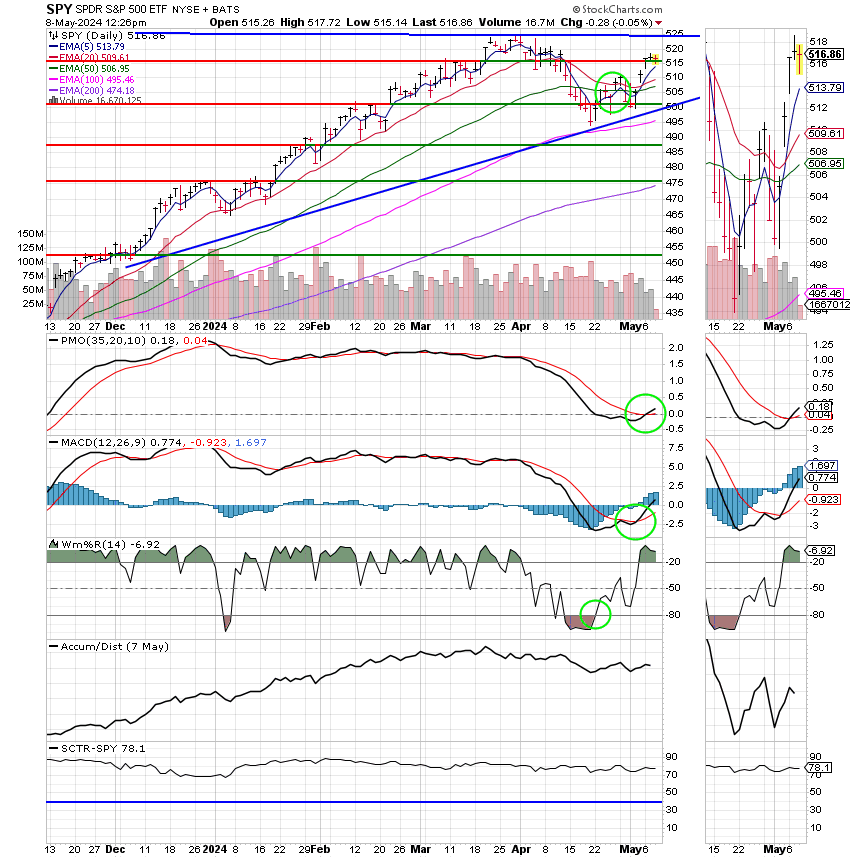

Good Morning, Summers here and we’re all busy, so I’ll try to keep it brief this week. Last Thursday our charts showed a change in trend. So we reentered the equity market with the S Fund which had the strongest chart and were rewarded with a nice day on Monday. However, the two trading days since then have been at best slightly negative. We find the market moving up a few days and then down again as traders assess each piece of news as to how it might affect interest rates. As I have oft repeated, this volatility will remain until the rate of inflation finally stabilizes at two percent. The thing we are focused on right now is the intermediate trend. It is impossible to predict where the market is moving in the short term as each piece of news can effect market players thoughts on what the Fed might do next. Basically it’s a fools errand to try to predict where the market will move from day to day. I understand that everyone knows someone who got it right. You know what I say? Even a blind squirrel gets a nut every now and then. It’s sensational when you make a prediction and it turns out right but for the most part it’s pure blind, dumb, luck when you get it right. That is why I try really hard to stay out of the business of prognostication. Right now the trend is moving higher and as long as it is we will remain in the market. The main thing to understand in this market is that there will continue to be a lot of movement. A lot of smoke and very little fire. I don’t expect to make a lot of money right now. I am expecting only moderate to small gains. My main focus as always will be to keep what I have while hopefully adding a little to it. Am I saying we won’t make a big gain? No, what I am saying is that I am not expecting to make a large gain. I will be pleasantly surprised if we do. For the rest of this week the market will trade off of the tail end of this seasons corporate earnings reports as well as anything investors can glean from the Fed. Investors will get a slew of Federal Reserve commentary. Federal Reserve officials including Vice Chair Philip Jefferson, Boston Fed President Susan Collins and Fed Governor Lisa Cook are all expected to give remarks. Of course, we need to keep an eye on the middle east as it appears that Israel is prepared to move into Rapha. You never know when market moving news can show up from there or the Ukraine. In my personal opinion they are the silent elephants in the room. For now at least that’s what’s going on in the market world. If you are busy, you can skip all that and simply watch your charts. Your results will be the same either way. Put your faith in God and your charts and don’t worry with the news unless you have a little extra time. That’s where my priority always has been and that’s where it always will be.

Todays trading up to this point has generated the following results: Our TSP allotment is trading at -0.57%. For comparison, the Dow is adding +0.22%, the Nasdaq is off -0.27%, and the S&P 500 is slightly lower at -0.06%.

Dow ticks higher, tries to extend winning streak to 6 days: Live updates

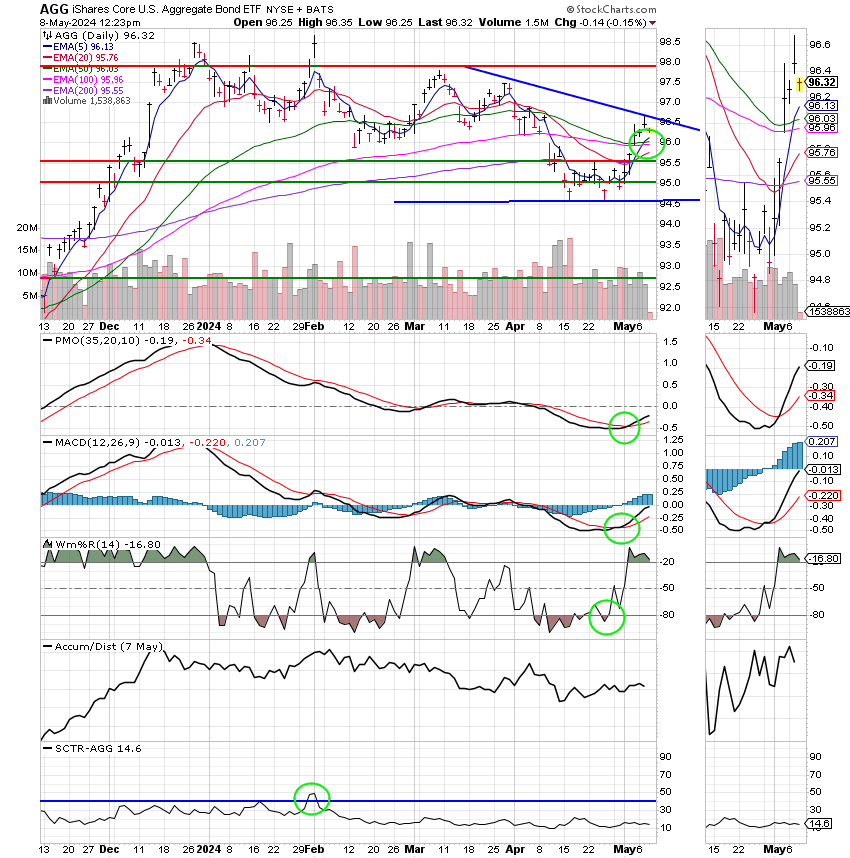

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy, We are currently invested at 100/S. Our allocation is now +5.33% for the year not including the days results. Here are the latest posted results:

| 05/07/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.2324 | 18.9054 | 81.2423 | 80.18 | 42.507 |

| $ Change | 0.0023 | 0.0436 | 0.1129 | -0.1790 | 0.0874 |

| % Change day | +0.01% | +0.23% | +0.14% | -0.22% | +0.21% |

| % Change week | +0.05% | +0.33% | +1.18% | +1.22% | +0.92% |

| % Change month | +0.09% | +1.60% | +3.03% | +3.99% | +3.11% |

| % Change year | +1.50% | -1.65% | +9.25% | +4.00% | +5.79% |