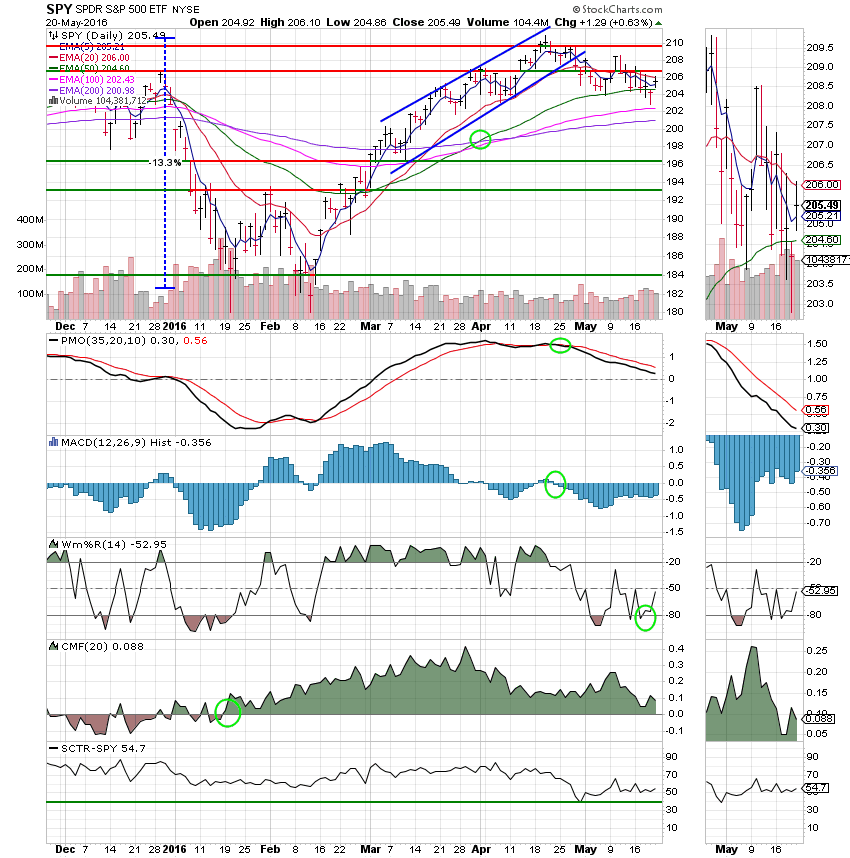

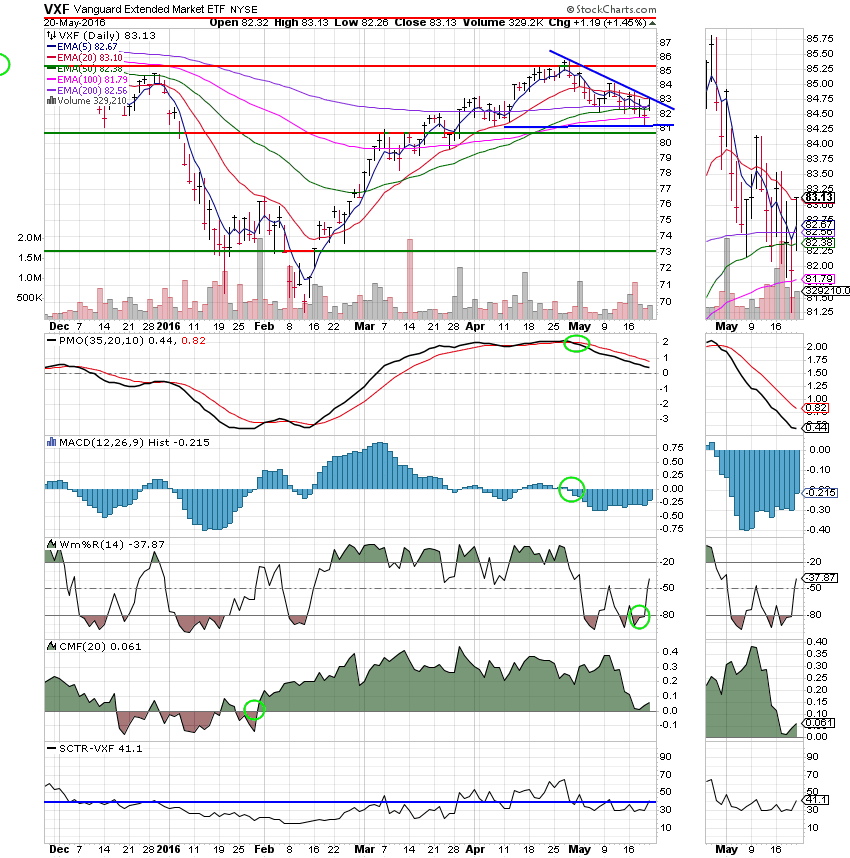

Good Evening, The market shrugged off the Fed and moved back up after a disappointing day yesterday. If the current pattern holds we should move back down on Monday. One disturbing thing that I have been tracking on the charts is a head and shoulders pattern on the SPX. This pattern is a reversal pattern and is pretty reliable. I didn’t annotate it on tonight’s chart but it is fairly easy to identify. Just look for a left shoulder, head, and right shoulder. Should it execute the down side target is the length from the neckline to the top of the head. I’ll try to annotate it on the next chart I do. I didn’t have time to go in to a lot of detail tonight. The main reason I posted this blog was to let you know that a sell signal in the S Fund was averted for now. As you may remember from last night. I noted that it could be averted if we had a strong rally and that’s exactly what we got!

The days trading left us with the following results: Our TSP allotment out performed today with a gain of +1.45%. For comparison, the Dow added +0.38%, the Nasdaq +1.21%, and the S&P 500 +0.60%. Praise God! We had a great day when we really needed one.

Stocks Close Higher as Tech Rallies, Fed Fears Fade

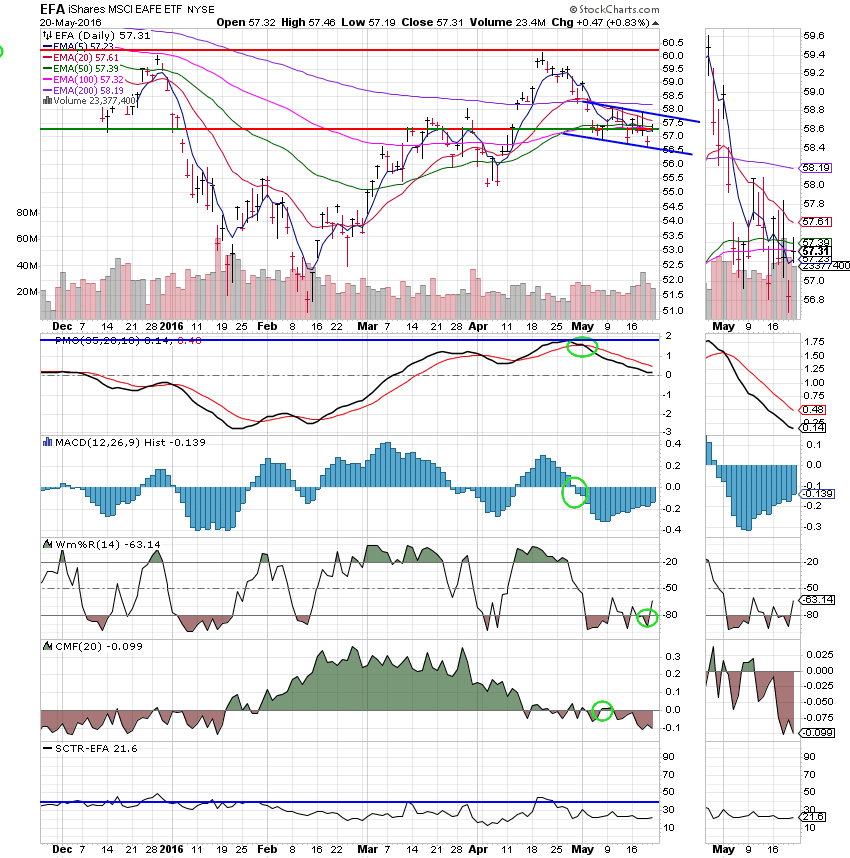

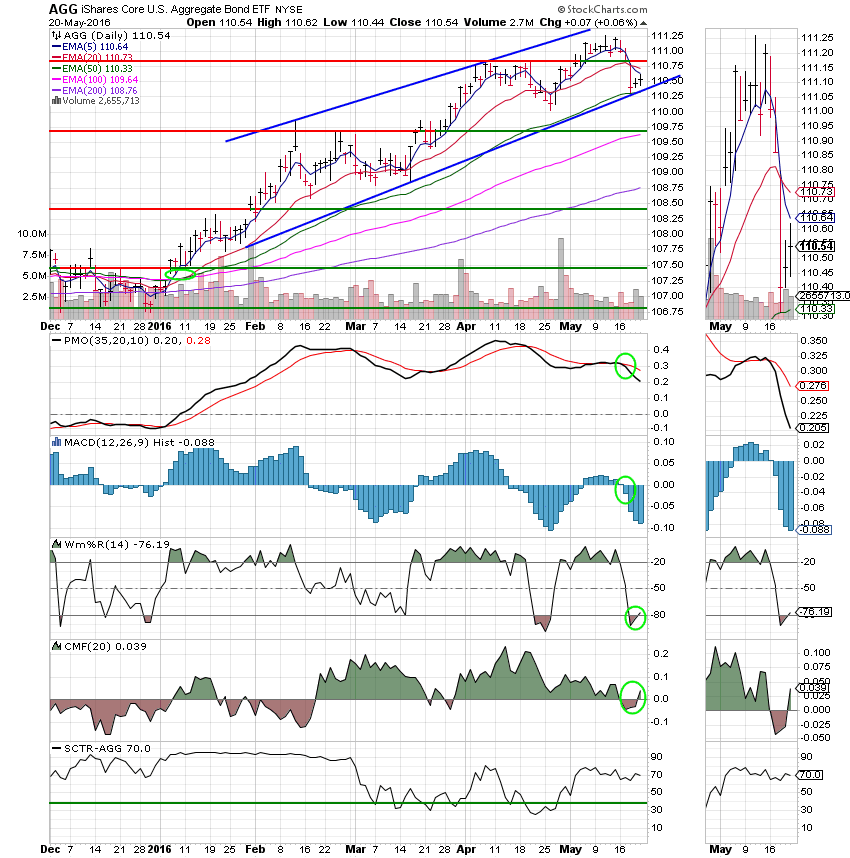

The days trading left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Neutral. We are currently invested at 100/S. Our allocation is now +0.53% not including today’s gains. Here are the latest posted results:

| 05/19/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0228 | 17.5294 | 27.7601 | 34.6492 | 23.3391 |

| $ Change | 0.0007 | 0.0364 | -0.1026 | -0.2144 | -0.1929 |

| % Change day | +0.00% | +0.21% | -0.37% | -0.62% | -0.82% |

| % Change week | +0.03% | -0.61% | -0.26% | -0.51% | -0.59% |

| % Change month | +0.09% | -0.15% | -1.03% | -2.66% | -2.76% |

| % Change year | +0.72% | +3.39% | +0.72% | -1.66% | -3.14% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8907 | 23.2689 | 25.0612 | 26.5173 | 14.9577 |

| $ Change | -0.0164 | -0.0541 | -0.0838 | -0.1045 | -0.0681 |

| % Change day | -0.09% | -0.23% | -0.33% | -0.39% | -0.45% |

| % Change week | -0.10% | -0.20% | -0.28% | -0.33% | -0.36% |

| % Change month | -0.30% | -0.78% | -1.14% | -1.34% | -1.54% |

| % Change year | +0.66% | +0.26% | -0.01% | -0.20% | -0.46% |