Good Evening,

Stocks sold off again today. They didn’t sell off as bad as they did yesterday and managed to close off their lows for the day. There are some interesting dynamics going on in the market right now. The issues that drove the selling the last two days were #1 The rising price of oil and its potential effect on inflation. #2 A renewed concern by traders that the FED will raise interest rates in response to higher inflation. #3 Remarks by Fed Chairwoman Janet Yellen that stock valuations are getting high. I think Aunt Janet’s remarks are ill-timed to say the least. The result of all this is that we have a pretty good sell off going. It could actually turn into our first correction in over three years. However, saying that we’re going to have a correction is kind of like trying to use valuation to call the top of the market. Who’s to say. This market has been extended forever and when it finally does correct there will be plenty of folks saying I told you so. The truth of the matter is that a market this extended could always correct and nobody can say when that time will come!

The day’s trading left us with the following results: Our TSP allotment actually managed small gain at +0.0757% thanks in a large part to the I Fund. For comparison, the Dow lost -0.48%, the Nasdaq -0.40%, and the S&P 500 -0.45%. The three indices did manage to close up off their lows for the day so hopefully we will see some upside tomorrow. I thank God for our small gain on a losing day!

Wall St. ends lower on global bond rout, Yellen warning

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +3.51% on the year, not including today’s results. Here are the latest posted results:

| 05/05/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7111 | 16.9272 | 27.7482 | 37.5437 | 26.4185 |

| $ Change | 0.0008 | -0.0298 | -0.3296 | -0.5308 | -0.1818 |

| % Change day | +0.01% | -0.18% | -1.17% | -1.39% | -0.68% |

| % Change week | +0.02% | -0.27% | -0.88% | -1.07% | -0.61% |

| % Change month | +0.03% | -0.64% | +0.20% | -0.36% | -0.88% |

| % Change year | +0.65% | +0.75% | +2.15% | +3.44% | +9.08% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6884 | 23.4941 | 25.586 | 27.2975 | 15.5452 |

| $ Change | -0.0397 | -0.1283 | -0.1827 | -0.2272 | -0.1452 |

| % Change day | -0.22% | -0.54% | -0.71% | -0.83% | -0.93% |

| % Change week | -0.17% | -0.42% | -0.56% | -0.65% | -0.73% |

| % Change month | -0.05% | -0.13% | -0.17% | -0.20% | -0.23% |

| % Change year | +1.36% | +2.60% | +3.14% | +3.48% | +3.92% |

Let’s hit the charts.

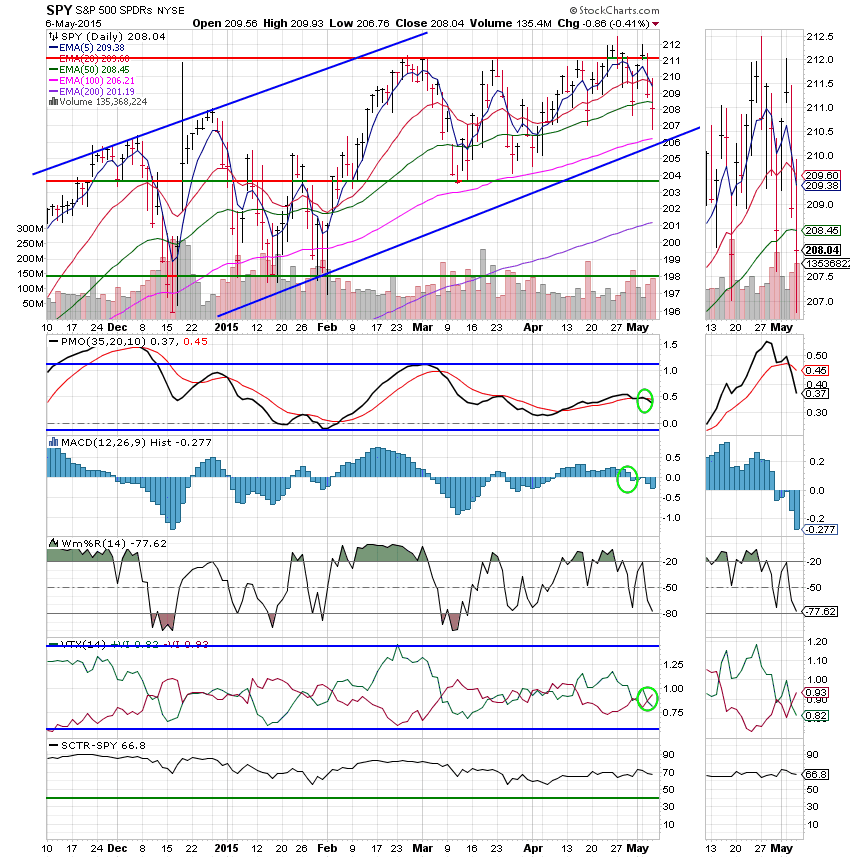

C Fund: Price closed below its 50 EMA so there is no doubt that this chart is starting to weaken. However, the Williams %R is still positive and there is still quite a bit of room between the 20 EMA and the 50 EMA. There is no real concern about a sell signal just yet.

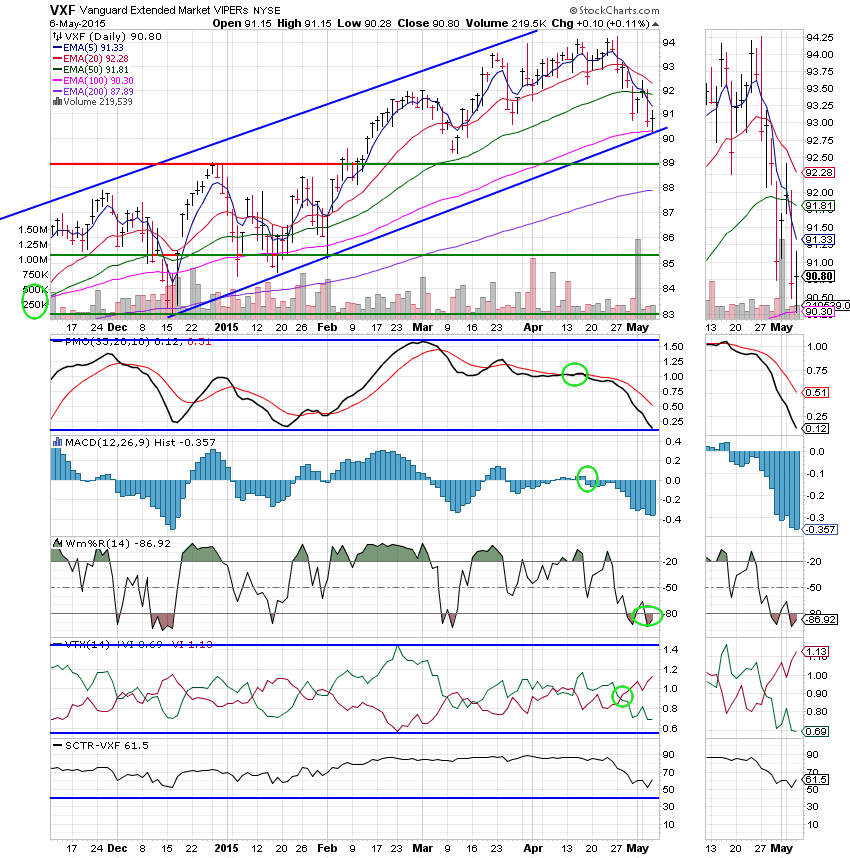

S Fund: The S Fund stopped its slide today, but price still closed well under its 50 EMA and continues to pull the 20 EMA lower. It must do some work in the coming days to ensure that the 20 EMA remains on top. The Williams %R did turn back up today which could be the beginning of a new short term run. As I have oft mentioned, small caps led us down and they will lead us back up. The fact that small caps showed some strength today is encouraging!

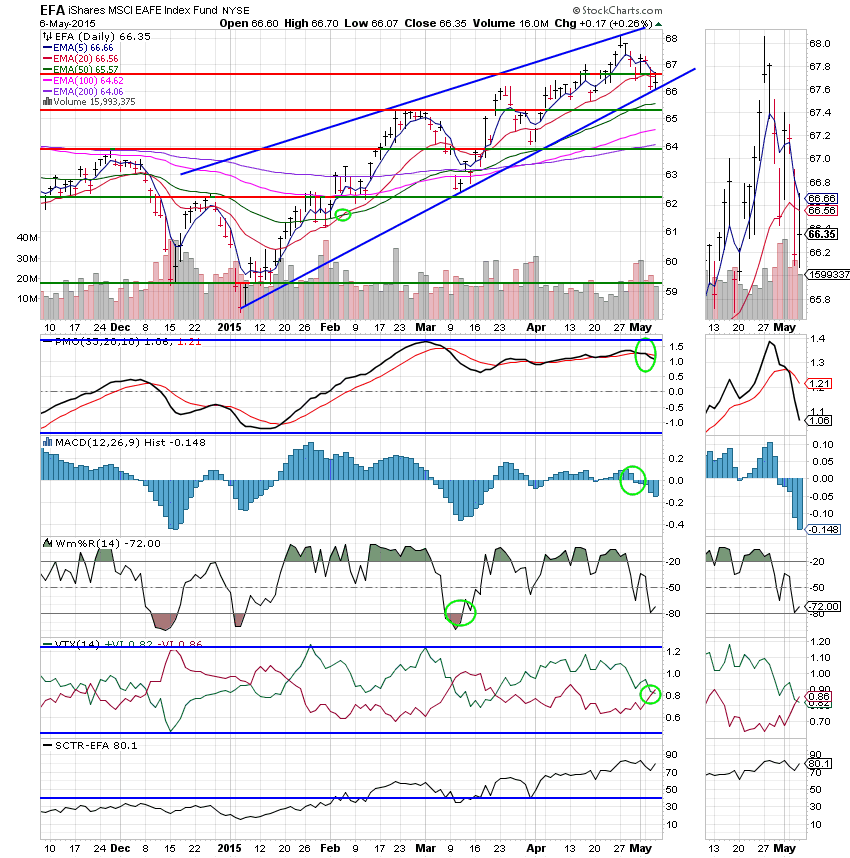

I Fund: Yesterday we talked about the importance of the lower trend line and today price was able to reverse and close with a gain after testing it. So far so good! The VTX did go negative on the day, but that’s no real surprise given recent weakness. On the positive side, the Williams %R turned up in neutral territory. This could be the signal of a new run up for the short term and right now we’ll take anything we can get!

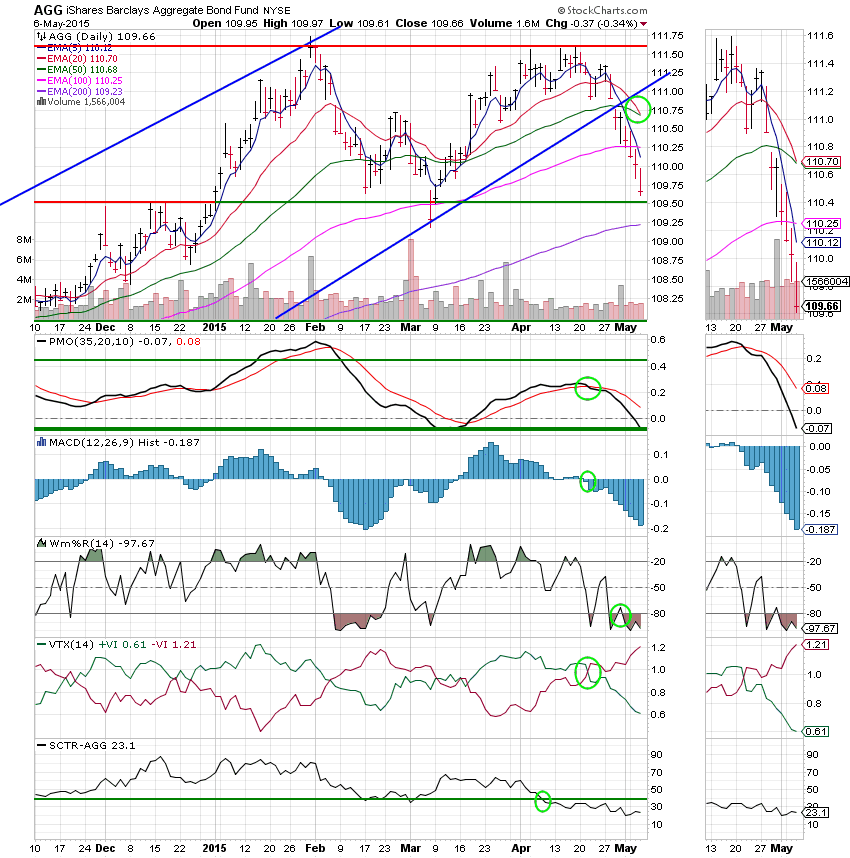

F Fund: We called this one right as our neutral and sell signals were on the money. Price dropped again today dragging the 20 EMA down through the 50 EMA generating an overall sell signal for the F Fund. It’s a solid sell signal with all six indicators in negative configurations. Shame on you if you got caught in bonds!

I know that everyone is crying correction and that may be the case, but let me point out three positive things. #1.Small caps may be bottoming. The fact that they were one of the leaders today is good. #2. I know that the threat of higher interest rates has a lot to do with the drop in bonds, but 90% of the time when bonds move down, stocks move up. #3 I follow a lot of other indicators that are too numerous to mention here. You can check out some of the articles that I posted on our face book page about market tops if you want an idea of what they are. Anyway, they are still bullish to the last indicator. It is my thought that while we may indeed have a correction, that it will not turn into a bear market. I still think there is some upside but it will be a choppy market to get there. Either way, God is with us and He will see us through to the end. Give Him all the praise for He and He alone is worthy! May He continue to bless your trades! Have a great evening.

God bless,

Scott![]()