Good Evening,

The market drifted sideways with a negative bias in the morning and then spent the afternoon slowly moving up, closing out on its highs for the day. Both the S&P and Dow set new records, but not by much. The prevailing thought in the media was that market players convinced that current economic data will keep the Fed from raising interest rates in the near future. For the record, our bet here has always been for a rate increase in September. The gains were a little thin today, but they were gains and as I have often said I’ll take a small gain over a loss any day. Small caps took the lead today with foreign markets bringing up the rear. If foreign markets (the I Fund in particular) follow recent history, they will have a big day when everything else under-performs. We will see.

Speaking again of the current market, I have made some of my biggest gains in years when the market slowly and consistently moved up. Not that I necessarily think this market will continue moving up in today’s fashion, but I’m just saying that you don’t have to rip off huge gains everyday to make a lot of money. Slow and steady is more often the way it is made.

The day’s trading left us with the following results: Our TSP allotment slipped back -0.03% as the I fund took the day off. For comparison, the Dow added +0.14%, the Nasdaq +0.60%, and the S&P 500 +0.30%. I thank God that the market as a whole moved up.

Dow, S&P close at record highs as rate-hike angst abates

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +6.16% on the year not including the day’s results. Here are the latest posted results.

| 05/15/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7191 | 16.9661 | 28.2285 | 38.3718 | 27.195 |

| $ Change | 0.0008 | 0.0736 | 0.0251 | 0.0459 | 0.1016 |

| % Change day | +0.01% | +0.44% | +0.09% | +0.12% | +0.37% |

| % Change week | +0.04% | +0.03% | +0.39% | +0.79% | +1.46% |

| % Change month | +0.08% | -0.41% | +1.93% | +1.84% | +2.04% |

| % Change year | +0.70% | +0.98% | +3.91% | +5.72% | +12.29% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7723 | 23.7589 | 25.9556 | 27.7495 | 15.8373 |

| $ Change | 0.0113 | 0.0277 | 0.0372 | 0.0441 | 0.0275 |

| % Change day | +0.06% | +0.12% | +0.14% | +0.16% | +0.17% |

| % Change week | +0.17% | +0.41% | +0.52% | +0.59% | +0.68% |

| % Change month | +0.43% | +1.00% | +1.27% | +1.45% | +1.65% |

| % Change year | +1.84% | +3.76% | +4.63% | +5.20% | +5.87% |

Let’s see what the charts look like tonight.

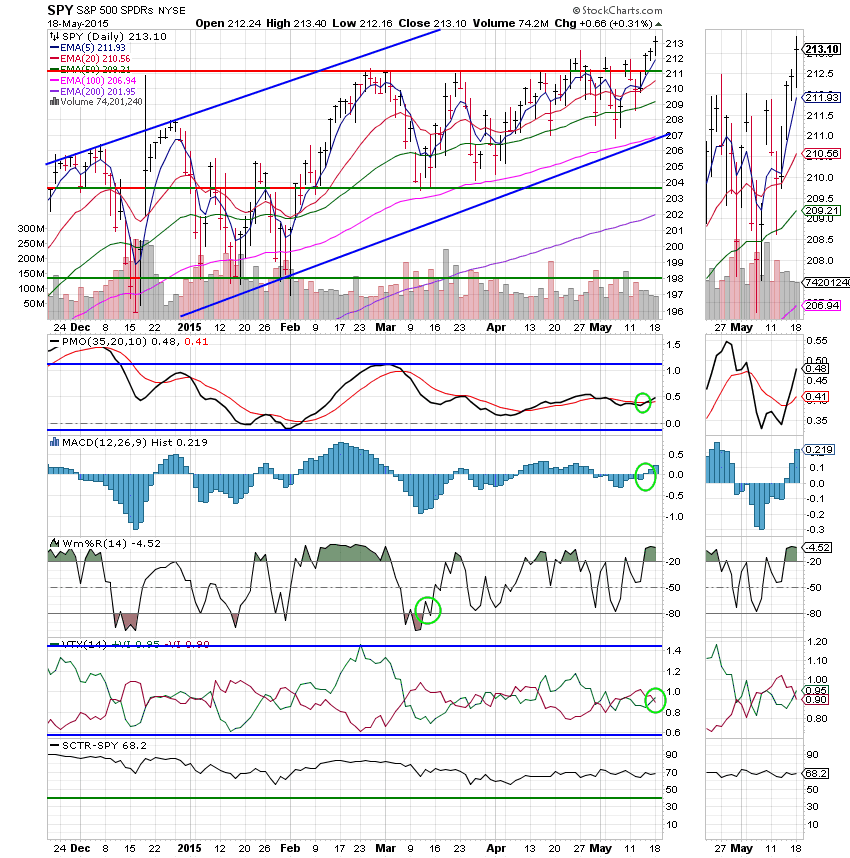

C Fund: Price set a new all time high today at 213.10. The VTX turned bullish putting all of our indicators in positive configurations.

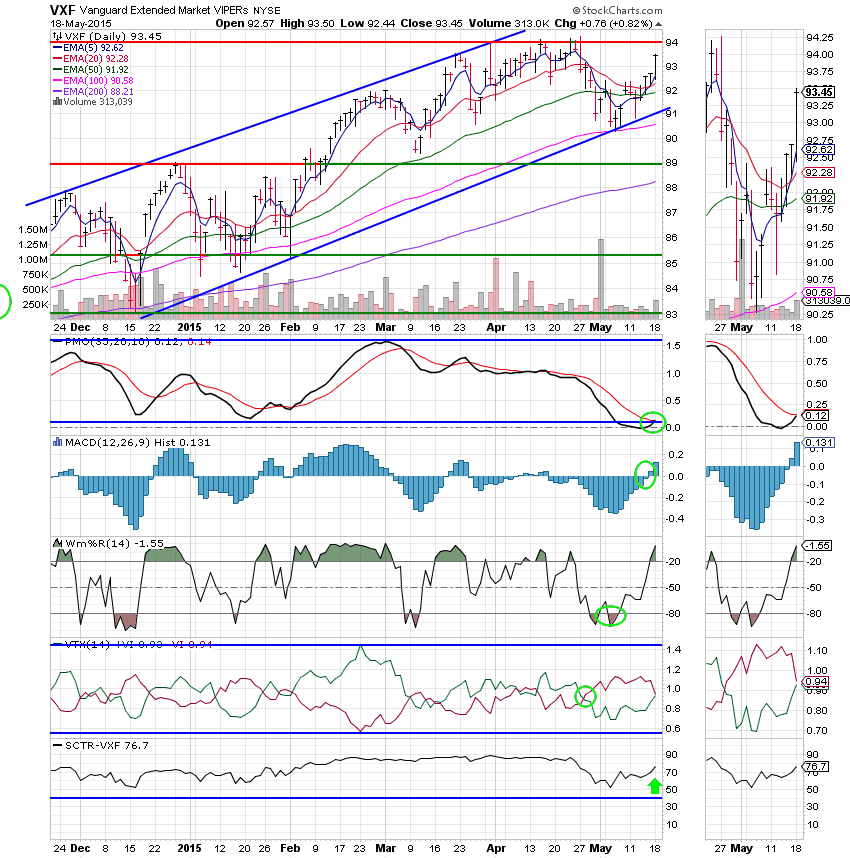

S Fund: The S Fund outperformed having its best day in a while with price moving back into the center of the ascending channel. The PMO made a positive crossover of its EMA by the thinnest of margins moving the overall signal for the S Fund to Buy. Also worth noting, the SCTR improved to a respectable 76.7 indicating that it may be time to allocate more capital here.

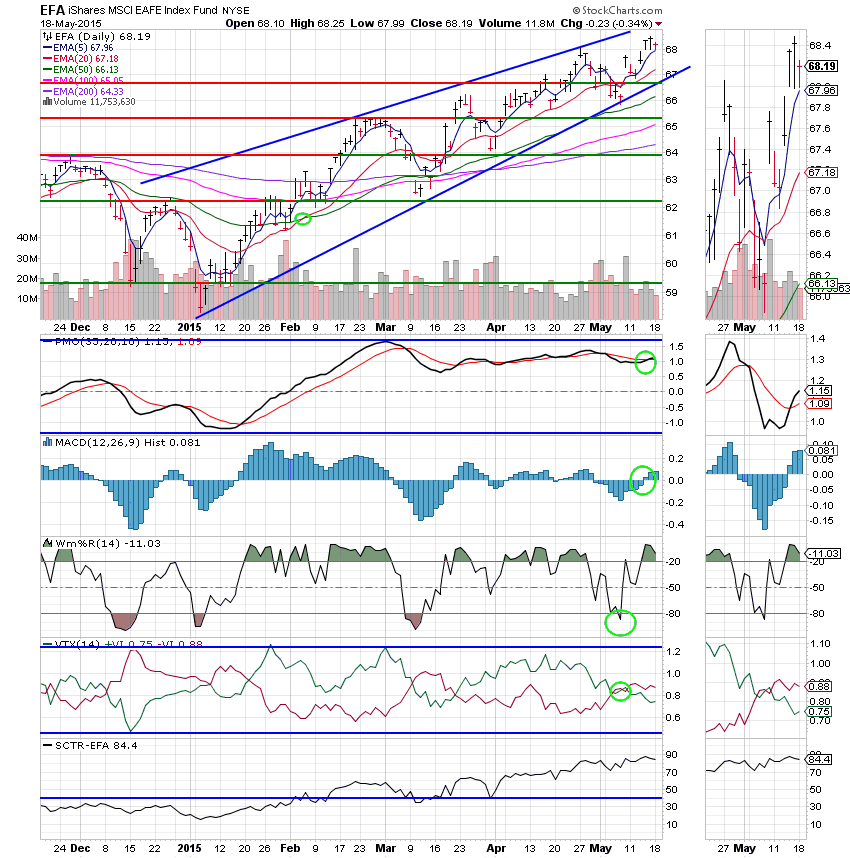

I Fund: The I Fund under-performed today as it suffered from a stronger dollar. Price remains in the middle of the ascending wedge so there are no real problems here. Only the VTX is in a negative configuration and the SCTR remains strong at 84.4.

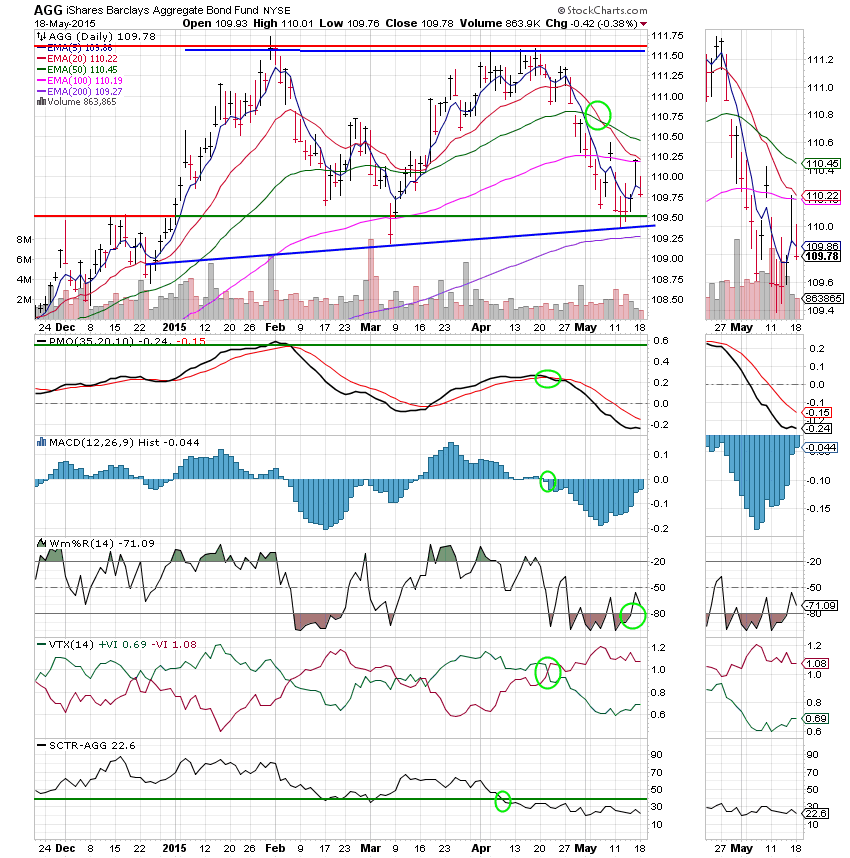

F Fund: The Fund (Bonds) continue to show weakness as reflected by most of our indicators. In particular, the Williams %R turned back down and the SCTR dropped back to 22.6. Actually, this is a good thing as money that is moving out of bonds is probably whats driving stocks to new records.

Nothing really new to add here. We are moving into the summer months when a lot of traders take time off so volume will continue to be tepid at best. That said, I never take the summer off, or as they say sell in May, as I have just as often made nice gains during the summer as not. I thank God that our allocation continues to do well. Give Him all the praise! That’s all for tonight. Have a great evening and I’ll see you tomorrow.

God bless,

Scott![]()