Good Afternoon, All in all we had a successful week this week. Our allocation in the I fund posted a nice gain and appears on the charts as if it has a little more room to run. Our retooled indicators continue to work well and are giving us a clear view of what’s going on in the market and where we need to be invested. It is unfortunate that we underperformed in 2022 and the first quarter of 2023. I take responsibility for that one. I should have adapted faster to the dramatic change in the character in the market brought on by the unwinding fiscal stimulus. Not to beat a dead horse to death, but that was absolutely the reason for the difficulty. In truth, a great majority of active managers struggled in the same way that we did. The only folks who didn’t struggle in the same way were ones running buy and hold systems who continued with their usual subpar performance. Yes, some of them adjusted their allocations and made them less aggressive, but they continued to have money allocated to most or all of the thrift funds allowing them to be partially right and partially wrong at all times. We commonly refer to that as the shotgun approach. They are always hitting part of the target but they are always missing some of it as well. Most of them claimed victory while demonizing the more actively managed systems. As you already know, a few of them showed up here and got pretty nasty. I know that a lot of you are comparing these systems. I did that as well before I became comfortable with the one that would ultimately make me the most money. With that in mind would be amiss not to point out their shortcomings, but I will do it here, mnot on their site or page and I will do it in a respectful manner. I will not engage in the back and forth that those folks seem to enjoy. As far as their conduct goes I will say this and only this. Jesus said you will know them by their fruits….. So where do the buy and hold systems fall short? As the market improves which it is beginning to do they will continue to maintain their investments in all five TSP funds. That will give them at least some capital in the defensive based G and F funds. Here in lies the problem. That money will vastly under perform in a bull market. By investing in those funds when the market is trending higher they will limit their performance and the longer the bull market lasts the more profits they will miss. Yes, when the market finally turns down they will initially have at least some money in the defensive funds but not enough to make up for all the profits that they missed when the it was moving higher. Not even close!! Then there’s the issue of maximizing their returns in the equity based funds that they are invested in when the market is rising. While the C, S, and I funds normally all rise during a bull market they are not created equal. One of them will almost always outperform the others. This is because there are times when large caps stocks are in favor, thus it is better to invest in the C Fund. Then there are times when midcaps and small caps are better, so it is best to invest in the S Fund. Finally, there are times when the value of the dollar drops making the currency exchange rates unfavorable for domestic stocks and the I Fund becomes the best place to be. There is seldom a time when the economic climate is just right to favor all funds equally. Spreading out investments among the three equity based funds results in additional under performance for the buy and hold systems. Why do they do what they do??? Quite simply they don’t have the knowledge or skill to do anything else and they believe that since they don’t that no on else does either. Until the unwinding of stimulus the buy and holders had been out perf0rmed at every juncture, but now, since the actively managed systems struggled with the unprecedented unwinding of fiscal stimulus (often referred to as quantitative tightening) they have claimed victory and are condemning the actively managed systems on every opportunity that they have. What they are doing is misleading. I’m not sure what their motivation is. Money? Pride? Probably more like both! That is the reason we don’t charge a fee here and they don’t like that at all. After all, it takes money out of their pockets doesn’t it! And….where does that money go?? Why back in your pockets of course! The bottom line is this. Your goal is to have has much at retirement money as you can possibly have. With that in mind you need to do the best over the long run that you can possibly do. So when evaluating each service, don’t look at what they did in a particular year. Look at what they did over several years. What were their results over 5, 10, 15, or even 20 years. Then if they are the best go with them. Good luck getting them to provide you with those results! All that said, the best that the buy and hold systems will ever do is is match the returns of the S&P 500. That’s it. At the same time the actively managed systems have produced and will produce hundreds of percentage points of additional returns over the same time frame. The folks that run these buy-n-hold systems try to use use fear to convince investors to follow them. They tell you that your too close to retirement or that you will lose big because nobody can time the market so your better off staying in it… Oh yes, they love to use the term “time”. They are so ill informed that they don’t know the difference between market timing and following the trend which are two totally different philosophies. Another thing they love to say is that technical analysis is fortune telling. Really??? Statistical charts that employ solid mathematics are fortune telling? Statistics are definitely not fortune telling! The truth is that most of them don’t have the education or backgrounds to understand the mathematics used on technical charts. So they condemn what they can’t understand. They come from a mindset that tells them if you can’t out perform something you elevate yourself by trying to make it look bad. This is much of what I have encountered in the last 18 months or so. It never happened before, because we’d never had a bad year before. Well, we got that bad year out of the way now and the indicators we developed from it are among the best in the business. I would say this in response to our antagonists. If they want to disrespect us they can try but they’d better post their results first or they will look pretty foolish doing it….. Back to the current market. Bet you though I’d never get there didn’t you?

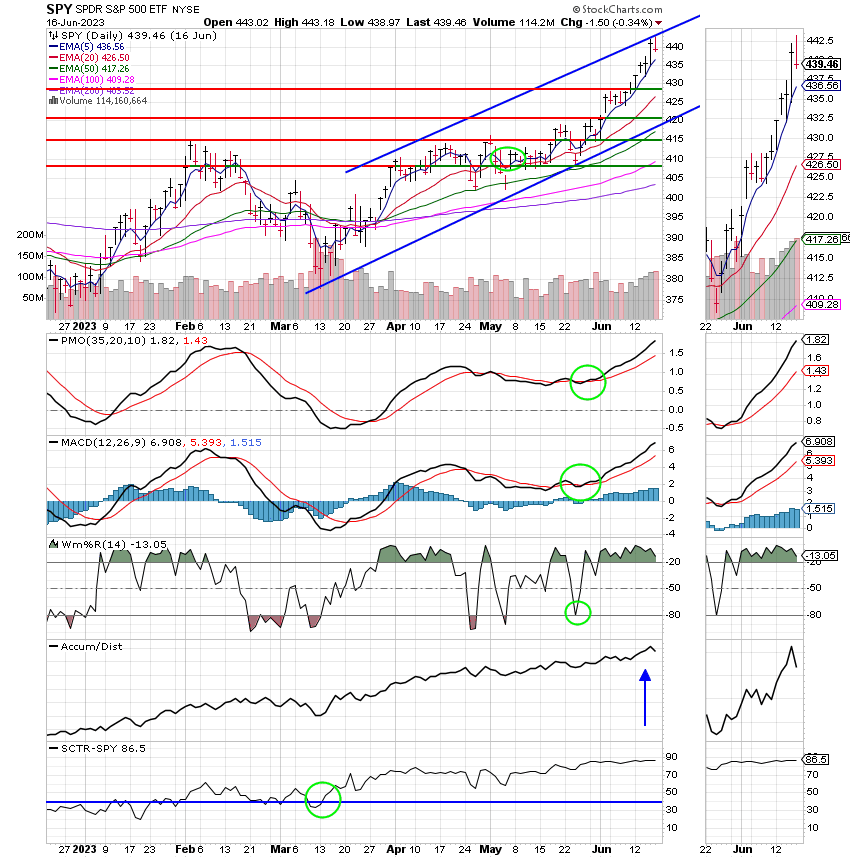

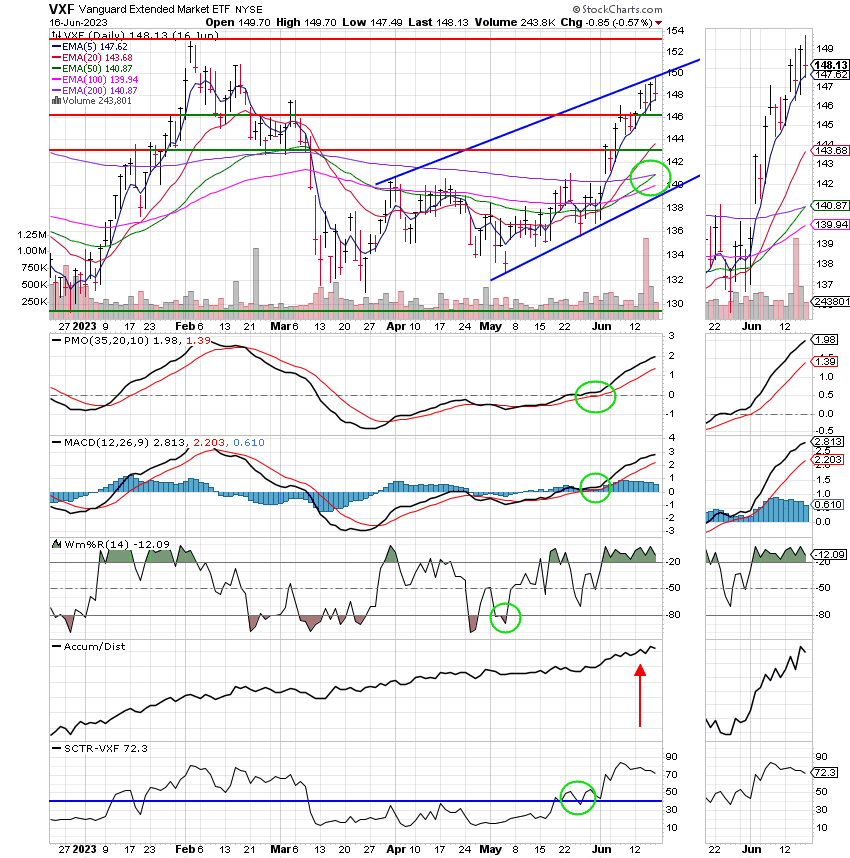

Last week investors got everything they wanted and stocks surged as a result. The Federal Reserve delivered what investors wanted when they left rates unchanged last Wednesday after 10 consecutive hikes. While the Fed signaled that two more rate increases were coming this year, many traders and economists on Wall Street believe the Fed could be nearly done. Earlier in the week, the May consumer price index came in at the lowest in two years. Friday brought more good news on the inflation and economic front. Consumer inflation expectations fell in June, with one-year assumptions for price pressures declining to 3.3% from 4.2% in May. The headline reading from the University of Michigan Survey of Consumers came in at 63.9, higher than estimates of 60.2 from Dow Jones. What more could we ask for? The market results clearly reflected it. Our investment in the I fund posted a nice gain for the week. Both the C and S Funds had a nice run as well. However, those two funds gained so much so fast that they have become extended. Our charts suggest that they may undergo a healthy pullback in the near future. In contrast, the chart for the I fund shows that it has a little more room to run, but the key word is little. That room will soon run out and we’ll have to find a new place to go when it does. Ideally, we’d like to move either the C or the S fund at that time provided that they have completed their pullbacks. In the event that they have not pulled back, we will move to the G Fund and wait for a suitable entry point into one of our equity based funds to develop. Our task now is to watch our charts closely for these things to take place and react to what we see in a timely manner.

Fridays trading left us with the following results: Our TSP allotment slipped back -0.22%. For comparison, the Dow fell -0.39%, the Nasdaq -0.68%, and the S&P 500 -0.37%. We came on top for the negative day. Praise God for that!

S&P 500 breaks six-day win streak on Friday, but still notches best week since March: Live updates

The weeks action left us with the following signals: C-Hold, S-Hold, I-Buy, F-Hold. We are currently invested at 100/I. Our allocation is now +1.03% for the year. Here are the latest posted results:

| 06/16/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.5389 | 18.6405 | 68.19 | 68.7498 | 38.5888 |

| $ Change | 0.0019 | -0.0381 | -0.2499 | -0.4345 | -0.0256 |

| % Change day | +0.01% | -0.20% | -0.37% | -0.63% | -0.07% |

| % Change week | +0.07% | +0.20% | +2.62% | +2.05% | +2.75% |

| % Change month | +0.17% | -0.24% | +5.59% | +7.44% | +6.00% |

| % Change year | +1.76% | +2.38% | +15.76% | +11.73% | +13.69% |