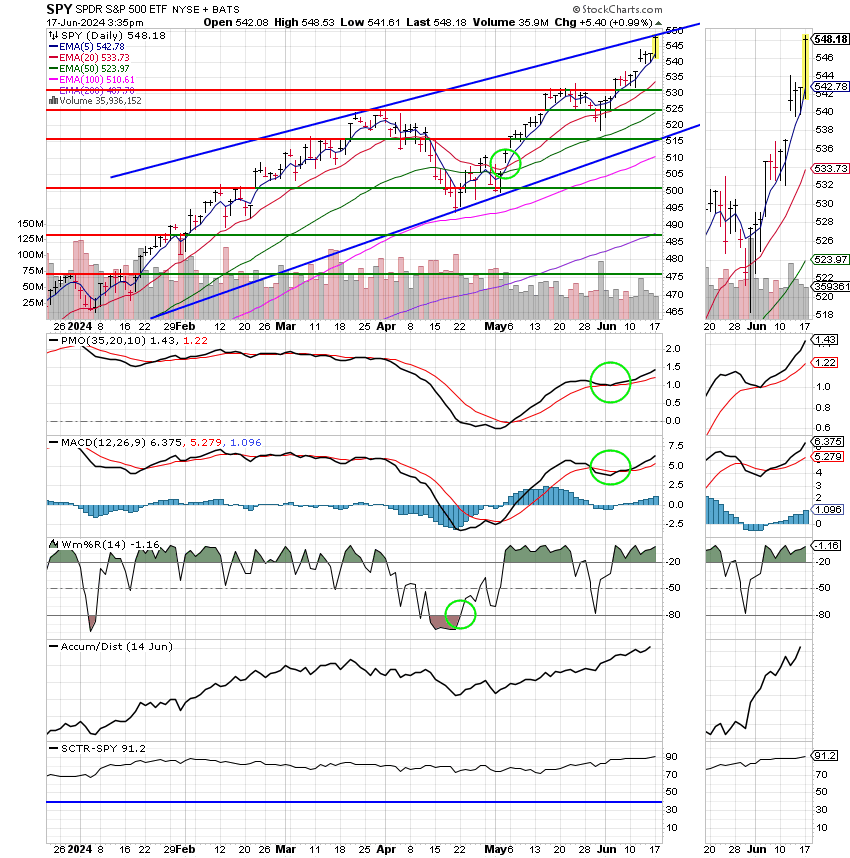

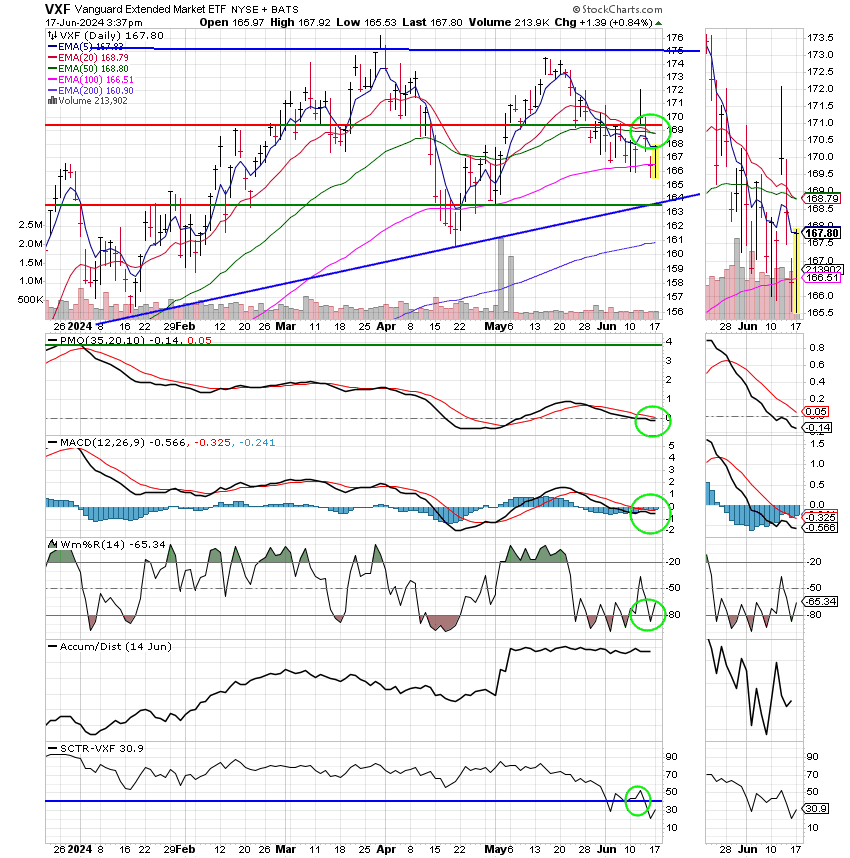

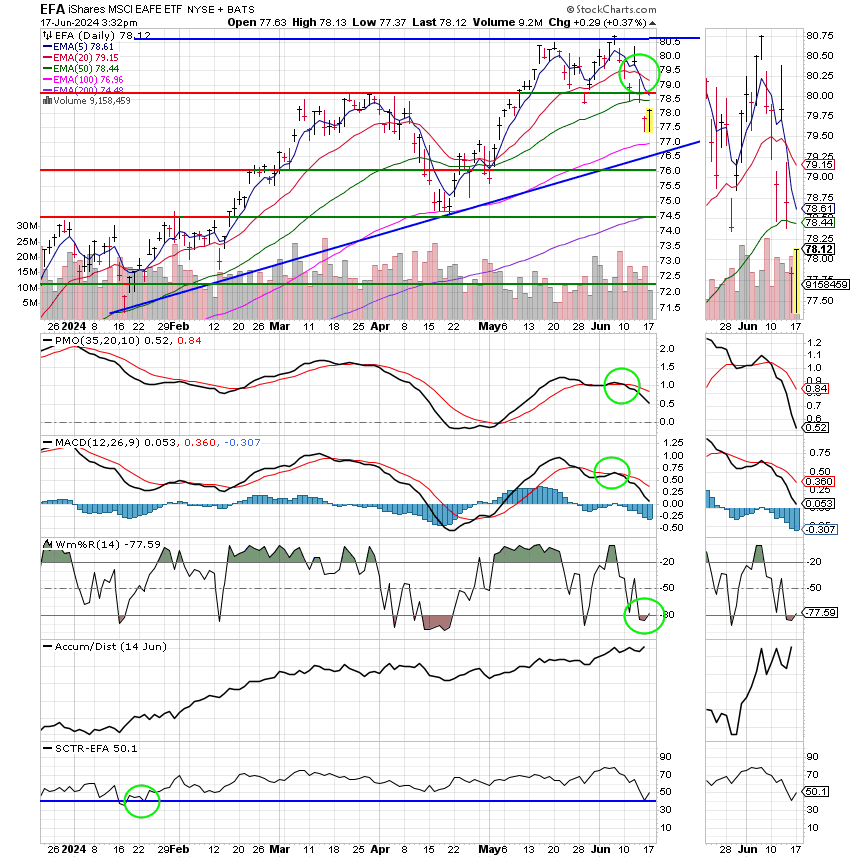

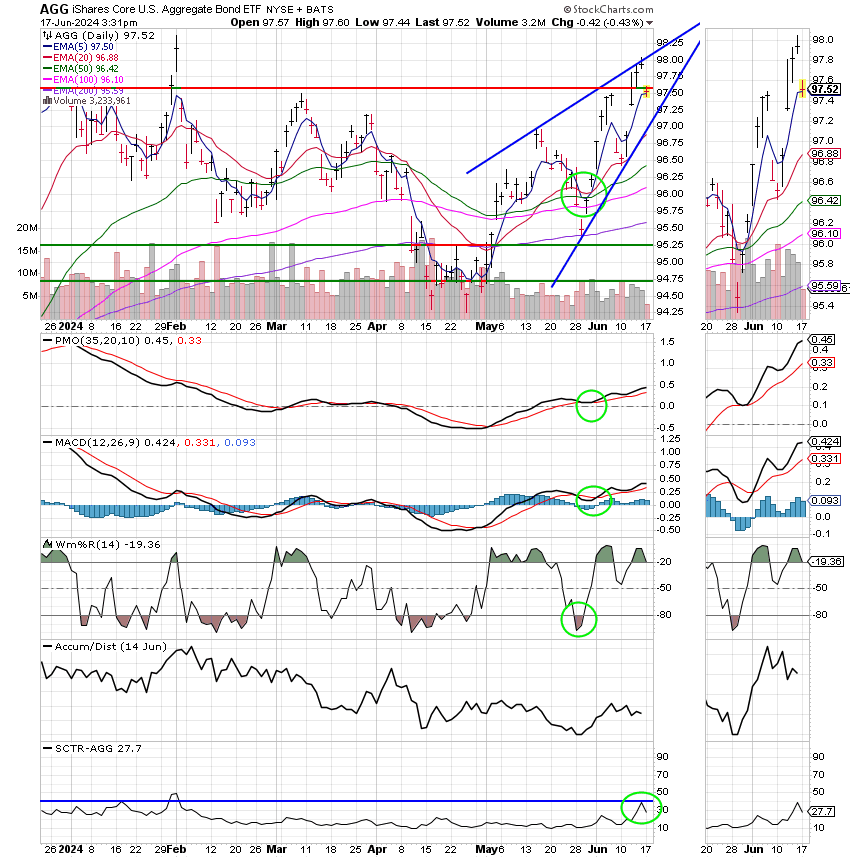

Good Afternoon, I’ve had more than a few questions about what I’m going to do given that I’m out of the market and it keeps moving higher. A few folks said that our new system is not working well. I will respond to that now. The system is fine. It’s spot on the most accurate system I have ever seen. I want to be totally clear about that. So why am I sitting in the G Fund? Here’s the story. At the time we got out of the market I did not have a sell signal in the C Fund. I repeat, I did not have a sell signal and you know what? I still don’t have one. At the time another analyst and I were watching small caps and mid caps deteriorate and felt like the C Fund would soon follow in their steps. Why did we think that? Because they usually do. So we assumed (which is a dangerous word in this business) the the C Fund would deteriorate as well. I fought the notion of selling due to the fact that the C Fund did not have a sell signal, but then the S Fund sold off again and produced a sell signal. Several of the charts that I follow other than the C fund where deteriorating as well. Market breadth was terrible with more stocks losing than gaining. In addition to that treasury yields were rising which is also a drag on stocks. The other analyst and myself both decided that the S&P 500 which the C fund tracks would soon follow the others lower. So we moved to the G Fund as our primary focus is on preserving retirement money. In other words, I ignored the new system and got out anyway. When I did so I made two crucial mistakes that cost us all some nice gains. First, I failed to recognize the strength of Nvidia. Why am I saying that about one stock? Nvidia’s market cap has now eclipsed 3 trillion dollars. Yes that’s trillion with a capital T. As a result is has now been given a 20% weight value in the XLK Technology Sector SDPR Fund. NVDA just keeps rising and shows no sign of stopping since it’s chips are considered the best in the business for Artificial Intelligence or AI. All things AI are as hot as it gets in the market and Nvidia is the AI darling. To add to that Apple which also has a sizeable market cap just made just got into the AI game in a major way. As a result a precious few mega cap tech related stocks have been able to move the S&P 500 higher even with the rest of the market tanking. Of course, that is with the exception of the NASDAQ which has always been considered a tech based index. Okay, alright, where does that leave us? Right now on the outside looking in and that’s not very comfortable place to be. However, the thing that we must all realize is that this mistake while painful is not devastating as we’ve lost nothing. We did successfully protect our gains so far this year. With that in mind we must be very careful about jumping back into a very extended C Fund that is ripe for a pullback. That said, our plan is now to get back into the market when the S or the I fund generate a new buy signal. Chasing the C Fund at this point is a risky proposition. Again, we’ve missed out on some gains but we haven’t lost anything. If we’re smart and manage our portfolios correctly then we can add to what we have. The second thing I did was underestimate the power of our new system. I just couldn’t believe the C fund would not pull back even though that was exactly what the new system was telling me. Based on the fundamentals and other charts I was watching it seemed virtually impossible that the C Fund would not pull back. I knew this system was good but this good? I just could not believe that. Well I was wrong and the system was right. It was that good. It was better than I thought. This was my mistake, but I assure you it will not happen again. I will never second guess this system. So what is the plan moving forward?? We will not chase the C Fund. We will watch the S Fund for a new buy signal and move into it when we are sure we safely make money. We will continue to watch the C Fund after that and see if it provides us with a decent entry point. If not we will make what we can make safely in the S and I funds until it does. Who knows, that may take a 10% correction if we ever see one of those again and it’s hard to believe we will not. Normal up trending markets will usually correct in the 10% range on the average 3 or 4 times in the period of a year. Has Robinhood trading and high speed algorithms made it where we will never see a real correction again? I seriously doubt that but then again, I seriously doubted that the C Fund would move up without a pullback and it sure as heck did! Lesson learned. One positive thing to take from this is that our system is even better than we though it was. Much much better and we thank God for giving it to us. One more thing of note. This is options expiration week, so you really shouldn’t make any decisions based on this weeks action.

Todays trading so far has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is gaining +0.63%, the Nasdaq +1.43%, and the S&P 500 +1.02%.

S&P 500 hits a fresh record high to start the week: Live updates

Recent action has left us with the following signals: C-Buy, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now + 5.40% for the year. Here are the latest posted results:

| 06/14/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3227 | 19.2541 | 85.2377 | 78.2574 | 42.2965 |

| $ Change | 0.0023 | 0.0226 | -0.0128 | -0.9159 | -0.4360 |

| % Change day | +0.01% | +0.12% | -0.02% | -1.16% | -1.02% |

| % Change week | +0.09% | +1.30% | +1.62% | -0.37% | -2.17% |

| % Change month | +0.18% | +1.75% | +3.00% | -1.81% | -2.16% |

| % Change year | +2.00% | +0.16% | +14.62% | +1.51% | +5.26% |