Good Morning, Well we got the last minute budget deal that we anticipated this weekend. House Speaker Kevin McCarthy and President Joe Biden came up with a compromised budget that included some of the spending cuts that the Republicans were demanding. The key word here is “some’. President Biden described the budget in this way. He said that not everyone gets everything they want in a compromise. Here in lies the issue. The far left progressive Democrats do not like the bill and neither do the far right republicans. President Biden and House Speaker McCarthy must still sell this compromise to their respective parties in congress. While I think the bill will pass, it will probably not pass without a little drama and drama creates doubt. One thing we all know the market does not like and that’s doubt. So don’t expect the market to go straight up from here with no issues. The far right and the far left will clash on this budget. However, I believe that they will pass it in the end. Why? Because they have to. That’s why! The majority of investors think that the market will go straight up from here. No doubt, there will be a relief rally, but I do not believe it will last. Once this issue is resolved the market will refocus on the long term issues that have plagued us for the past 18 months or so. Inflation and Interest rates. Invest0rs will refocus on the Fed and their policy to control inflation. At each meeting there will continue to be doubt about whether or not the Fed will increase rates and then when it is obvious that they are finished increasing rates investors will focus on when rates will start to decrease. Let me make this simple for you. Until the rate of inflation stabilizes at 2 percent and interest rates return to prepandemic levels, there will continue to be doubt. Folks, there is a reason that doubt and dip both start with a D!! It has always been our thought here that a new bull market will not start until rates are stabilized at these levels. Currently, We remain invested in the G Fund. I know that it’s tempting to chase equities higher today as they will surely have a reaction rally to the budget agreement, but we must remain cognizant that there is still some substantial downside risk. What will the market do when all the political drama is over and it refocuses on the issues we discussed above? It will continue to slog it out. It will not get better in one day. It will take time. It took time for these conditions to develop and it will take time for them to go away. In simple terms, this is not a sprint. It is a marathon. Let that sink in. This market requires patience. As I have said and said and will say again. This is not the market of the past stimulus filled decade. So those of you that started trading during that time or those of you who have became used to those conditions in which the market simply continued to move higher with no major selloffs must come to realize that the market will require same patience as that it did before all the stimulus. The days of stimulus filled instant gratification are over…… Our strategy will now be to watch our charts for a good entry point back into equities. That may come in a week or it may be a matter of months. We just can’t say. Either way, we will remain patient and focus on protecting our precious capital first. There will be plenty of time to get back into the market when a new bull market begins. No hurry!!

The days trading has so far generated the following results. Our TSP allotment remains steady in the G Fund. For comparison, the Dow is off -0.23%, the Nasdaq is trading higher at +0.68%, and the S&P 500 is up +0.16%. So far not what we expected given the tentative budget agreement, but the day is still young.

S&P 500 rises as lawmakers reach tentative debt ceiling deal, Nvidia hits $1 trillion market cap: Live updates

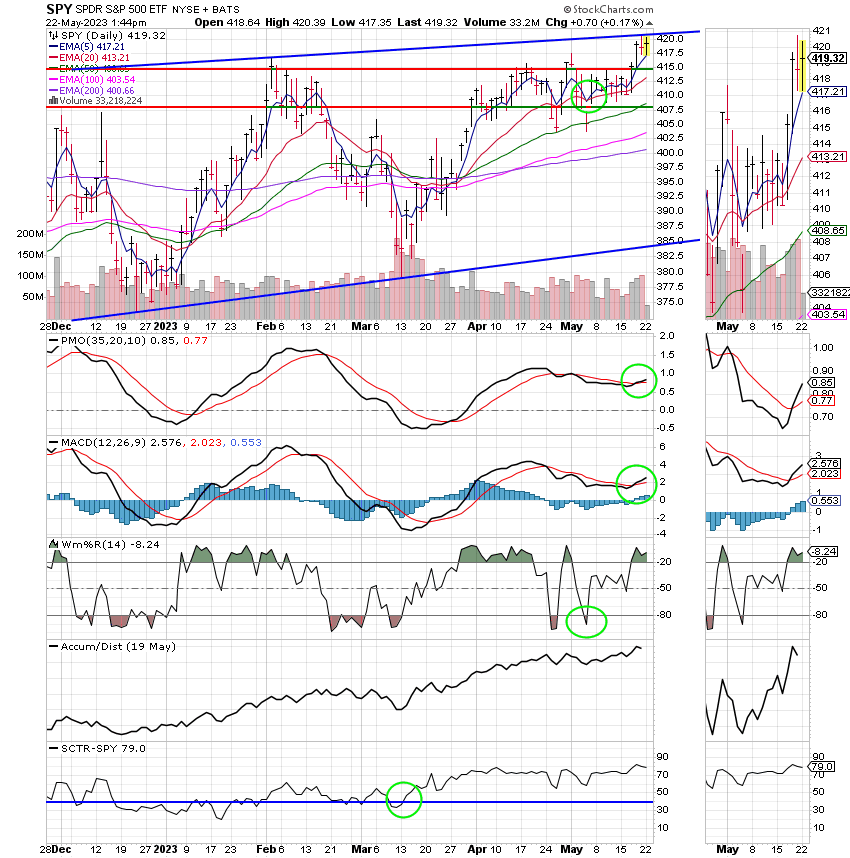

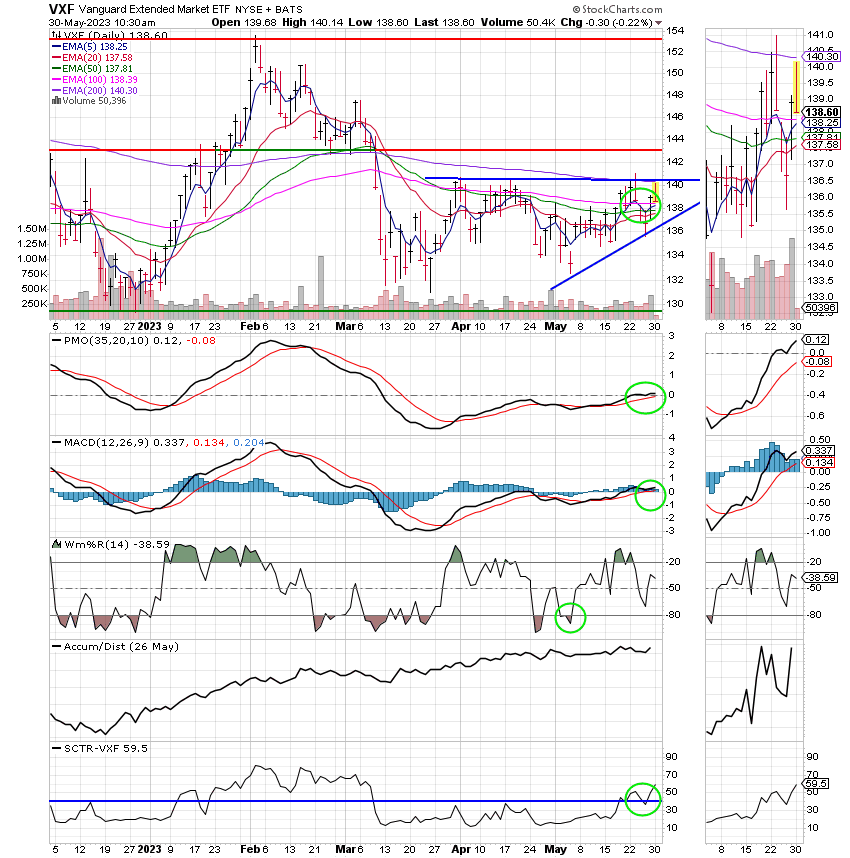

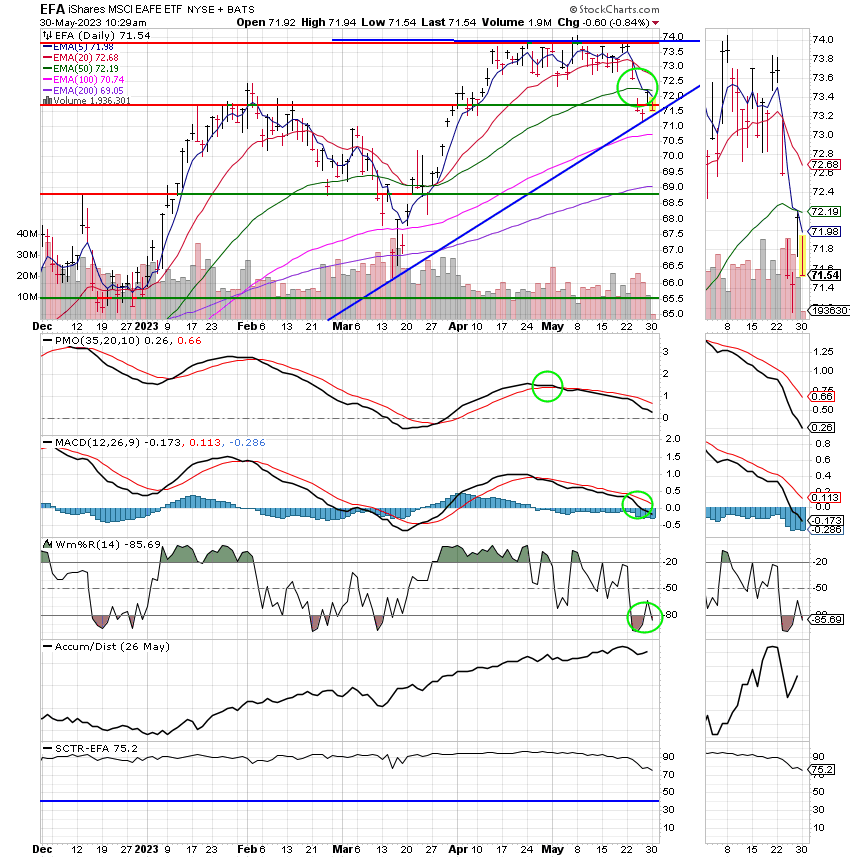

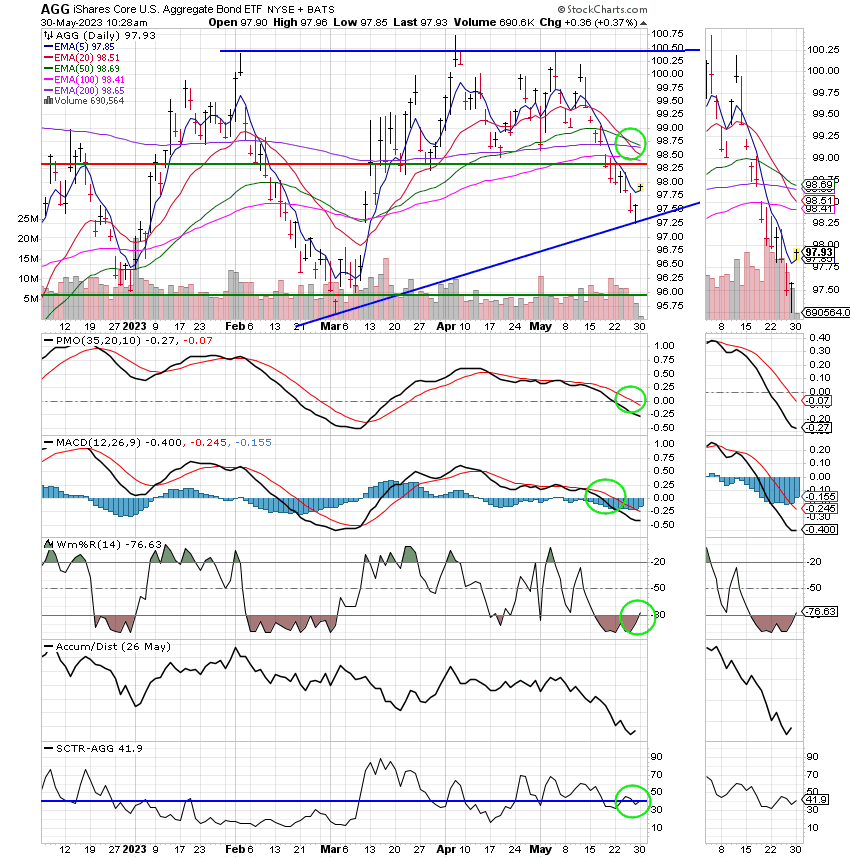

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -2.14% for the year not including the days results. Here are the latest posted results:

| 05/26/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5004 | 18.4739 | 64.9565 | 64.4145 | 37.1748 |

| $ Change | 0.0018 | 0.0125 | 0.8409 | 0.9306 | 0.3524 |

| % Change day | +0.01% | +0.07% | +1.31% | +1.47% | +0.96% |

| % Change week | +0.07% | -0.57% | +0.34% | +0.30% | -1.98% |

| % Change month | +0.26% | -2.21% | +1.02% | +1.11% | -1.99% |

| % Change year | +1.54% | +1.46% | +10.27% | +4.69% | +9.52% |