Good Evening,

Tired of reading so much? I can sum this up pretty quick! Greece + China = Dip. There was no agreement between Greece and the EU on a bailout package. In China, traders were upset with new margin rules. So our market dipped and then worked its way higher during the afternoon session. Although it ended in the red, it was well off its lows for the day. It should be noted that we were able to hang onto most of our gains from yesterday.

Tomorrow it’s all about the GDP reading that will be released at 8:30 AM ET. It’s anybody’s guess how the market will react to the report. If it’s too high, the market may sell off out of concern for interest rate hike. If the GDP is good, but not very strong, the market will probably move up as a rate hike will be less likely. If the GDP is too low, the market will probably sell off, but one never knows for sure. Bad news has a way of being good news when these interest rate increases are the issue. We will see….

I will say it again. I think this interest rate thing is overblown. Even if they increase the rates, which would mean that we have a strong economy, the rates would still be at historic lows. In the long run, I really don’t see this as having the impact that a lot of folks think it will. The FED has repeatedly said that even when they increase rates, they will do so very slowly. They have also said that any increase will be data dependent. So do you see anything close to a level inflation that needs to be controlled? Neither do I and that is why I think this interest rate thing is overblown. I for one, will be glad when they finally do make a slight increase. Then traders can focus on other issues…

The day’s action left us with the following results: Our TSP allotment dipped slightly at -0.154%. For comparison, the Dow fell back -0.20%, the Nasdaq -0.17%, and the S&P 500 slipped -0.13%. I thank God that we were able to hang onto most of yesterday’s gains. May He guide us through the GDP report tomorrow.

Wall St. inches down on Greece, China worries

The day’s trading left with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +5.23% on the year not including the day’s results. Here are the latest posted results:

| 05/27/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7288 | 16.958 | 28.2587 | 38.6194 | 26.767 |

| $ Change | 0.0008 | 0.0035 | 0.2611 | 0.3552 | 0.1312 |

| % Change day | +0.01% | +0.02% | +0.93% | +0.93% | +0.49% |

| % Change week | +0.03% | +0.43% | -0.10% | -0.03% | -0.99% |

| % Change month | +0.15% | -0.46% | +2.04% | +2.50% | +0.43% |

| % Change year | +0.77% | +0.93% | +4.02% | +6.40% | +10.52% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7723 | 23.7282 | 25.9117 | 27.6999 | 15.8009 |

| $ Change | 0.0299 | 0.0956 | 0.1353 | 0.1676 | 0.1074 |

| % Change day | +0.17% | +0.40% | +0.52% | +0.61% | +0.68% |

| % Change week | -0.02% | -0.14% | -0.19% | -0.22% | -0.27% |

| % Change month | +0.43% | +0.87% | +1.10% | +1.27% | +1.41% |

| % Change year | +1.84% | +3.62% | +4.46% | +5.01% | +5.63% |

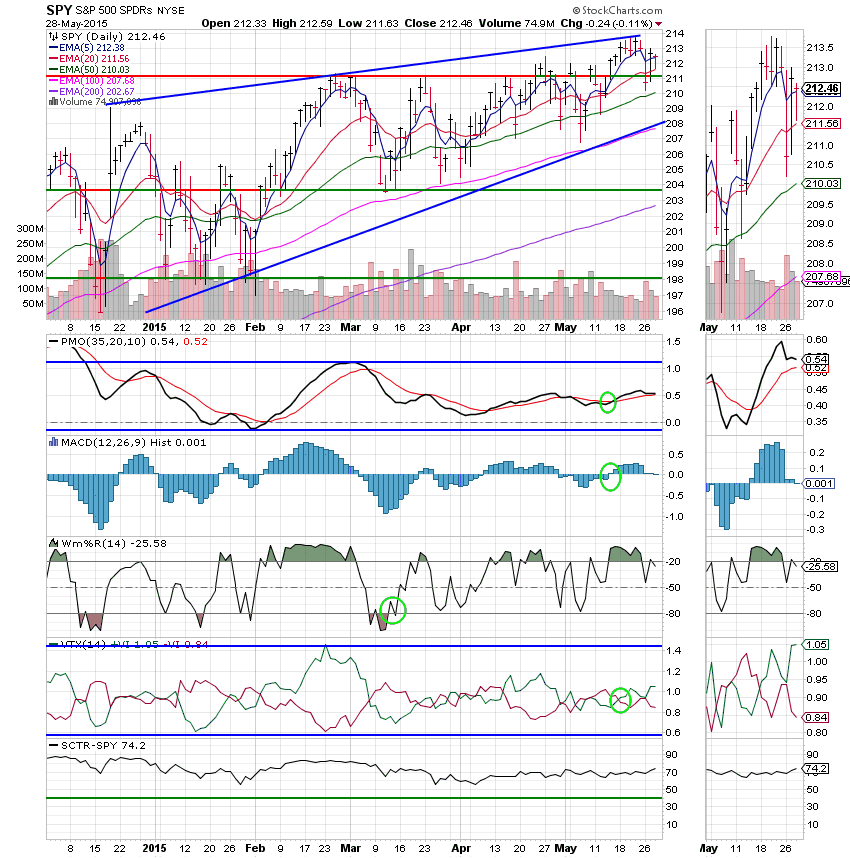

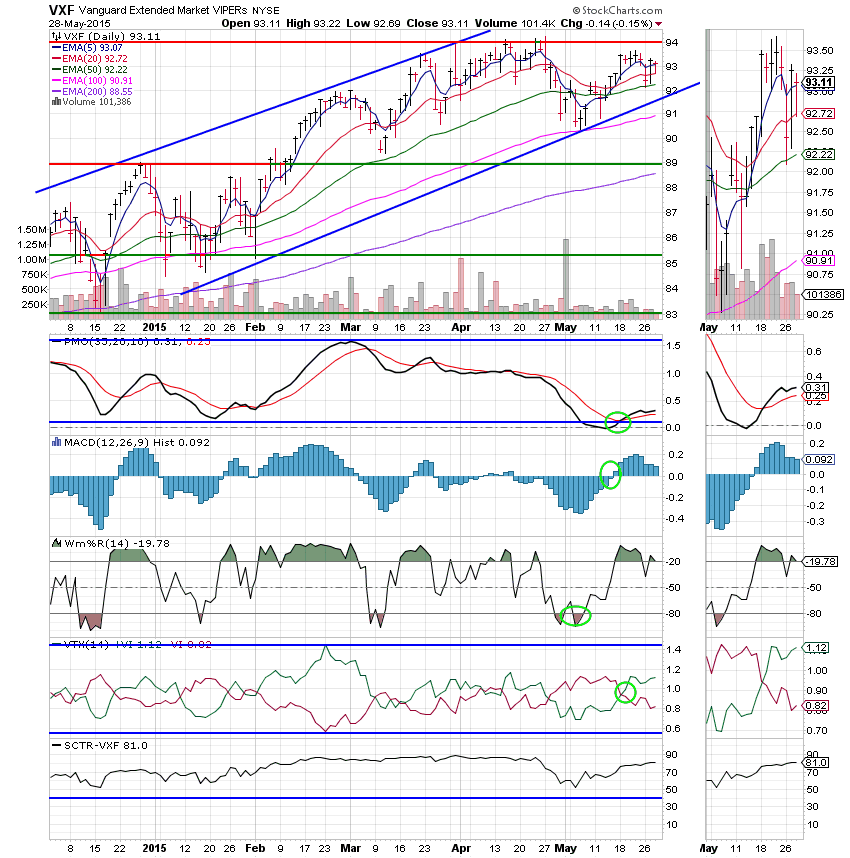

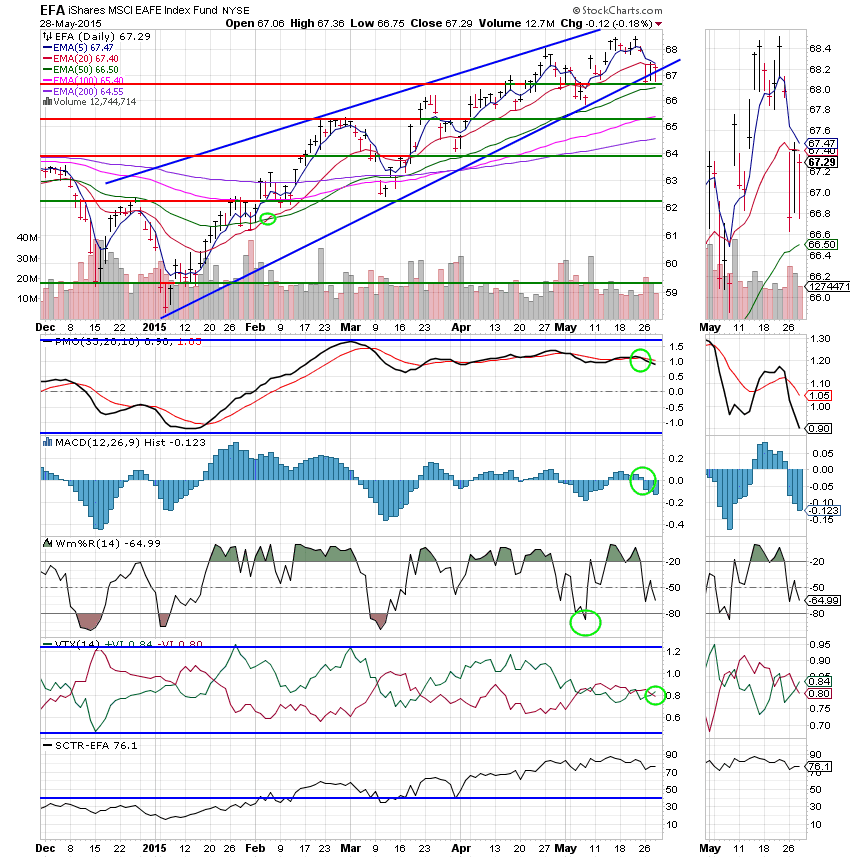

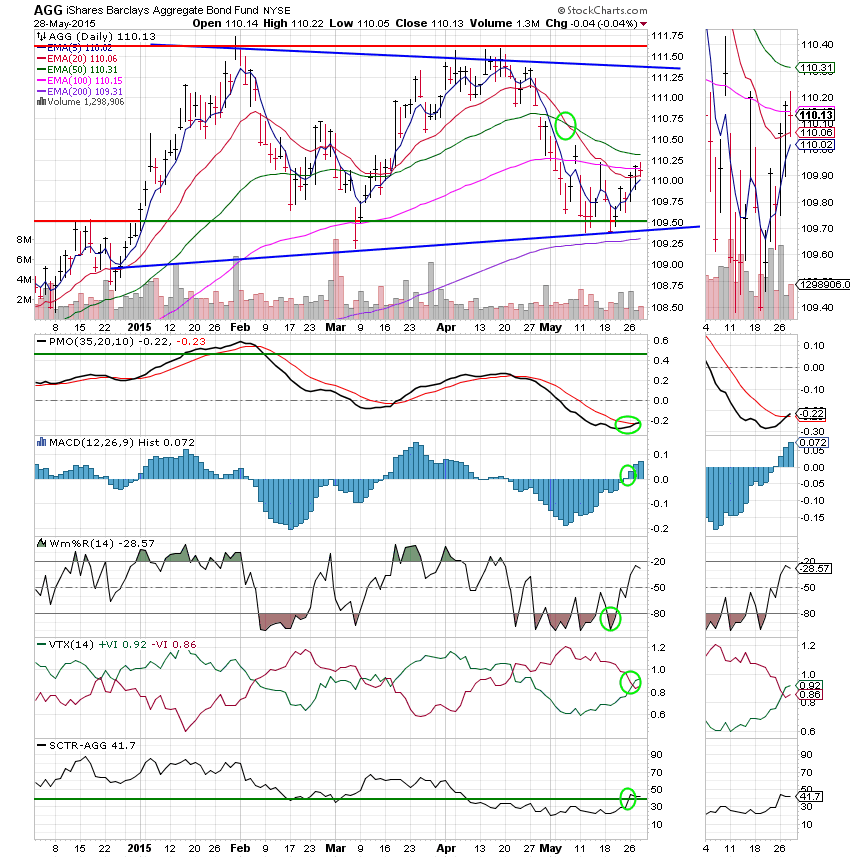

Let’s hit the charts.

C Fund: Price closed right on its 5 EMA today leaving our indicators mostly unchanged. The MAC D will go negative during tomorrow’s session barring a strong move up.

S Fund: Price closed right on its 5 EMA leaving the indicators unchanged. Unlike the C Fund, the S Fund has a stronger chart with none of its indicators in danger of going negative.

I Fund: Price again tested support which held at 66.70. The I fund remains on an overall neutral signal with the PMO and MAC D in negative configurations.

F Fund: Price finished flat today. Therefore, all indicators remained unchanged. The F fund remains at an overall Neutral signal with the 20 EMA below both the 50 and 100 EMA’s. The 20 EMA must cross back up through the 50 EMA in order to generate a buy signal for this chart. For a better understanding of how price is used to determine signals, you can visit our Facebook page. I posted an excellent article written by Erin Heim of Decision Point covering this subject. It’s a 15 minute read and will give you a much better understanding of how price is used to determine the short, medium, and long term trends. It is the most important indicator you can use!

We should know which direction the market is going when the GDP read comes out at 8:30 AM ET in the morning. Don’t forget to buckle your seat belts. It could be a wild ride. That’s all for tonight. May God continue to bless your trades. Give Him all the praise! Have a nice evening.

God bless,

Scott![]()