Good Evening, This week is all about the Fed. All developments will be viewed through “rate increase” glasses. Each news item will be judged on how it might effect the Fed’s decision on whether or not to increase interest rates. The biggest item of all will be Friday’s payroll report. It has the gravity to determine whether or not there will be a June rate hike all on it’s own. We’ll see how the market responds to this news and react accordingly. Right now, however, our allocation is working just fine.

Praise God, our allocation out performed the market for another day gaining +0.60%! For comparison, the Dow was flat at +0.01%, the Nasdaq +0.08%, and the S&P 500 eased up +0.11%.

Stocks Creep Higher as Fed’s Beige Book Muddies Rates Outlook

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +5.14% on the year not including the days results. Here are the latest posted results:

| 05/31/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0313 | 17.5703 | 28.5534 | 36.2385 | 24.0673 |

| $ Change | 0.0029 | 0.0176 | -0.0268 | 0.1039 | -0.0112 |

| % Change day | +0.02% | +0.10% | -0.09% | +0.29% | -0.05% |

| % Change week | +0.02% | +0.10% | -0.09% | +0.29% | -0.05% |

| % Change month | +0.15% | +0.08% | +1.80% | +1.81% | +0.27% |

| % Change year | +0.78% | +3.63% | +3.60% | +2.85% | -0.12% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.0135 | 23.6144 | 25.5801 | 27.1564 | 15.3673 |

| $ Change | 0.0027 | 0.0010 | -0.0003 | -0.0008 | -0.0008 |

| % Change day | +0.01% | +0.00% | +0.00% | +0.00% | -0.01% |

| % Change week | +0.01% | +0.00% | +0.00% | +0.00% | -0.01% |

| % Change month | +0.38% | +0.69% | +0.91% | +1.03% | +1.15% |

| % Change year | +1.35% | +1.75% | +2.06% | +2.20% | +2.27% |

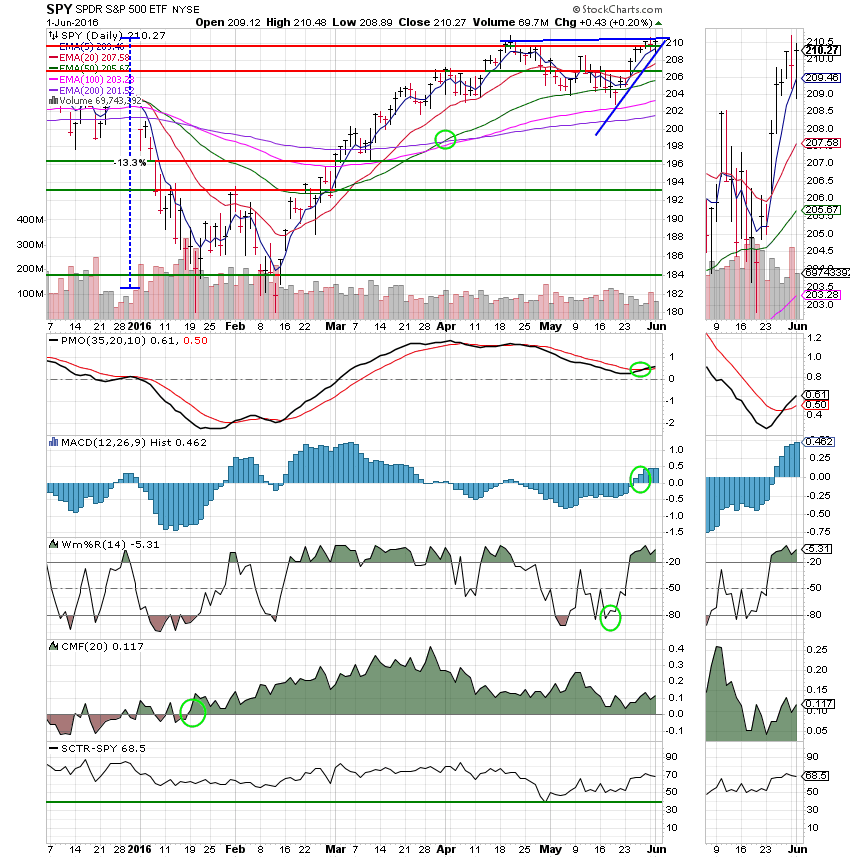

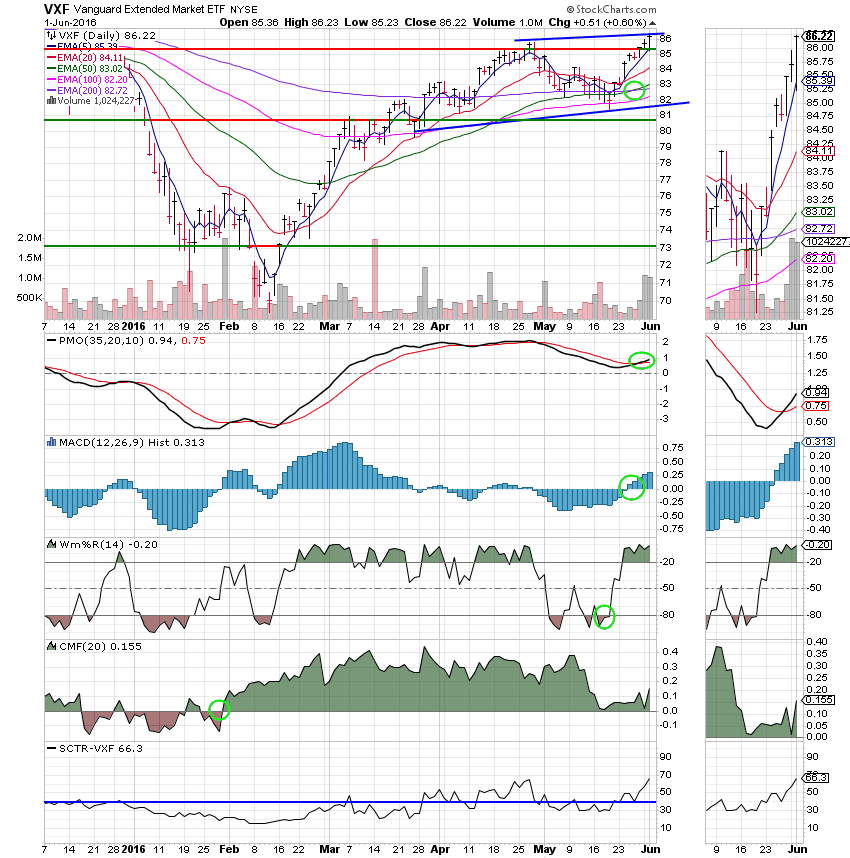

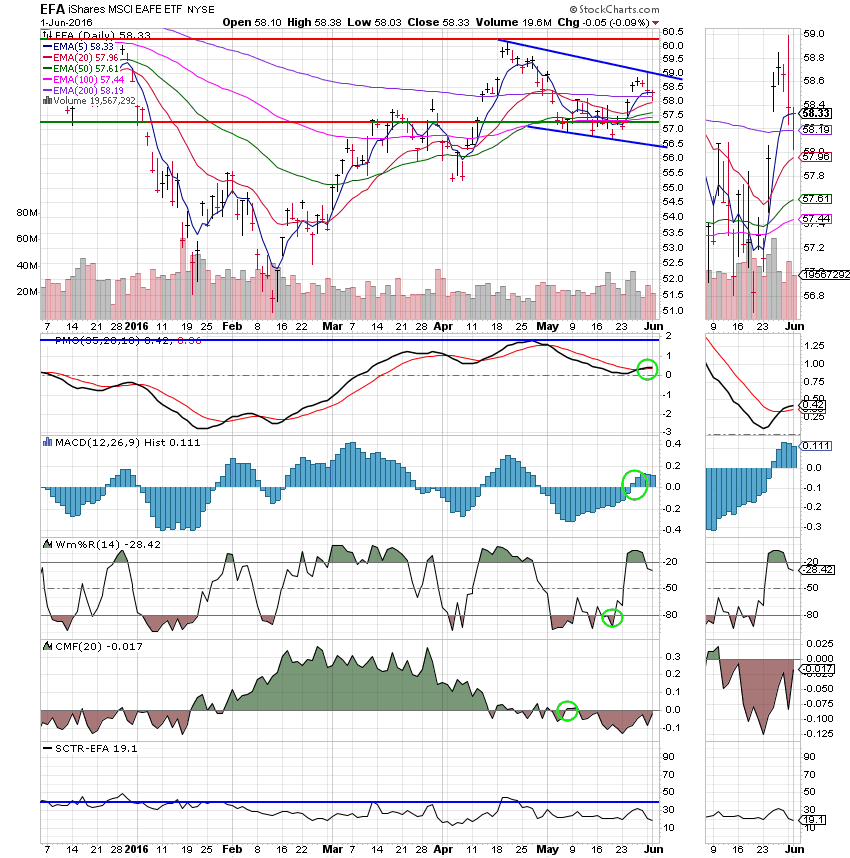

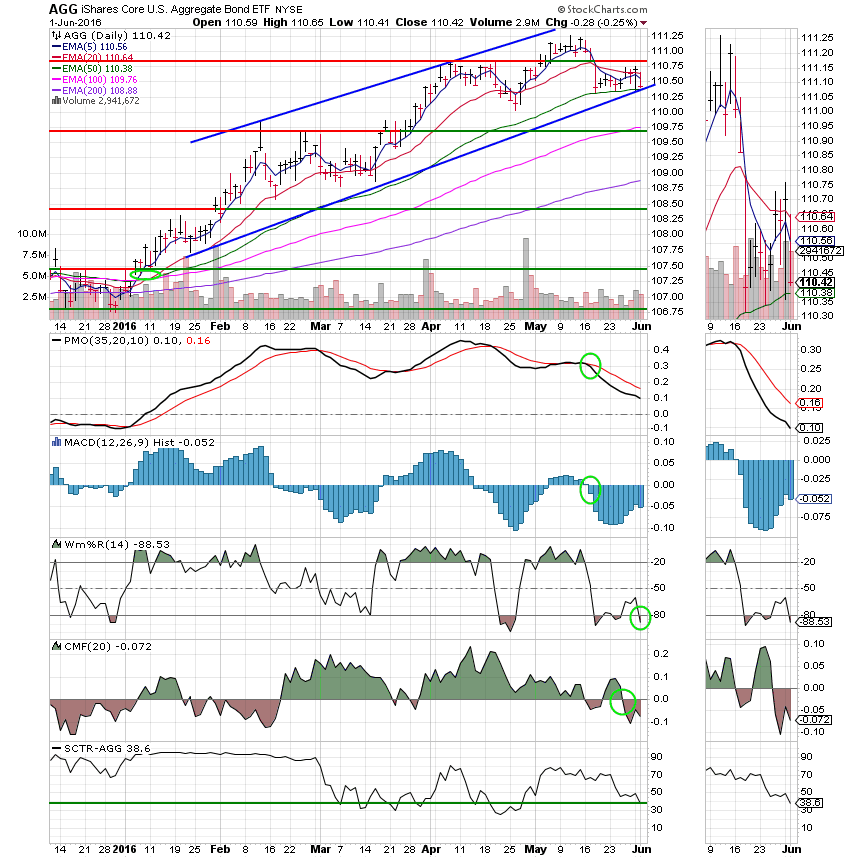

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

The S Fund is currently out performing the market and we’re invested at 100/S. We’ll continue to monitor the charts to see how current events effect things and react to the action before us. Right now everything is good. Give God all the praise and glory! Have a great evening.