Good Afternoon, Not much has changed since last week. Market players continue to be focused primarily on the Government Debt Ceiling negotiations and secondarily on whether or not the Fed will increase rates at their next meeting. Anything else that would influence the market beyond those two issues at this time would be a total surprise or like we prefer to call them here, a landmine. The next immediate market moving event is a meeting between House Majority leader Kevin McCarthy and President Joe Biden at 5:30PM this afternoon. Stocks will likely remain flat as they are now ahead of the meeting as nobody wants to place a big bet ahead of an event that is occurring after hours. So expect a some movement at tomorrows open. According to Secretary of Treasury, Janet Yellen there are currently about 10 days before the government will be unable to pay all it’s debts. The major disagreement is that the Republicans are insisting on spending cuts before they will increase the debt ceiling and Democrats want to increase revenue (taxes) if there are any spending cuts which they do not favor. I’ll let you form your own opinions on the political ramifications of this debate. I’m only reporting facts as related to the market….We continue to hold tight in the G Fund waiting until we see some fundamental changes reflected on our charts. Right now the stocks remain in the same trading range that they have been in all spring. This trading range needs to be resolved before we will see any meaningful movement higher or lower. For now, we will continue to play it safe…..

Current trading has produced the following results: Our TSP allotment remains steady in the G Fund. For comparison, the Dow is now off -0.17%, the Nasdaq is higher at +0.59%, and the S&P 500 is up+0.21%. This market give the impression that it would like to rise but there are simply too many headwinds at this time coming primarily from the debt negotiations.

S&P 500 is little changed as traders monitor debt ceiling talks: Live updates

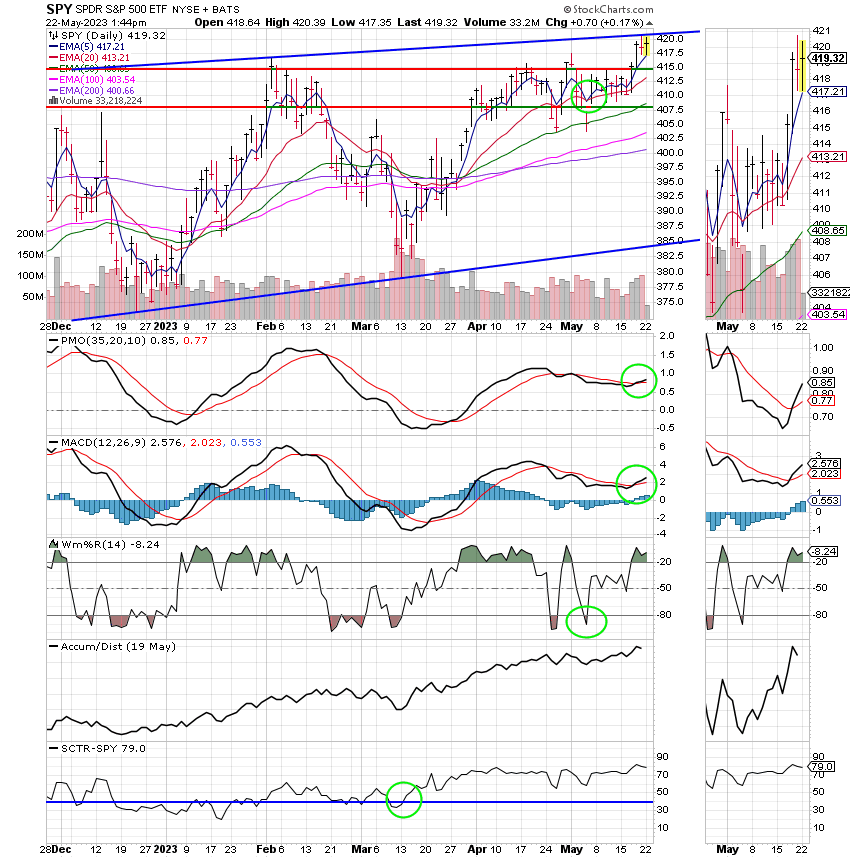

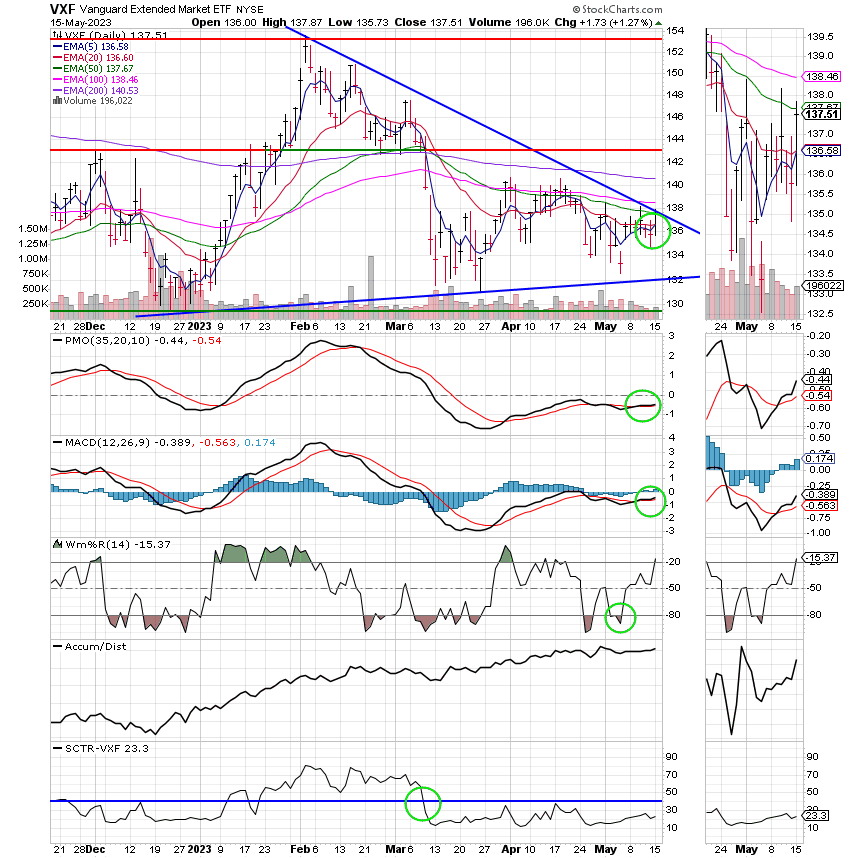

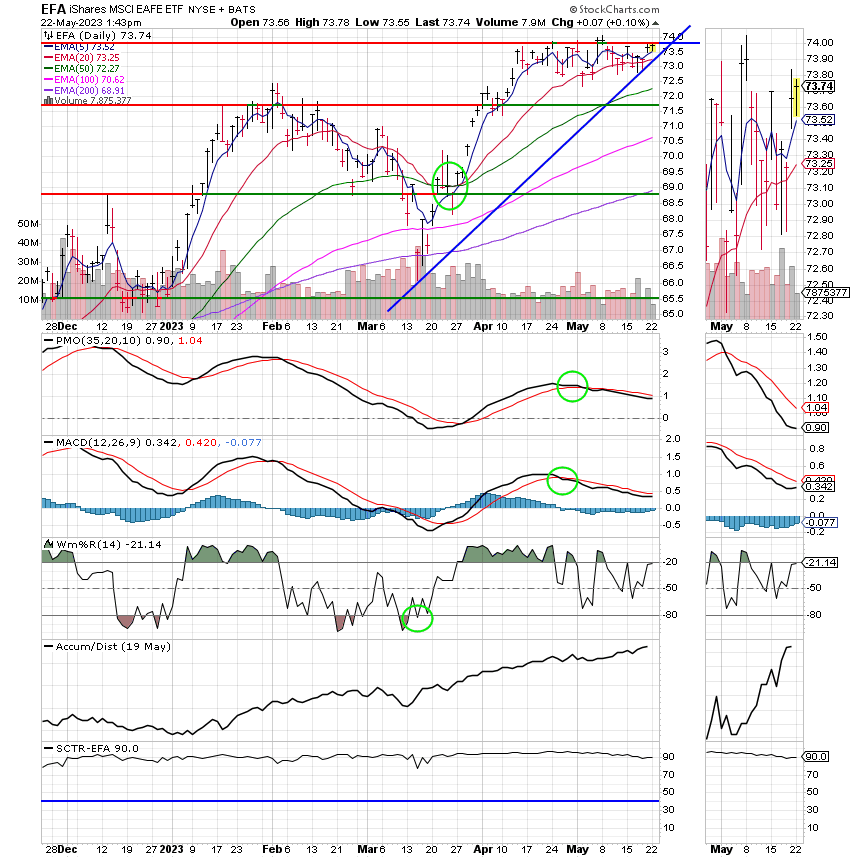

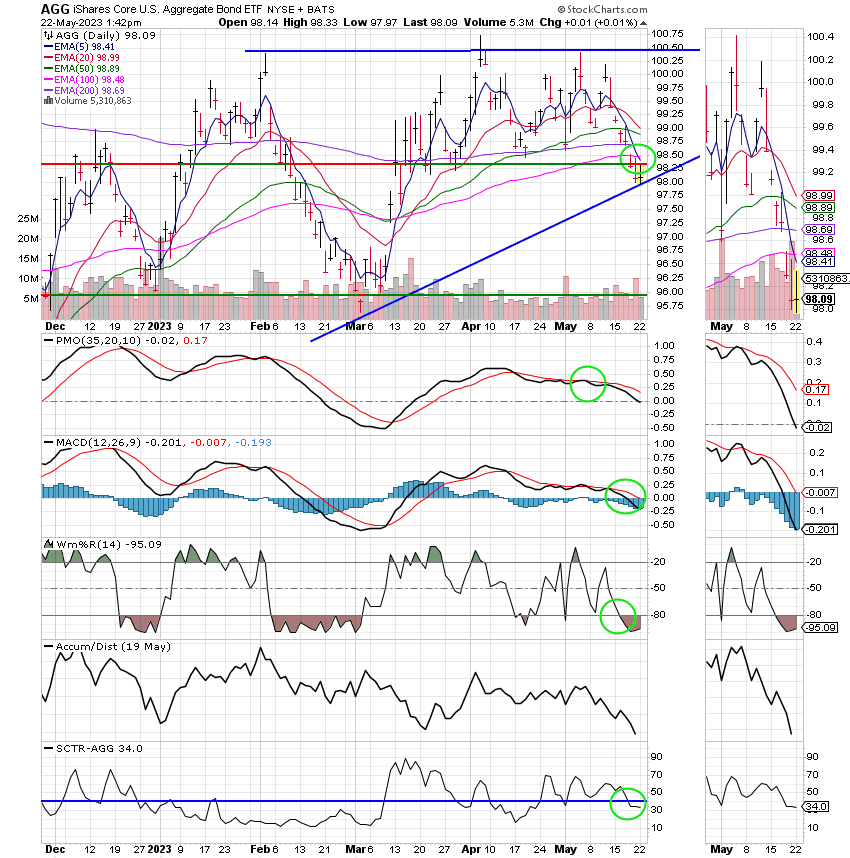

Recent action has generated the following signals: C-Buy, S-Buy, I-Hold, F-Sell. We are currently invested at 100/G. Our allocation is now -2.21% for the year not including the days results. Here are the latest posted results:

| 05/19/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.4882 | 18.58 | 64.7332 | 64.2249 | 37.9242 |

| $ Change | 0.0018 | -0.0479 | -0.0923 | -0.4635 | 0.2154 |

| % Change day | +0.01% | -0.26% | -0.14% | -0.72% | +0.57% |

| % Change week | +0.07% | -1.37% | +1.70% | +1.92% | +0.64% |

| % Change month | +0.19% | -1.65% | +0.67% | +0.81% | -0.01% |

| % Change year | +1.47% | +2.05% | +9.90% | +4.38% | +11.73% |