Good Evening,

We started off the morning with a little pop from a good earnings report from Comcast and then spent the day drifting in the same range. After the open it was pretty dull. The major indices did manage to close with small to moderate gains on the day. The dull trading left us with the following results: Our TSP allotment gained +0.0569% on the day. For comparison the Dow was up +0.26%, the Nasdaq +0.23%, and the S&P 500 +0.29%. Thank God for another positive day!

Wall Street ends on upbeat earnings from Berkshire, Cognizant

The day’s trading left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Neutral. I posted an excellent article about what to do with signals by Carl Swenlin on our Facebook page at My TSP Guide. The Facebook page is an excellent source of additional information for the TSP investor. Check it out!

Our TSP allotment is now +4.28% on the year, not including the day’s results. Here are the latest posted results:

| 05/01/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7078 | 16.9726 | 27.9953 | 37.9493 | 26.5799 |

| $ Change | 0.0007 | -0.0637 | 0.3025 | 0.2711 | -0.0726 |

| % Change day | +0.00% | -0.37% | +1.09% | +0.72% | -0.27% |

| % Change week | +0.04% | -0.92% | -0.42% | -2.19% | -0.88% |

| % Change month | +0.00% | -0.37% | +1.09% | +0.72% | -0.27% |

| % Change year | +0.62% | +1.02% | +3.05% | +4.55% | +9.75% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7181 | 23.5937 | 25.7288 | 27.4753 | 15.6589 |

| $ Change | 0.0211 | 0.0691 | 0.0987 | 0.1234 | 0.0783 |

| % Change day | +0.12% | +0.29% | +0.39% | +0.45% | +0.50% |

| % Change week | -0.19% | -0.46% | -0.62% | -0.74% | -0.83% |

| % Change month | +0.12% | +0.29% | +0.39% | +0.45% | +0.50% |

| % Change year | +1.53% | +3.04% | +3.72% | +4.16% | +4.68% |

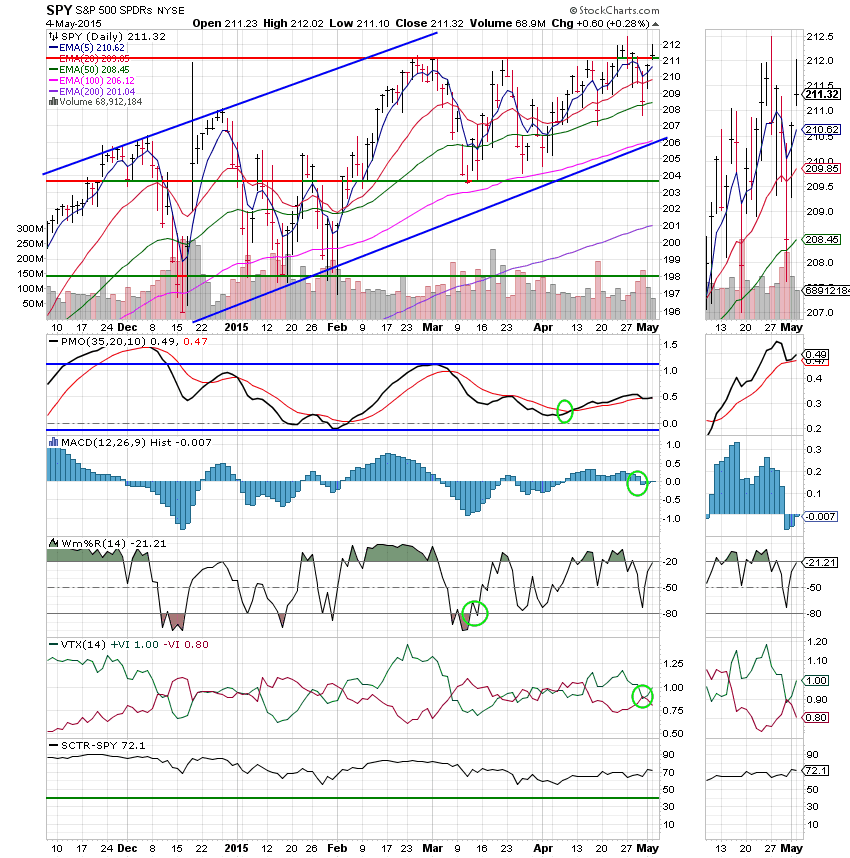

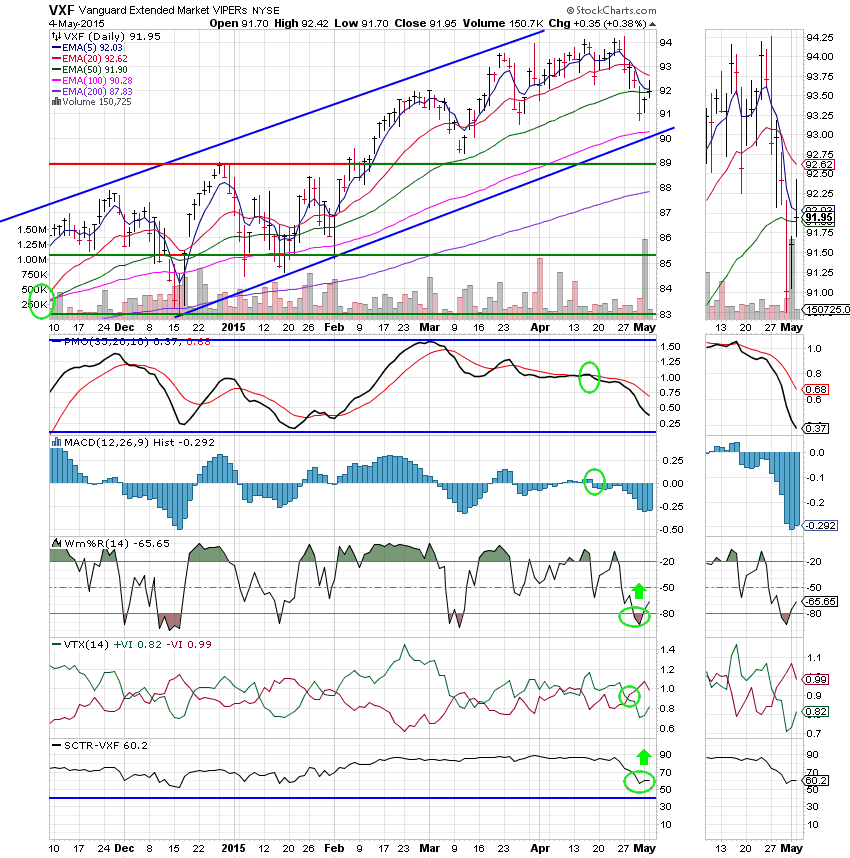

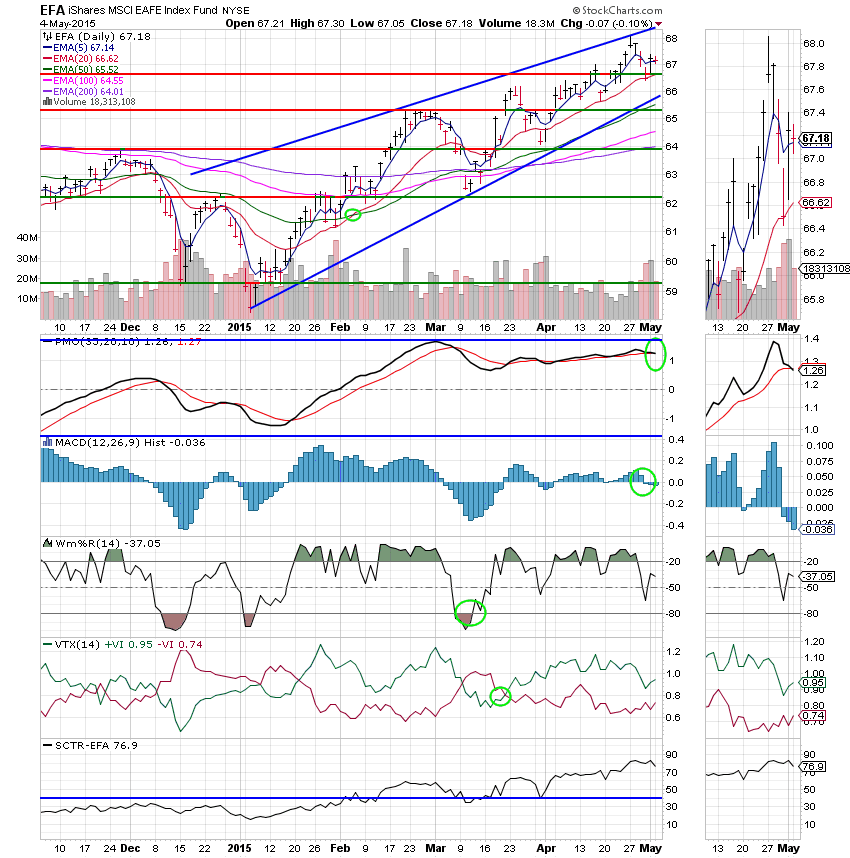

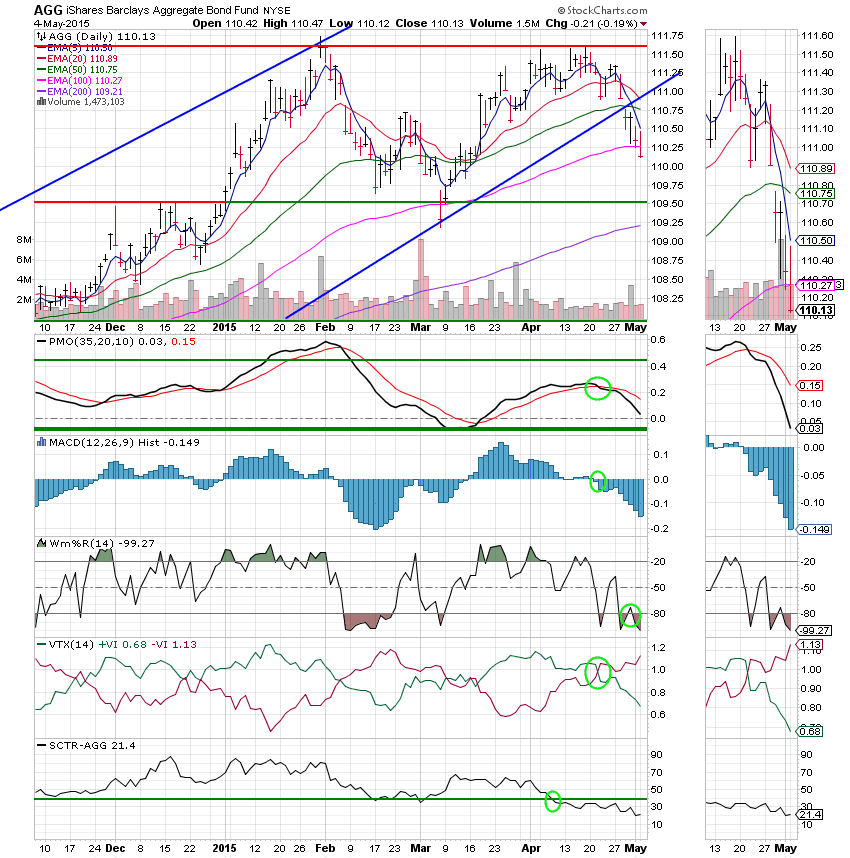

Now let’s take a look at the charts:

C Fund: The C Fund continues to hang in there with price closing above resistance at close to 211. The PMO and VTX have turned back up improving the internal strength of this chart.

S Fund: Price regained its 50 day moving average. However this chart still has a lot of work to do in order to generate a buy signal. The Williams %R, the VTX, and the SCTR are all heading up so it looks like the S fund may have bottomed. Also worth noting is that Friday’s bounce occurred on very high volume which is another bullish sign.

I Fund: The I Fund took another day off but price still remains above support at just under 67 and in the center of the ascending wedge. If this bullish pattern executes, this fund will move higher! On the negative side, the PMO dropped under its EMA today. This gives the S Fund a neutral signal with two indicators (the PMO and MAC D) in negative configurations. No real concern here as both signals could easily reverse.

F Fund: The F Fund continues to deteriorate with price closing below its 100 EMA. All indicators with the exception of price have already turned negative. Should price continue to drop through its 20 EMA (and I think it will) this fund will generate a sell signal.

Our job now is to monitor our charts to make sure that this bounce doesn’t fail. That’s all for tonight. Have a nice evening and may God continue to bless your trades.

God bless,

Scott![]()