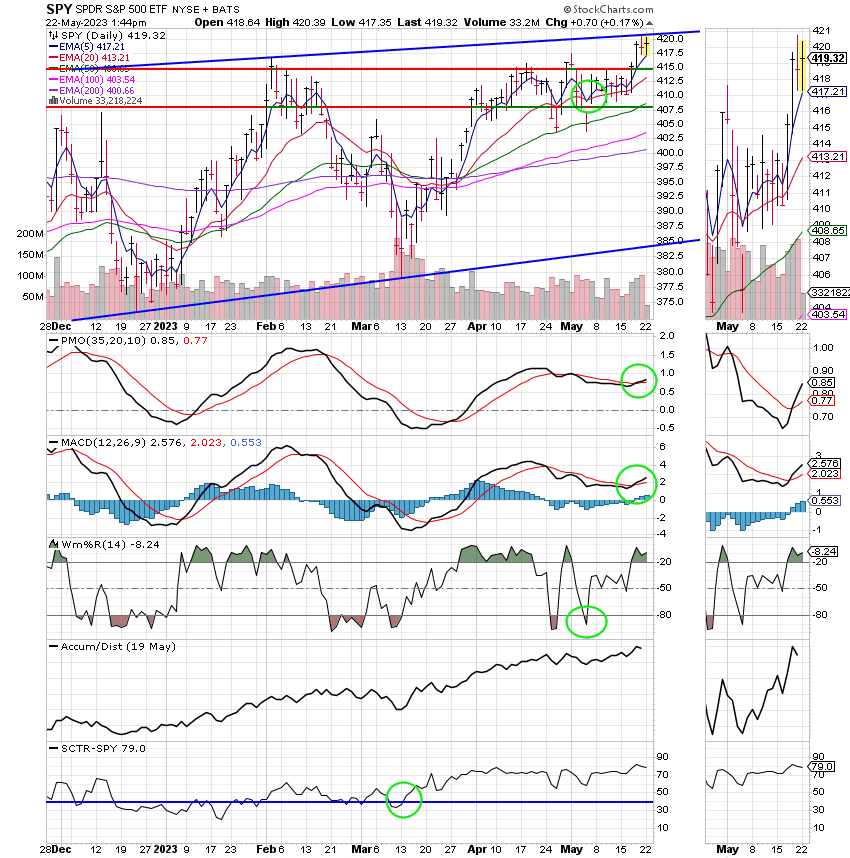

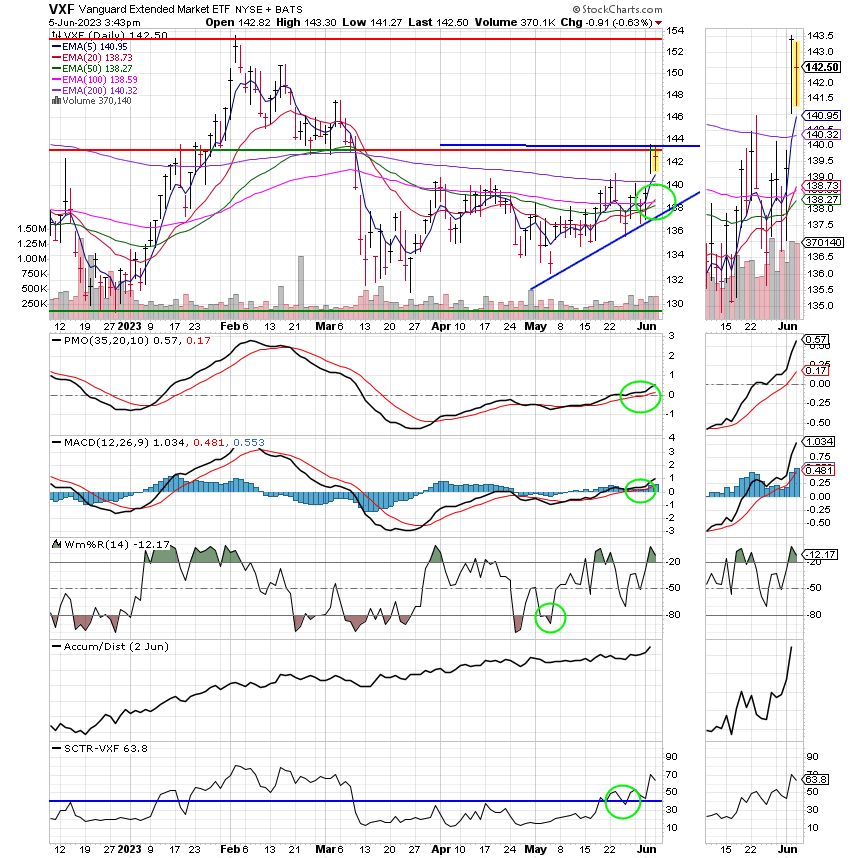

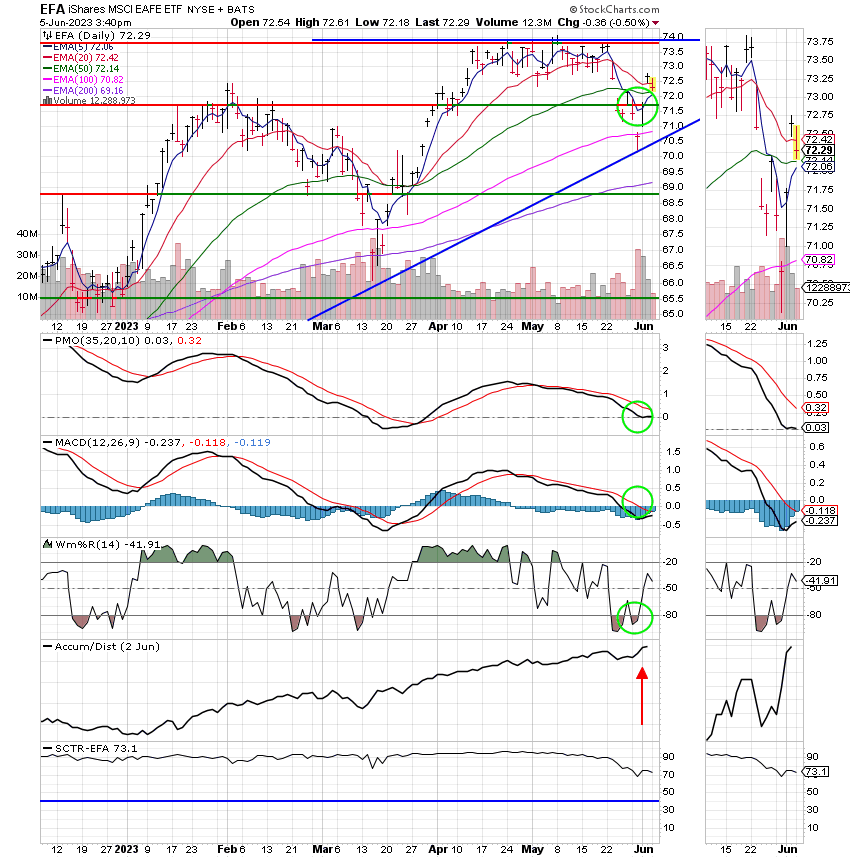

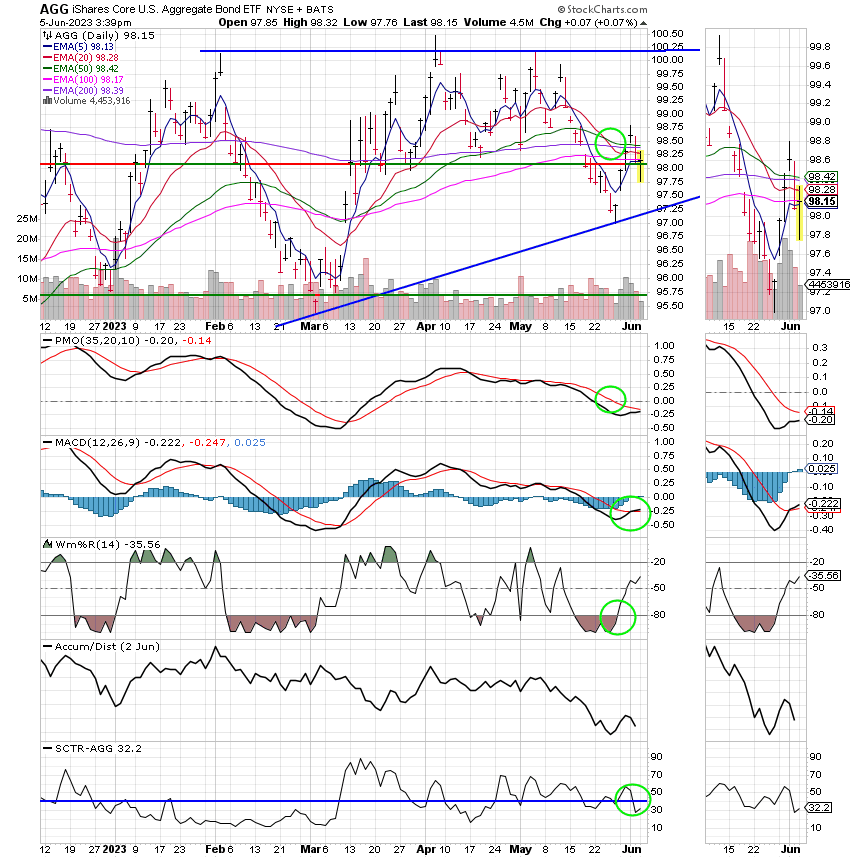

Good Afternoon, Last week was a busy week to be sure and most of went in a positive direction making conditions ripe for the market to rise in the short term. First and foremost there was a debt ceiling deal which passed trough the house and senate a lot faster than we anticipated. Then there was a blow out jobs report that showed a larger than expected gain in jobs. Nonfarm payrolls grew much more than expected in May, rising 339,000. Economists polled by Dow Jones expected a relatively modest 190,000 increase. It marked the 29th straight month of positive job growth signaling to the market that at least for now there will not be a recession. There has never been a recession without a loss in jobs. It is now the opinion of most investors that there will not be a recession in 2023 as previously thought. Although the bond yield curve has been signaling a recession for a while, it is now believed that the strong job market is delaying it until 2024. Thirdly, Tech stocks have been on a tear due to excitement over AI or Artificial Intelligence. Tech along with Communications and Energy sectors have been fueling this rally. For the most part, the other sectors have not participated. The overall breadth of the market has not been good. The recent rally has been almost entirely supported by tech stocks. Breadth will have to improve if we are to have a sustained rally! At this point everything hinges on the June meeting of the FOMC or “the Fed”. It is going to be very difficult for them to decide whether or not they will increase rates. Signals have definitely been mixed with many showing the economy and inflation slowing down while others are showing that things are still very strong, maybe too strong for inflation to recede. There is 50/50 chance that the Fed will increase rates at the nest meeting making it extremely hard to tell in which direction the market may move. I would not recommend making any big changes between now and the conclusion of that meeting. For now, we have made a short term move into the I Fund. Last week the I fund successfully tested support on it’s chart at 71.71. Given what our other indicators are showing us, we feel that the I Fund could rebound around three percent. Our plan which all depends on the market reaction to the upcoming Fed decision is to ride the I Fund higher to overhead resistance at 74.00 and then look to move to the C or S Funds if a good entry point presents itself. How long we will stay in the I fund will largely depend on what the dollar does which will depend on what the Fed does. Right now our charts tell us that the dollar is due for a short term move lower which will benefit the I fund and supports our analysis that it will move approximately 3% higher. The weaker the dollar, the stronger the I Fund. Our plan if all goes well is to capture that three percent. Either way we’ll be watching the charts for the C and S Funds closely as we expect them to pullback and then move higher. We are looking to any pullback as a possible entry point into the strongest one of those two funds if and when it comes. Once again, it all depends on the Fed or should I say the market reaction to the Fed. Please keep praying that God will guide our hand. We can never do enough of that!

Current trading is generating the following results: Our TSP allotment is currently lower at -0.48%. For comparison the Dow is off -0.45%, the Nasdaq is -0.15%. and the S&P 500 is also lower at -017%. The market appears to be taking a day off after a large rally Friday.

S&P 500 slips after touching new 9-month high: Live updatesThe

The days action has left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/I. Our allocation is now -2.07% not including the days results. Here are the latest posted results:

| 06/02/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5127 | 18.6319 | 66.1783 | 66.5917 | 37.4047 |

| $ Change | 0.0019 | -0.0941 | 0.9518 | 1.9295 | 0.4169 |

| % Change day | +0.01% | -0.50% | +1.46% | +2.98% | +1.13% |

| % Change week | +0.07% | +0.86% | +1.88% | +3.38% | +0.62% |

| % Change month | +0.02% | -0.28% | +2.48% | +4.06% | +2.74% |

| % Change year | +1.61% | +2.33% | +12.35% | +8.23% | +10.20% |