Good Morning, First of all I want to wish you all blessed memorial day. It is a day when we should all take the time to reflect on those who came before us and especially those who served in our armed forces to kept us all free. We could not do such things as invest or worship freely without their sacrifice.

So what is the purpose of this blog? Is it a market news blog???? Is it an instructional blog on investing? Is it to keep up with new trends in Thrift? It has been a little bit of all of those things in the past. Actually, it started out many years ago as a Email chain. A lady that worked in the same agency as I did asked me to send her my allocation. I told her that I would but I was not responsible for her results. Next she asked me if she could share it with some of her friends. Her friends then started asking questions which I felt obliged to answer. The next thing it was like the Genie that couldn’t be put back in the bottle and here we are today! So what is it?? Upon reflection I’d have to say that it’s about keeping our group functioning in a way that all the members can be blessed by it’s existence. We invest together and pray together. For the most part we have been successful. We had only two bad years since the nineties. The Lord has truly blessed our hand. While the majority of us are Christians not all of us are. However, it my desire that all would come to know the our blessed Lord and Savior Jesus Christ. He came that we might have life and life abundant and we know that He is the reason for our success. We give Him praise! The purpose of this blog is to organize this group and to do whatever it takes to make it successful. One week that might be talking about Market Fundamentals. Another week it might be talking about technical analysis. The next it might be talking about the spiritual aspects of what we are trying to accomplish. Whatever it takes!!! Back when we started this I used to focus strictly on Technical Analysis, but after a while folks said they either didn’t have the time or the interest to pursue that. They just wanted to know where to put their money. So again, we just talk about whatever is going on in our group from week to week.

So how about this week? First lets do some house keeping. We finally had our new My TSP Guide app added to the Apple store last week and contrary to popular belief is does function as designed. In addition, we will soon have one in the Google apps store as well. So getting back to the App. It functions flawlessly. However, I cannot say the same for the website. There has been an ongoing problem with the web page refreshing. I post something on it, but folks don’t see it until later in the day. Obviously, that won’t work f0r our Alerts as members of our group need to know right away what the change to our allocation is. I have complained to the web folks who I might add are different from the app folks and right now that is all I know. So until this problem is fixed…..When you receive a push notification that there is a new Alert and you only see the last alert when you open it, you at least know there is a new alert. If you go directly to the website you still will not see it because it is the website itself that is the problem. The only two ways I can get around this are to post a direct link to the Alert and/or blog on the Facebook page which I do or receive the Email Alert which is always up to date. Those are the two ways you can get the Alert immediately until they get this problem solved with the Website. One more time! If you get a push notification saying there is a new alert then there is a new alert. If you don’t see it, then go find it. I strongly recommend that you sign up for the E mail notification. You can do that either on the website or on the app. I realize that this is a little extra work for you but you have to admit that with the service being free you are still getting your moneys worth…..:)

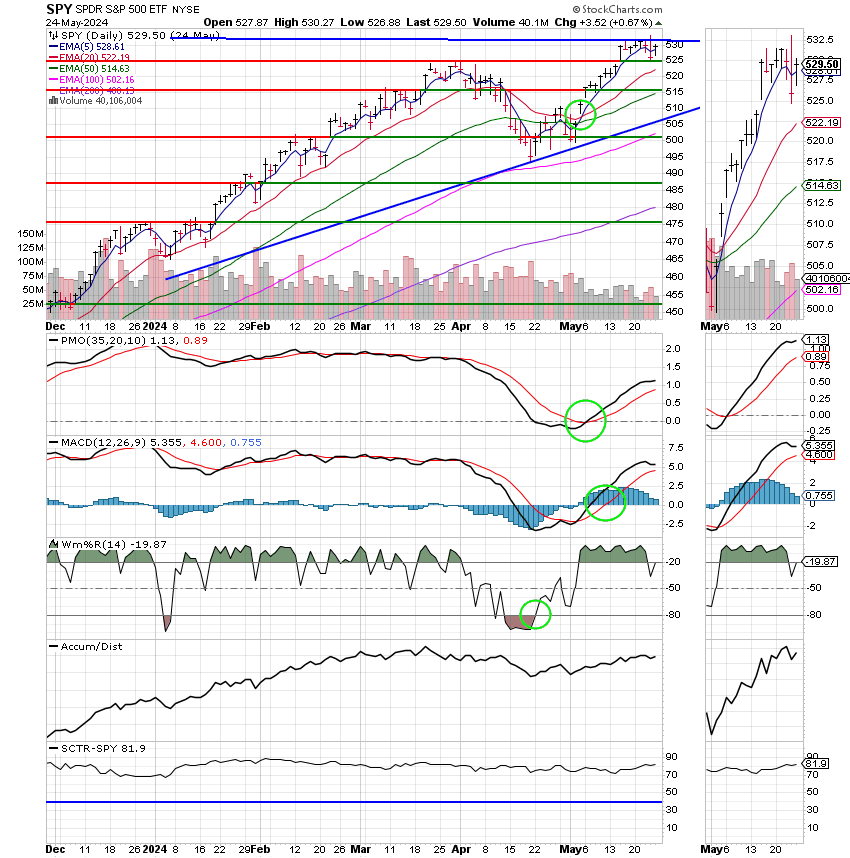

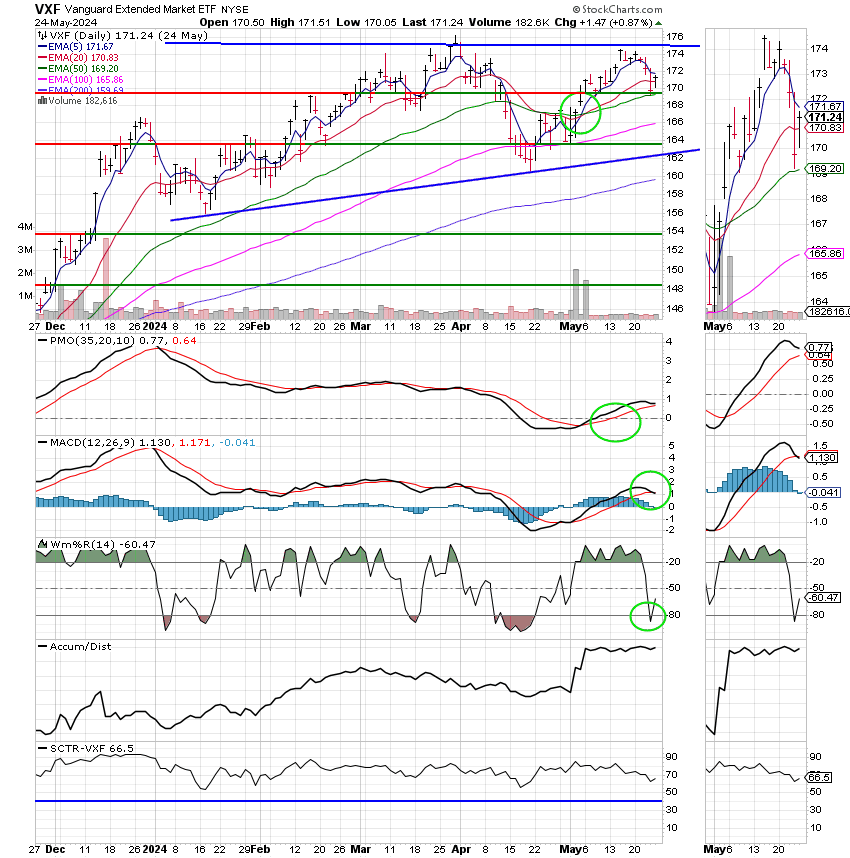

How about the move that caused all this controversy in the first place? There are two kinds of moves that we make. The first kind is to move to a safe haven to protect our capital during a Downturn and the second is a move to improve our performance. The move we made on Friday was to improve performance. Sometimes market conditions change to favor one equity based fund over another. That does mean that you invested in the wrong fund to begin with! It means only that the chart for one fund improved while the chart for the fund you are invested in became weaker. Most of the time, both funds will continue to make money. So when you make a move from one fund to another in this case it is not critical if you make the move immediately. You will not lose money. Possibly some performance, but not money. That said it is more important to make the move in a timely manner when moving to a safe haven or when buying you are back into the market. Even then, a day’s delay will probably not make much difference. I would remind everyone that we’re not timing the market here. That is an entirely different style of investing and we don’t have time to go over that today. So to sum it all up. The chart for the S Fund weakened and the chart for the C Fund strengthened. So….we made a change.

While we did make a change, a glance at my charts tells me that the current trend higher may be coming to an end soon. I cannot tell you how soon, but what I can say is that the uptrend is weakening. So we will keep a close eye on our charts and should we need to sell then we will sell. We have a good system. We have only to routinely run it or I guess another way to say that is that it’s all just another day in the office……

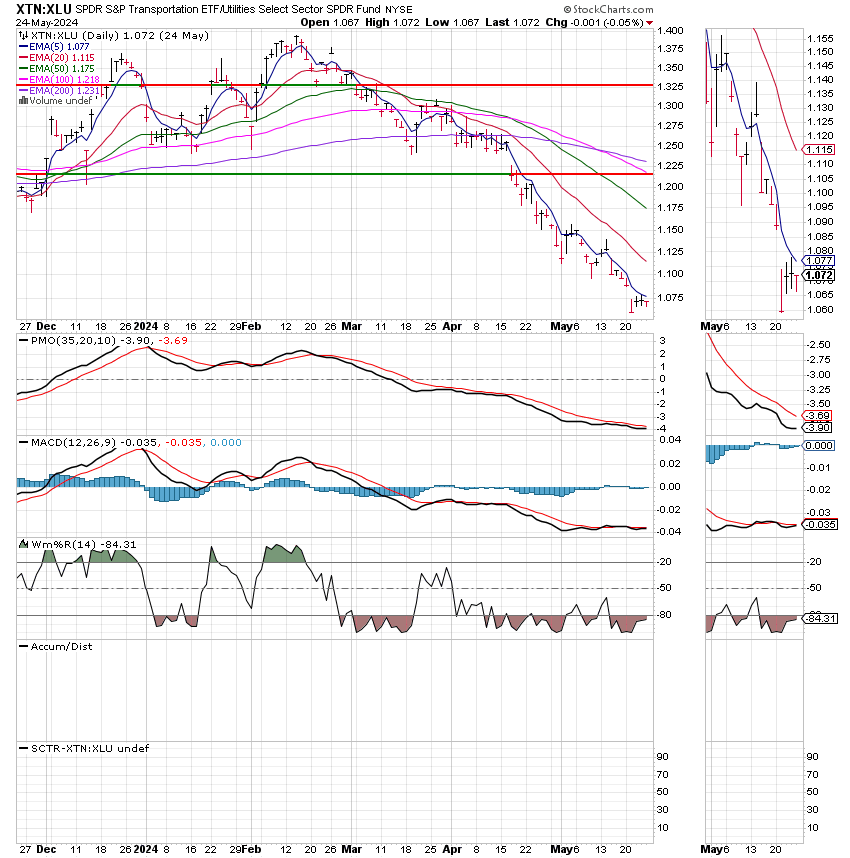

The main reason I think the uptrend will come to the end is that the transportation sector has been declining. Here is the chart I look at that tells me that. It is the Transportation sector vs the Utilities sector. Utilities is a safe haven in the times of decline and Transportation is associated with long uptrends. In short, your not going to have a rally without transportation. Here is the chart:

As you can see it is moving lower. Study it and you will understand how if works.

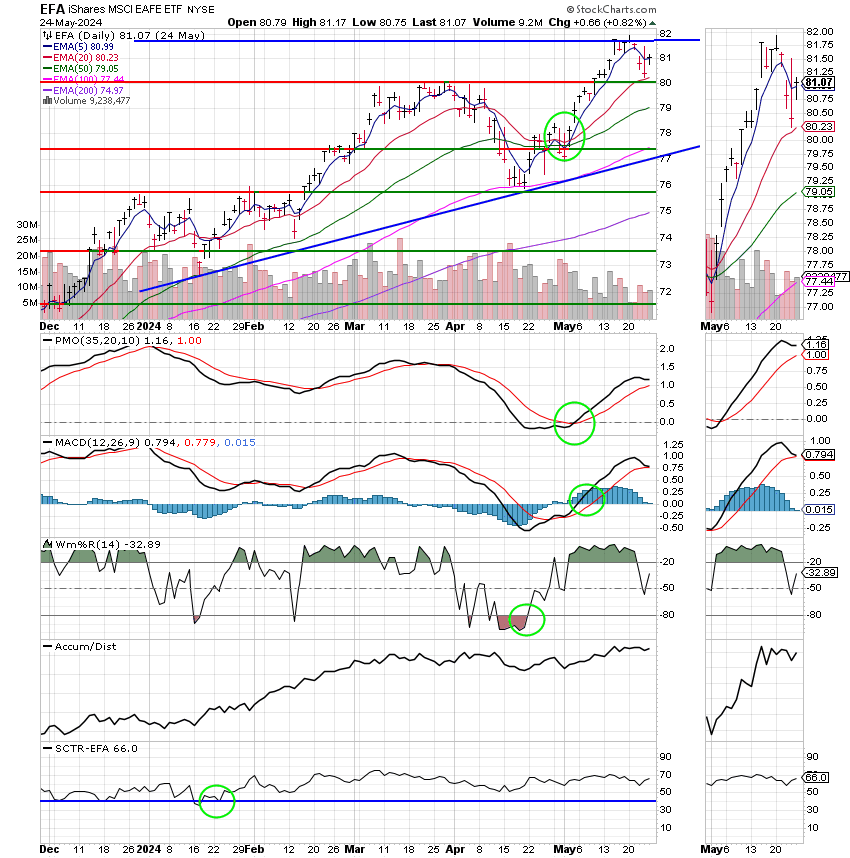

To tie things up, we are currently in an uptrend. The C fund has taken over as the strongest chart among our equity based TSP funds. So we made a move to 100/C. While we are in a uptrend, it is evident that at some time in the not so distant future the market will pull back. There are also some fundamentals that support this observation. Our goal as always is to ride this elevator as high as we can and get off before it heads back down. Just another day in the office…..

The market is closed for the holiday today but here is a look at Fridays action. Our TSP allocation added +0.87%. For comparison, the Dow was flat at -0.01%, the Nasdaq was higher at +1.10%, and the S&P 500 gained +0.66%. Praise God for a day in the green!

Nasdaq closes Friday at record high as Nvidia and the AI trade rallies on

The most recent action has left us with the following signals: C-Buy, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now +5.73% for the year. Here are the latest posted results:

| 05/24/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.2731 | 18.9218 | 83.1676 | 80.4848 | 43.1674 |

| $ Change | 0.0024 | 0.0166 | 0.5804 | 0.6912 | 0.2551 |

| % Change day | +0.01% | +0.09% | +0.70% | +0.87% | +0.59% |

| % Change week | +0.09% | -0.25% | +0.05% | -1.30% | -0.71% |

| % Change month | +0.31% | +1.69% | +5.47% | +4.38% | +4.71% |

| % Change year | +1.73% | -1.56% | +11.84% | +4.40% | +7.43% |