Good Evening, Once again, it paid us to be patient. Our indicators went right to the brink of a sell signal and our emotions told us to sell, but we never got a clear sell signal and were rewarded for our discipline with a big rally today! It appears that investors now have come to grips with the fact that the Fed will likely have at least two interest rate hikes in 2016. They have also come to understand that the Fed will not raise rates rapidly. The result of all of this was one of the best days so far in 2016!

The days rally left us with the following results: Our TSP allotment gained +1.69%. For comparison, the Dow added +1.22%, the Nasdaq +2.00%, and the S&P 500 +1.37%. Thank God for a great day!

Banks and tech drive Wall Street up over 1 percent

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +1.80% on the year not including the days gains. Here are the latest posted results:

| 05/23/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0256 | 17.5304 | 27.8742 | 35.0887 | 23.4904 |

| $ Change | 0.0021 | -0.0064 | -0.0572 | -0.0520 | -0.0627 |

| % Change day | +0.01% | -0.04% | -0.20% | -0.15% | -0.27% |

| % Change week | +0.01% | -0.04% | -0.20% | -0.15% | -0.27% |

| % Change month | +0.11% | -0.15% | -0.62% | -1.42% | -2.13% |

| % Change year | +0.74% | +3.39% | +1.13% | -0.42% | -2.51% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9146 | 23.3353 | 25.161 | 26.641 | 15.0376 |

| $ Change | -0.0063 | -0.0217 | -0.0340 | -0.0422 | -0.0270 |

| % Change day | -0.04% | -0.09% | -0.13% | -0.16% | -0.18% |

| % Change week | -0.04% | -0.09% | -0.13% | -0.16% | -0.18% |

| % Change month | -0.17% | -0.50% | -0.74% | -0.88% | -1.02% |

| % Change year | +0.80% | +0.55% | +0.39% | +0.26% | +0.08% |

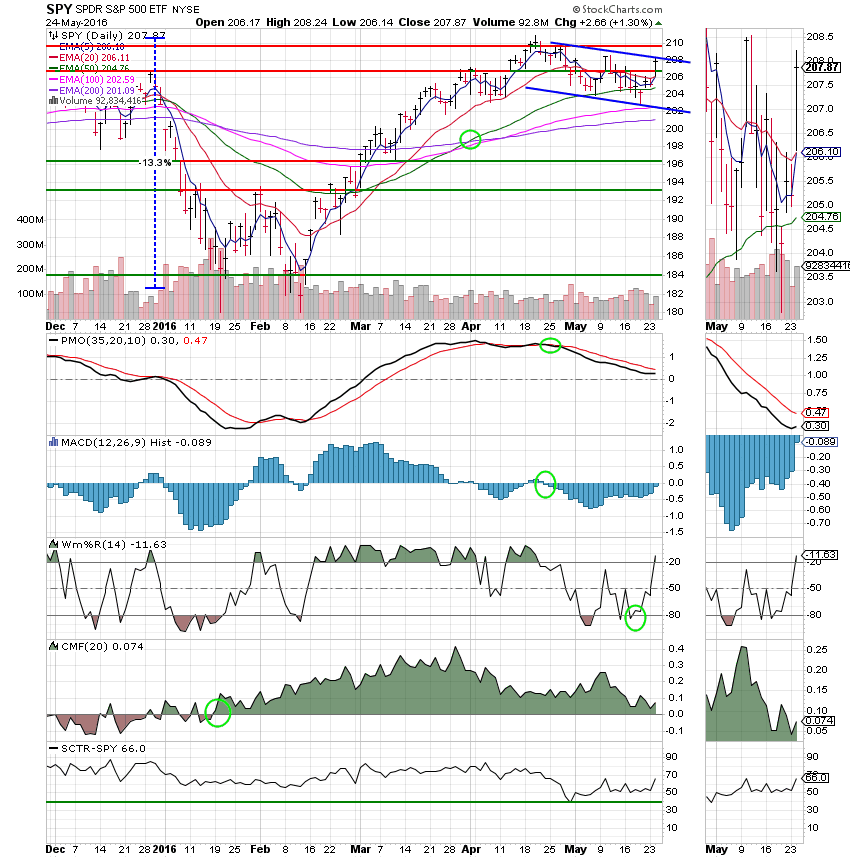

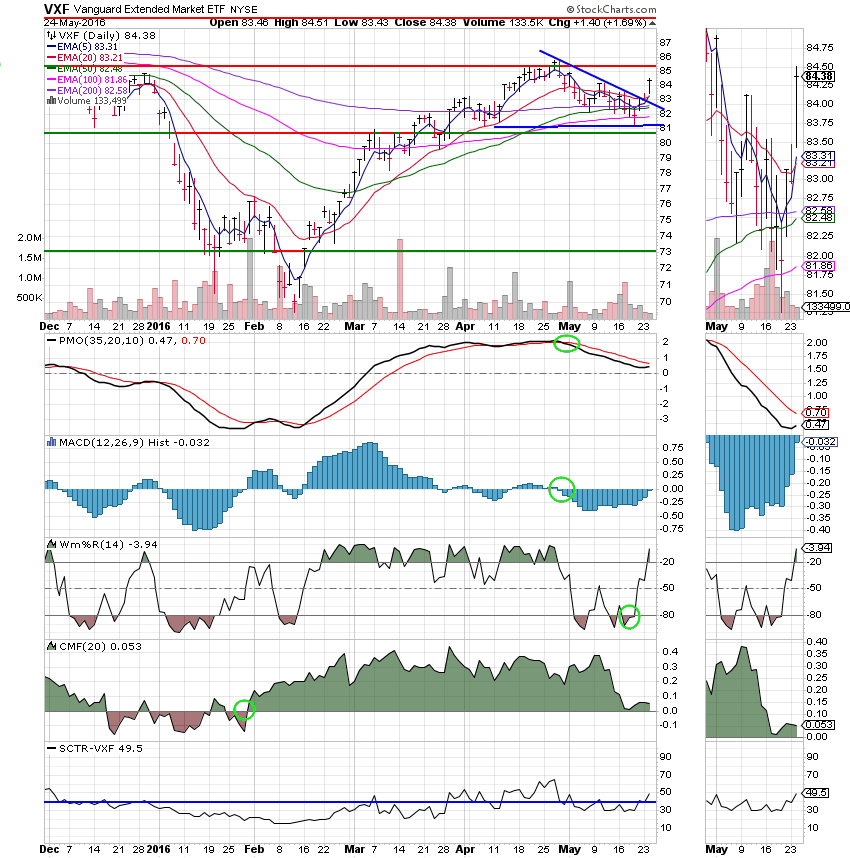

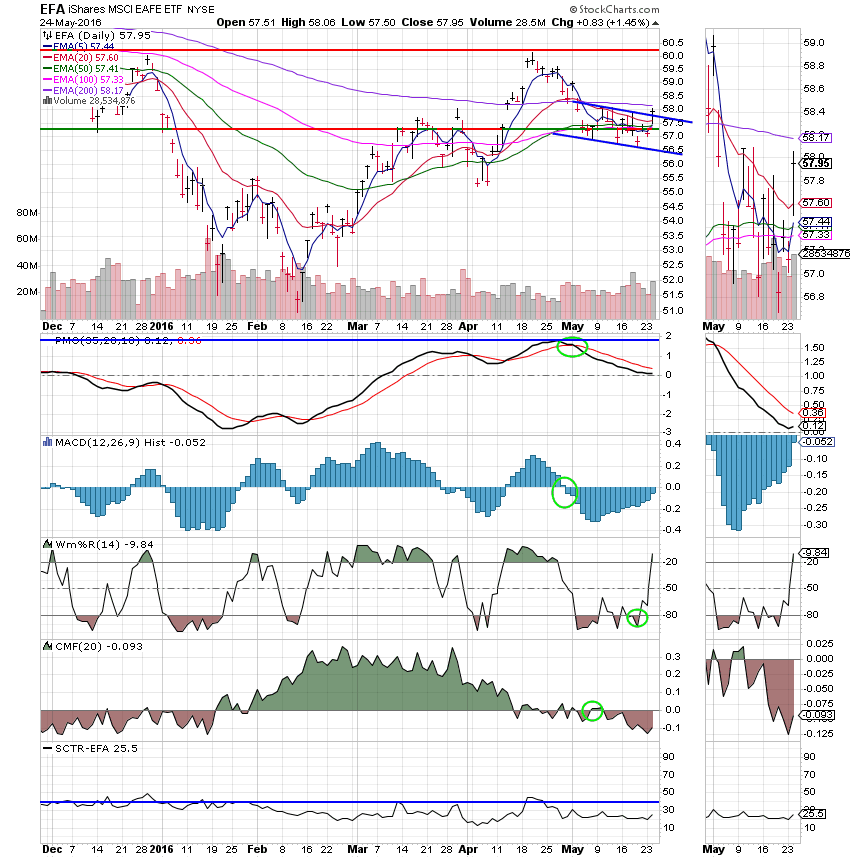

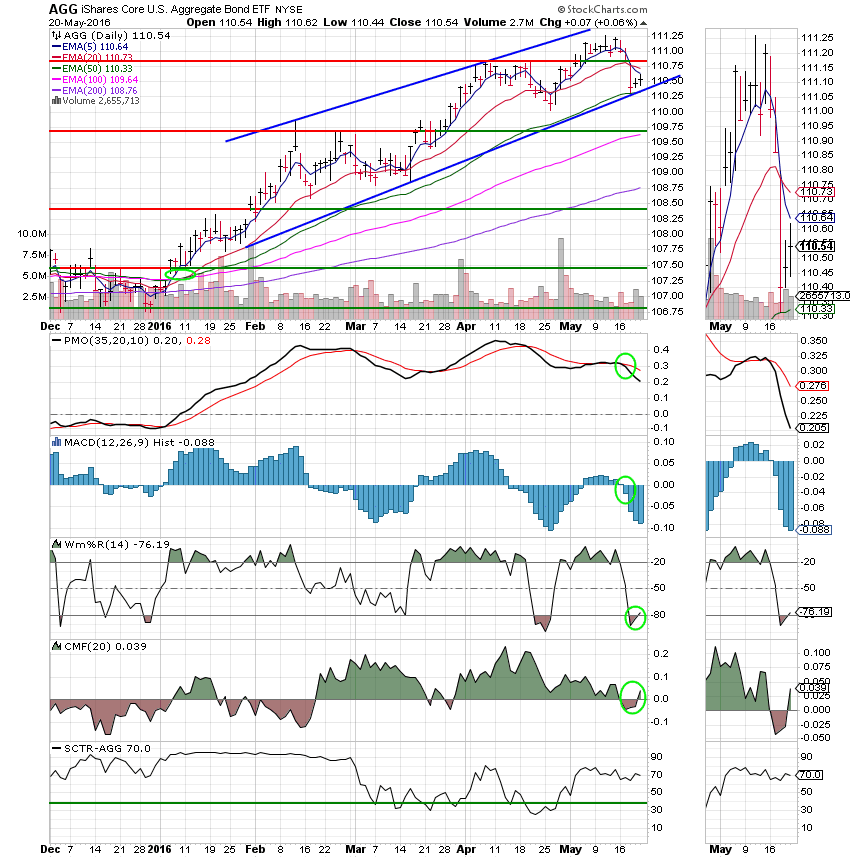

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund: Price broke through the upper trend line of the bearish wedge. Next resistance is in the 85.50 range….

I Fund: The 5 EMA crossed back up through the 50 EMA while the Williams%R is still positive for an overall Neutral signal. Price broke through the upper trend line. There is no more resistance until 60.25.

F Fund: Price is testing resistance at the lower trend line….

I know it’s exciting when have a rally like we did today. However, we really didn’t gain or lose anything in the long term view as we remain bound in the same wide trading range. I do thank God for another nice rally to keep us in the game. Have a nice evening!