Good Evening, The main theme of the market has not changed. It is still about the recovery but the way the market reacts to the recovery news is slightly different than it was in the spring. Let me explain. In the spring the emphasis was more about the recovery, about if we would recover and how long it would take. It is pretty much accepted and baked into the market that the US will have a full and timely recovery from the economic crisis created by the pandemic. The focus now has turned to how long it will take for the economy to overheat and force the Federal Reserve to taper their stimulus. Each and every economic report and news release as viewed in the terms of how it will affect the Fed’s decision to raise interest rates and slow down their stimulus in order to control inflation. I guess in even simpler terms you could say it’s all about inflation. So far most of the reports have been goldilocks warm in that they have show an improving economy but not one that is improving so fast as to cause a significant rise in inflation. Fridays job report was a good example. according to CNBC “Job creation disappointed again in May, with nonfarm payrolls up what normally would be considered a solid 559,000 but still short of lofty expectations, the Labor Department reported Friday. Payrolls were expected to increase by 671,000, according to economists surveyed by Dow Jones. Markets were not disappointed by Friday’s report. Stock market futures actually rose, with investors betting that the measured pace of job gains would keep the Federal Reserve from raising interest rates and tightening monetary policy.” So as you see it’s all about the Fed taking action to control inflation. You can bet that every time inflation is mentioned or inferred that the market will fall. The market is very addicted to all this cheap capital. We all knew when it started in 2009 (or was it the fall of 2008) that it would come to an end someday. Well that day is fast approaching and would already have arrived if not for the pandemic. It says here that the market will have some heavy withdrawal symptoms when the stimulus is removed. So as they say on the farm….better make hay while the sun is shining!!

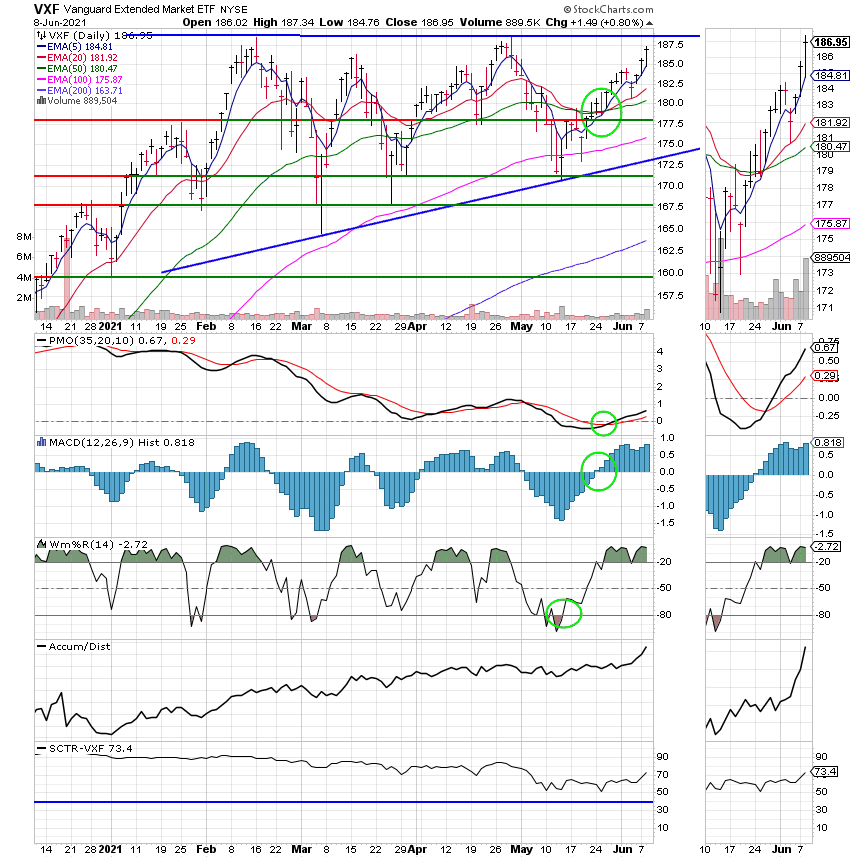

The days trading left us with the following results: Our TSP allotment had another great day posting a gain of +0.80%. For comparison, the Dow slipped -0.09%, the Nasdaq gained +0.33%, and the S&P 500 finished flat at +0.02%. Praise God for another great day!

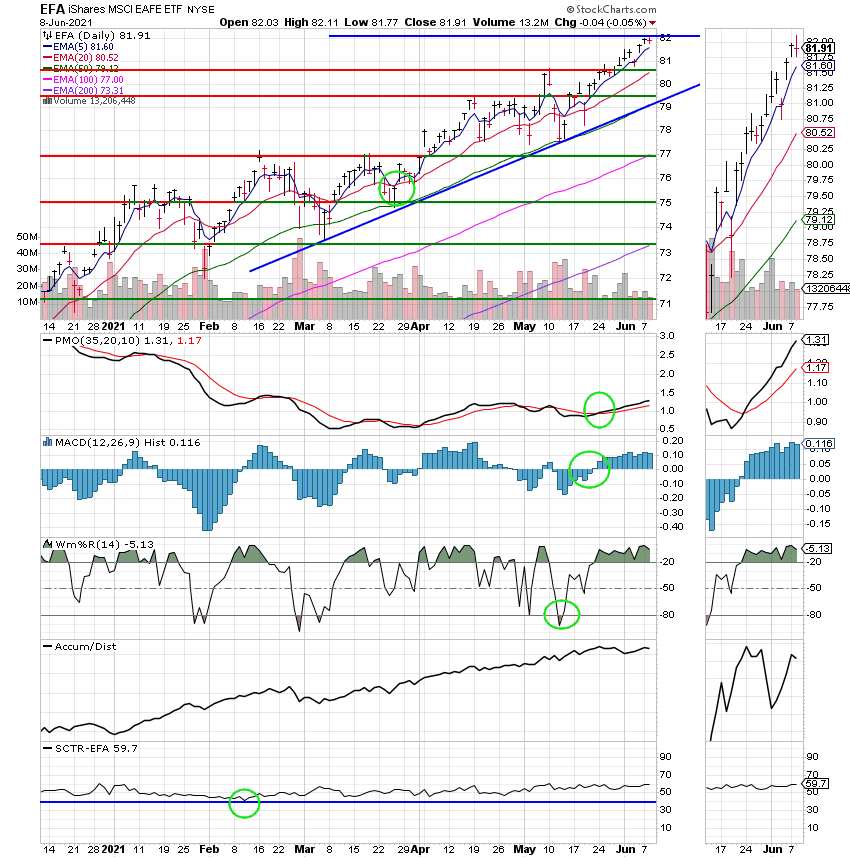

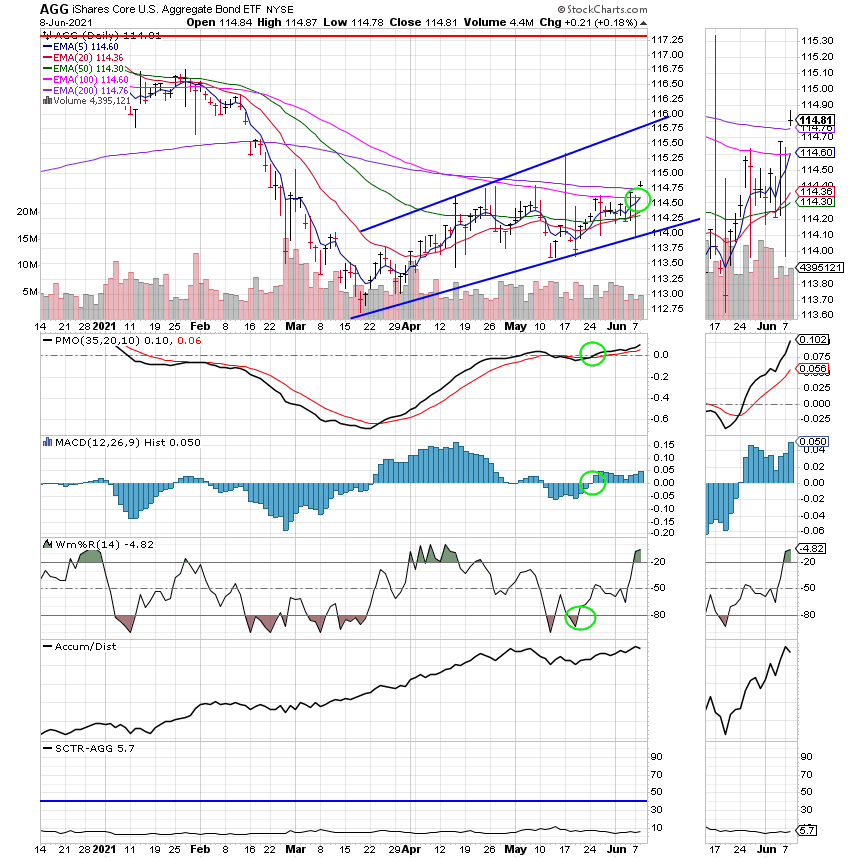

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S our allocation is now +14.11% for the year. Here are latest posted results.

| 06/08/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6006 | 20.781 | 63.3327 | 84.6673 | 39.5758 |

| $ Change | 0.0006 | 0.0361 | 0.0134 | 0.6704 | 0.0105 |

| % Change day | +0.00% | +0.17% | +0.02% | +0.80% | +0.03% |

| % Change week | +0.02% | +0.12% | -0.06% | +1.91% | +0.41% |

| % Change month | +0.03% | +0.26% | +0.59% | +2.24% | +1.13% |

| % Change year | +0.56% | -1.96% | +13.27% | +14.11% | +11.83% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.9792 | 11.8445 | 41.7799 | 12.5471 | 47.4801 |

| $ Change | 0.0093 | 0.0085 | 0.0380 | 0.0127 | 0.0526 |

| % Change day | +0.04% | +0.07% | +0.09% | +0.10% | +0.11% |

| % Change week | +0.10% | +0.19% | +0.24% | +0.26% | +0.29% |

| % Change month | +0.26% | +0.50% | +0.63% | +0.69% | +0.75% |

| % Change year | +3.15% | +6.14% | +7.74% | +8.45% | +9.18% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 13.0087 | 28.5008 | 14.0054 | 14.0053 | 14.0052 |

| $ Change | 0.0158 | 0.0369 | 0.0198 | 0.0198 | 0.0198 |

| % Change day | +0.12% | +0.13% | +0.14% | +0.14% | +0.14% |

| % Change week | +0.32% | +0.34% | +0.40% | +0.40% | +0.40% |

| % Change month | +0.81% | +0.86% | +1.02% | +1.02% | +1.02% |

| % Change year | +9.80% | +10.43% | +12.84% | +12.84% | +12.83% |