Good Evening, I am busy going in several directions these days. As you probably guessed, this isn’t the only thing I do. I have a parent in long term care and work in two church ministries in addition to my stocks and this service and that’s only part of it. My purpose in saying this is to let you know where my priorities are. After God and my family, my number one priority is to monitor the charts and do the research for the stocks and funds that I follow. That way, any changes I make are made in a timely manner and that especially includes TSP. I never fail to do the research for this allocation. After that is done and only after that is done do I take the time to do this blog. In other words when I am busy I make sure I monitor all the allocations for which I am responsible before I do this blog which means that I do not do this blog every night. However, even on days that I don’t complete a blog, I will put out an alert if any changes are necessary. Our main focus should always be on the performance of our allocation, not on putting on putting on a performance……..I prefer to let the returns do the talking when I can and I thank God that most years they have been good!

Today the market launched on earnings from Amazon and a statement from the Bank of Japan that they will take measures to strengthen the yen if necessary. It continued higher into the afternoon and closed out at it’s highs. It was the best day since April 15th. Enough said….

The days rally left us with the following results: Our TSP allotment gained +1.19%. For comparison, the Dow added +1.26%, the Nasdaq +1.26%, and the S&P 500 +1.25%. Thank God for a good day!

Amazon delivers S&P 500 its best day in two months

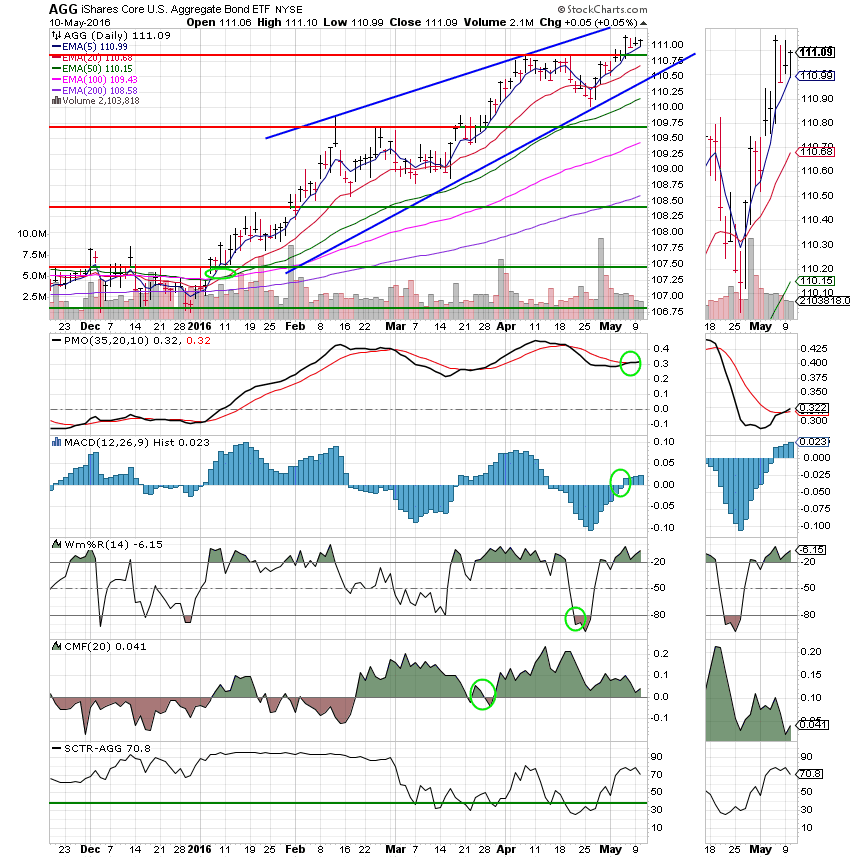

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +2.08% on the year not including the days gains. Here are the latest posted results:

| 05/09/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0157 | 17.6027 | 27.9774 | 35.1839 | 23.5284 |

| $ Change | 0.0021 | 0.0156 | 0.0213 | 0.0604 | -0.0092 |

| % Change day | +0.01% | +0.09% | +0.08% | +0.17% | -0.04% |

| % Change week | +0.01% | +0.09% | +0.08% | +0.17% | -0.04% |

| % Change month | +0.04% | +0.26% | -0.26% | -1.15% | -1.97% |

| % Change year | +0.67% | +3.82% | +1.51% | -0.15% | -2.35% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9208 | 23.3641 | 25.2086 | 26.7009 | 15.0753 |

| $ Change | 0.0048 | 0.0087 | 0.0115 | 0.0135 | 0.0082 |

| % Change day | +0.03% | +0.04% | +0.05% | +0.05% | +0.05% |

| % Change week | +0.03% | +0.04% | +0.05% | +0.05% | +0.05% |

| % Change month | -0.13% | -0.38% | -0.55% | -0.66% | -0.77% |

| % Change year | +0.83% | +0.67% | +0.58% | +0.49% | +0.33% |

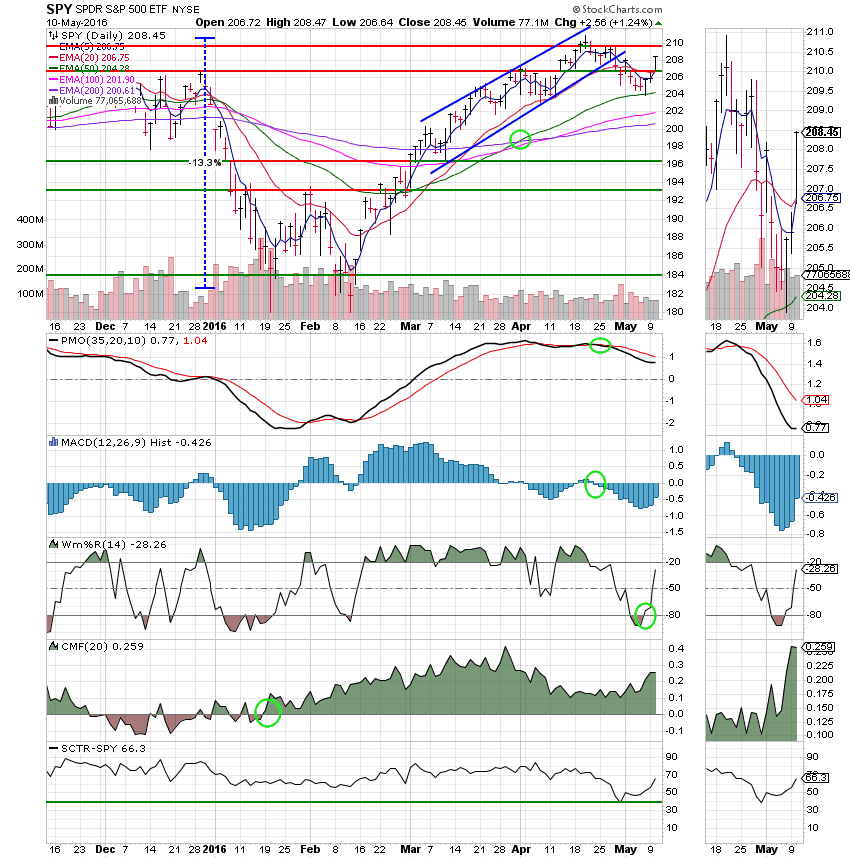

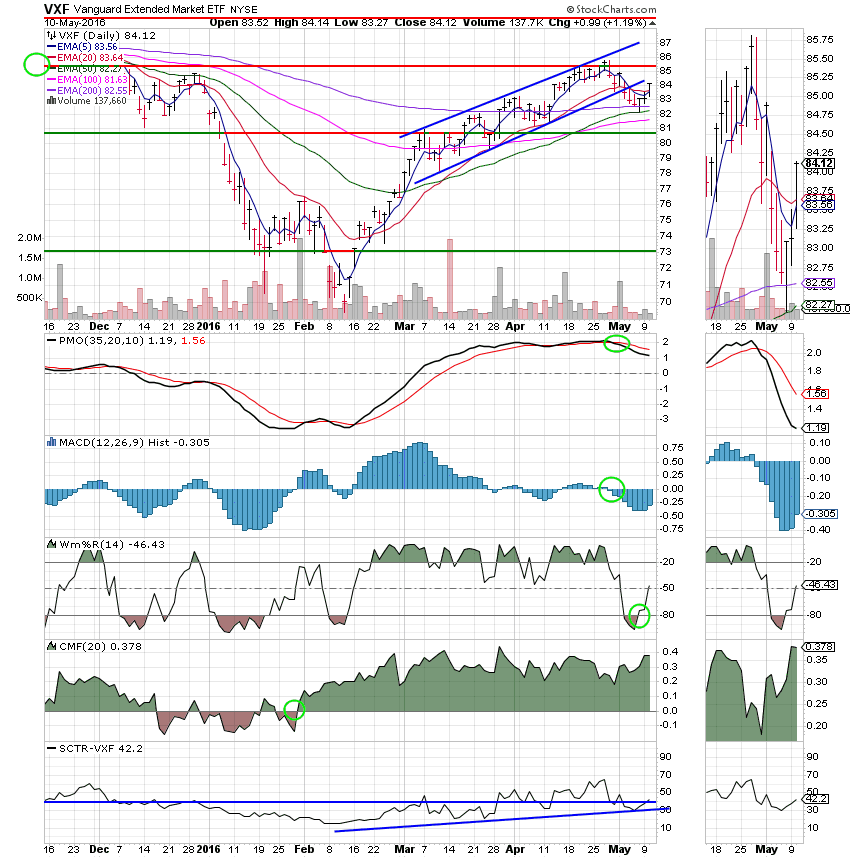

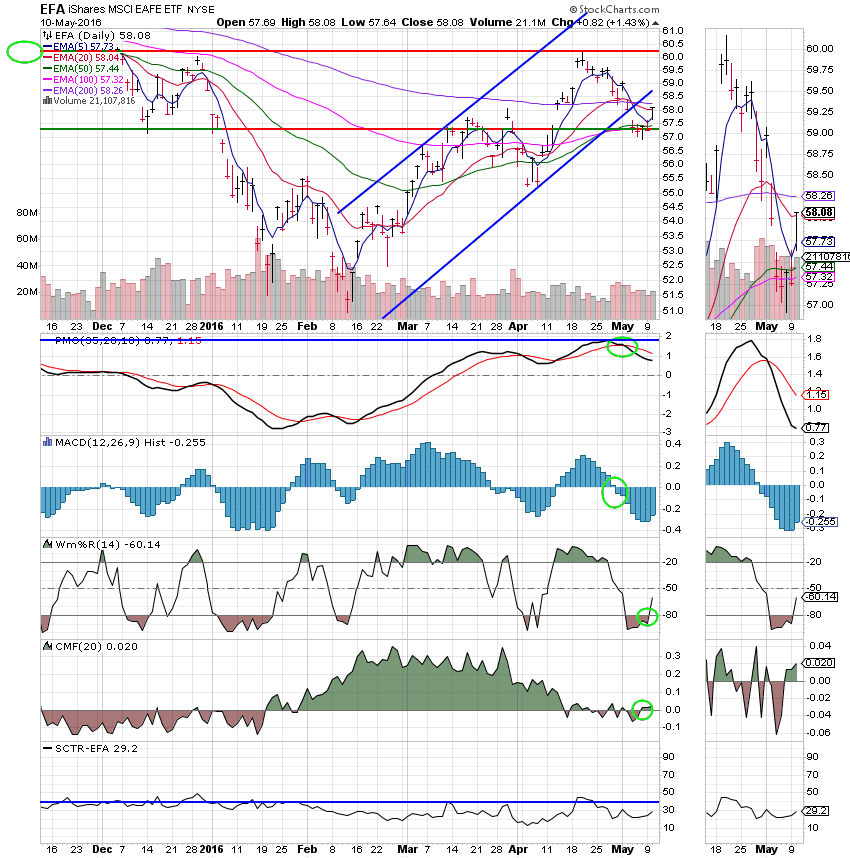

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

For now, we’ll keep watching our charts. As long as the 5 EMA remains over the 50 EMA in the S fund no adjustments are required. That’s all for tonight. Have a great evening and may God continue to bless your trades!