Good Afternoon, I have technical problems a plenty today. I finally signed into the website after an hour of trying. I’m not sure whether the problem is on my end or their end, but I finally got signed in using my old (slow laptop). I’m running a diagnostic on my other machines in an attempt to figure out exactly what the problem is. Heretofore it is an enigma! I’m not an IT guy but I might as well be one. I guess I’ll type this blog on this old laptop. The thing is that I’m just not used to the key board and it’s SLOW. So please ignore any errors!! This old and I mean old laptop is the only thing I have that will log onto the site to post this blog. I know, that’s what I get for doing it on a Sunday……

So it’s been a few weeks since I’ve posted a blog. Should we ever have problems with this site again, I’ll just put a post on Facebook. The problem is that not all the folks in our group do Facebook. So not everyone will see it if I do. I pray that I can get this fixed. I’m surprised that this thing even still works. It’s that old. Necessity is the mother of invention though, so here we go! I spent a few weeks on vacation which I haven’t done since before the pandemic. It was nice but I discovered that I don’t really rest all that well and the news flow was horrendous. Wars, rumors of wars, trade negotiations…… to be honest with you I spent most of my time thinking about the market. It certainly would have helped if we’d had a normal slow summer, but instead we got the world on the verge of world war three. I prayed about it and I know that our heavenly Father had it all under control. but nonetheless I still kept thinking about the market. My investments, your investments, everyone’s investments! It’s just easier to be here to deal with it and by the way do you realize how hot it gets in the badlands under a heat dome! Did I mention we had a tornado in Missouri? Now that was restful! Folks I’m just glad to be here. I’m not sure if your so glad but I am. Anyway, as I mentioned we had a lot going on in the past four weeks or so. We had the war between Israel and Iraq and all the hoopla leading up to it. We had the US Bombing of the Iranian Nuclear Facilities. We had congress tussling over the big beautiful bill. We had a wide variety of economic reports that swung from euphoria to dread and back. Now we have a surprising cease fire in the middle east, we have a trade agreement with China, and I believe that we have an interest rate coming from the FED in the month of July. Watching the Economic reports alone might lead us to believe that, but there’s more. There is currently a bunch of buying in treasuries, especially short term treasuries. This buying is sending treasury yields lower and that almost always telegraphs lower interest rates. If you don’t believe me then just look at the treasury yields prior to the last three interest rate cuts on September 17th, November 7th, and December 18th. Each time the rates dropped it was preceded by a drop in yields. Every time, no exceptions! Looking at these and many additional charts, I believe that there will be an uptrend in July that will be followed with a dip some time in late August or early September. However, the market should recover when the Fed reduces rates for the last time in 2024 likely in September or November. As ya’ll know I don’t usually prognosticate but this time I’m making an exception. I could be totally wrong and that’s why we watch the charts but it certainly looks like things are moving in a positive direction. We will remain invested at 100/S in an attempt to take advantage of falling interest rates. May God continue to guide our hand as we move forward.

Fridays trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow gained +0.94%, the Nasdaq +0.52%, and the S&P 500 +0.50%. Here’s the latest news.

Stock futures rise after S&P 500 notches a fresh record high: Live updates

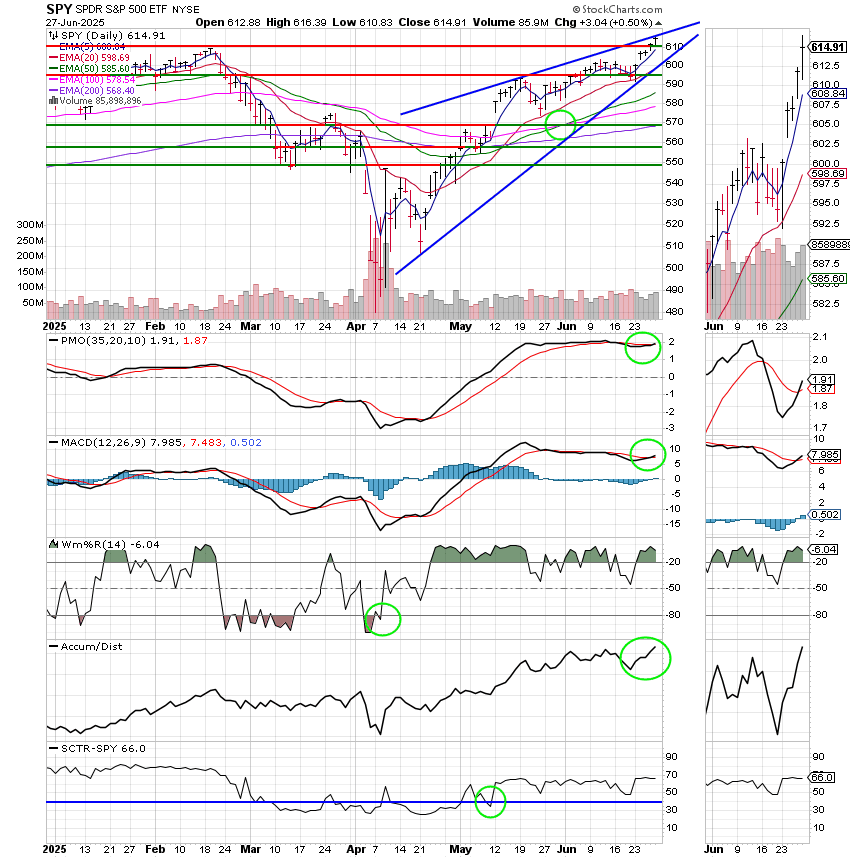

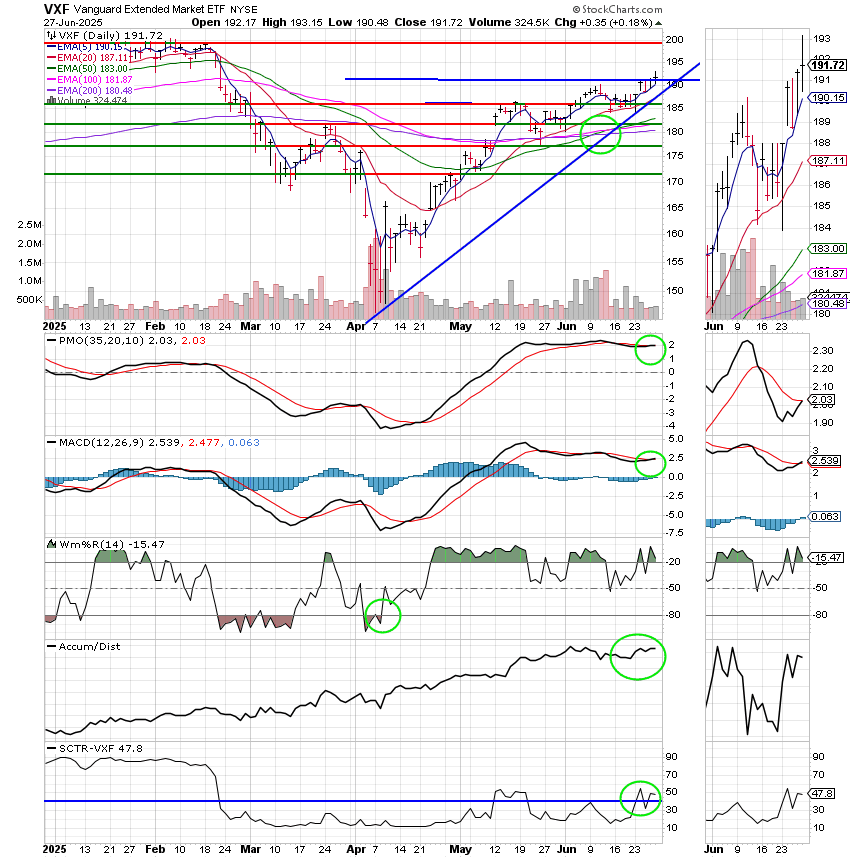

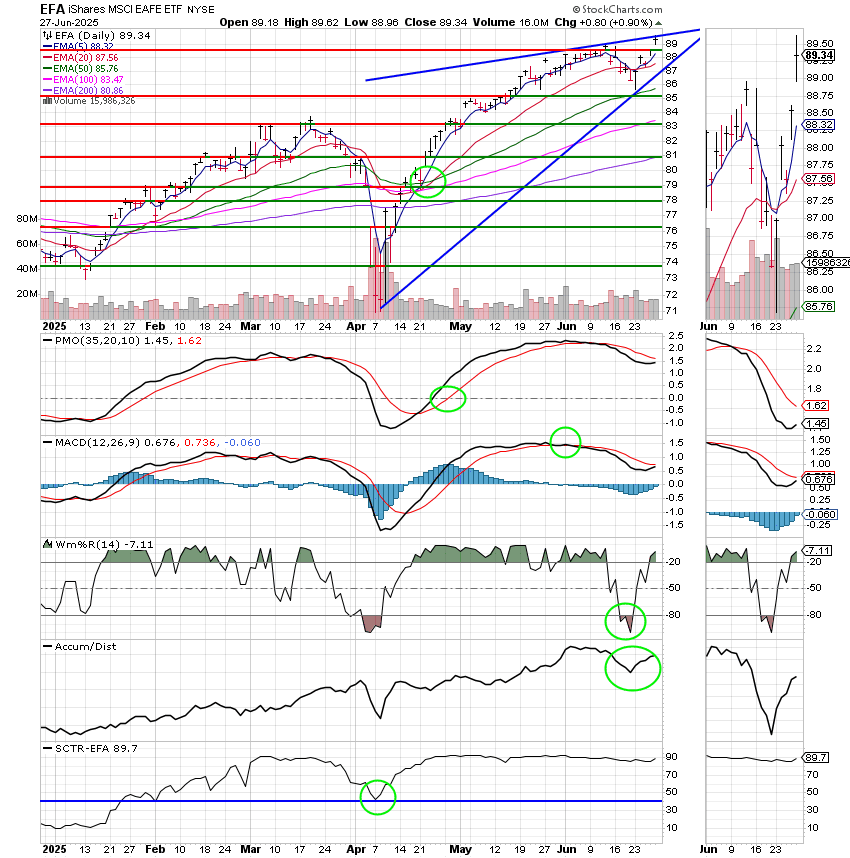

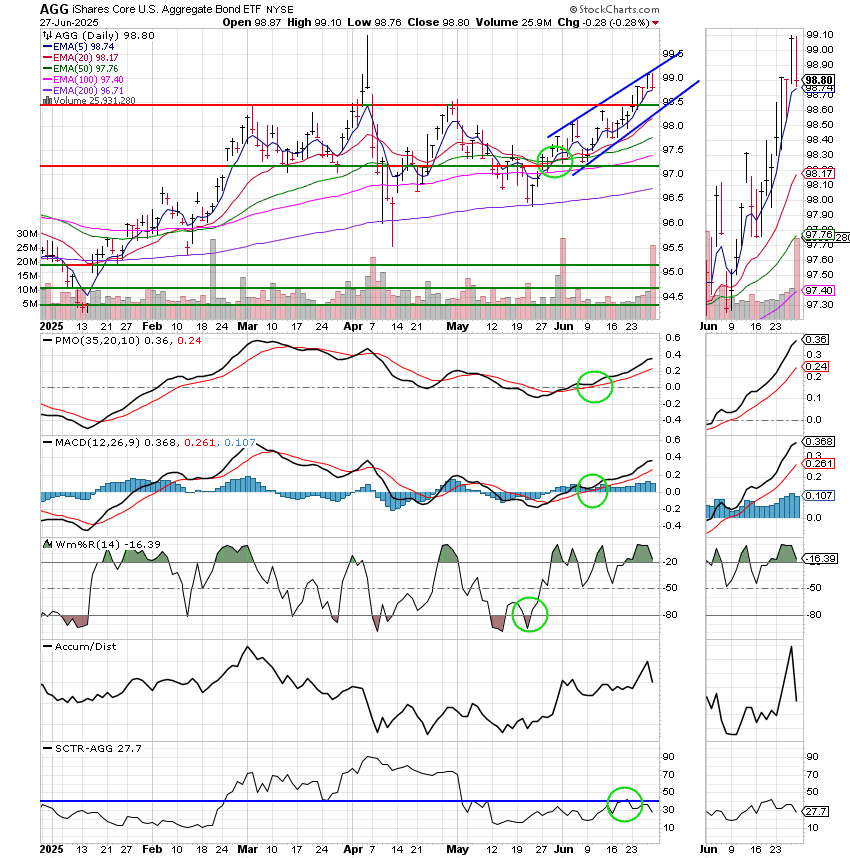

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +7.15% for the year. Here are the latest posted results:

| 06/27/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.164 | 20.1893 | 98.1591 | 91.5783 | 49.6351 |

| $ Change | 0.0024 | -0.0437 | 0.5159 | 0.1741 | 0.3078 |

| % Change day | +0.01% | -0.22% | +0.53% | +0.19% | +0.62% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.33% | +1.18% | +4.53% | +4.86% | +3.54% |

| % Change year | +2.19% | +3.65% | +5.63% | +1.58% | +18.47% |