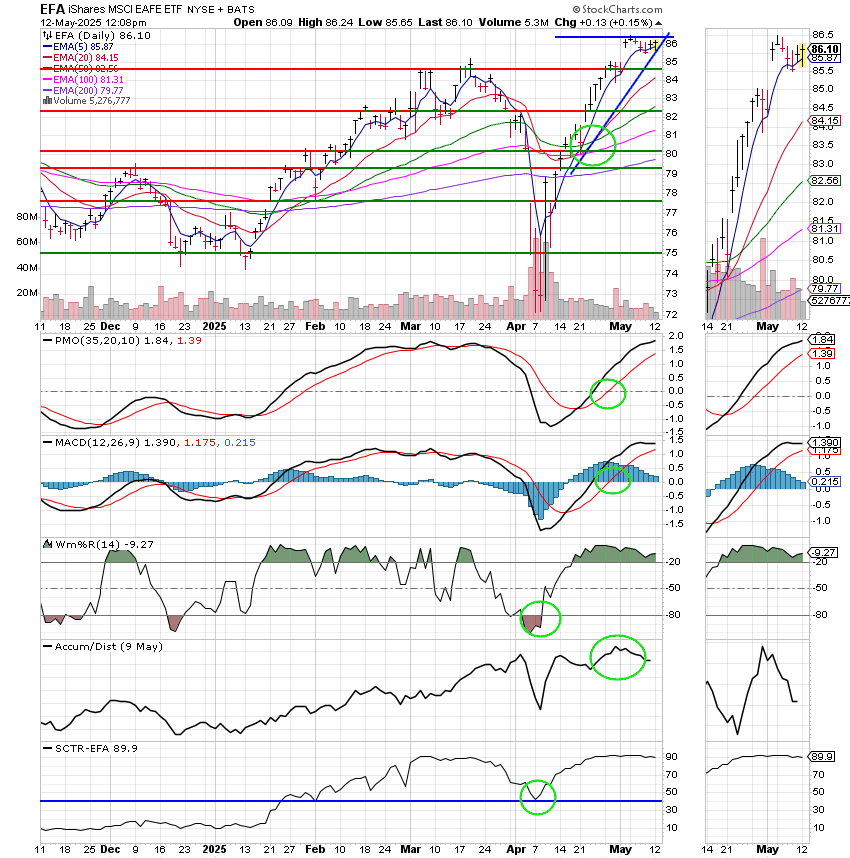

Good Morning, Our charts told us we were at the bottom and the fundamentals agreed. The opportunity was so compelling that we probably jumped back in a few weeks to early, but we wanted to make darn sure we were positioned for the run that would surely come. The market dipped and many chicken little investors said that the sky was falling, but again our charts told us the bottom was in. We talked about how the market might drop, but that it wouldn’t be a meaningful drop. Remember???? Some of our antagonists have a selective memory when it comes to these things. We talked about the catalysts that would ultimately make the market move higher while others told us to sell or move to the I Fund. The S Fund is far t0 risky right now they said. Look at what the I fund is doing they said, but our charts told us that the dollar would reverse and get stronger when a new uptrend started. So we patiently remained positioned and now we get our reward. Small caps are flying higher, the I fund is under performing and the C Fund just isn’t as strong as they thought it would be. Our charts were right and we read them correctly. Where are all the services that said we were done two years ago? Where are they? They had their one year in the sun. We had twenty before that and now we’ll have twenty more. The market changed in 2020. Actually it began changing in 2008 as we previously discussed. So we improvised, adapted, and overcame. In the end our critics were nothing more than noise. So why am I saying this? Am I being arrogant? Absolutely not!!!! God’s word says that pride goes before destruction and a haughty spirit before a fall. I am pointing this out for two reasons. The first is that those folks were pretty cruel when the posted all their trash on our Facebook Page. However, it the interest of free speech, we let it stand. Some or our folks posted on the other pages and were immediately taken down. So what does that tell you when they need to control the narrative? Sounds like a bunch of socialists to me. I hear from some of our folks that they won’t even post their yearly returns now. I wonder why?? All we were ever trying to do here was help folks. All they ever tried to do at those services was make money, that is for themselves. Money is a tool to be used in the kingdom of God but the love 0f it is the root of all evil. I certainly hope some of you folks will remind them of all this. They believe in good luck, but we believe that hard work and faith in God makes “good luck”. As far as I’m concerned things have now come full circle. I know that the moderator of one of those groups sarcastically made the statement while we were struggling to adjust to the changing market conditions that “I hear he isn’t doing so well these days”. I waited until today to reply to that and you antagonists can feel free to take this back to her. A while back there was country song written that applies to this situation. It was appropriately entitled “How do you like me now”. So you haters take that back were it needs to go. Oh yeah and by the way….we forgive you. You are welcome here. Always.

I apologize for that since it kind of got us off track. My only real reason for pointing it out is a hope that everyone learned from the whole situation how to be the best investor that they can be. Moving on….. As you all know unless you’ve been under a rock, we now have a the beginning of a trade deal with China. They represent the second largest economy in the world. So de escalation of that trade dispute will definitely light a fire under the market. Officials now have until an August deadline to iron out the details of the agreement. While that will lead to some volatility, I have little doubt that a complete agreement will be reached. Like I said before. They need us more than we need them. They know it and we know it. It’s time for a fair trade deal that will benefit both sides.

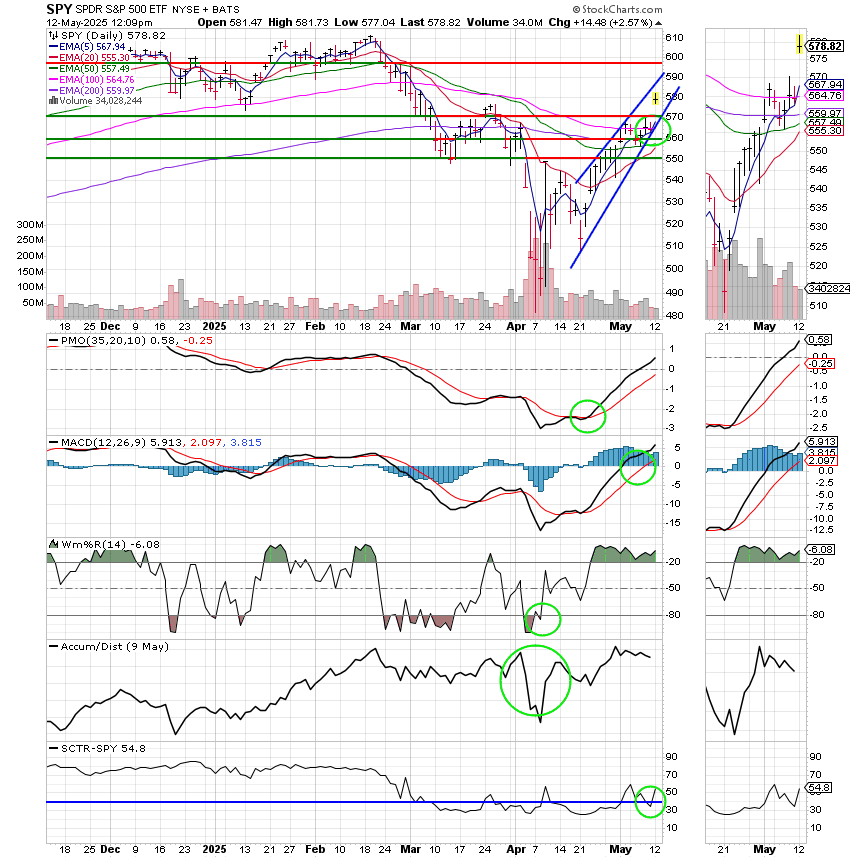

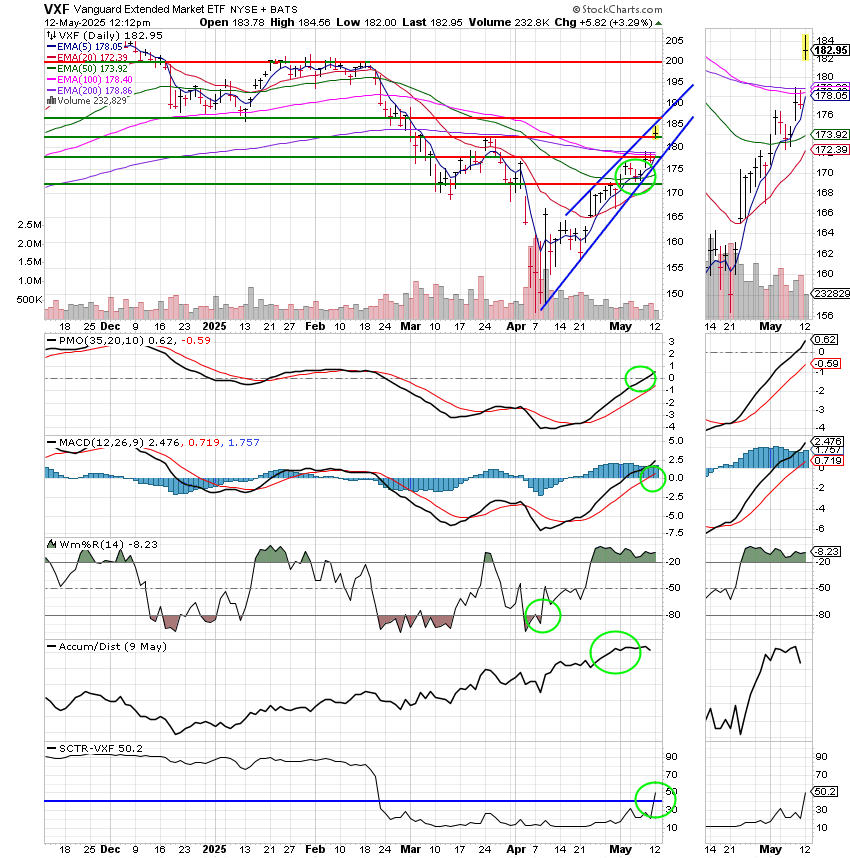

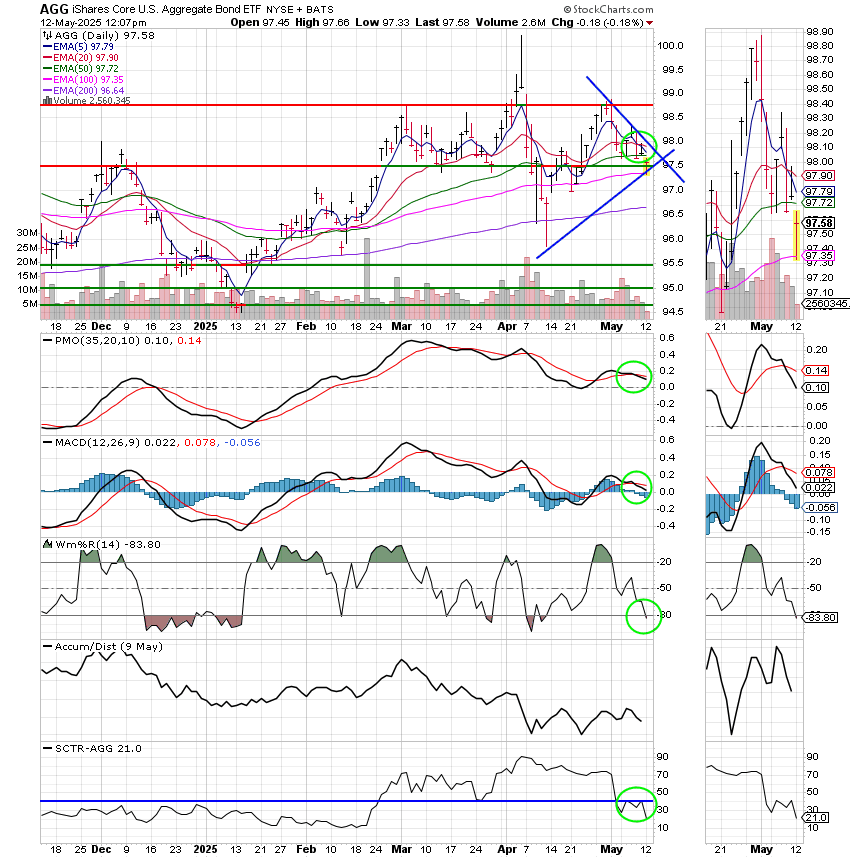

Tomorrow we have the CPI report and Thursday we have the PPI report. Both reports are followed closely by investors and the Fed as a gauge of inflation. The recent sentiment of a lot of investors is that the trade war will lead to higher inflation. We will see….. I believe any pressure on inflation crated by the trade dispute will be transitory. These are the main things going on this week. I fully expect more trade deals to be announced and that each one will provide buying opportunities anew. Our charts are clean and green now. So our task is to watch for the next downturn and I honestly don’t think that will come for a while. That said, there is a reason that we watch the charts. We’ve been surprised before and I’m sure we’ll be surprised again…… I want to take a little time to thank God who continues to guide our hand in all we do. Seek first His kingdom and all those other things will be added unto you.

The days trading so far has produced the following results. Our TSP allotment is now up +3.12%. We thank God for that. For comparison the Dow is adding +2.13%, the Nasdaq +3.47%, and the S&P 500 +2.44%. Praise God for such a good day!

Dow surges more than 1,000 points after China and U.S. agree to temporary tariff cuts: Live updates

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +0.79% for the year not including the days gains. Here are the latest posted results:

| 05/09/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.0511 | 19.9079 | 89.8127 | 84.4044 | 46.3638 |

| $ Change | 0.0022 | 0.0163 | -0.0481 | -0.0598 | 0.2649 |

| % Change day | +0.01% | +0.08% | -0.05% | -0.07% | +0.57% |

| % Change week | +0.08% | -0.16% | -0.45% | +0.79% | +0.07% |

| % Change month | +0.11% | -0.94% | +1.66% | +3.62% | +1.53% |

| % Change year | +1.58% | +2.21% | -3.35% | -6.37% | +10.66% |