Good Evening,

The market took a day off consolidating after the recent run amid renewed concern by investors about the Fed’s timing of interest rate hikes. As I mentioned in several earlier posts, this interest rate debate will likely fuel market instability for quite a while. Especially when the FED meets each month to consider policy…. At any rate, the market didn’t suffer any technical damage and still remains in an established up trend. Sure, the trend will end someday, but it has been a bad play to bet against the central bankers for some time.

The day’s trading left us with the following results: Our TSP allotment fell back -0.277%. For comparison, the Dow added +0.07% (Finishing at a new record), the Nasdaq lost -0.17%, and the S&P 500 dropped -0.06% although it did set intraday record. The market continues to show a lot of support and based on that I really don’t think it’s done moving up. Although, I feel equally as strong that the gains will continue to be choppy and painful…

Stocks end mixed; Dow creeps up to new record high

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 23/C, 14/S, 63/I. Our allotment is now +6.30% on the year, not including today’s results. Here are the latest posted results:

| 05/18/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7215 | 16.9043 | 28.3162 | 38.6952 | 27.1695 |

| $ Change | 0.0024 | -0.0618 | 0.0877 | 0.3234 | -0.0255 |

| % Change day | +0.02% | -0.36% | +0.31% | +0.84% | -0.09% |

| % Change week | +0.02% | -0.36% | +0.31% | +0.84% | -0.09% |

| % Change month | +0.10% | -0.77% | +2.25% | +2.70% | +1.94% |

| % Change year | +0.72% | +0.61% | +4.24% | +6.61% | +12.19% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7808 | 23.7888 | 26.0005 | 27.8091 | 15.8759 |

| $ Change | 0.0085 | 0.0299 | 0.0449 | 0.0596 | 0.0386 |

| % Change day | +0.05% | +0.13% | +0.17% | +0.21% | +0.24% |

| % Change week | +0.05% | +0.13% | +0.17% | +0.21% | +0.24% |

| % Change month | +0.47% | +1.12% | +1.45% | +1.67% | +1.90% |

| % Change year | +1.89% | +3.89% | +4.81% | +5.42% | +6.13% |

Let’s hit the charts.

C Fund: The C Fund was basically flat today, but remains in great technical shape with all indicators in positive configurations.

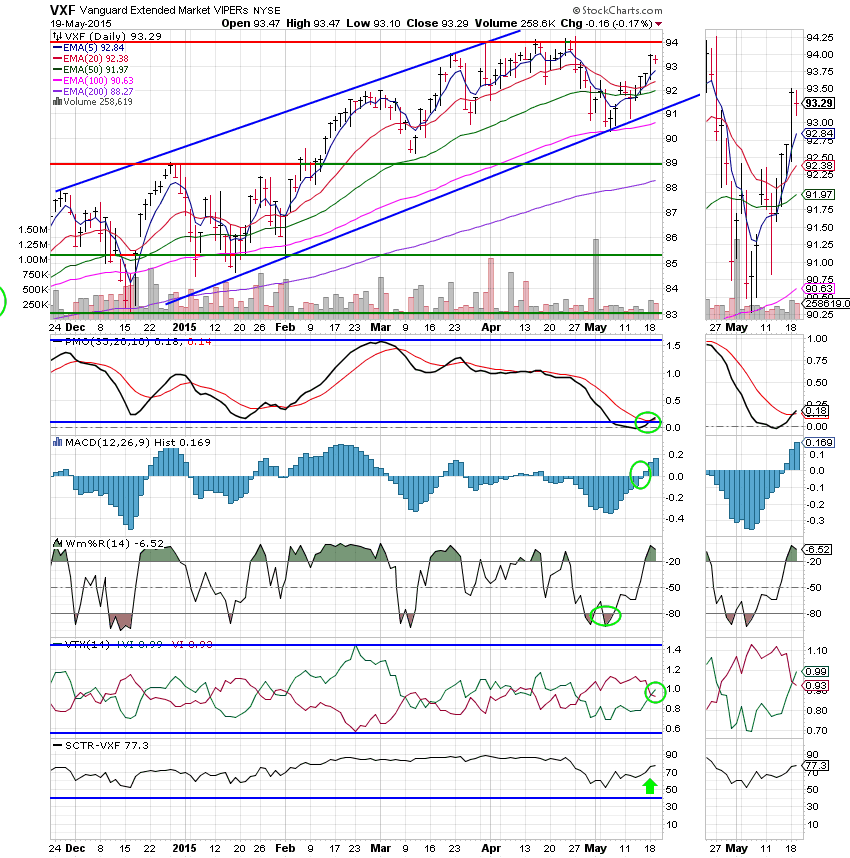

S Fund: Although price dropped today, the S Fund continues to strengthen technically with the VTX moving to a bullish signal. The SCTR is now at a strong 77.3.

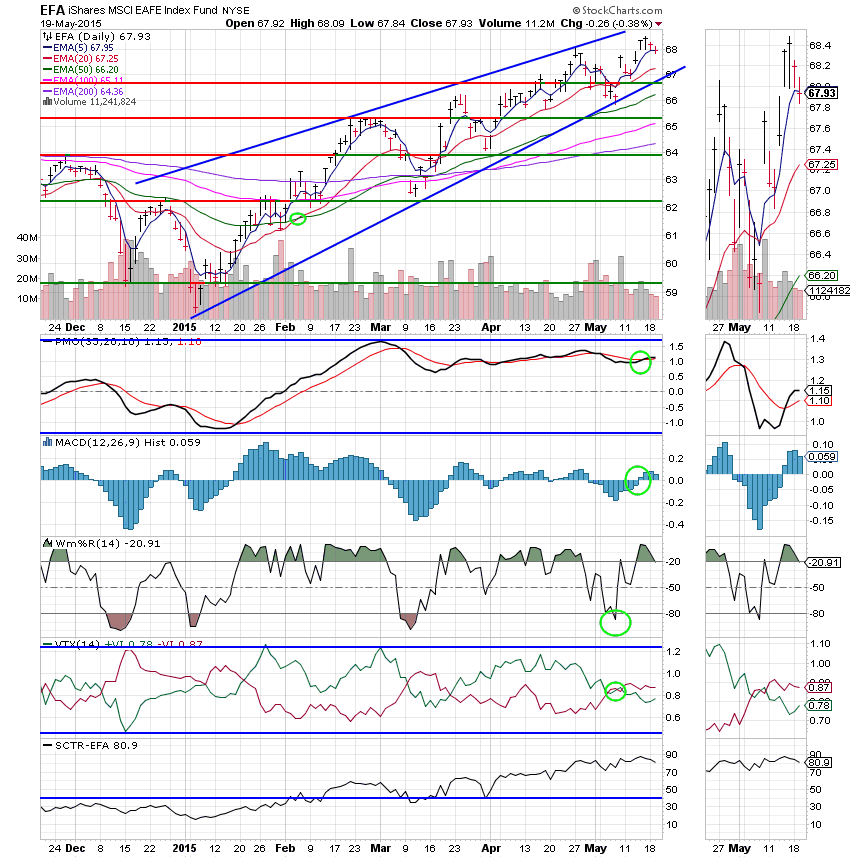

I Fund: OK, I can hear you all now: What happened to the I Fund the past few days? The dollar strengthened. A stable dollar is definitely a good thing. A strong dollar or should I say a very strong dollar is not so good. It hurts US Corporations that do business abroad and the same exchange rate that hurts those businesses hurts the I Fund which is priced in dollars. That’s it, plain and simple. While the I fund has had a few weak days, price remains in the middle of the bullish ascending wedge. Most of the indicators have weakened slightly, but no real technical damage has been done here just yet. We’ll have to keep a close eye on the chart as well as the chart for the dollar. So goes the dollar, goes commodities, goes the trade deficit, goes the exchange rate, goes the I Fund. All that said, the I Fund is due for a good day and the dollar will have to do some back filling after a gap up………

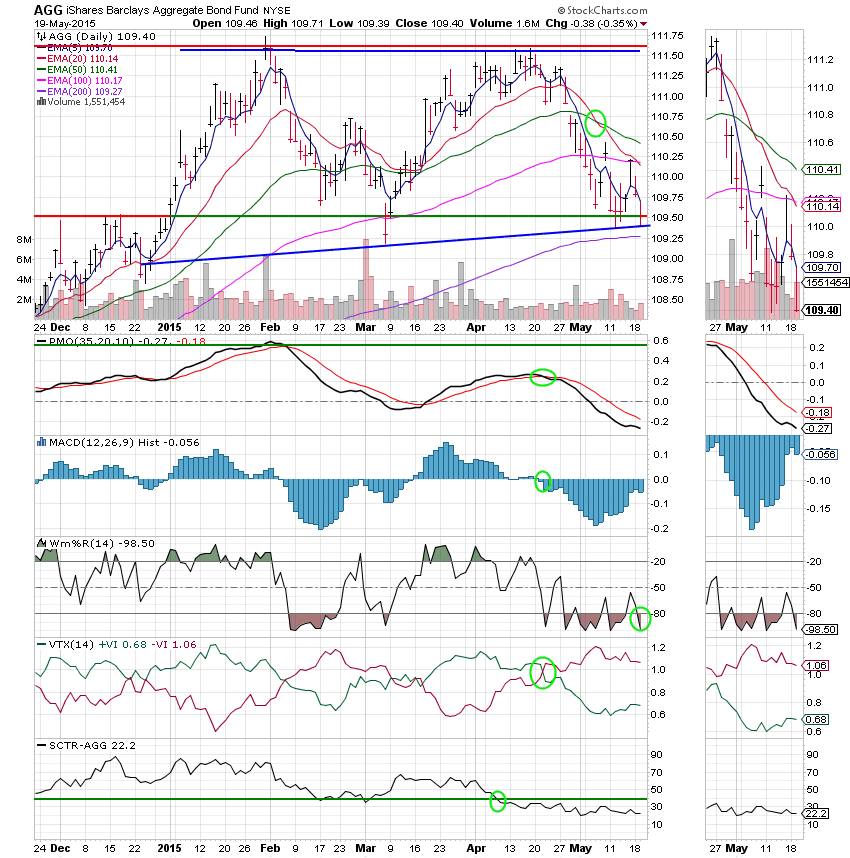

F Fund: The F Fund continues to weaken as bonds got slammed for another day. Price closed right on the lower trend line with the 200 EMA looming just below. This chart is in bad shape. Our sell signal was solid and if you were holding this one and sold on our recommendation you are no doubt very happy now. There will come a day for bonds, but that day is not today….. Also, as I mentioned yesterday, the money going out of bonds has to go somewhere and that somewhere is usually stocks!

As most of you that have been with our group know, we re-balance our allotment on or around the 25th of each month. It is routine maintenance that we do to keep our portfolio healthy. We wait until late in the month for two reasons. #1 To get as much monthly data as we can get in order that we make our adjustments based on how each fund is currently performing. #2. To ensure that we keep two trades available at all times if possible. I have found that running out of trades too early in the month is a bad thing. Of course, that is not a problem on the street– one of the main reasons that you want to roll your money out of Thrift when you retire. All that said, it looks like some more money will be heading into small caps this month if they continue to perform as they are. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless,

Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.