Good Morning, Well we’re out again. Friday we put in an interfund transfer to move to 100/G. Why? I watch several charts not just the one I’m invested in. It is important to have an overall view of the market in order to discern where it might be moving. One of the things I look at is stocks by capitalization. Specifically, I divide them into three groups. Small caps, mid caps, and large caps. It has been my experience over the years that watching small caps closely is like having a canary in a coal mine. They often move in a faster and more pronounced fashion than do large caps. Most of the time wherever small caps go large caps are soon to follow. So if you see small caps entering a down trend then you better get out of large caps before they enter one too. That’s what we saw and that’s why we moved quickly on Thursday. While our charts show that we should have had a little more upside in the C Fund before we were forced out, we chose to sell into strength and protect the profits that we have in hand. We must never lose sight of the fact that we are investing retirement money here. We must try to make it grow to be sure but we must do so in as safe of a manner as possible. So when we get wind of a possible downturn we will always sell and take the safe route. We believe firmly that is not what you make that matters. It’s what you keep that’s important!

So where are we at in the market this week? There’s a myriad of action happening that could influence trading ahead of this months Fed meeting. Here is what we have on tap for the week.

10 a.m. Construction spending (April)

10 a.m. ISM manufacturing (May)

10 a.m. JOLTS job openings (April)

Earnings: Hewlett Packard Enterprise, Bath & Body Works

10 a.m. ISM services PMI (May)

Earnings: Campbell Soup, Dollar Tree

8:30 a.m. Initial jobless claims

Earnings: J.M. Smucker Co.

8:30 a.m. May jobs report

You can consider all those possible inflection points that could send the market higher or lower. Our stance here is that the market will eventually dip before it resumes the current uptrend. Therefore, we have positioned ourselves to take advantage of that dip. One thing to always bear in mind regarding trades in the market. A normal healthy market seldom moves straight up or straight down. Often when you make a trade you will find yourself wondering if you did the right thing. This type of second guessing will often lead to poor investment decisions if you let it. Once you’ve done your due diligence and made a trade you must give it time to work. If you are incapable of doing this then you should probably put your money in a lifecycle fund and leave it there. You will find your life a lot less stressful if you do. My philosophy is different. I make the trade, then pray about it and turn it over to God. Also one more important thing. I never wait until I have a profit before I exit a trade. I exit a trade because my charts tell me too. There’s an old saying and it is so true in investing. IF you want to get out of a hole then quit digging! My focus is continually on maintaining as high a balance in my portfolio as possible. I don’t care what trading system you use. Yours should be too.

The days trading so far has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is trading lower at -0.27%, the Nasdaq higher at -0.92%, and the S&P 500 is up +0.33%.

Recent trading left us with the following signals: C-Hold, S-Sell, I-Buy, F-Buy. We are currently invested at 100/G. Our TSP allotment is now +5.21% for the year. Here are the latest posted results:

| 05/31/24 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

18.2899 |

18.9225 |

82.7584 |

79.7001 |

43.2298 |

| $ Change |

0.0024 |

0.0673 |

0.6666 |

0.2231 |

0.4625 |

| % Change day |

+0.01% |

+0.36% |

+0.81% |

+0.28% |

+1.08% |

| % Change week |

+0.09% |

+0.00% |

-0.49% |

-0.97% |

+0.14% |

| % Change month |

+0.41% |

+1.69% |

+4.96% |

+3.36% |

+4.86% |

| % Change year |

+1.82% |

-1.56% |

+11.29% |

+3.38% |

+7.59% |

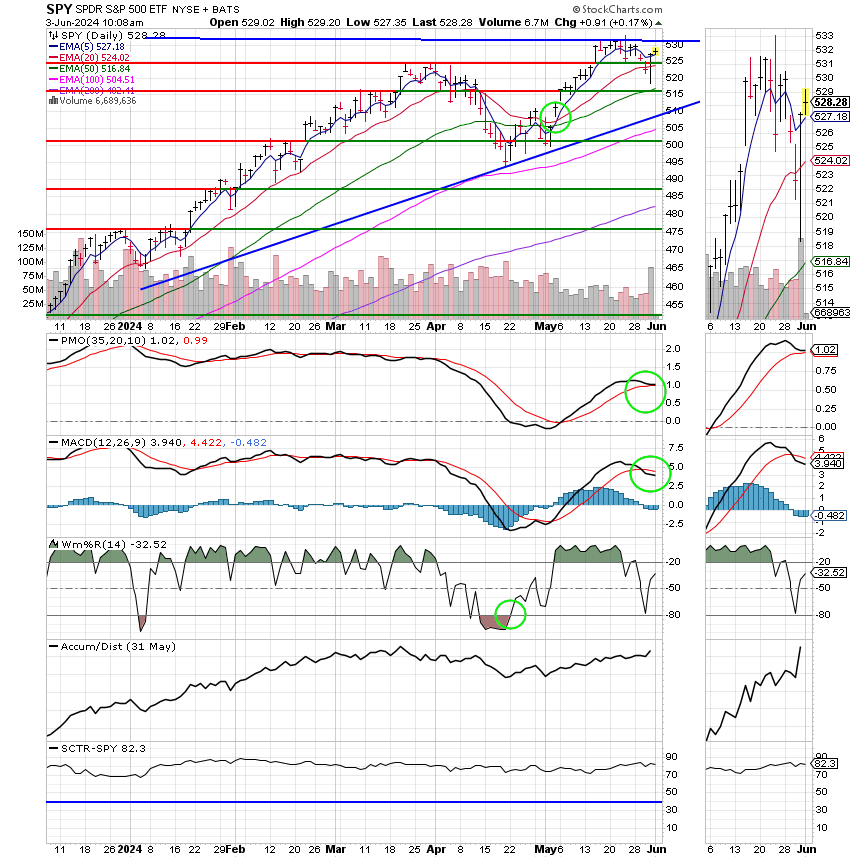

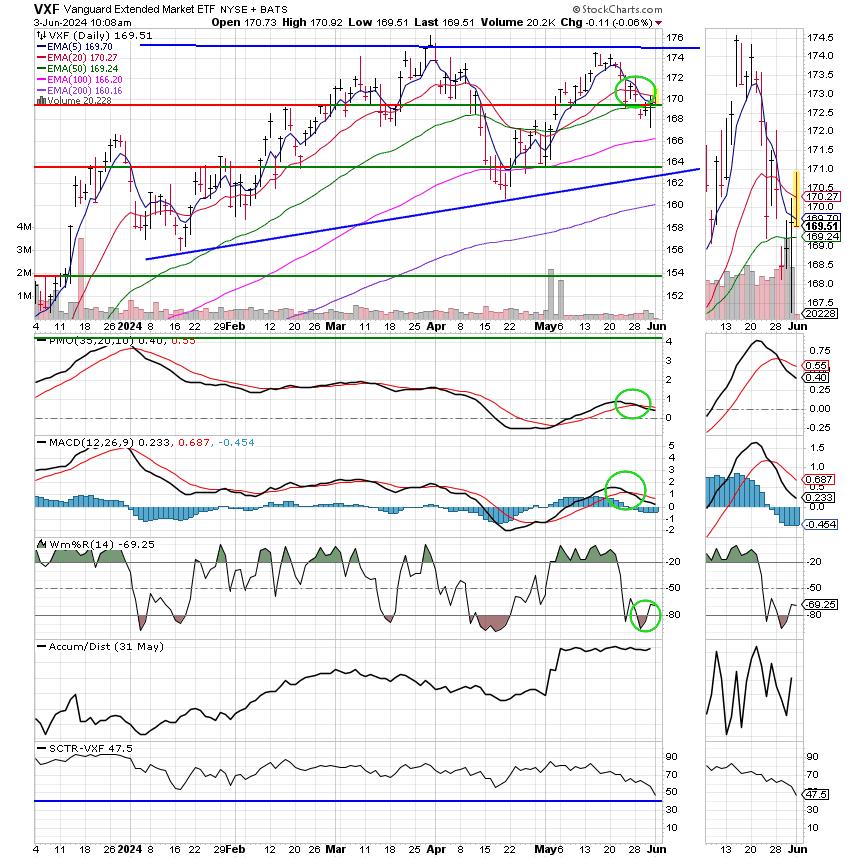

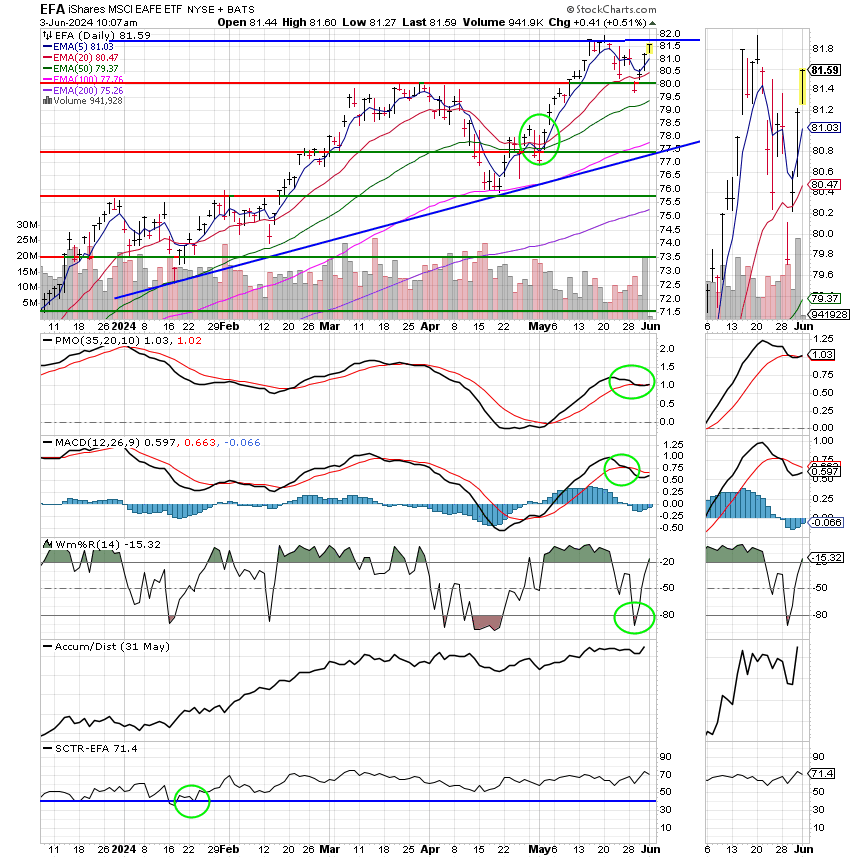

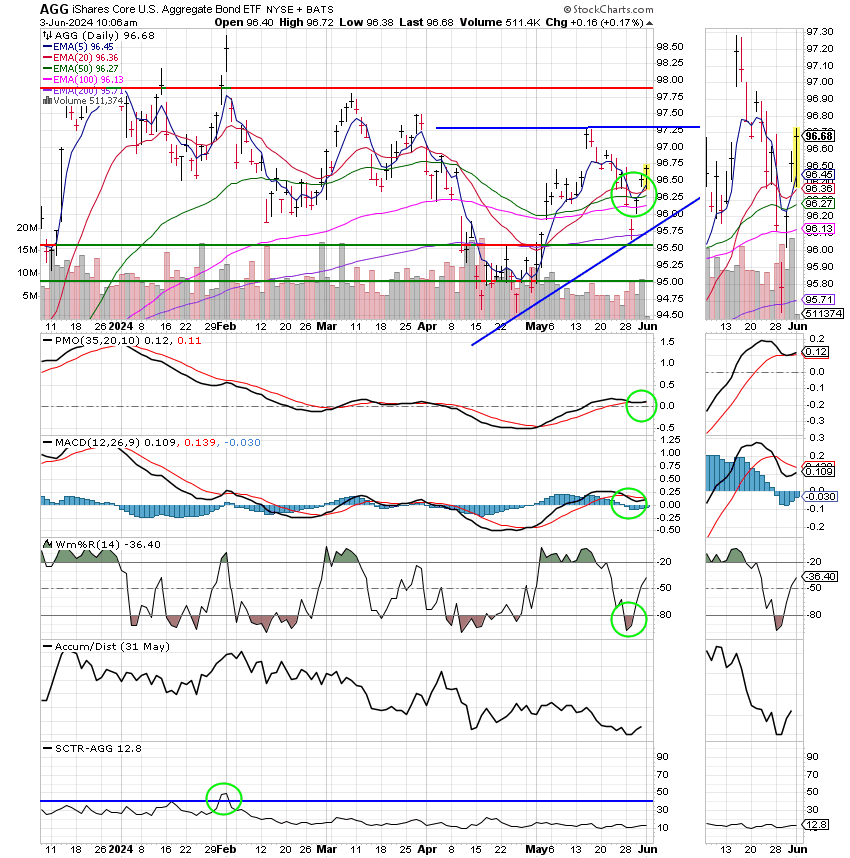

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Nothing new to add here. Our task simply remains to monitor our charts and make adjustments as necessary. That’s all for this week. Have a great day and may God continue to bless your trades!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.