Good Evening,

The market took an early dip then came back when dip buyers turned things around in response to a positive PMI report. After being revived, the indices drifted the rest of the day finishing well off their highs but still in the green. After looking at my charts, it was obvious that the value of the dollar is having the greatest impact on US markets. It’s not about the dollar though. No, it’s really about the Euro which is currently weak due in a large part to the Greek situation. The weak Euro is what’s causing the dollar to rise. Keep your eyes on Europe. It is the key to everything right now.

Although the action was slow, we did start June with a positive day. Here are the results: Our TSP allotment added +0.06%. For comparison, the Dow gained +0.16%, the Nasdaq +0.25%, and the S&P 500 +0.21%. I thank God for a good start to the month!

Wall Street edges up after recent losses, mixed data

The day’s action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Neutral. We are currently invested at 29/C, 37/S, 34/I. Our allotment is now +4.45% on the year not including today’s results. Here are the latest posted results:

| 05/29/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.732 | 16.9915 | 28.0503 | 38.3701 | 26.5402 |

| $ Change | 0.0024 | 0.0277 | -0.1778 | -0.1968 | -0.2016 |

| % Change day | +0.02% | +0.16% | -0.63% | -0.51% | -0.75% |

| % Change week | +0.05% | +0.63% | -0.84% | -0.68% | -1.83% |

| % Change month | +0.17% | -0.26% | +1.29% | +1.84% | -0.42% |

| % Change year | +0.79% | +1.13% | +3.26% | +5.71% | +9.59% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7505 | 23.6427 | 25.7891 | 27.5483 | 15.7016 |

| $ Change | -0.0189 | -0.0735 | -0.1050 | -0.1294 | -0.0848 |

| % Change day | -0.11% | -0.31% | -0.41% | -0.47% | -0.54% |

| % Change week | -0.14% | -0.50% | -0.67% | -0.77% | -0.90% |

| % Change month | +0.30% | +0.50% | +0.62% | +0.72% | +0.78% |

| % Change year | +1.72% | +3.25% | +3.96% | +4.43% | +4.97% |

Let’s take a look at the charts.

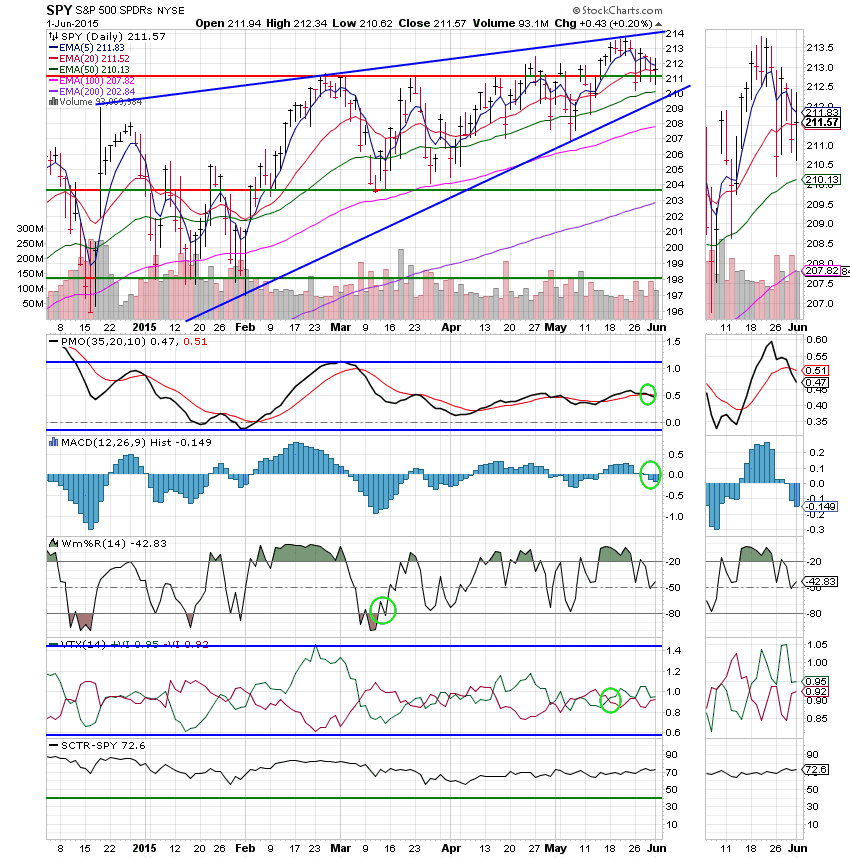

C Fund: The C Fund managed a small gain with price closing above support and right on its 20 EMA. The PMO and MAC D remain in negative configurations leaving the C Fund with an overall Neutral signal. The SCTR is showing steady strength at 72.6.

S Fund: The S Fund has demonstrated strong underlying support by hanging onto a buy signal. Price made a nice gain of 0.25% to close just below its 5 EMA. All indicators remain in positive configurations with the Williams %R turning back up. The SCTR improved to 84.8 showing that the S Fund is very strong as compared to other ETF’s. This is the best place within thrift to allocate your money at this time, but as you know, that can easily change. However, it’s so far so good for now!

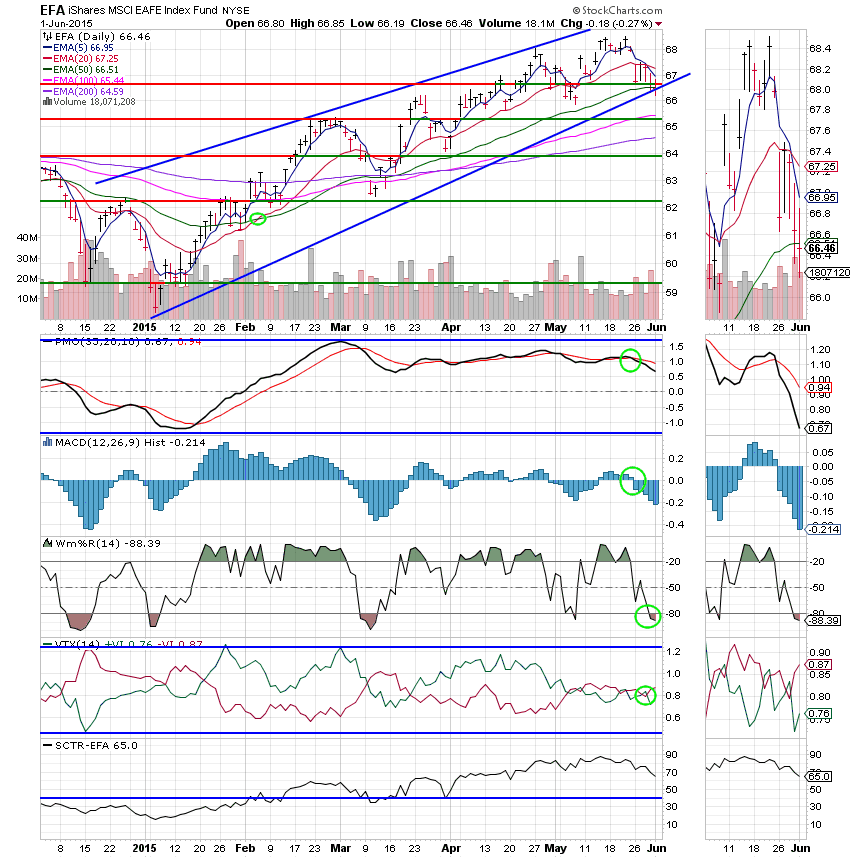

I Fund: The I Fund is definitely getting weaker. Why? Look no further than the strength of the dollar and you will have your answer. Price closed below support at 66.70. It tested the lower trend line of the ascending wedge for the second straight session but was unable to to breach this area of support. We will keep an eye on this as it will tell us much about the short to intermediate term future of this fund. One positive thing is that the Williams %R appears to be bottoming which favors a new short term trend. I know that some of you are wondering why we are in the I Fund at all. To that, I answer that the I Fund is only one “Greek agreement” away from a really nice run. Everything else, in Europe is improving. Given a resolution of Greek situation, European stocks and currency will strengthen and the dollar will weaken. Should that take place a lot of you will be wishing you had more money invested in this fund. Either way, it is unwise to put all your eggs in one basket. Unless, of course, that is the only basket without a hole in it!

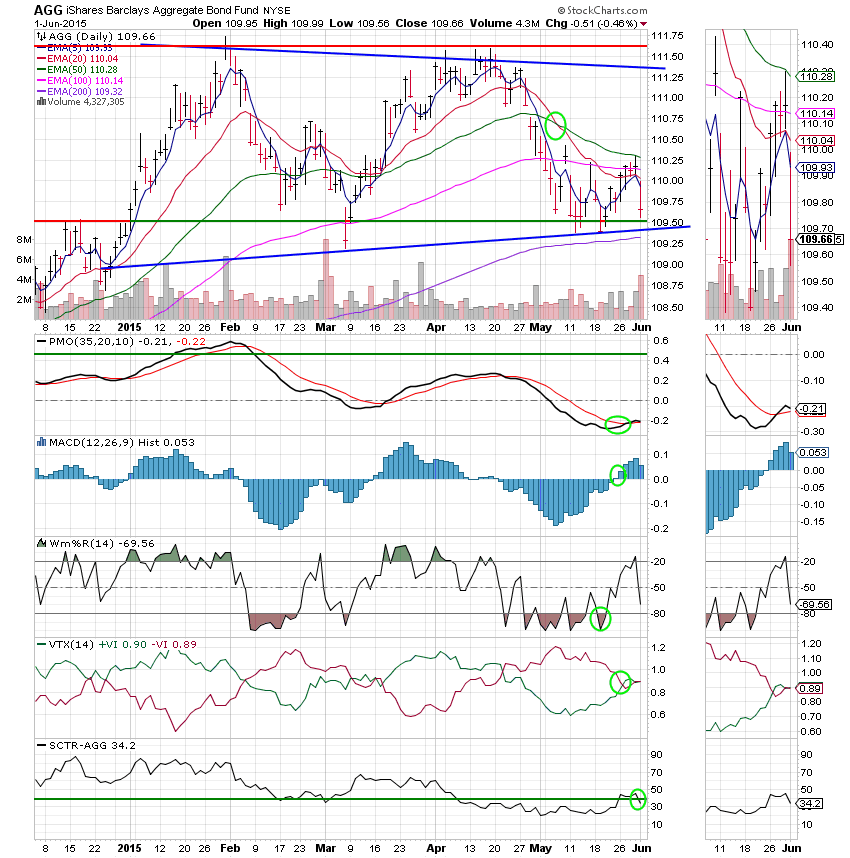

F Fund: Bonds were hammered a gain today with price moving giving back most of its recent gains and again testing support in the 109.50 area. Price has been trading just above this support line since the beginning of May. Should it fail to hold, it would most likely be the signal of a longer term breakdown in bonds. The Williams %R is in an absolute free fall and the SCTR fell back below 40 which is a key number that we watch. As I have often said, money coming out of bonds doesn’t really worry me as it usually finds its way into stocks.

The important thing is that we got off to a positive start for the month of June. Given the PMI numbers the market would have and should have been better but was clearly muted by a strong dollar. Once again, keep your eye on the Euro and the Dollar and you’ll know where we are heading. That’s all for tonight. Have a great evening and may God continue to bless your trades!