Good Evening,

Today was the last trading day in May and I was glad to see it end with a profit in hand. May is traditionally not one of the best months to be in the market, but the old adage “sell in May and go away” didn’t work this time around with the major indices finishing the month in the green. This morning’s GDP reading came in worse than expected with the economy actually contracting by .7% in the first quarter. That started things rolling down hill. The dip buyers stepped in and drove stocks back up but were unable to sustain the momentum and were ultimately driven back by the lack of an agreement between Greece and its creditors. There was a lot of talk about Greece stepping out of the EU so I’m surprised the selling was as muted as it was. All in all, the market managed to finish the day with only moderate losses.

Like I said, I’m thankful that we made it out of the month with a profit. I’d like to say that things are going to get better in the coming months, but I expect that we’ll get more of the same with trading really getting interesting in September. Why September? There are a myriad of reasons. However, the biggest one is that is when the banks are predicting that the FED will increase interest rates. Getting back to the GDP issue. I’m really not overly concerned with the negative numbers. As we previously discussed, we had record snowfall coupled with dock problems. When put together, they made for a dismal quarter, but both issues were temporary and are gone now. That said, things should return to normal. That is, as normal as this central bank and computer manipulated market can get. No use in complaining about it. That won’t change a thing. All we can do is adapt and overcome and with God’s help, that is exactly what we will do. Give Him all the Praise!

The day’s trading left us with the following results: Our TSP allotment fell back -0.694%. For comparison, the Dow dropped -0.64%, the Nasdaq -0.55%, and the S&P 500 -0.63%.

Wall St. ends down after weak economic data but gains in May

The month’s action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Neutral. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +5.11% on the year, not including today’s results. Here are the latest posted results:

| 05/28/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7296 | 16.9638 | 28.2281 | 38.5669 | 26.7418 |

| $ Change | 0.0008 | 0.0058 | -0.0306 | -0.0525 | -0.0252 |

| % Change day | +0.01% | +0.03% | -0.11% | -0.14% | -0.09% |

| % Change week | +0.03% | +0.46% | -0.21% | -0.17% | -1.08% |

| % Change month | +0.15% | -0.43% | +1.93% | +2.36% | +0.34% |

| % Change year | +0.77% | +0.96% | +3.91% | +6.26% | +10.42% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7694 | 23.7162 | 25.8941 | 27.6777 | 15.7864 |

| $ Change | -0.0029 | -0.0120 | -0.0176 | -0.0222 | -0.0145 |

| % Change day | -0.02% | -0.05% | -0.07% | -0.08% | -0.09% |

| % Change week | -0.03% | -0.19% | -0.26% | -0.30% | -0.37% |

| % Change month | +0.41% | +0.81% | +1.03% | +1.19% | +1.32% |

| % Change year | +1.83% | +3.57% | +4.39% | +4.92% | +5.53% |

Let’s check out the charts.

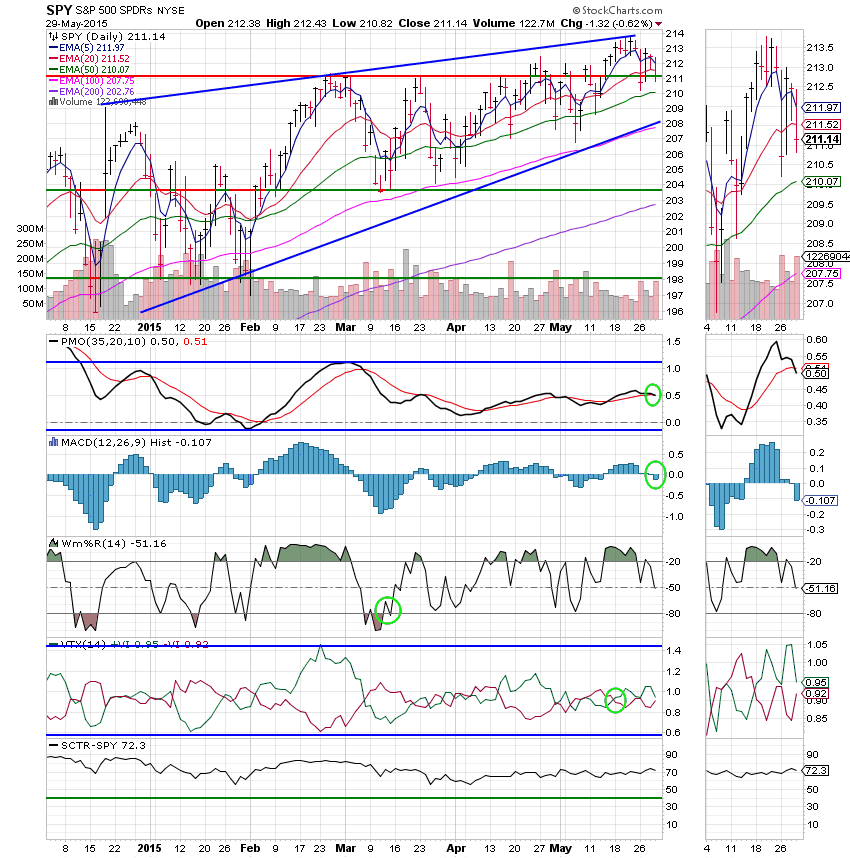

C Fund: Price closed right on support at 211. We’ll have to watch on Monday to see if this key area of support is breached. As anticipated, the PMO and MAC D slipped into negative configurations, moving the overall signal for the C Fund to Neutral.

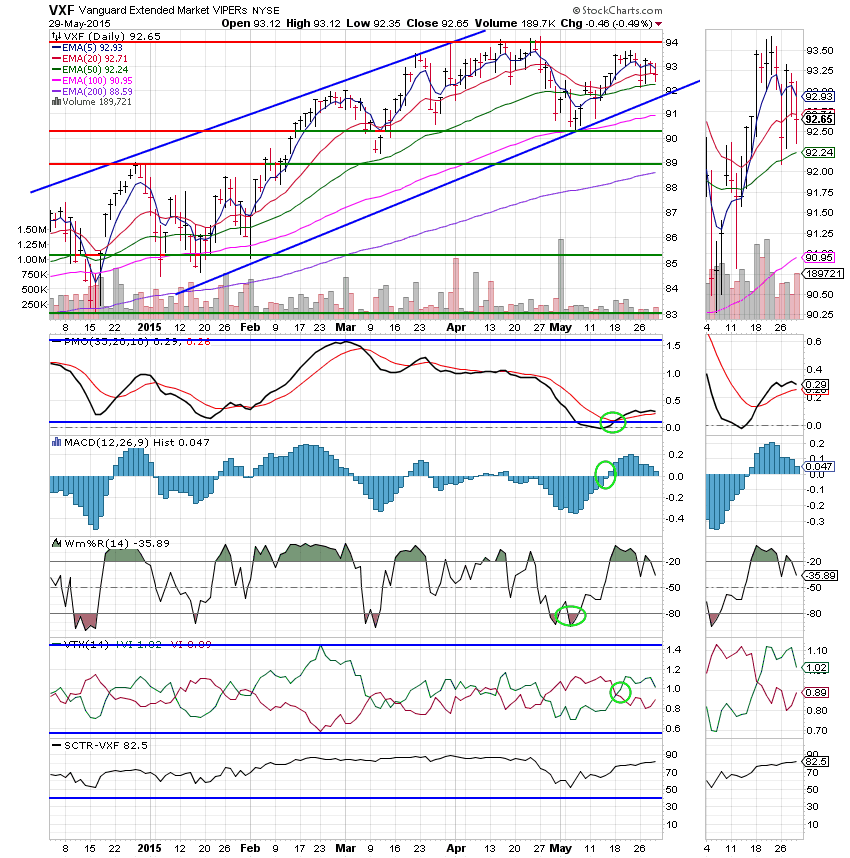

S Fund: Price closed just below the 20 EMA, but well above the 50 EMA. The S fund remains on a buy signal with all indicators still in positive configurations. The indicators are all showing a stress from the negative action, but are hanging in there for now.

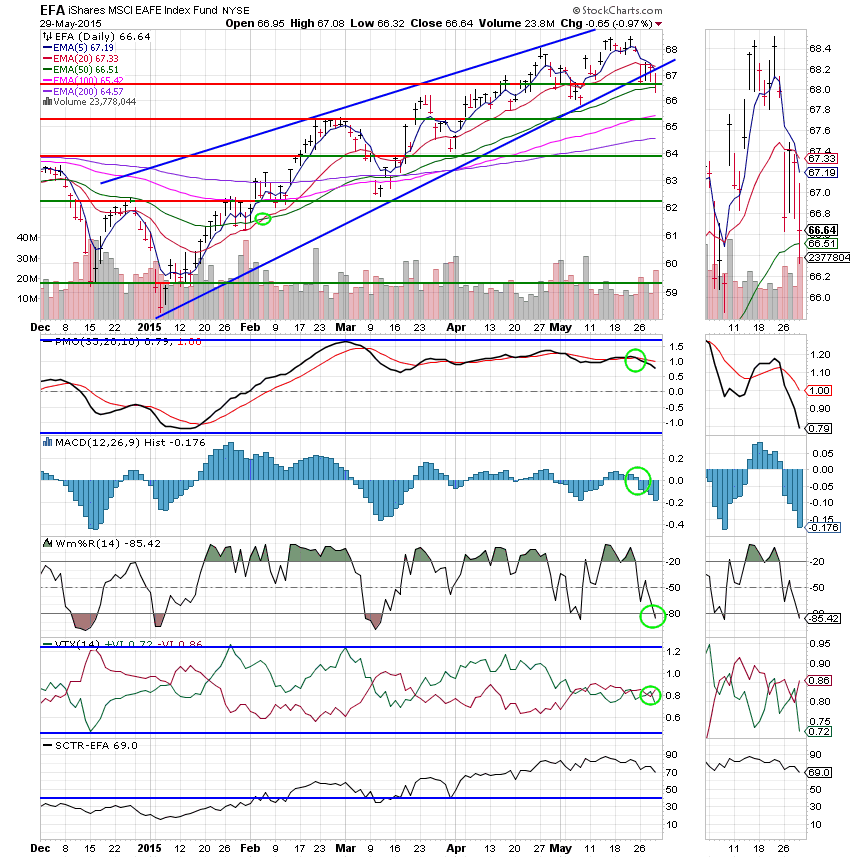

I Fund: Price closed fright on support at 66.70. So far this key area of resistance has held. We will watch it carefully Monday. If support is broken, the new downside target would be 65.50. The Williams %R moved into a negative configuration further solidifying this charts Neutral signal. The I Funds overall performance has dropped in recent weeks and is being reflected by a dropping SCTR that is now at 69.

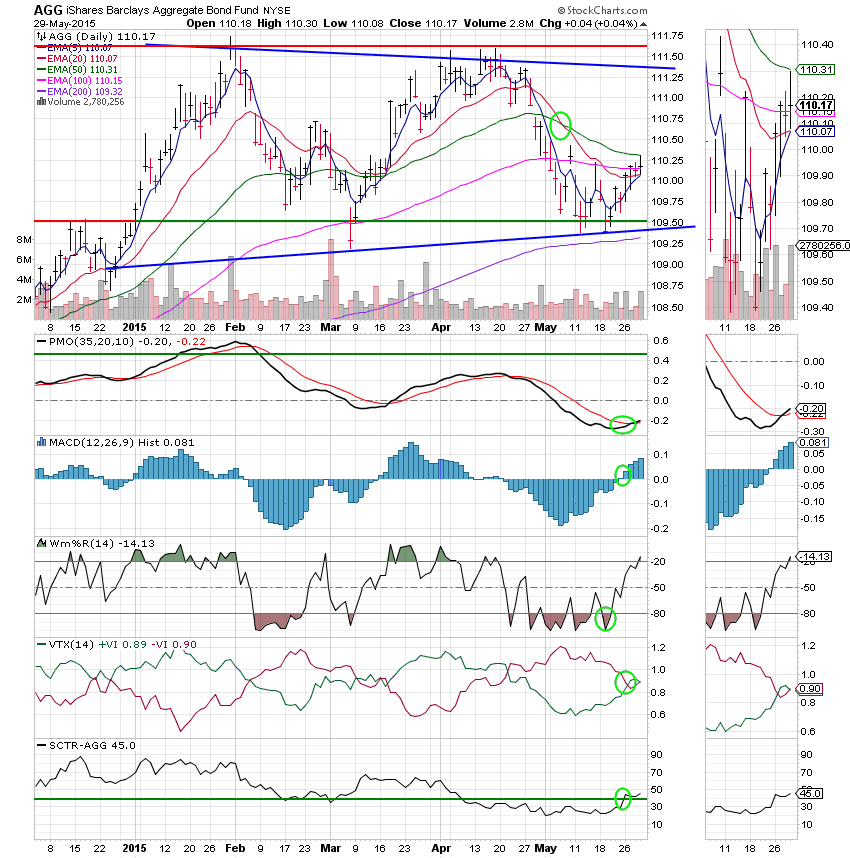

F Fund: Bonds are hanging in there as might be expected with the negative action in stocks. Price again closed above the 100 EMA. The VTX whipsawed and is back on a bearish reading. The overall signal for this chart remains at Neutral with price and the VTX in negative configurations. I will never assign a buy signal to a chart with the 20 EMA below the 50 EMA. As far as I’m concerned, that is an intermediate term down trend.

That’s if for May. We can close the books. Thanks be to God again that we were able to close them in the green. Let’s all continue to pray that we can add to that gain between now and December! That’s all for now. Have a nice weekend and we’ll do it all again on Monday!

God bless,

Scott![]()