Good Evening, When the market is volatile I get a lot more E-mails and messages. A lot more! I’ve certainly been busy this week. There’s one thing about it though. When I get a lot of messages at the same time their usually about the same thing. This time around I have had two questions. #1 What am I going to do if I need to get back into the market while the Thrift system is down for maintenance and #2 When are we going to get back in which is usually accompanied by some version of It’s going up and I’m missing it or It’s going up and I’m losing (I guess they say that because they view not being in as losing). Hmmm, does that mean we were gaining when the market went down several recent weeks? As I pointed out on face book last week. There are a lot of folks that are worried about the maintenance shutdown at Thrift. They are concerned that they might miss a trade. We never think in short terms like a week. We are always looking for intermediate to long term trends. The thing I keep telling folks that are worried about this short Thrift shutdown is that they have grown too accustomed to the market that was fueled by government stimulus the past 12 years. The stimulus is gone! It will not behave as it did during that period. Changes in the overall trend will take a lot longer. Changes won’t come in minutes or hours. They will come in weeks, days and months. Put away the mindset of trying to time the market. For the most part that is a losing strategy and that’s not what we try to do here. You will have plenty of time to get in and out of the market when you need to. The key is to always have a strategy and to be patient while your executing it. So when will we get back in??? When the charts tell us to. We’re in it for the long run. Selling is not a dirty word. I like to think of it as insurance. I sell and if the market continues lower then I collect on the policy. If it moves up and I have to buy back in at a higher price then that’s that’s the cost of having the policy. I do this based on the charts and I will readily admit that the more mechanical it is the better. It’s best when the investment decision is cut and dry and there is no emotion involved. In the ideal situation that is the way we like to do it. The lack of clarity in 2022 has made this the most difficult year I have traded in to date. The the next most difficult year was 2009 when they first added stimulus with the most difficult year since that being the current year with the removed stimulus. Sooo……… what does that tell you about stimulus….

This week we had more of the same with the market being driven by higher inflation and lower growth. The question that everyone is asking is how much has this been discounted by the market? I don’t believe fully. I simply don’t trust this rally just yet. The charts have some work to do before we can say there’s a bottom. I still think there are too many negative issues for the market to ignore. That said, all market recoveries start with an oversold bounce. How do we react? We react in the same way we would any time that we anticipate a possible change in the trend. We raise our vigilance and check our charts closely for evidence that this move could be developing into something more. In other words we watch ever so closely for the next intermediate to long term trend that we can ride. One more word of advice along this line. There are things not to pay attention to like you coworkers talking about what they did or did not do in the market. That makes for nice conversation on the lunch break but it can pressure you into losses. The second thing is the overall negativity of the news. Doom despair and agony on me, Deep dark depression, excessive misery! That sort of thing!! Don’t be overwhelmed by that negative stuff and be pressured into bad decisions. You take that as a signal to double check your charts. That will keep you emotions out of it. The second thing that you should be focused on instead of your neighbors TSP is your Thrift account balance. Specifically, how close you are keeping it to it’s highs. How are you performing vs the major indices. Focus on what you can do better. What you did right and what you did wrong. Focus your attention and energy on those things but never be pressured into decisions by the need to make up for what you missed (your coworkers gains) or what you lost because Joe Thrift got out of the market and you didn’t. Not every trade is going to go your way but if you focus really hard on keeping YOUR account near it’s highs and the signals on YOUR charts you will find yourself having success beyond what you thought was possible. Why not focus entirely on what you make? After all that’s what everyone else does right? This is why!!!!!(OK old timers you can skip over this sentence because you’ve heard it many times before) It’s not how much you make that counts, It’s how much you keep!! Keeping is as good and often better than making. You’ve got to have an overall strategy for theme when you do this. What are the principles of your investment system going to be? The statement above should be the center of you investment strategy and our Heavenly Father should be at the center of it all.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow dropped -0.67%, the Nasdaq -0.41%, and the S&P 500 -0.63%.

Dow falls 200 points as Wall Street closes out a wild month

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is currently -18.56% on the year not including the days results. Here are the latest posted results:

| 05/26/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8797 | 19.1524 | 61.6252 | 65.3406 | 34.8302 |

| $ Change | 0.0013 | 0.0124 | 1.2035 | 1.5929 | 0.3990 |

| % Change day | +0.01% | +0.06% | +1.99% | +2.50% | +1.16% |

| % Change week | +0.05% | +0.73% | +4.03% | +3.30% | +2.63% |

| % Change month | +0.21% | +1.13% | -1.65% | -3.53% | +1.19% |

| % Change year | +0.86% | -8.30% | -14.35% | -21.69% | -11.69% |

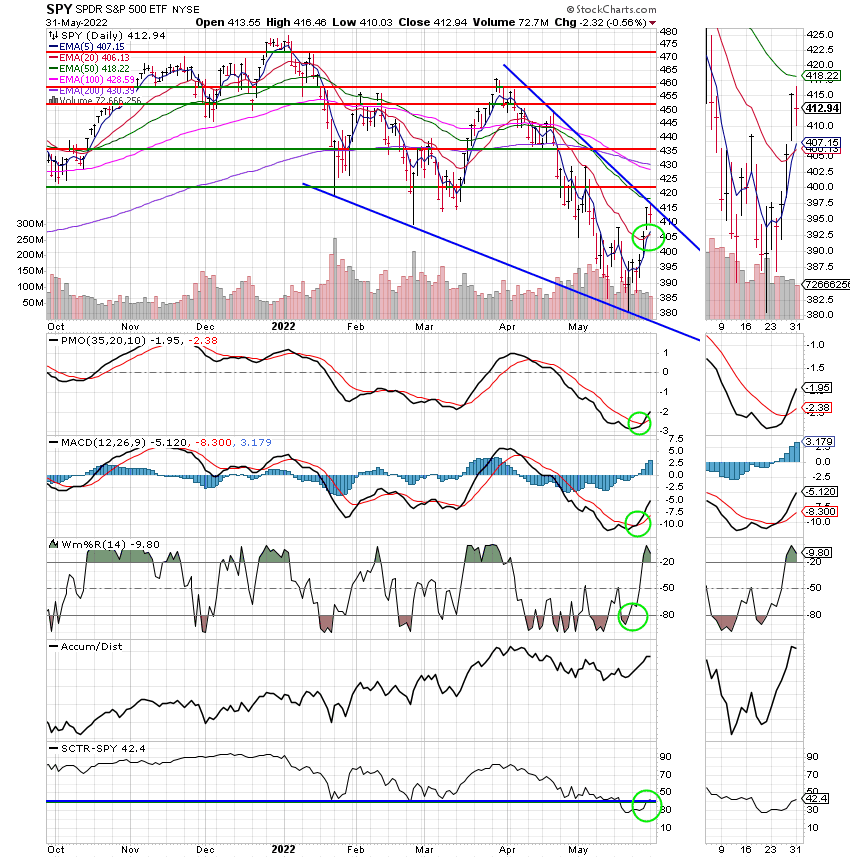

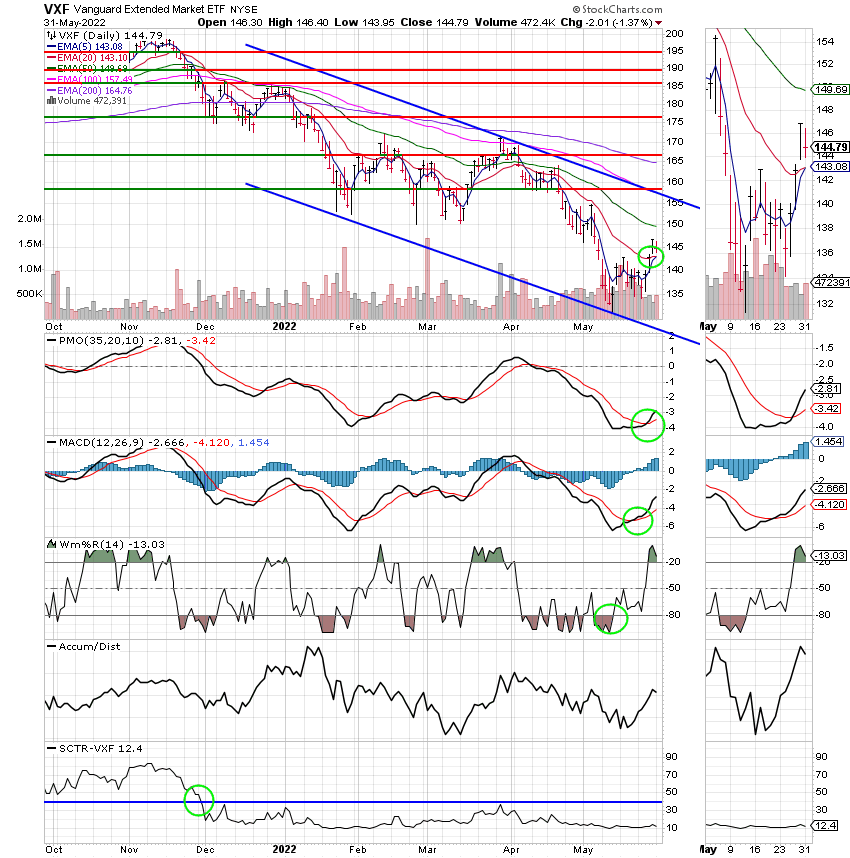

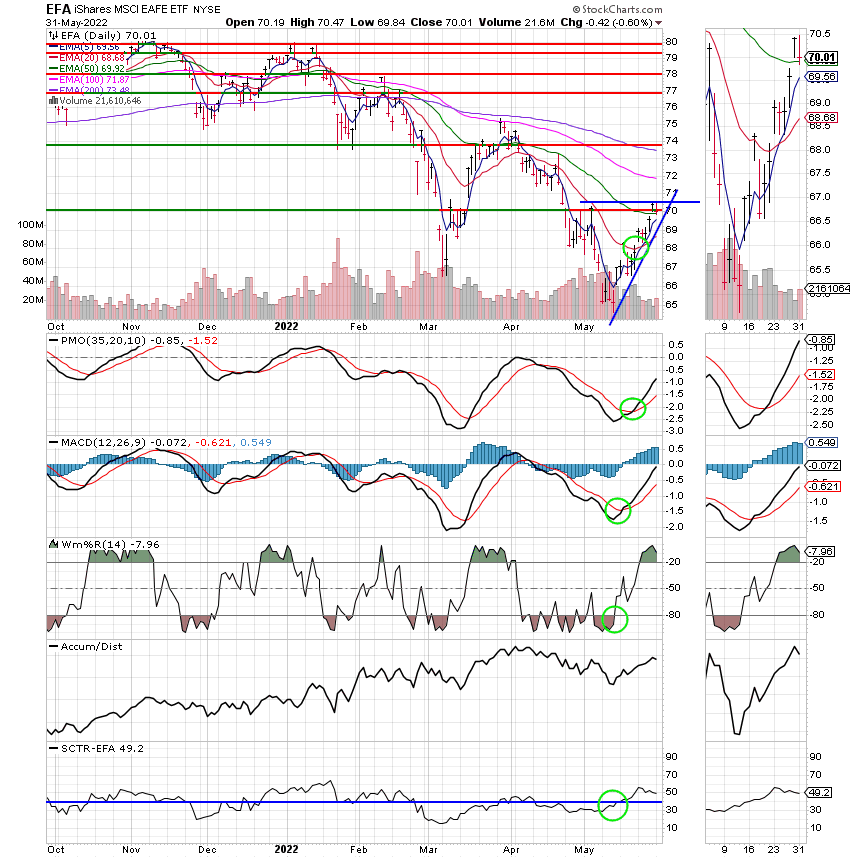

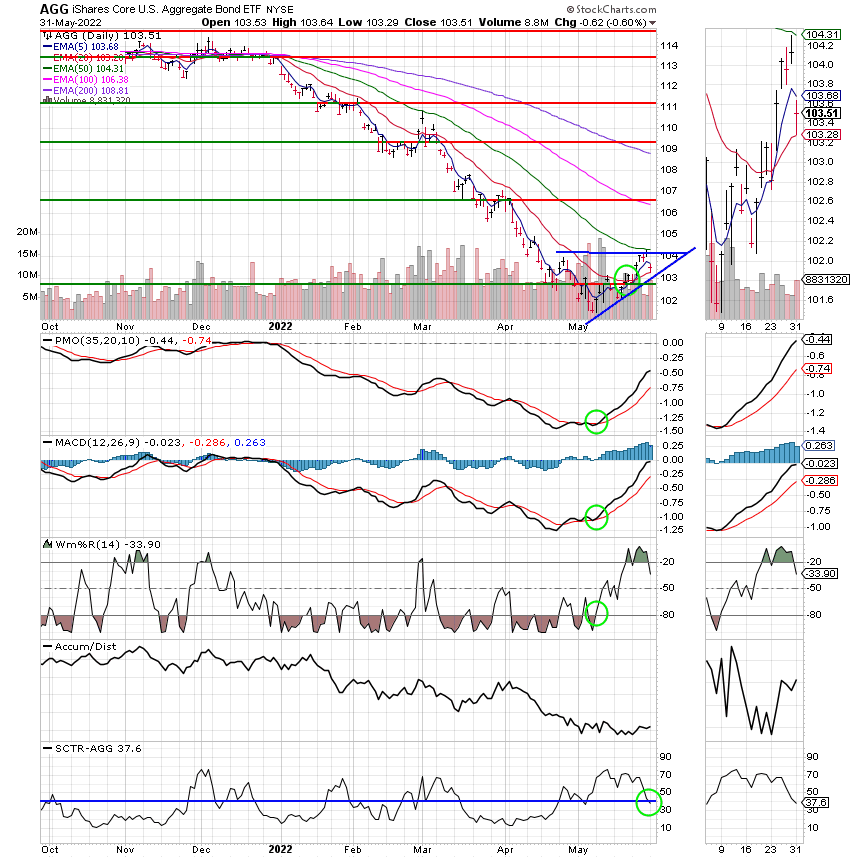

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying for our group! That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.