Good Evening, We’ve always said don’t fight the Fed referring to the Federal Reserve. However, don’t fight the Fed has taken on a new meaning with the current administration. The Trump administration views the market as a report card and they intend to keep it moving in a positive direction no matter what it takes. Like them or not, they are pro market! In several recent blogs we discussed how certain news which especially includes COVID 19 news would instill a high level of volatility into this market. So last Thursday’s disastrous session coming on the news that a second outbreak of Corona virus had begun should have come as no surprise to any of you. The market lost over six percent as traders panicked on the news. You know what I’m going to say about that…. PANIC IS NOT A STRATEGY!!!!!! If you want to sell you need to ask yourself three questions. First and foremost, have the charts changed? Second, has the reason you made the investment changed? and Third do you need the money? and by need the money I mean now! If the answer is no then you don’t need to sell. Rarely if ever have I seen one days action move a chart from a strong buy to a sell. That said you’d be surprised how many folks I know that considered doing just that on Thursday! Then came four successive pieces of news that brought the market back. The first one which occurred during Friday afternoons session turned a market around that was selling off in it’s tracks. It was a dramatic reversal. That news as you all know by now was that the Federal Reserve had decided to make individual bond purchases to further assist businesses during the recovery. The buying carried through to Monday. However, the buying seemed destined to slow down on Tuesday. That is until we got a triple dose of good news to reenergize the buying. First data released by the Commerce Department showed retail sales jumped by a record 17.7% in May, blowing past the 8% increase analysts expected. Second, Investor risk appetite was given a further boost by the Trump administration’s anticipated $1 trillion dollar infrastructure package aimed at jump-starting the economy. Third, a UK-led drug trial showed low doses of generic steroid drug dexamethasone reduced COVID-19 death rates among the most severe cases. OK, there you have it positive economic news, more stimulus, and progress on dealing with COVID 19. A triple dose of confidence for investors. Yep, don’t fight the Fed and never underestimate science…..If you reduced your exposure to stocks then you missed out on three successive days of gains and for the record, I don’t think we’re through after today’s wonderful news. I’m still bullish moving forward. My bet is that the news will only get better as time moves on. May God continue to guide us to a victory over this demonic virus!

The days trading left us with the following results: Our TSP allotment made up some lost ground with a nice gain of +1.95%. For comparison, the Dow was up +2.04%, the Nasdaq +1.75%, and the S&P 500 +1.90%. Praise God for a nice day!

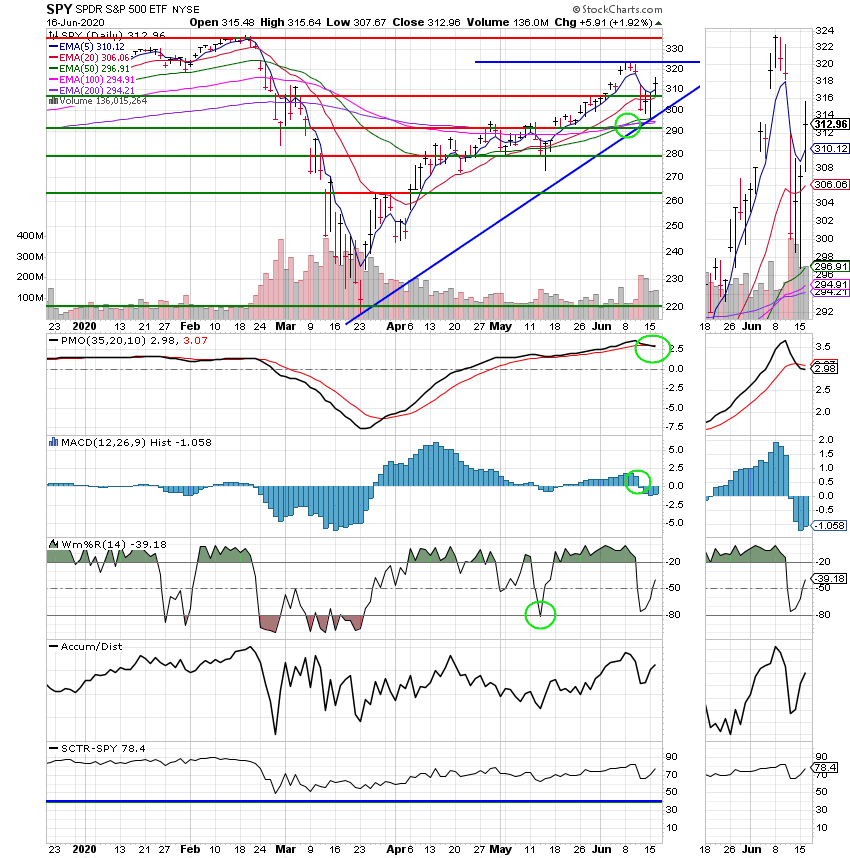

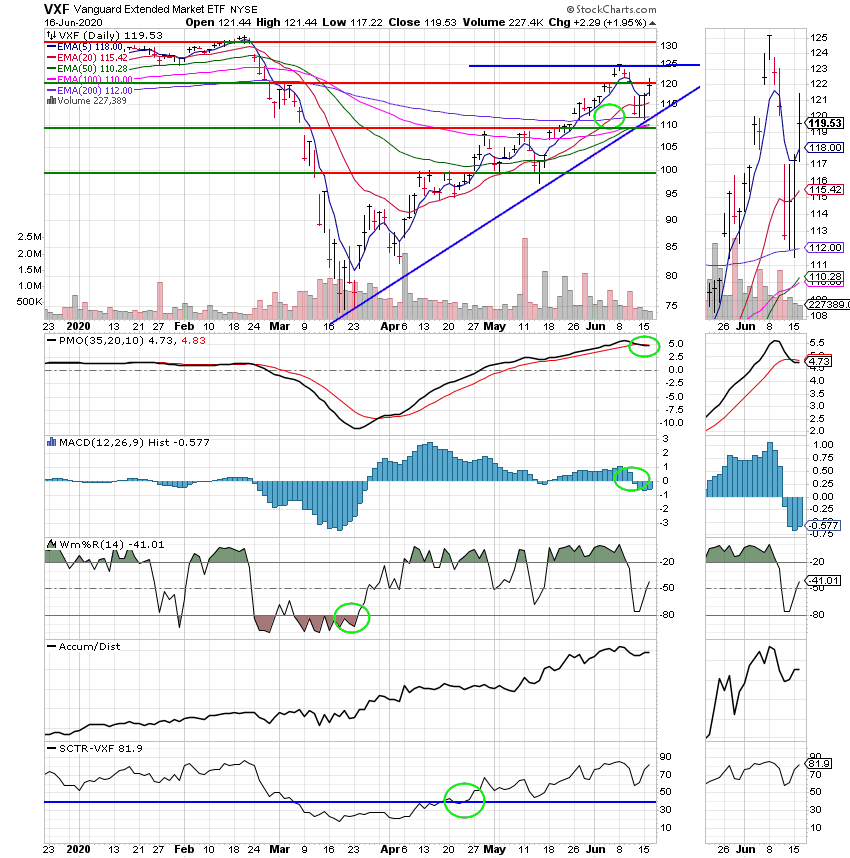

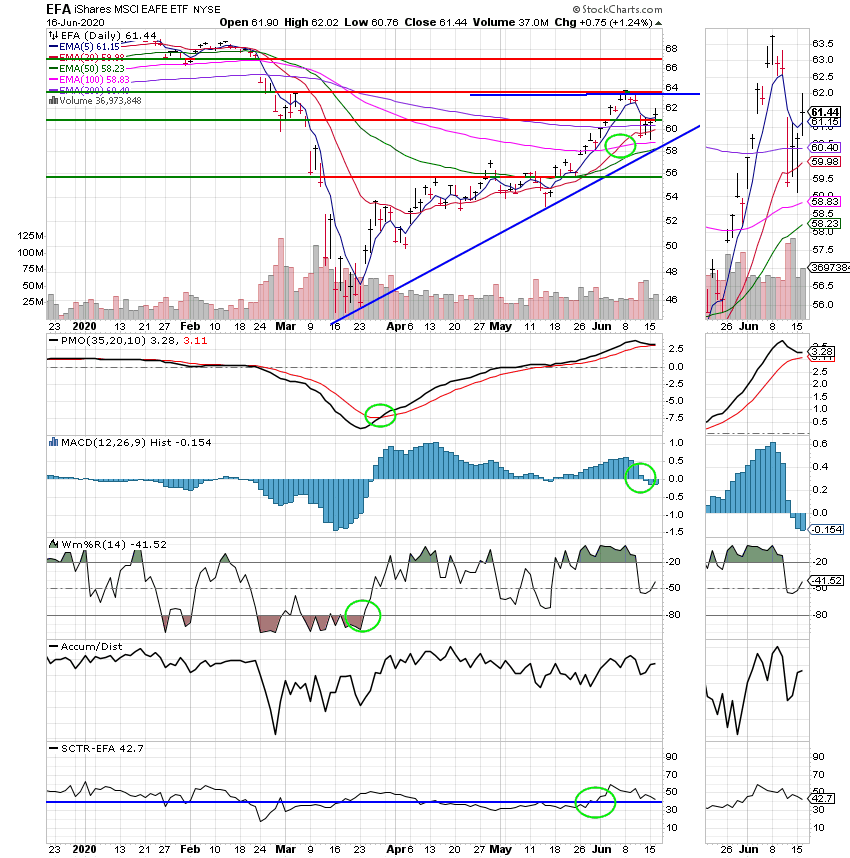

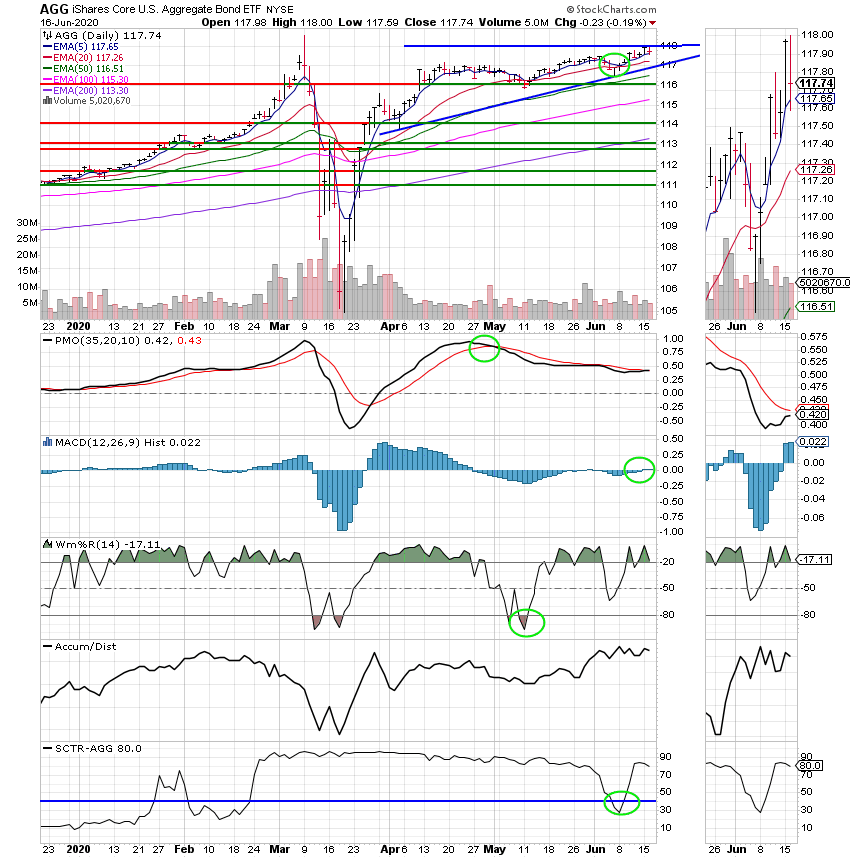

Today’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +12.73% not including the days results. Here are the latest posted results:

| 06/15/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4423 | 20.8369 | 45.2527 | 52.322 | 28.9501 |

| $ Change | 0.0010 | 0.0037 | 0.3758 | 1.0706 | 0.1049 |

| % Change day | +0.01% | +0.02% | +0.84% | +2.09% | +0.36% |

| % Change week | +0.01% | +0.02% | +0.84% | +2.09% | +0.36% |

| % Change month | +0.03% | +0.25% | +0.83% | +2.70% | +2.94% |

| % Change year | +0.56% | +5.68% | -4.25% | -7.03% | -11.51% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.0834 | 29.0146 | 33.6719 | 36.7683 | 21.3177 |

| $ Change | 0.0398 | 0.0583 | 0.1734 | 0.2275 | 0.1518 |

| % Change day | +0.19% | +0.20% | +0.52% | +0.62% | +0.72% |

| % Change week | +0.19% | +0.20% | +0.52% | +0.62% | +0.72% |

| % Change month | +0.47% | +0.50% | +1.19% | +1.41% | +1.59% |

| % Change year | -0.48% | -1.00% | -3.39% | -4.32% | -5.18% |