Good Evening, Things have settled down a bit and we have started out this week well……normal. Yes the best description of the action so far this week is normal and I attribute that to the fact that we have no major crisis so far this week. I praise God for that. The main things that have settled us back down to a state of normal are first that the crypto currency market has recovered from last weeks major selloff and second that the bond yields have been tame. Also, not to be overlooked is that recent Fed statements have managed to calm investors inflation fears. Just a quick thought on the crypto thing. Whether we like it or not the market has become increasingly tied to crypto currencies which just for the record I don’t like. I know that a lot of you invest in them and I also am aware that some of you have done quite well. I am happy for you! However, I still think that investing in crypto is like investing in a bubble. You are totally dependent on other investors to drive up the price. That is it. That is all there is. Crypto has no intrinsic value whatsoever. I’d much rather own companies or physical products such as precious metals or grain. The only value I see is in it all is the blockchain technology that crypto currencies use. So last week bitcoin which is the number one crypto currency crashed and and the market sold off as well. That was especially true for companies like Tesla that have become heavily invested in the currency. Anyway, my point is that to a certain degree, so goes crypto so goes the market these days…… but at least so far this week, everything seems normal and that’s just alright with me.

The days trading left us with the following results. Our TSP allotment posted a nice gain of +1.37%. For comparison, the Dow was up +0.03%, the Nasdaq +0.59%, and the S&P 500 +0.19%. We had them covered today. Praise God for a great day!

The days action left us with the following signals: C:Buy, S-buy, I-Buy, and F-Hold. We are currently invested at 100/S. Our allocation is now +10.68% on the year. Here are the latest posted results:

| 05/26/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5919 | 20.7256 | 62.8277 | 82.1225 | 38.9179 |

| $ Change | 0.0007 | -0.0139 | 0.1185 | 1.1363 | -0.0465 |

| % Change day | +0.00% | -0.07% | +0.19% | +1.40% | -0.12% |

| % Change week | +0.02% | +0.34% | +0.98% | +1.66% | +0.66% |

| % Change month | +0.11% | +0.34% | +0.48% | -1.48% | +3.04% |

| % Change year | +0.51% | -2.22% | +12.37% | +10.68% | +9.97% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.8941 | 11.762 | 41.4101 | 12.4254 | 46.9794 |

| $ Change | 0.0119 | 0.0129 | 0.0597 | 0.0199 | 0.0831 |

| % Change day | +0.05% | +0.11% | +0.14% | +0.16% | +0.18% |

| % Change week | +0.25% | +0.48% | +0.61% | +0.67% | +0.72% |

| % Change month | +0.36% | +0.61% | +0.74% | +0.79% | +0.84% |

| % Change year | +2.77% | +5.40% | +6.79% | +7.40% | +8.03% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.8613 | 28.157 | 13.8051 | 13.805 | 13.8048 |

| $ Change | 0.0249 | 0.0590 | 0.0360 | 0.0360 | 0.0359 |

| % Change day | +0.19% | +0.21% | +0.26% | +0.26% | +0.26% |

| % Change week | +0.77% | +0.82% | +0.96% | +0.96% | +0.96% |

| % Change month | +0.88% | +0.93% | +1.07% | +1.07% | +1.06% |

| % Change year | +8.55% | +9.10% | +11.22% | +11.22% | +11.22% |

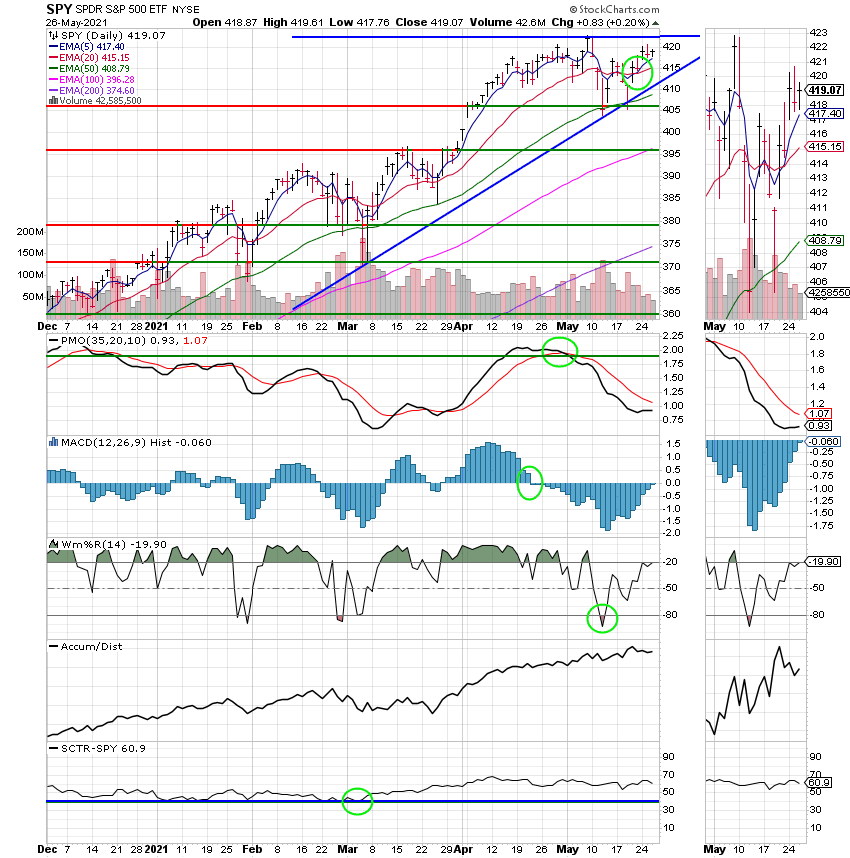

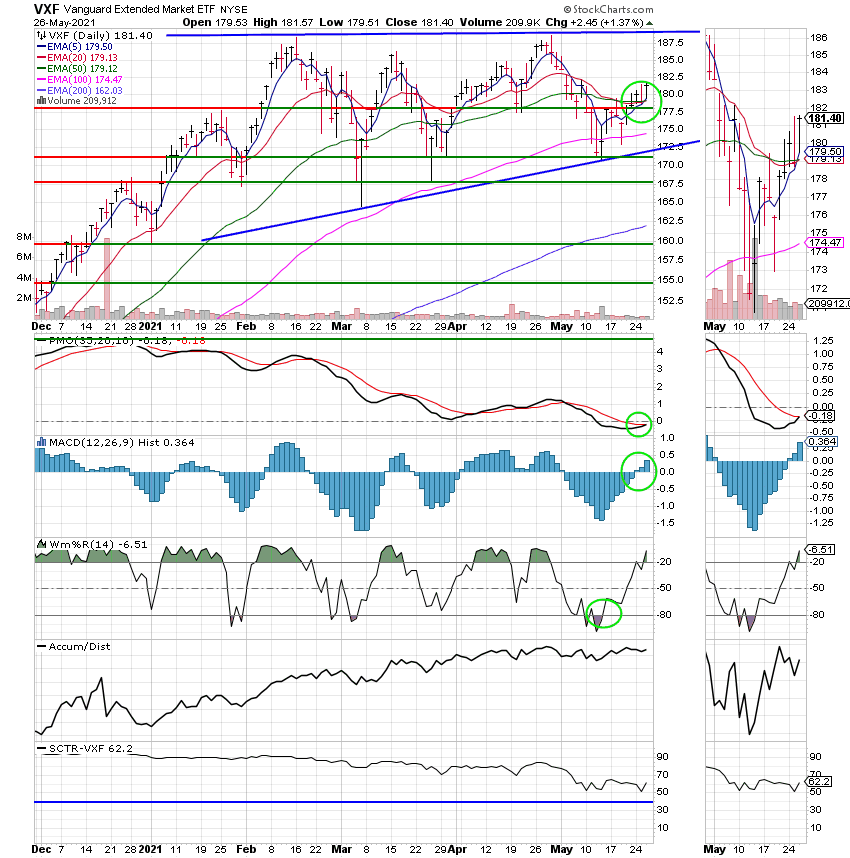

S Fund:

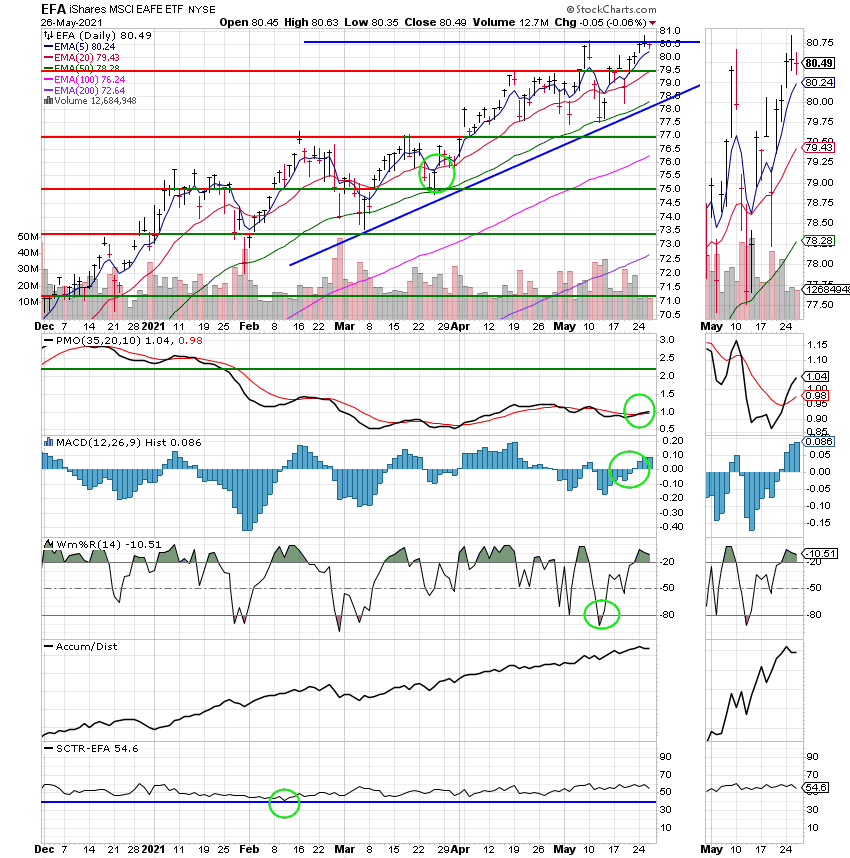

I Fund:

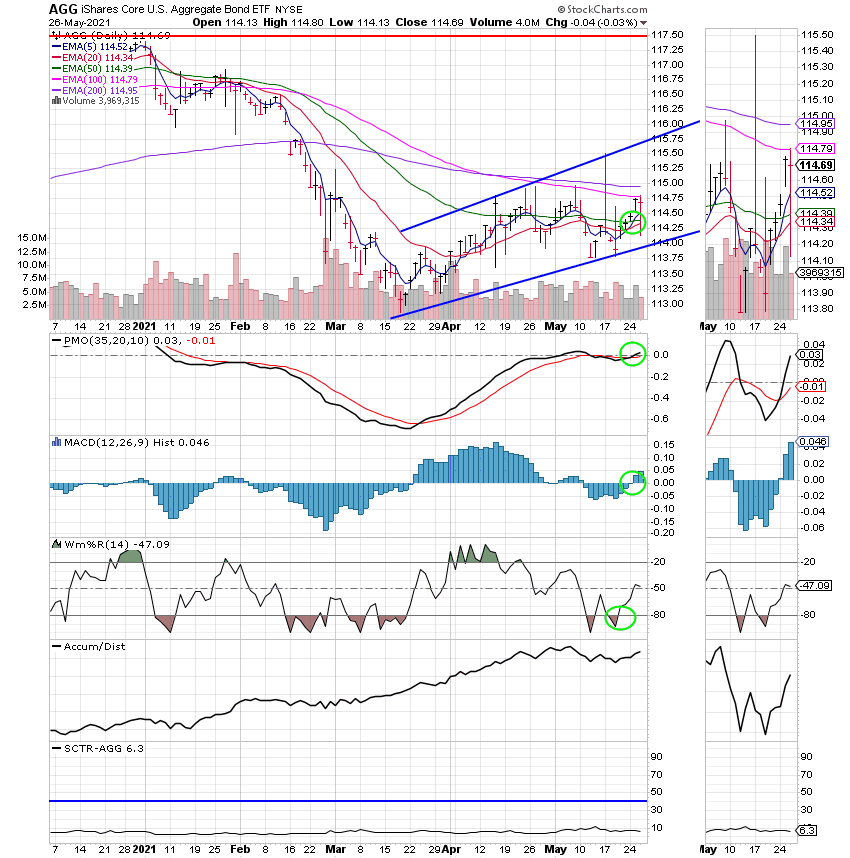

F Fund:

We’ll be entering the dog days of summer soon. Lets see if the a recovery induced rally can make them more exciting than usual. That’s all for tonight. Have a great evening and may God continue to bless your trades.