Good Morning, Wow, this is one of those summers that’s going by really fast. The issue of persistent inflation and when the Fed might cuts rates is keeping the market more volatile than it usually is this time of year. As I said almost two years ago, this will not end until the rate of inflation recedes to 2 percent. You can bank on it. Until then it will be make a little here give up a little there. I realize that the S&P 500 is up some 12% YTD. However that figure as it was last year is misleading. The great majority of those gains were made in the first two months of the year. Since then it has been give and take. This week will determine the direction of the market until the next Fed meeting. There’s a lot going on but there are two things in particular that will impact the market the most. First and foremost is the June meeting of the FOMC better known to us as the FED. The Fed meets eight times per year (more if needed) to determine monetary policy which is driven by their dual mandate to maintain employment and control inflation. I posted an excellent explanation of the FED and what they do on our Facebook page. I would highly recommend that you give it a read. It explains what the Fed is, what they do, how they do it, and how they have managed the economy over the past several years. Here’s the link! Anyway, they are expected to hold rates steady at this meeting. My guess is that the market will react negatively as they were originally expected a rate decrease by this meeting. I got news for them though. There will not be a rate decrease until September or November and maybe not even in 2024. The second big market moving event will be the May consumer price index that’s set to release Wednesday. Economists polled by Dow Jones anticipate a rise of 3.4% from the year-ago period, and a 0.1% increase on a monthly basis. That’s compared to increases of 3.4% and 0.3%, respectively, in the prior reading. Core CPI, which excludes volatile food and energy prices, is expected to show an increase of 3.5% year over year, and a 0.3% gain on the month. Previously, it gained 3.6% and 0.3%, respectively. If the Fed statement is hawkish and this report is hot, then buckle up, it’s going to be another rough ride! Not saying it will, just saying it might. The possibility is there.

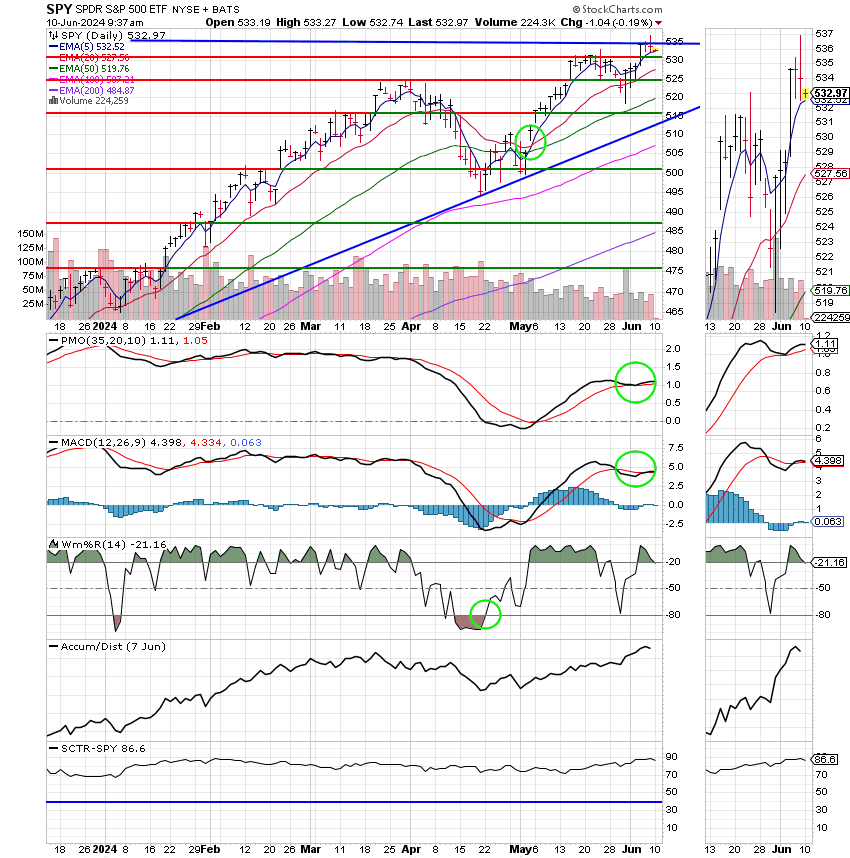

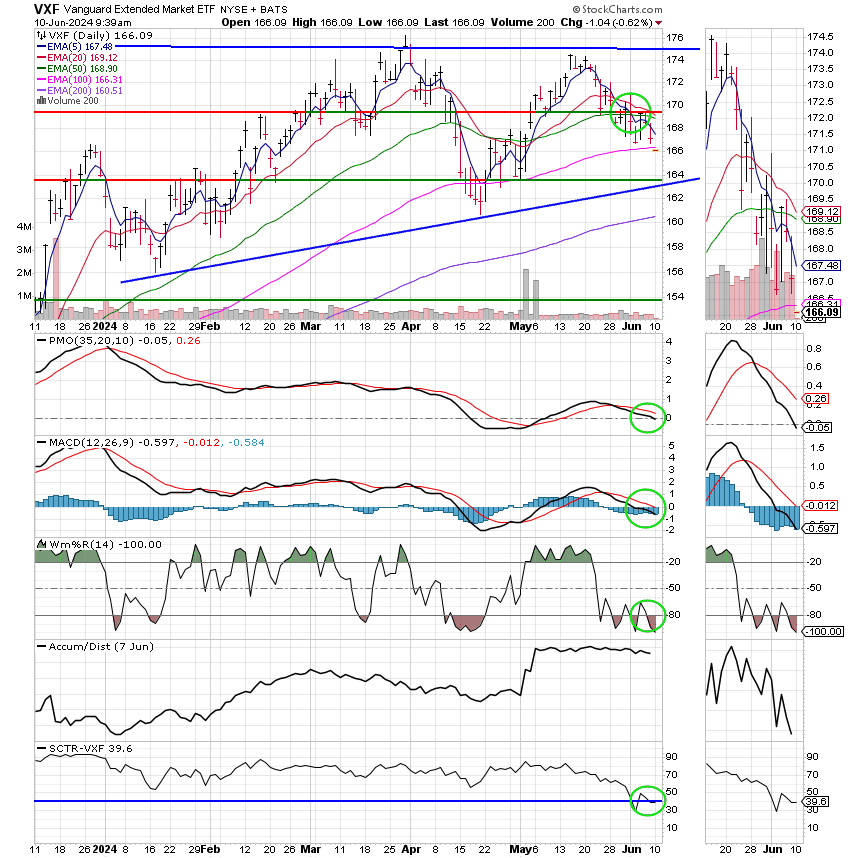

Last week we moved to the G Fund as small and mid cap stocks continued to take a nosedive. As usual, I received negative feed back on the decision since the C Fund was still doing well. At least it had one really good day anyway. As I wrote on Facebook and will repeat here, small caps and midcaps make up a sizeable portion of the market. The fact they are moving in one direction and that large caps namely the S&P 500 are moving in another is not a good thing. 90 percent of the time small caps will move long before large caps do and the market will become bifurcated. The thing you must understand about this is that it will not remain that way forever. Eventually one of two things will happen. Either the large caps will sell off and join the small caps in the downturn or the small caps will rally and join the large caps in the uptrend. The market will not remain bifurcated. Small caps stocks move faster because they are…..well……smaller. It doesn’t take as much to move them. Most of the time the large caps will eventually follow the small caps. If I had to put a percentage on how many times that small caps follow larger caps then I’d say less than 10% of the time. So they way I see the current situation is like this. Those that stay in the market have better than a 50% chance that that the market will trend lower in that large caps (the C Fund) will sell off. In the same breath, they have less than a 50% chance that the market will head higher. To sum this all up. We are managing risk and I don’t like those odds. Y0u must remain cognizant of the fact that we are investing retirement money here. We must be responsible. Sure we want to make money, but we want to do so in the safest way we can. Our priority is on maintaining our principle we believe that “It’s not what you make that’s important. It’s what you keep!” If we follow that principle as we always have then everything else will take care of itself. We will leave the big gaudy gains to others because we know that in the end they will lose more than we do as well. We don’t measure our performance in one day, one week, or even one month. We measure it in years. We want the most we can have in the end. We’ll let the others be the hero’s. Which brings me to an important point. One style of investing does not fit all. Everyone is different. Their time, temperament, and abilities are different and most of all the size of their portfolios is different. One person may have more to lose than the next. The next one might need to accept a higher level of risk in order to grow their money faster. There were folks this week that didn’t understand why we got out of the C fund. They felt like they were losing money because the C Fund had one really nice day. If you are one of those folks then you might be better off putting it in the C Fund and letting it ride for a while. There’s nothing wrong with that. It is an investment strategy that over time will make you money. Will it make you the most money? If you think so then that’s what you should do. While we are not ready to assume high risk you might be and if you are then that’s what you should do. Another option for you is to invest in the appropriate lifecycle fund. There is nothing wrong with that either. Your life will be a lot less stressful that way. You will always be in the market when it is moving higher. Of course, you will always be in the market when the market is moving lower as well. Now that’s what stresses me out, but everyone is different. Like I said, no one size fits all and there are many ways to make money. You simply have to find the one that is best and most comfortable for you. So let me sum this up. Our focus here is not on making big gains. Our focus here is on keeping what we have! Yes there have been times in the past that we have made big gains. When we do move in the market we are aggressive, but at the same time we are also strategic. We invest in equities when we feel that the risk is the lowest and inversely we sell at times like this when we feel the risk is high. My prayer for everyone of you is that you will find the system that works best for you and provides you with the best retirement that you can possibly have. If you find yourself getting upset with the moves that we make here then try something else until you find the best investment strategy for your situation. May the Lord truly bless you in this endeavor!

Todays trading so far has left us with the following results: Our TSP allocation is steady in the G Fund. For comparison, the Dow is off -0.20%, the Nasdaq is higher at +0,12%, and the S&P 500 is flat at +0.01%.

Stocks slip to start the week as traders look ahead to Fed decision, inflation data

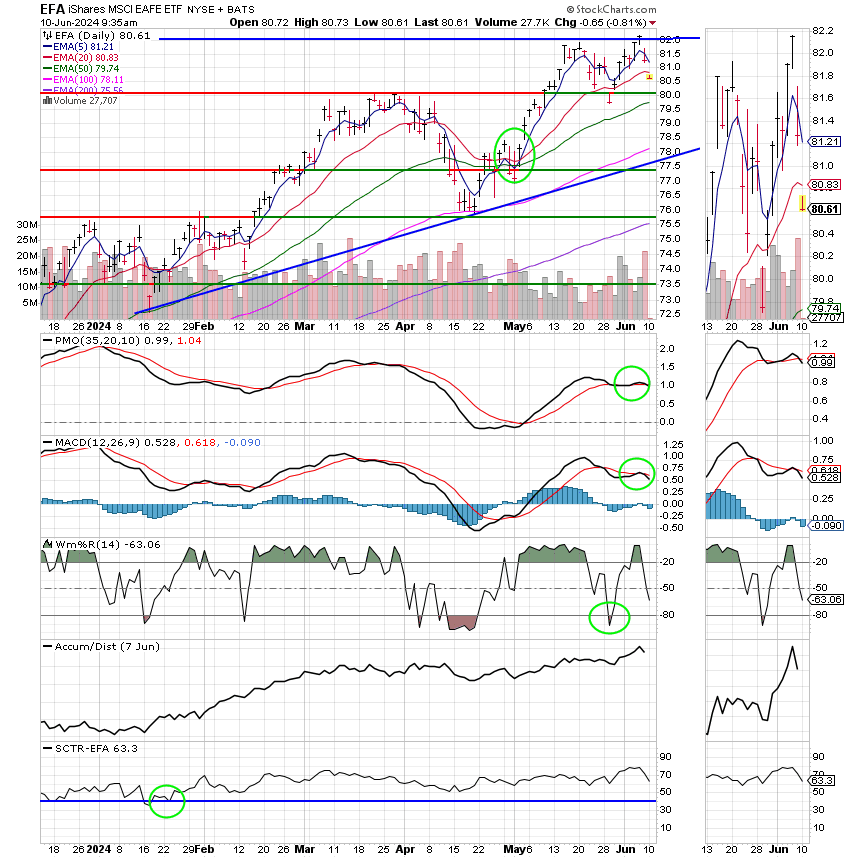

Recent action has generated the following signals: C-Buy, S-Sell, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now +5.30% for the year not including the days results. Here are the latest posted results:

| 06/07/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3064 | 19.0069 | 83.879 | 78.5511 | 43.2347 |

| $ Change | 0.0024 | -0.1545 | -0.0785 | -0.7096 | -0.4222 |

| % Change day | +0.01% | -0.81% | -0.09% | -0.90% | -0.97% |

| % Change week | +0.09% | +0.45% | +1.35% | -1.44% | +0.01% |

| % Change month | +0.09% | +0.45% | +1.35% | -1.44% | +0.01% |

| % Change year | +1.91% | -1.12% | +12.79% | +1.89% | +7.60% |