companies give with regard to the tariffs. Good guidance will move us higher and poor guidance will move us lower. Also, to a lesser degree, corporate profitability must not diminish. If it does, that could also be viewed as a negative effect of the trade war. So…..with all this considered, we wait.

The days trading so far has produced the following results. Our TSP allotment is trading a little lower at -0.19%. For comparison, the Dow is -0.15%, the Nasdaq -0.72%, and the S&P 500 -0.59%.

Dow drops more than 100 points, S&P 500 set to end 9-day winning streak: Live updates

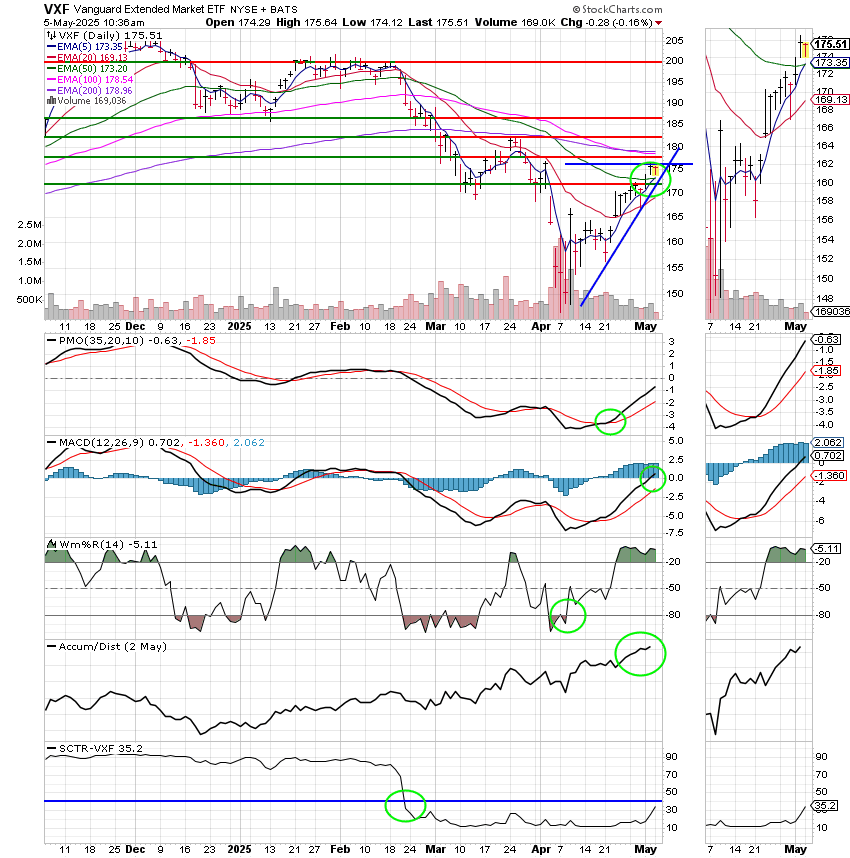

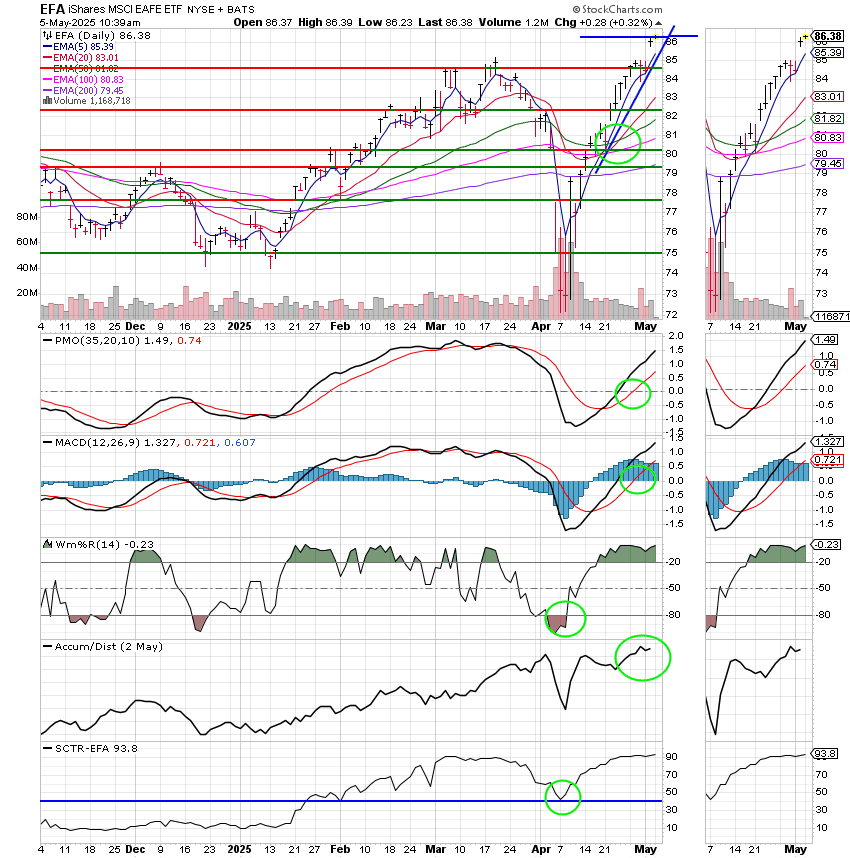

The most recent action has generated the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now back in the green at +0.00%. Now lets make some money! Here are the latest posted results:

| 05/02/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.0355 | 19.9398 | 90.215 | 83.742 | 46.3334 |

| $ Change | 0.0022 | -0.0903 | 1.3125 | 1.8186 | 0.8280 |

| % Change day | +0.01% | -0.45% | +1.48% | +2.22% | +1.82% |

| % Change week | +0.08% | -0.30% | +2.94% | +3.42% | +2.79% |

| % Change month | +0.02% | -0.78% | +2.12% | +2.81% | +1.46% |

| % Change year | +1.50% | +2.37% | -2.92% | -7.11% | +10.59% |

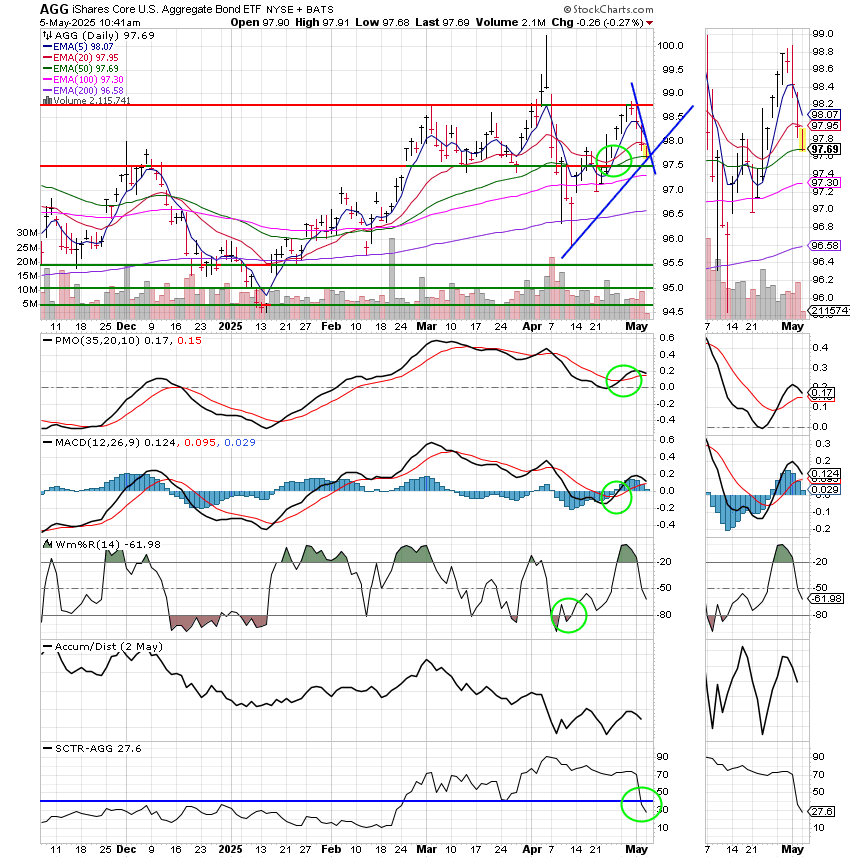

F Fund:

Nothing to add here. We just need to keep an eye on our charts. That’s all for this week. Have a great day and may God continue to bless your trades’