Good Evening,

Well… we were looking out for a possible failed bounce and we got one. Today’s selling was broad based and there was nowhere to hide. If you were holding long positions then you felt the pain. The selling was fueled by news that the trade deficit had grown to the largest that it has been in 6 1/2 years. It was also based on a renewed concern about the FED raising interest rates. I have already commented on the interest rate issue. I don’t see any way that the FED could raise rates before September and when a rate increase finally comes we will still be at historic lows. Come on, it’s not like they’re going to raise the rates drastically in one day! Is anybody besides me not surprised that the trade deficit grew? Given the strong dollar and the fact that some of our largest ports in California were basically shut down for an extended period of time, it should come as no surprise. However, the media must have something to write about. They must have an explanation for the market selling off and today, this is it.

The day’s bloodletting left us with the following results: Our TSP allotment dropped a whopping -1.40%! For comparison, the Dow lost -0.79%, the Nasdaq 1.55%, and the S&P 500 -1.18%. It was pretty nasty out there. So what am I going to thank God for today? Of course, that it is over!

Wall St. ends lower on weak trade data; investors eye Fed

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 23/C, 14/S, 63/I. Our allotment is now +4.45%on the year, not including the day’s results. Here are the latest posted results:

| 05/04/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7103 | 16.957 | 28.0778 | 38.0745 | 26.6003 |

| $ Change | 0.0025 | -0.0156 | 0.0825 | 0.1252 | 0.0204 |

| % Change day | +0.02% | -0.09% | +0.29% | +0.33% | +0.08% |

| % Change week | +0.02% | -0.09% | +0.29% | +0.33% | +0.08% |

| % Change month | +0.02% | -0.47% | +1.39% | +1.05% | -0.20% |

| % Change year | +0.64% | +0.92% | +3.36% | +4.90% | +9.84% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7281 | 23.6224 | 25.7687 | 27.5247 | 15.6904 |

| $ Change | 0.0100 | 0.0287 | 0.0399 | 0.0494 | 0.0315 |

| % Change day | +0.06% | +0.12% | +0.16% | +0.18% | +0.20% |

| % Change week | +0.06% | +0.12% | +0.16% | +0.18% | +0.20% |

| % Change month | +0.18% | +0.42% | +0.54% | +0.63% | +0.70% |

| % Change year | +1.59% | +3.16% | +3.88% | +4.34% | +4.89% |

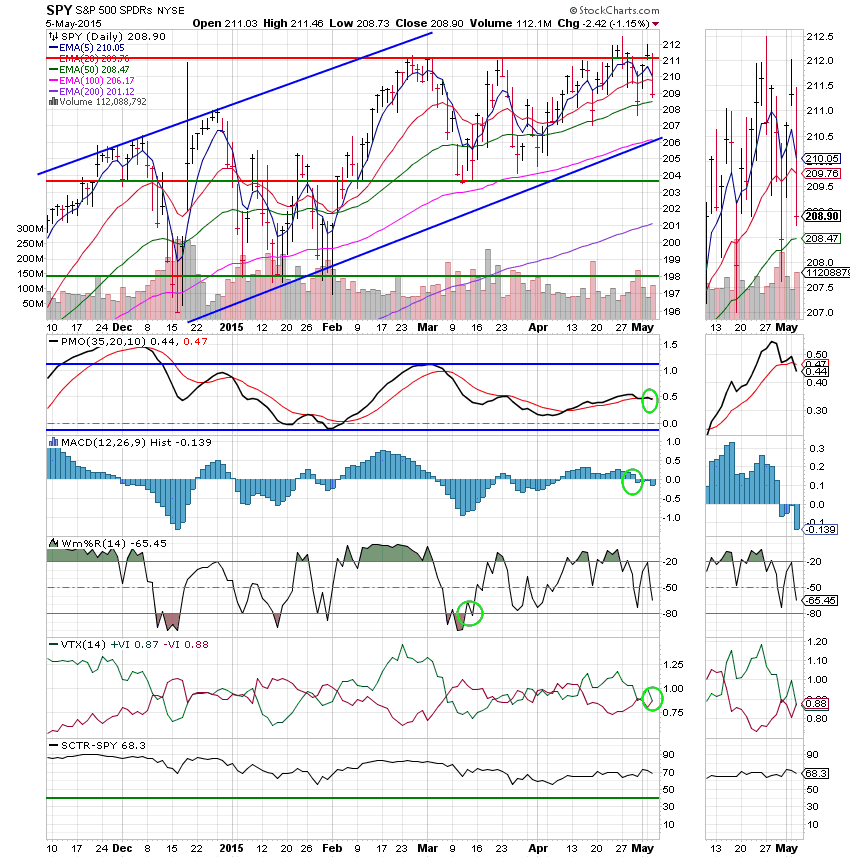

Now, lets take a look at the charts:

C Fund: The C Fund generated a Neutral signal today as the PMO made a negative crossover of its EMA and the VTX turned bearish. Price closed below support as well as below its 20 EMA. However, it did manage to stay above its 50 EMA.

S Fund: Price dropped and again closed under its 50 EMA. Should it not improve it could drag the 20 EMA through the 50 EMA which would generate a sell signal provided that the other indicators remain in negative configurations. Also of note, price is getting close to challenging the lower trend line. This is a key area of support. If it is broken, the next area of support is at 89. After that it gets real ugly, but for now the trend is still up.

I Fund: Price dropped back below support in the 66.80 area and is now challenging the lower trend line. Currently, this is a bullish pattern and will remain so as long as the lower trend line holds. However, the pattern could resolve to the downside in the event that this key support is broken. This fund is currently neutral with the PMO and MAC D in negative configurations. If the lower trend line holds, I am still bullish on the I Fund!

F Fund: No surprise here with the latest interest rate scare that bonds continue to deteriorate. Barring a miracle, it now looks like the F Fund will generate a sell signal in the coming days. Price again closed below the 100 EMA and is dragging the 20 EMA closer to a negative crossover of the 50 EMA which will generate the signal. Enough said here!

It’s not for the faint of heart out there. Now is when we really need to remain disciplined and stick with our charts. We don’t have any sell signals at this time, but we do have some looming in the distance. Once again, God will see us through this sell off. Give Him all the Praise! That ‘s all for tonight. Have a great evening!

God bless,

Scott![]()