Good Evening,

After looking at a few of our charts yesterday we determined that some of our indicators were calling, at least in the short term, for a bounce. That bounce came right on cue. The media stated that investors were encouraged by data from April that suggests the economy picking up again after a slow period. Am I missing something here or did we just have record snow fall on the eastern corridor? I think the adequate term to use would be thawing out instead of picking up…… So this is why we sold off in the first place and no one thought the economy was going to slow down in January and February with all that snow? Maybe they were really surprised…. or was it a dead cat bounce. I believe there’s more upside, but as usual, I’ll take my cue from the charts.

Today’s nice rally left us with the following results: Our TSP allotment gained back most of what it lost yesterday at +1.04%. For comparison, the Dow added +1.03%, the Nasdaq +1.29%, and the S&P 500 +1.09%. Praise God for a good day!

Wall St. ends up sharply as investors buy beaten-down shares

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Neutral. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +4.09% on the year not including today’s results. Here are the latest posted results:

| 04/30/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7071 | 17.0363 | 27.6928 | 37.6782 | 26.6525 |

| $ Change | 0.0008 | -0.0034 | -0.2818 | -0.5761 | -0.2022 |

| % Change day | +0.01% | -0.02% | -1.01% | -1.51% | -0.75% |

| % Change week | +0.03% | -0.55% | -1.50% | -2.89% | -0.61% |

| % Change month | +0.15% | -0.28% | +0.96% | -1.50% | +4.11% |

| % Change year | +0.62% | +1.40% | +1.94% | +3.81% | +10.05% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.697 | 23.5246 | 25.6301 | 27.3519 | 15.5806 |

| $ Change | -0.0356 | -0.1199 | -0.1723 | -0.2161 | -0.1391 |

| % Change day | -0.20% | -0.51% | -0.67% | -0.78% | -0.88% |

| % Change week | -0.31% | -0.75% | -1.00% | -1.19% | -1.33% |

| % Change month | +0.37% | +0.81% | +0.95% | +1.00% | +1.16% |

| % Change year | +1.41% | +2.73% | +3.32% | +3.69% | +4.16% |

Let’s take a look at the charts:

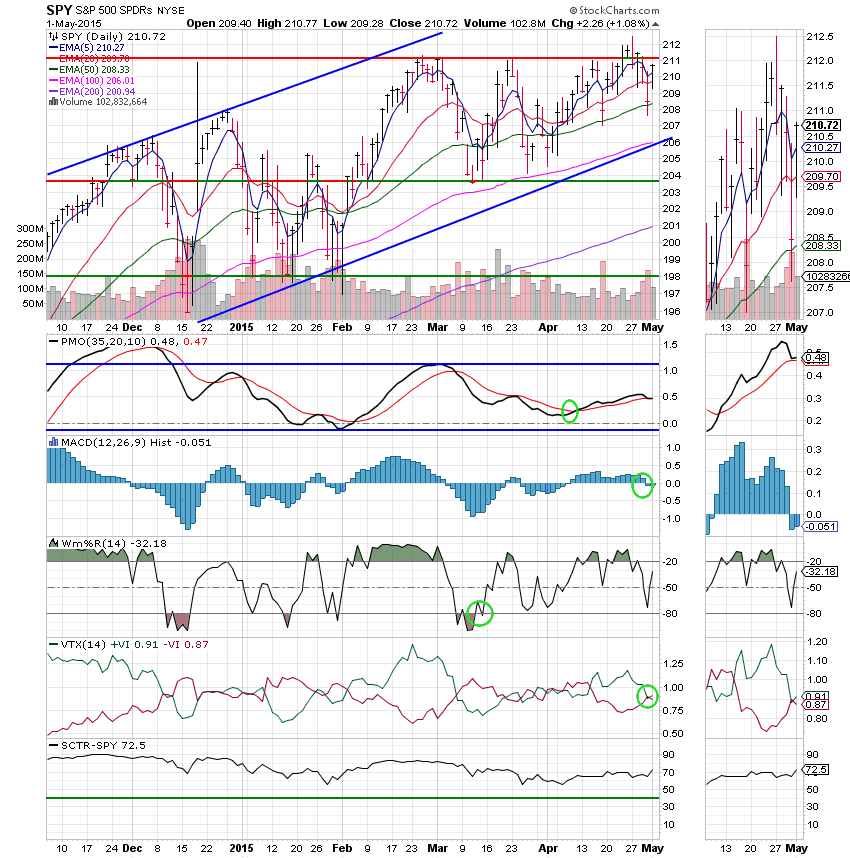

C Fund: The C Fund strengthened today as price closed back above its 5 EMA. The VTX whipsawed to go back into a positive configuration. All the other indicators improved as well.

S Fund: The S Fund managed a nice gain today, but price still closed under its 50 EMA as small caps lagged. On the positive side, the Williams %R confirmed its move up so the upswing should continue, at least for the short term. As I mentioned yesterday and maybe the day before, small caps have signaled lower prices and the subsequent up-swing each time we have experienced a dip. I am watching this fund closely to see if it might be signaling higher prices yet again. Should it turn up, it has a lot of room to run.

I Fund: The I Fund had a really nice day with price closing above resistance and moving back to the middle of the ascending wedge, which I might add is a bullish pattern! The MAC D remains negative, but other than that, I don’t have any bad things to say. Also on the positive side, the SCTR continues to strengthen and is now up to 83.4. That is an extremely strong rating verses other funds and stocks in the sector which justifies our allocation of 63% to this fund!

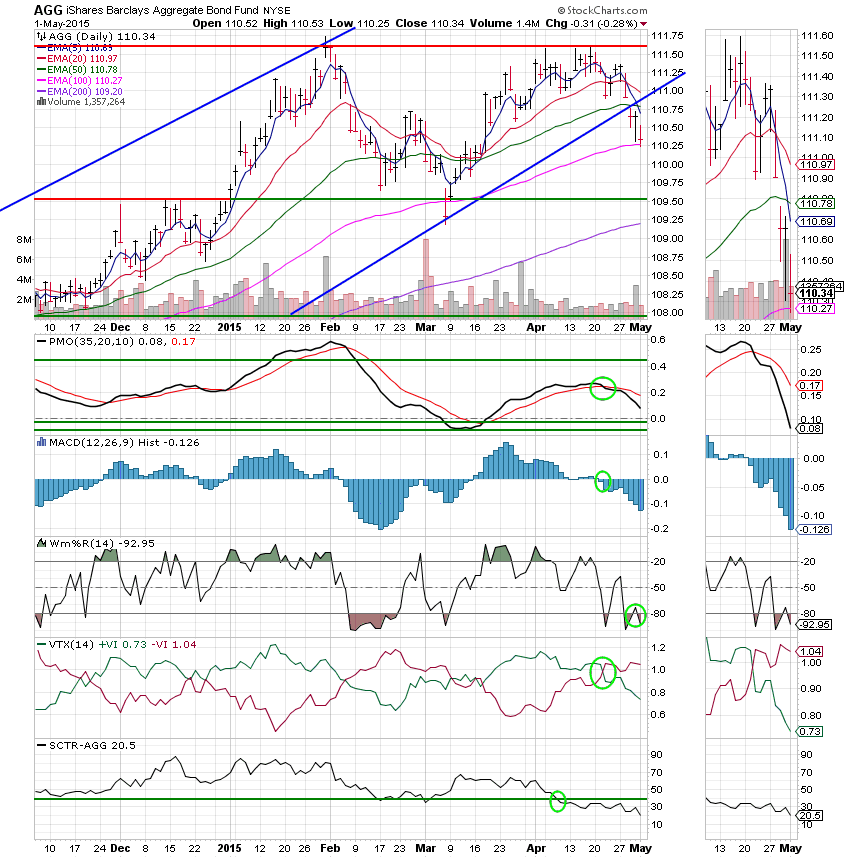

F Fund: What can I say? Our charts predicted this break down in bonds. What else does this tell us? It is probably telling us that stocks have some more upside. After all, where else can the money go? The fund price made its third consecutive close under its 50 EMA and is dragging this fund toward a sell signal if and when the 20 EMA crosses though the 50 EMA. All indicators for this chart continue to weaken and an SCTR of 20.5 is about as bad as it gets. Do I really need to tell you not to put any money here???

The market managed a nice bounce today. The question when you’ve had a bounce after a protracted sell-off: Is this a new trend or a dead cat bounce? There’s no way to know without watching the charts on Monday. My bet is that the uptrend will continue, but the recent pattern has been for there to be a failed bounce or two before things head back up for good. With that in mind, I caution you not to rush to judgment one way or the other as next week gets under way. Think with your charts and not with your hearts. Also, don’t forget to pray for God’s guidance as it is the true key to success both in stocks and life! Praise His Holy name!! Have a blessed evening!

God bless,

Scott![]()