Good Evening,

Today, the dollar went up and stocks went down. The end result is that we gave up a lot of the month’s gains. Not all of the gains, but a lot of them were gone in just one day. Just like last month and the month before. An entire month’s gains were vaporized on one trading session. So what gives? When it all shakes out, long positions just aren’t budging. We are constantly up against resistance as the major indices must set new records to move forward. In short, it is a day trader’s market.

So far in 2015, they are the only ones that can make a decent profit and even for them, it’s hit or miss. Overall, we gain ground only to lose it later and end up pretty close to where we started. You ask, how long can this go on? It’s hard to say. Market pundits have been talking about the market topping since 2013. Often these trends can go on a lot longer than what may seem reasonable. Also remember, markets seldom change direction in one day. They usually wear traders out before they scare them out. About all you an do in these situations is watch your charts and play the action that’s before you. There are times when when things get stagnant and you don’t make money. This is one of them. Eventually, a bigger correction will come and when it does, you sell. That’s it. There’s no reason to over complicate things. It’s not rocket science! Although, a lot of brokers that are collecting fat fees would like you to think so. It’s just plain common sense.

The day’s trading left us with the following results: Our TSP allotment fell back -1.494%. For comparison, the Dow lost 1.04%, the Nasdaq 1.11%, and the S&P 500 1.03%.

Wall St. drops on rate concerns, Greece

The day’s selling left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Sell. We put out an alert this morning for an interfund transfer. Our new allocation will be 29/C, 37/S, 34/I. Our allocation is now +5.92% for the year not including the day’s results. Here are the latest posted results:

| 05/25/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7247 | 16.8854 | 28.2878 | 38.6324 | 27.0344 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.12% | -0.89% | +2.15% | +2.53% | +1.43% |

| % Change year | +0.74% | +0.50% | +4.13% | +6.44% | +11.63% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7751 | 23.7622 | 25.9618 | 27.7614 | 15.8443 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.44% | +1.01% | +1.29% | +1.50% | +1.69% |

| % Change year | +1.86% | +3.77% | +4.66% | +5.24% | +5.92% |

Let’s take a look at the charts.

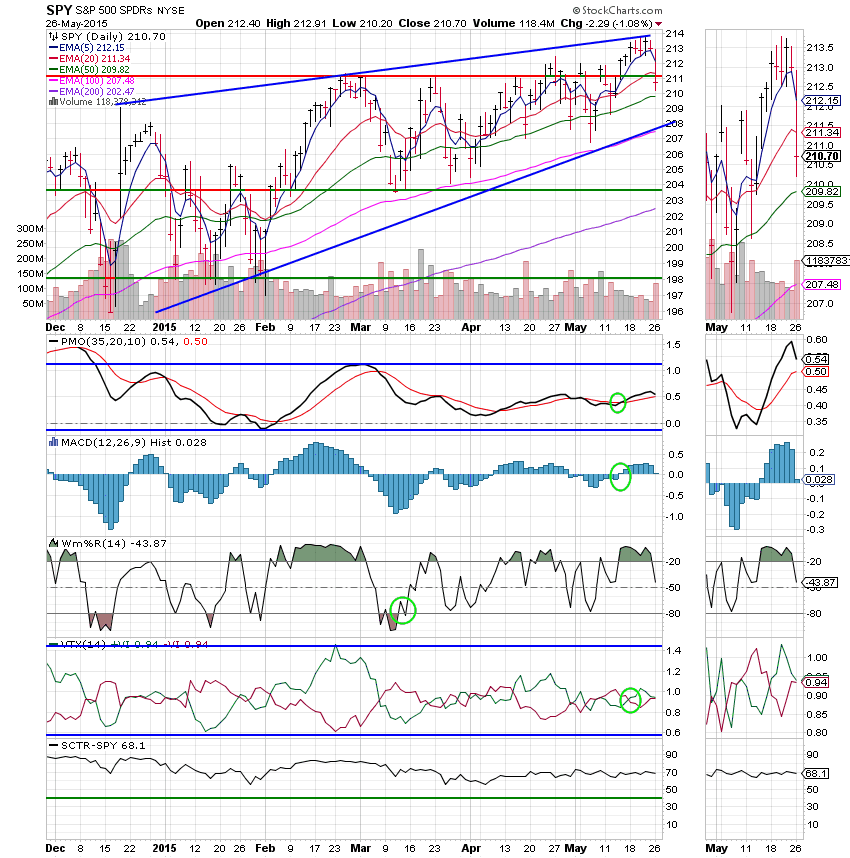

C Fund: Price dropped back below support and below its 20 EMA. All indicators were stressed by the selling, but remain in positive configurations for now. It will take a strong day tomorrow to prevent some of them from turning negative. The C Fund remains on a buy signal for now.

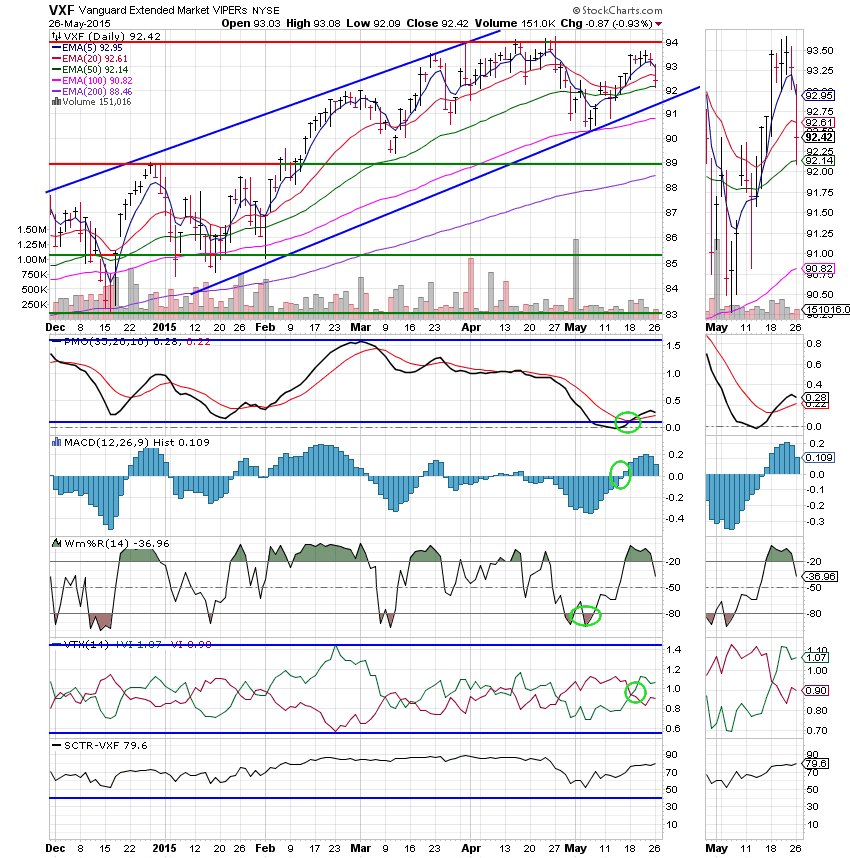

S Fund: This chart is almost identical to the C Fund with one exception: The indicators are a little stronger and are less likely to turn negative in the next session. Considering the magnitude of the selling, the S fund held up fairly well today. That’s not really surprising as small caps have been stronger in recent sessions.

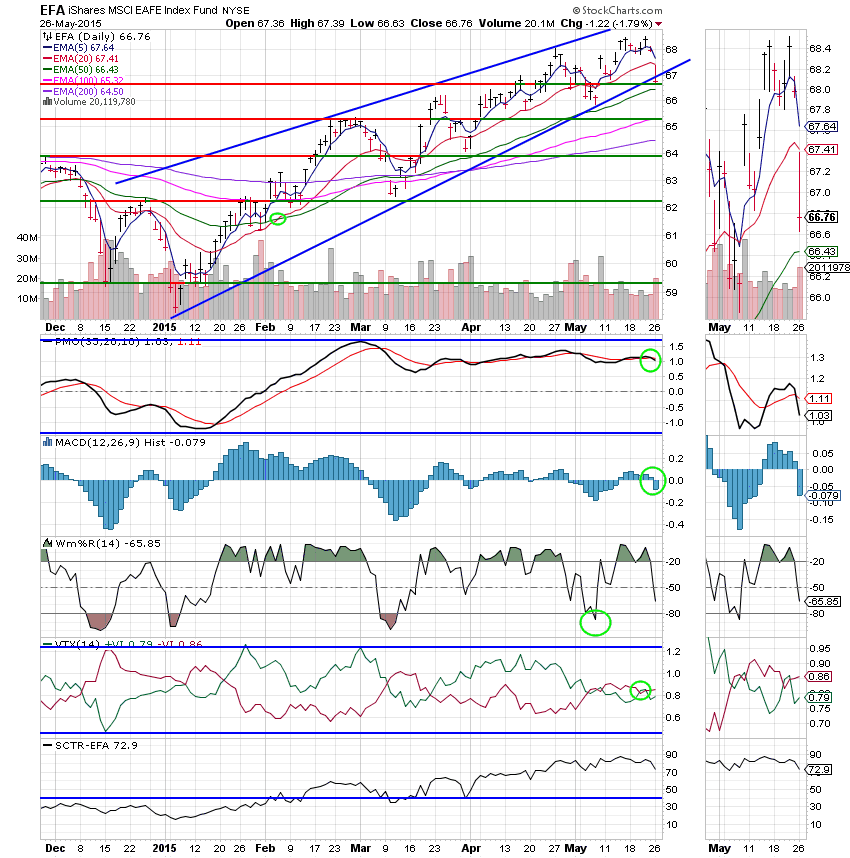

I Fund: Price dropped below its 20 EMA today, but remains above support in the 66.70 area. The I Fund moved to an overall Neutral signal with the PMO and MAC D slipping into negative configurations. The SCTR is also moving lower reflecting the weakness.

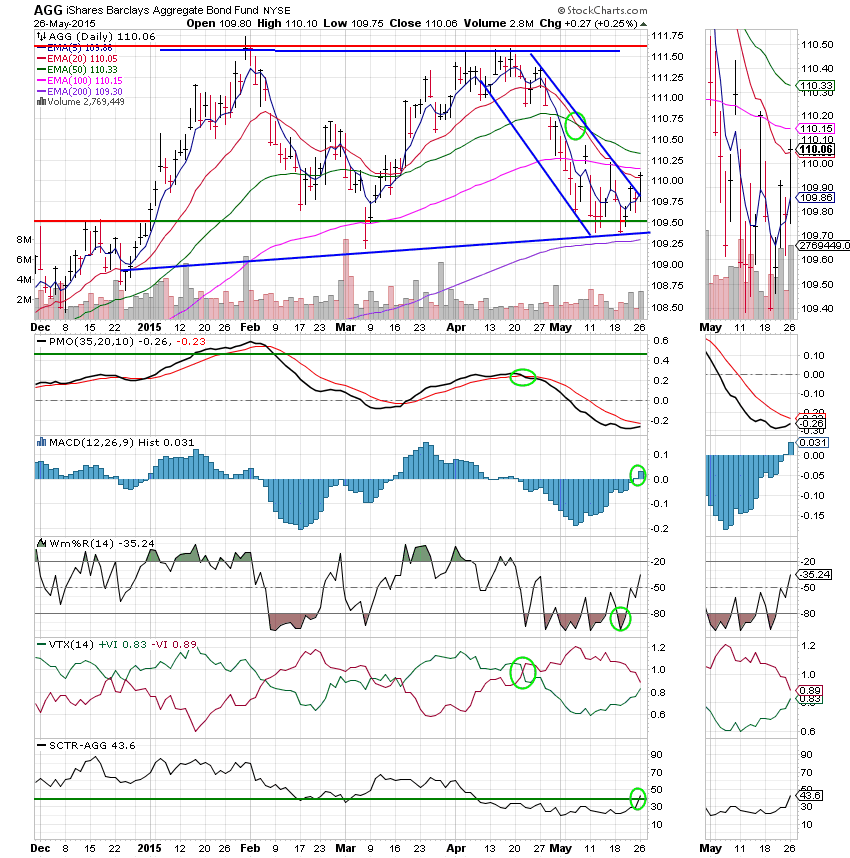

F Fund: Price moved back above its 20 EMA today. However, the 20 EMA still remains below the 50 and 100 EMA’s so this fund still has a lot of work to do in order to repair recent damage. The MAC D moved into a positive configuration and the SCTR moved back above 40. The good day for the F Fund was likely a result of money moving to bonds as a safe haven in response to the selling in stocks. This chart is a little better, but nowhere near a buy signal just yet.

I thank God that we are still holding a gain for the month after this strong day of selling. I am praying that the selling will ease up now and allow us to get out of May with some profit. The strong dollar and a renewed concern about the FED raising rates definitely caused the selling today. Overall, this should come as no surprise to you. We have discussed the fact that the interest rate debacle is likely to remain with us for a while. I really don’t think there will be any significant change in the character of the market in that it will likely remain hard to hold onto gains. In other words, I think there will be a lot of smoke but little fire. As I have said and said and said. All we can do is play the action that’s before us and take what it gives us. May God continue to guide our hand. Give Him all the praise! That’s all for tonight. Have a nice evening and I’ll see you tomorrow.

God bless,

Scott![]()