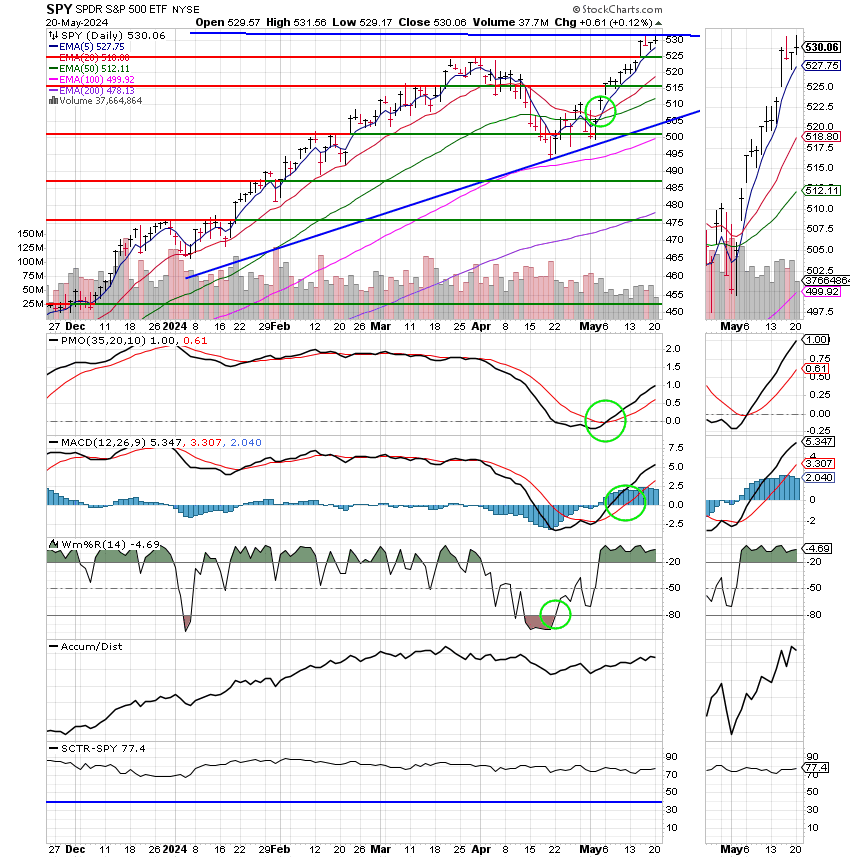

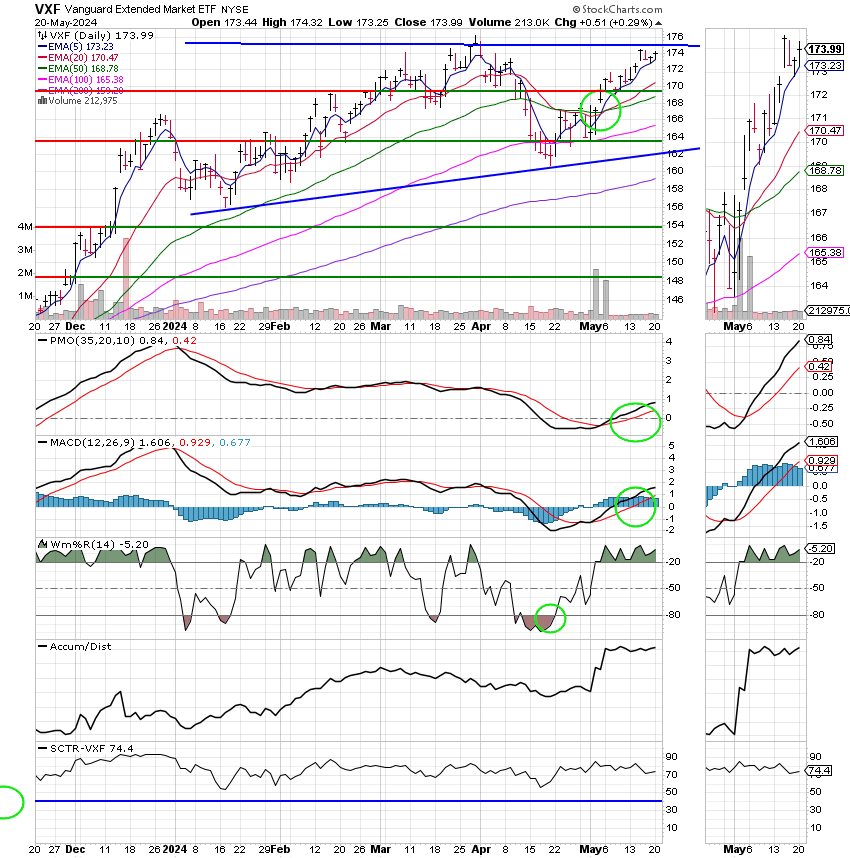

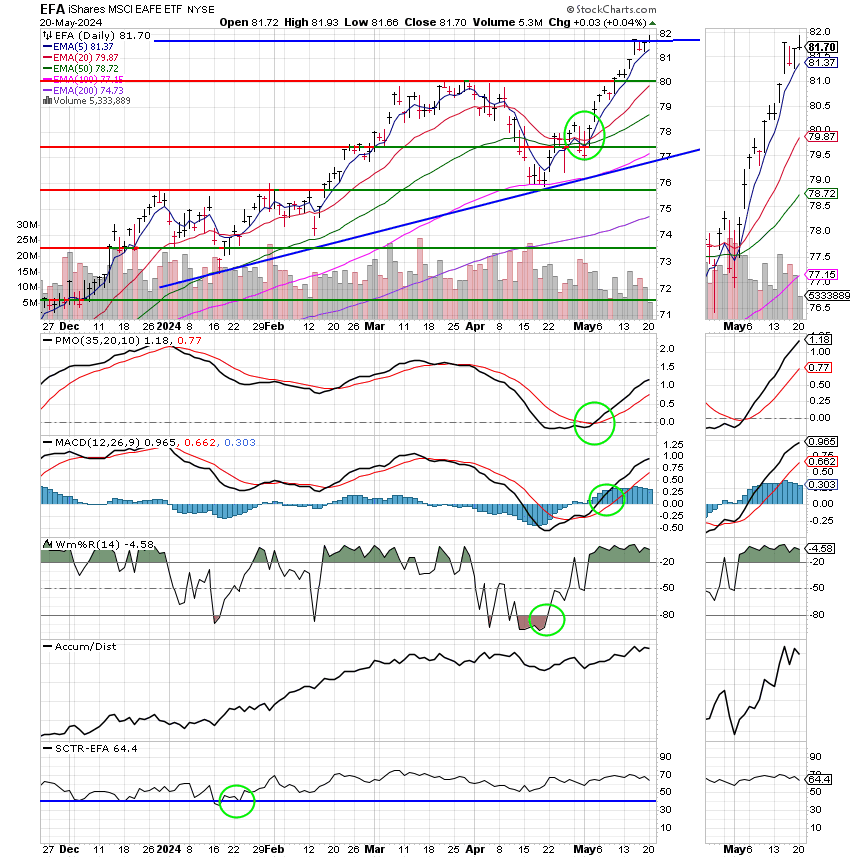

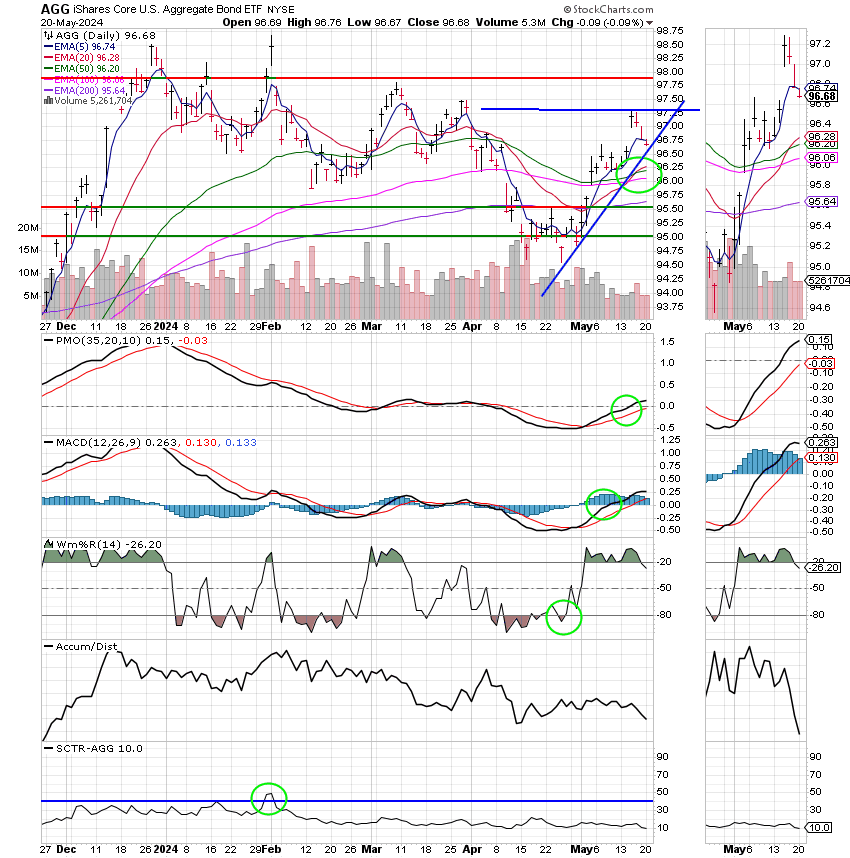

Good Evening, So much to do and so little time to do it! That’s what I feel like tonight. It’s certainly a good thing that we can check our charts quickly and know exactly where we’re at without having to read endless hours worth of news. How do you manage a busy career and have success in Thrift? That’s how. The market remains choppy for all the same reasons as the last six months. If not for the charts we would be lost on an endless ocean of market news without a compass. A routine review of tonight’s charts show that the uptrend continues despite all the recent give and take. The major indices bear that out as they all continue to eek out new highs. I know a few folks jumped out into the G Fund last week before the CPI report. Fortunately, while the report wasn’t perfect it pleased the market enough that we had a nice rally. When all was said and done there were new highs and higher lows. The uptrend remained in tact. I will admit that it felt a little risky. I certainly would not expect anyone to do anything they are not comfortable with. Like I told a few folks last week. The important thing is that you didn’t lose anything. So simply move on to the next trade. This week is dominated by one major earning report. Nvidia (NVDA) is scheduled to report after the close on Wednesday. Why is one earnings report able to have so much sway on the market. For two reasons. First, NVDA has the third largest market cap of any stock in the market. Just that alone gives is some influence. If you don’t think so then just watch the major indices when Apple or Microsoft report. Second, the rally over the past six months has been driven by artificial intelligence better known as AI. While it has been broadening into other sectors just a bit, AI remains the biggest driver of the market and who makes the best AI chips?? You guessed it, Nvidia. The last time Nvidia reported it blew earnings out of the water and was like the rising tide that lifted all ships. I don’t know if the company can post earnings like that again, but I’m willing to make a bet that business has been good with a well documented shortage of AI chips. Anyway, that is the elephant in the room. It’s nice to know things like this so you can check your charts a little closer when the event takes place but it’s not a game breaker. If you are busy with a family and a job a quick glance of the charts will tell you every thing you need to know.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.33%. For comparison, the Dow fell -0.46%, the Nasdaq was up +0.65%, and the S&&P 500 added +0.09%.

Nasdaq closes at a record on Monday as Nvidia shares rise 2%: Live updates

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +7.11% for the year not including the days results. Here are the latest posted results:

| 05/17/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.2563 | 18.97 | 83.1296 | 81.5412 | 43.4779 |

| $ Change | 0.0024 | -0.0461 | 0.1000 | 0.0686 | 0.1166 |

| % Change day | +0.01% | -0.24% | +0.12% | +0.08% | +0.27% |

| % Change week | +0.09% | +0.57% | +1.60% | +1.60% | +1.62% |

| % Change month | +0.22% | +1.94% | +5.43% | +5.75% | +5.47% |

| % Change year | +1.63% | -1.31% | +11.79% | +5.77% | +8.20% |