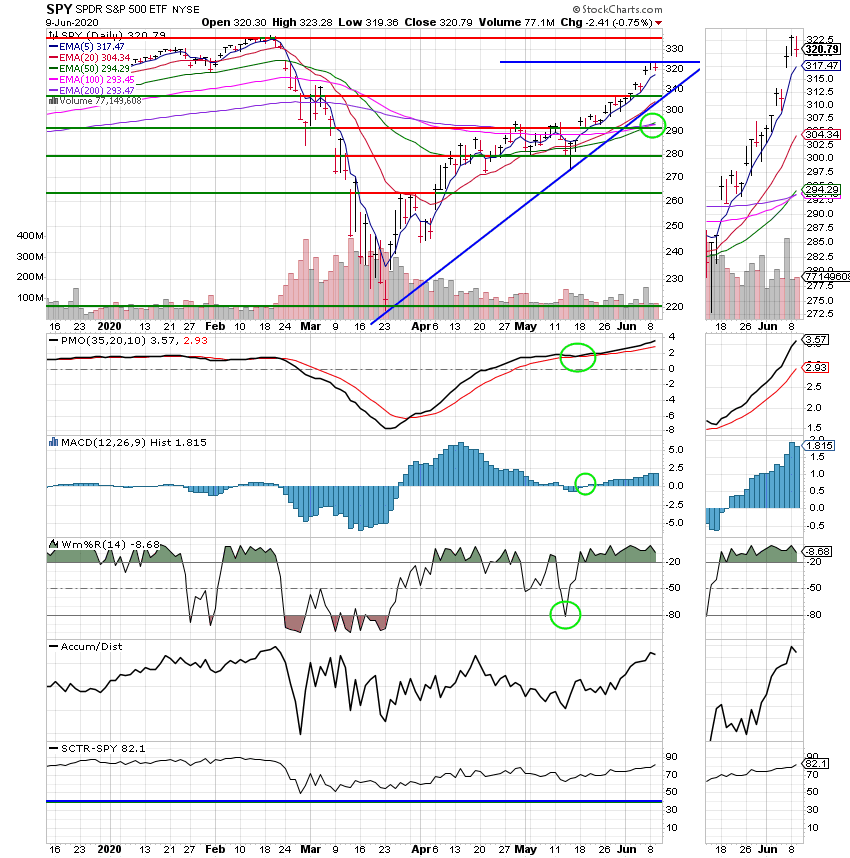

Good Evening, I will try to keep in brief. Things have been hectic around here and it is now pretty late. The market took a day off today. It’s pretty news driven these days. That is to say Corona Virus and Economic news driven. Today there were some conflicting reports released that left the market confused and if there is one thing the market dislikes it is uncertainty. The World Health Organization reported that Asymptomatic spread of COVID 19 is much less than previously thought which was somewhat positive. Then there was another report that stated that cases of COVID 19 are spiking in Arizona and that they may soon run out of hospital beds. There was also news released that said we officially entered a recession in late February. Does that surprise any one? Didn’t think so. At any rate the market broke it’s streak of something like six positive days. As we discussed before the market will continue to swing on Corona Virus and Recovery Related news. While a serious new outbreak of COVID 19 could send this market into another tail spin, today’s selling had more the feel of healthy consolidation after a nice run. In simpler words….profit taking. One thing I will mention about the most recent action is that the leadership has changed from growth stocks like Netfix (NFLX) to value stocks like J.P. Morgan Chase Bank (JPM) and that is a good thing as there has never been a meaningful uptrend without the participation of a broad range of value stocks. The bottom line is that while I am still expecting some rough water I am cautiously bullish about this market moving forward. And…. As my Uncle Bob would say….my money is where my mouth is……

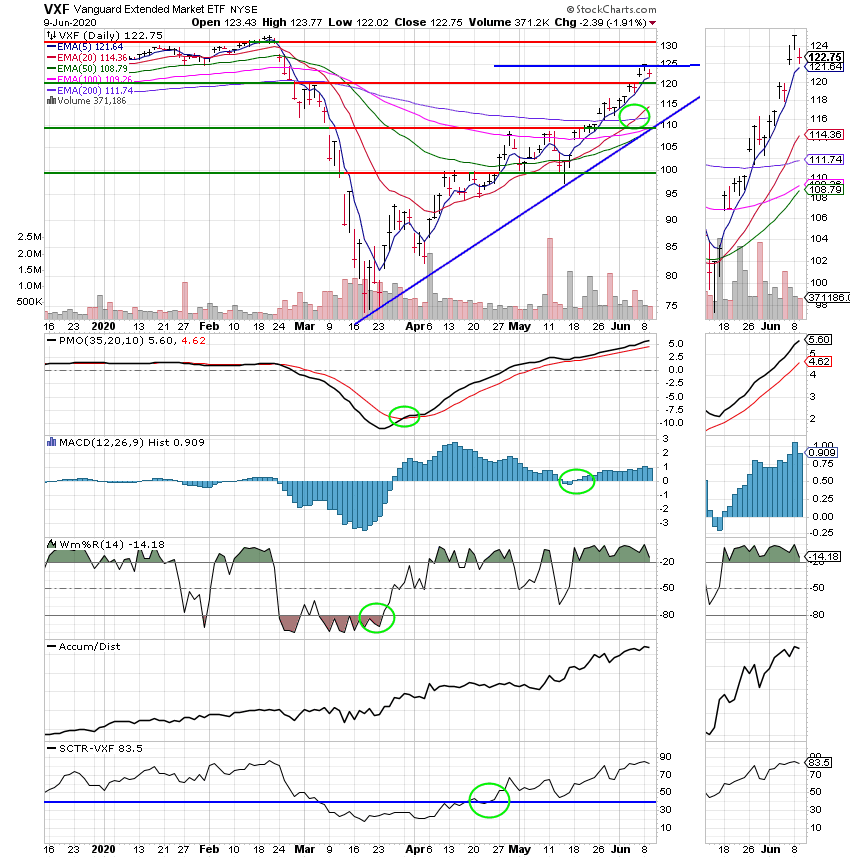

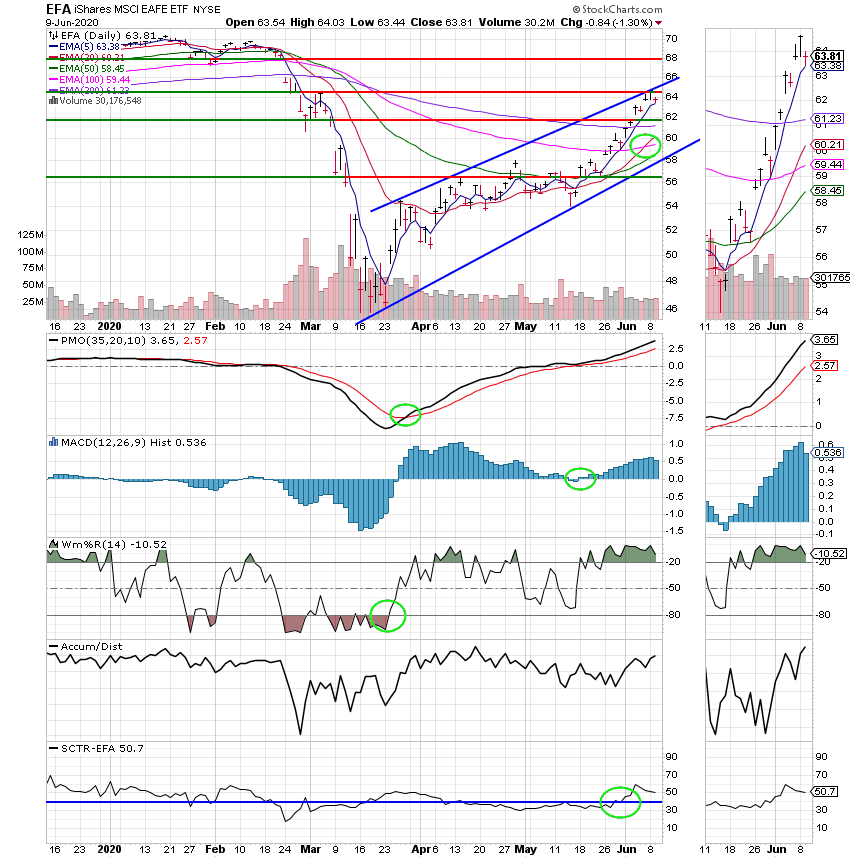

The days trading left us with the following results: Our TSP allotment gave up some of it’s recent gains trading down -1.91%. For comparison, the Dow fell -1.09%, the Nasdaq gained +0.29%, and the S&P 500 lost -0.78%. It was a rough day for small and mid caps.

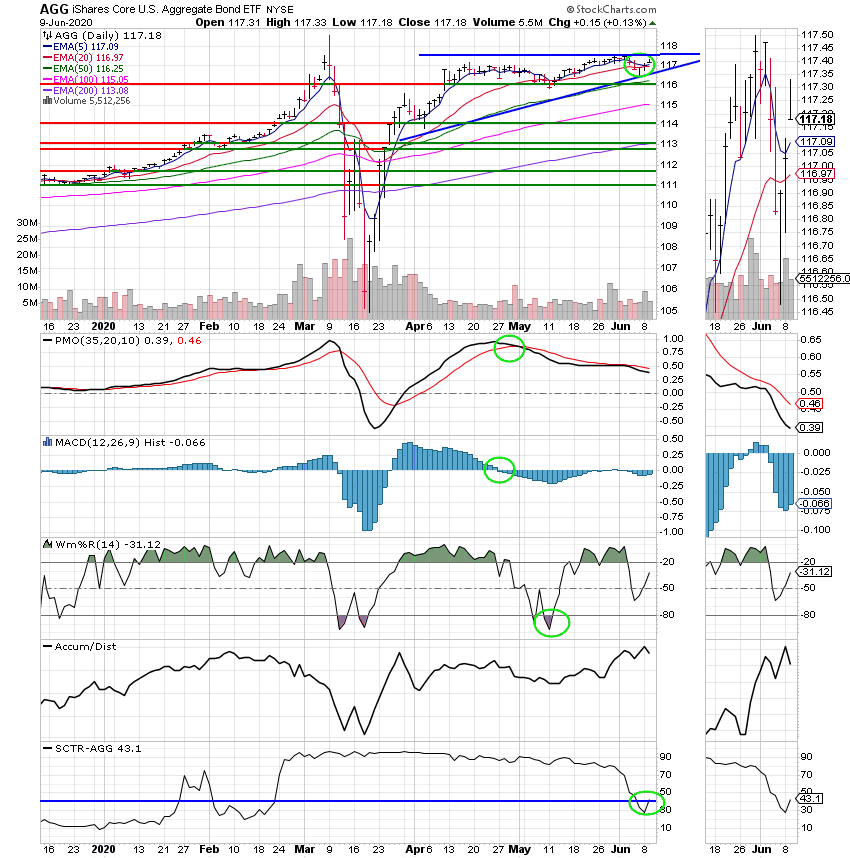

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/S. Our allocation is now +18.04% on the year. Wow, praise God!! Is there anyone that is not happy with that? I am thrilled. Our prayer now should be that God will continue to guide us. We must be prudent and give praise where praise is due for our success! So let me say one more time so there is no mistake. Praise God for guiding our group to this awesome return! Here are the latest posted results:

| 06/09/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4403 | 20.7657 | 47.3065 | 54.7837 | 30.2166 |

| $ Change | 0.0003 | 0.0422 | -0.3692 | -1.0655 | -0.2034 |

| % Change day | +0.00% | +0.20% | -0.77% | -1.91% | -0.67% |

| % Change week | +0.01% | +0.38% | +0.43% | +0.26% | +0.33% |

| % Change month | +0.02% | -0.10% | +5.40% | +7.53% | +7.44% |

| % Change year | +0.55% | +5.32% | +0.10% | -2.65% | -7.64% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.274 | 29.2953 | 34.5504 | 37.9228 | 22.0861 |

| $ Change | -0.0386 | -0.0571 | -0.1838 | -0.2437 | -0.1640 |

| % Change day | -0.18% | -0.19% | -0.53% | -0.64% | -0.74% |

| % Change week | +0.11% | +0.12% | +0.26% | +0.30% | +0.34% |

| % Change month | +1.38% | +1.47% | +3.83% | +4.59% | +5.26% |

| % Change year | +0.41% | -0.04% | -0.87% | -1.32% | -1.77% |