Good Day, I am making a rare weekend post this week as I’m going on vacation. The market has been very busy over the last few weeks. It has been mostly higher giving many investors the impression that the worst is over. Our charts agree in that we see money starting to flow into higher risk investments. Sentiment charts also support the fact that the character of the market is starting to change. The VIX which I follow closely fell to 13.83. I posted this on our social media page to alert folks that this important indictor reached the critical level of 16. Folks, make no mistake that if this holds it is good for the long term market. Pay close attention to what I am saying! “Long Term”!!!!! I did not say that the market will go straight up and never fall. Shortly after making that post I had someone comment that the market “crashed” the last time the VIX reached 16. I told them to define the term crash. To me for the market to crash means that it drops drastically in one day. October of 1987 comes to mind when the market lost approximately half its value in just one day. As I have preached many times in the past several months. Many investors and especially new investors got used to the stimulus induced market of the last decade. They either started trading during that time or forgot what it was like to trade prior to the financial crisis of 2009. To them and drop is a crash! Well I said it before and I’m going to say it again. Let me shout it from the mountain top!!! That dozen years or so was not the new norm!! It did not take the place of all the rest of the years that the market has ever traded!!!! A pullback or even a correction is not and never has been a crash!!!! Do you understand me???? Pullbacks and corrections ( a dip of 10% or more) are a healthy part of a normal market. They should be expected and even welcomed as an good entry point into an investment. Those who consider them a crash are in for a frustrating investment career if they fail to understand this. Enough of that. If you believe that the VIX at 16 is signaling a “CRASH” then your probably wasting your time here. Now let me tell you how we read the VIX. There is indeed a point at which the VIX signals that the market will enter into a major selloff and that it just the opposite of 16. Here is how we read the VIX. Anything above 20 means you should raise your level of caution. Anything above 24 means you should consider taking some profits. Anything above 29 means you should consider moving all your investments to safe havens. Conversely if the VIX is moving lower anything lower than 25 signals that conditions are starting to improve. Anything below 20 signals that you sh0uld start accumulating your favorite investments, and anything below sixteen means you should buy. Now to be fair you should follow your indicators to tell you when the pullbacks will occur but you can be pretty certain that the market will improve when the VIX drops below sixteen. Now, on the rest of the week. We have two market making events this week that will determine where the market goes from here. We have the CPI (consumer price index) which will be released on Tuesday. It is a favorite measure of inflation for the Fed which brings of to the second and all important event of the week which is the Fed meeting on Tuesday and Wednesday. Investors will be watching closely to see if he Fed increases or holds interest rates steady and they will be paying particular attention to the post meeting news conference which will be held at 2:00 PM EDST on Wednesday afternoon. They will be listening for hints as to how long the Fed will leave interest rates at their current levels and when and if they will start to lower rates. In the past I have tried to lay out the various scenarios and how the Fed might react to them, but I’m not going to do that this time. It has become difficult if not impossible to determine how the market will react to a certain outcome. For instance if they view a particular outcome as favorable, will they immediately start buying or will they see it as a good opportunity to take some profits before the next leg higher? Ever get caught in a market that went the opposite way that you thought it would?? A market that just didn’t make sense to you?? That’s what I’m talking about! What we will do here and what we have always done and that is to raise our level of vigilance and watch our charts closely and react to what we see. That ladies and gentlemen is what we do! Well that and praise the most high God! Never ever forget that He has always been the source of any success that we might have and we always want to acknowledge the wonderful things He has done for us.

Fridays trading left us with the following results: Our TSP allotment slipped -0.17%. For comparison, the Dow added +0.13%, the Nasdaq +0.16%, and the S&P 500 +0.11%. It was a decent week for the major indices.

S&P 500 notches fourth straight positive week, touches highest level since August: Live updates

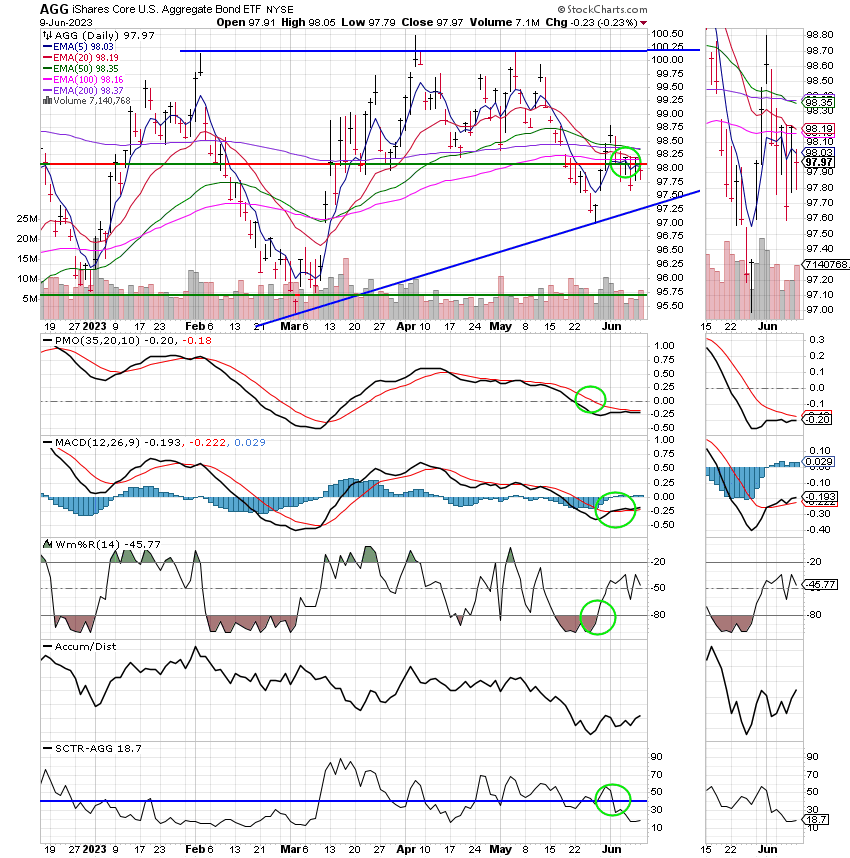

The weeks action left us with the following signals: C-Buy, S-Buy, I-Buy, F-hold. We are currently invested at 100/I. Our allocation is now -1.68% on the year. Here are the latest posted results:

| 06/09/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5258 | 18.6042 | 66.4473 | 67.3718 | 37.5563 |

| $ Change | 0.0019 | -0.0382 | 0.0780 | -0.3650 | -0.0204 |

| % Change day | +0.01% | -0.20% | +0.12% | -0.54% | -0.05% |

| % Change week | +0.07% | -0.15% | +0.41% | +1.17% | +0.41% |

| % Change month | +0.10% | -0.43% | +2.89% | +5.28% | +3.16% |

| % Change year | +1.69% | +2.18% | +12.81% | +9.49% | +10.65% |