Good Morning, Another day another challenge. This market is anything other than boring and I say that not necessarily in a good way! When it comes to the market I think boring is good. That means less volatility and that means less stress. Nonetheless, we have what we have and we must deal with it. This morning Moody’s (the credit rating agency) down graded US credit. This cut the United States’ sovereign credit rating down one notch to Aa1 from Aaa, the highest possible, citing the growing burden of financing the federal government’s budget deficit and the rising cost of rolling over existing debt amid high interest rates. It should come as no surprise to you that the house and senate have failed to deal with the budget deficit for years and years now. Our budget has not been balanced since Bill Clinton and Newt Gingrich last did it in the 1990’s. I’ll give old slick Bill one thing. He was absolutely spot on when he made his now famous statement “It’s the economy stupid”. Well you know what it still is! To be perfectly fair Moody’s is just bringing it’s rating in line with the other rating agencies. Moody’s had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible, and brings the 116-year-old agency into line with its rivals. Standard & Poor’s downgraded the U.S. to AA+ from AAA in August 2011, and Fitch Ratings also cut the U.S. rating to AA+ from AAA, in August 2023. Folks, here’s what is scary about all this. The US is running a massive deficit that keeps getting bigger as congress and successive administrations kick the can down the road refusing to deal with it! Well you know what? The can is starting to get t0o heavy to kick!!!! The U.S. is running a massive budget deficit as interest costs for Treasury debt continued to rise due to a combination of higher rates and more principal debt to finance. The fiscal deficit in the year that began October 1 is already running at $1.05 trillion, 13% higher than a year ago. Revenue from tariffs helped shave some of the imbalance last month. In its statement accompanying the downgrade, Moody’s analysts wrote that, “If the 2017 Tax Cuts and Jobs Act is extended, which is our base case, it will add around $4 trillion to the federal fiscal primary (excluding interest payments) deficit over the next decade.” “As a result, we expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending and relatively low revenue generation,” Moody’s said. ″We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024.″ The Moody’s downgrade came as the GOP-led House Budget Committee on Friday rejected a sweeping tax cut package as part of President Donald Trump’s economic agenda, including extending tax cuts first enacted in 2017. Although, I hear that it was approved by the house budget committee today. This madness has to stop. If not us then who will deal with it? If not now then when?

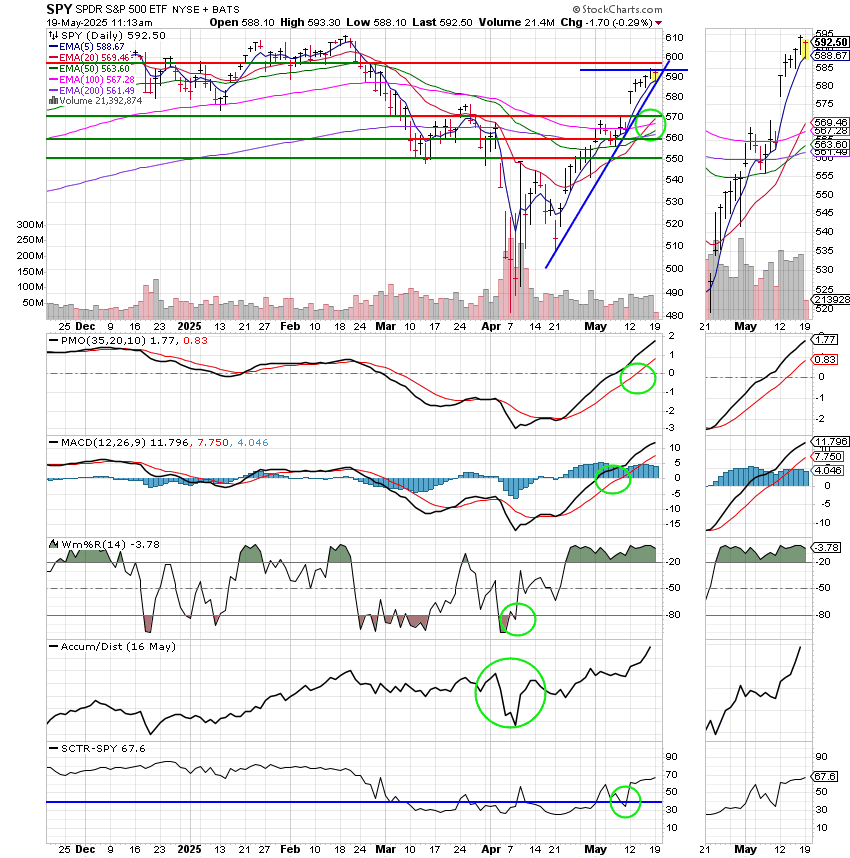

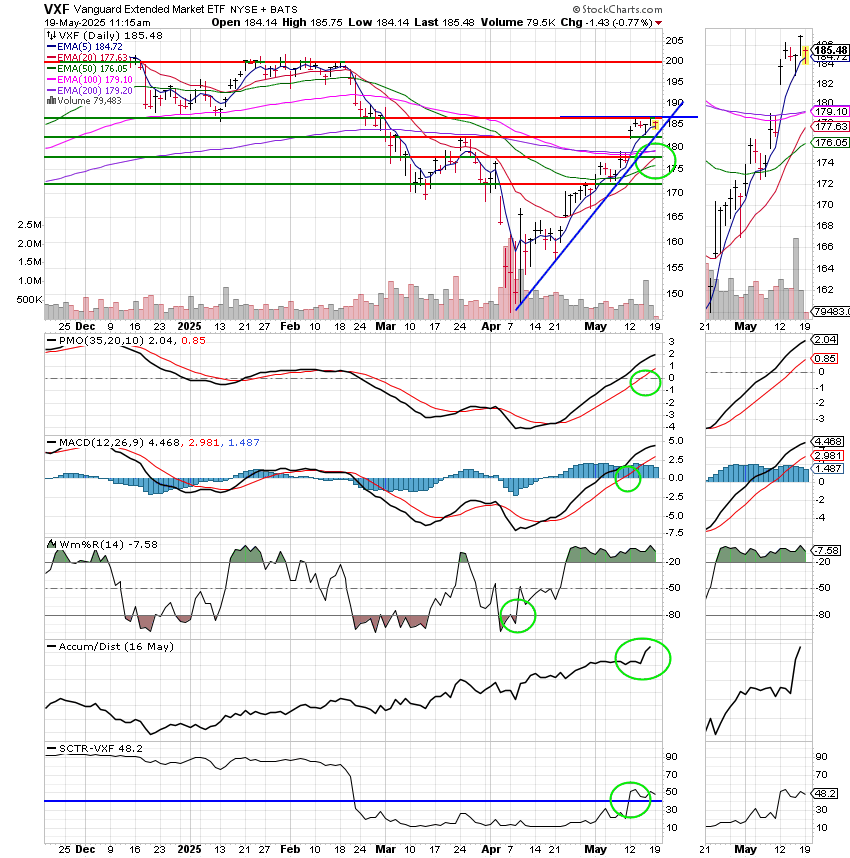

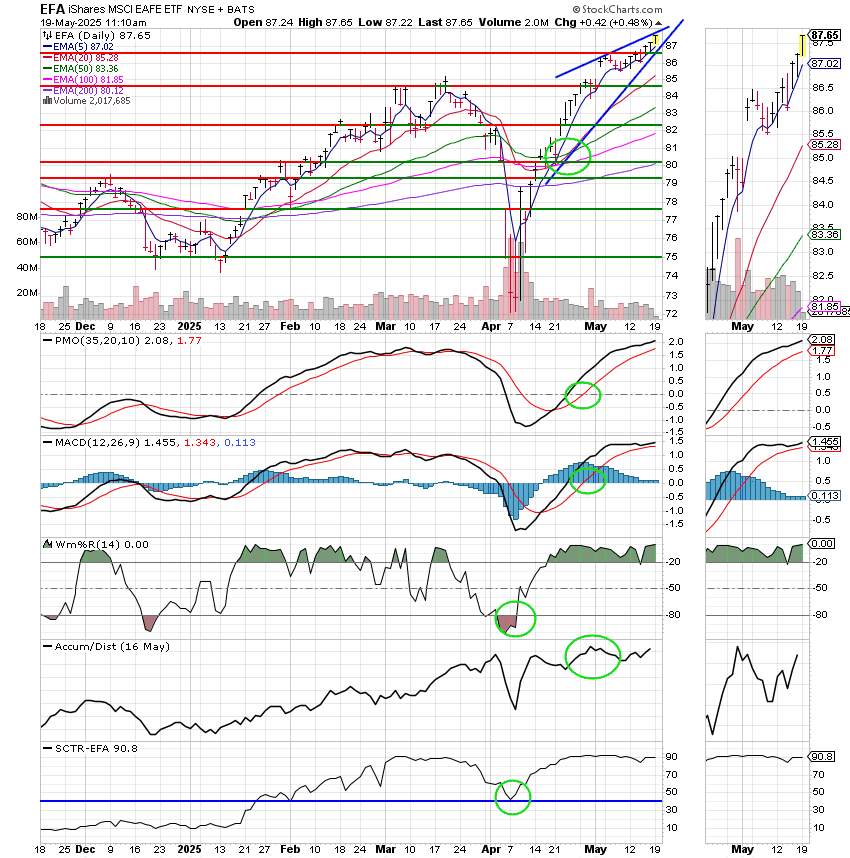

We’ll manage this mini crisis pretty much the same way we manage them all. We’ll calmy watch our charts and react to what we see. Right now they are in really good shape. So the market will probably bounce back after a day or so of pouting. However, this down grade and accompanying market response should remind us all that this problem must be dealt with or eventually things will not go well for us. Let me spell it out plainly. The budget must be balanced and the deficit must be reduced!

The days trading so far has left us with the following results: Our TSP allotment is trading lower at -0.81% which is not as bad as I would have expected. For comparison, the Dow is actually starting to turn green at +0.02%, the Nasdaq is off -0.54%, and the S&P 500 is giving up -0.23%. I expect we’ll survive this day. I just thank the Lord for the really good week we had last week. Who knows, perhaps this will only be a hiccup and we’ll bounce back before the days over. We’ll see. I will echo what was said in the discussion on our Facebook page. Right now is a really good time to assess your risk appetite. If your not comfortable with the current volatility then reduce your exposure to equities until you are. Do it while your ahead. Not after the market has dropped 20% or more. That’s panic and panic is not a strategy! Everyone’s situation and retirement timeline is different. You must do what’s best for you and what your most comfortable with. What is it all the young folks always say to me? Just sayin!

Stocks retreat to start week as yields spike on U.S. debt downgrade: Live updates

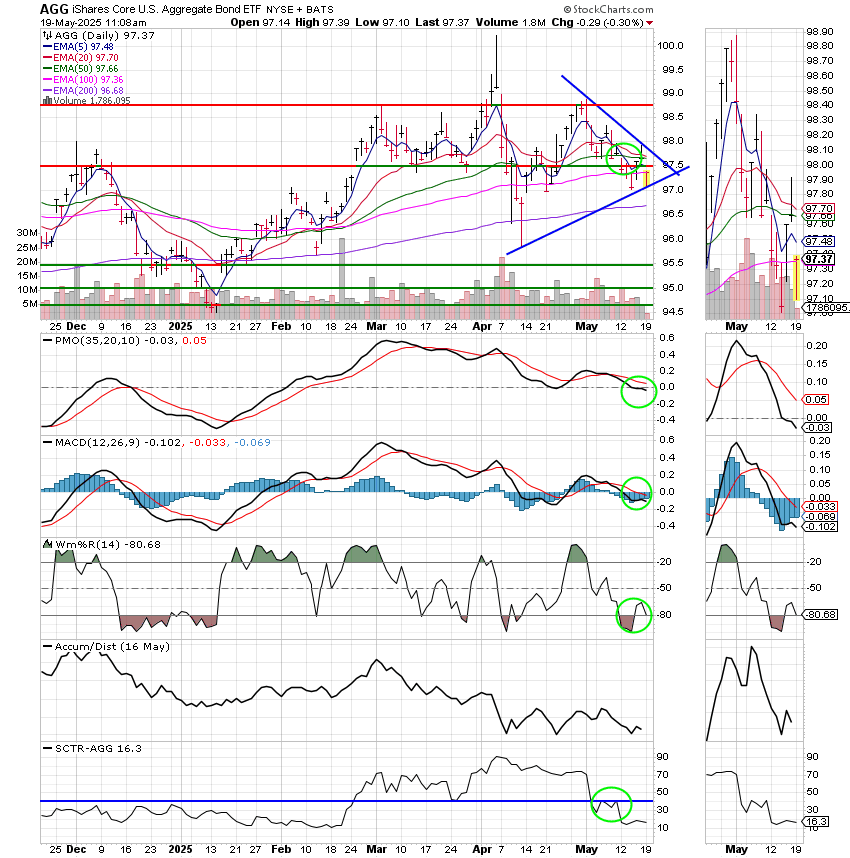

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +6.26% on the year not including the days results. Here are the latest posted results.

| 05/16/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.0667 | 19.8702 | 94.6008 | 88.9812 | 47.2925 |

| $ Change | 0.0022 | 0.0096 | 0.6703 | 0.8876 | 0.1306 |

| % Change day | +0.01% | +0.05% | +0.71% | +1.01% | +0.28% |

| % Change week | +0.08% | -0.19% | +5.33% | +5.42% | +2.00% |

| % Change month | +0.19% | -1.13% | +7.08% | +9.24% | +3.56% |

| % Change year | +1.67% | +2.01% | +1.80% | -1.30% | +12.88% |