Good Evening, Here we sit at the crossroads of another possible Fed rate decision that will be determined in a large part by tomorrows jobs report. If the report is favorable, the Fed hawks will likely push for a rate hike sometime before July. Possibly even as early as this month. However, one has to ask just how aggressive the Fed will be in light of the fact that Europe is still struggling. As you may remember, the Fed got egg in it’s face when the markets dropped in response to their December rate increase largely due to weakness in the European economy. My thinking would be that they would not want a repeat of that action and will be much more cautious this time around despite all the talk about a rate increase. Either way, tomorrows news will be a market mover. Looking at the charts, I would say that they are poised for a breakout and are ready to move to all time highs if tomorrows news is positive. We will see…. In the mean time, God blessed us again today as our allocation outperformed the market for a third consecutive day. Our allocation gained a nice +0.73%. For comparison, the Dow was up +0.27%, the Nasdaq +0.39%, and the S&P 500 +0.28%. Praise God, our gains are starting to add up!!

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allotment is now +5.75% on the year not including the days gains. Here are the latest posted results:

| 06/01/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.032 |

17.5538 |

28.5907 |

36.4482 |

23.952 |

| $ Change |

0.0007 |

-0.0165 |

0.0373 |

0.2097 |

-0.1153 |

| % Change day |

+0.00% |

-0.09% |

+0.13% |

+0.58% |

-0.48% |

| % Change week |

+0.02% |

+0.01% |

+0.04% |

+0.87% |

-0.53% |

| % Change month |

+0.00% |

-0.09% |

+0.13% |

+0.58% |

-0.48% |

| % Change year |

+0.78% |

+3.53% |

+3.73% |

+3.44% |

-0.59% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.0135 |

23.6152 |

25.5821 |

27.1598 |

15.3703 |

| $ Change |

0.0000 |

0.0008 |

0.0020 |

0.0034 |

0.0030 |

| % Change day |

+0.00% |

+0.00% |

+0.01% |

+0.01% |

+0.02% |

| % Change week |

+0.01% |

+0.01% |

+0.01% |

+0.01% |

+0.01% |

| % Change month |

+0.00% |

+0.00% |

+0.01% |

+0.01% |

+0.02% |

| % Change year |

+1.35% |

+1.75% |

+2.07% |

+2.21% |

+2.29% |

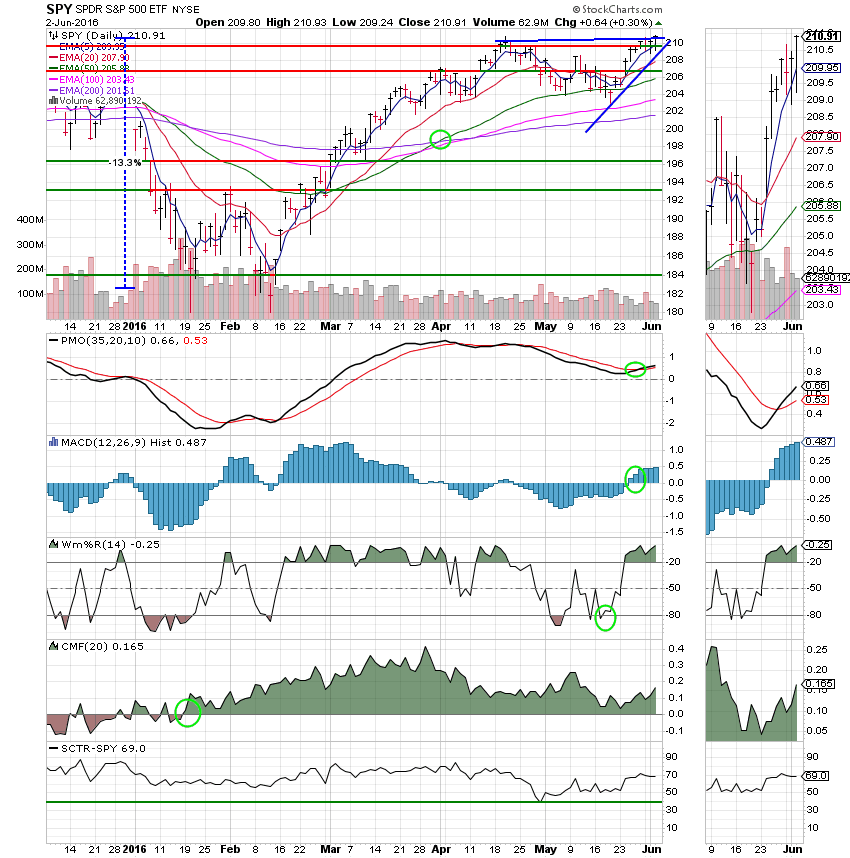

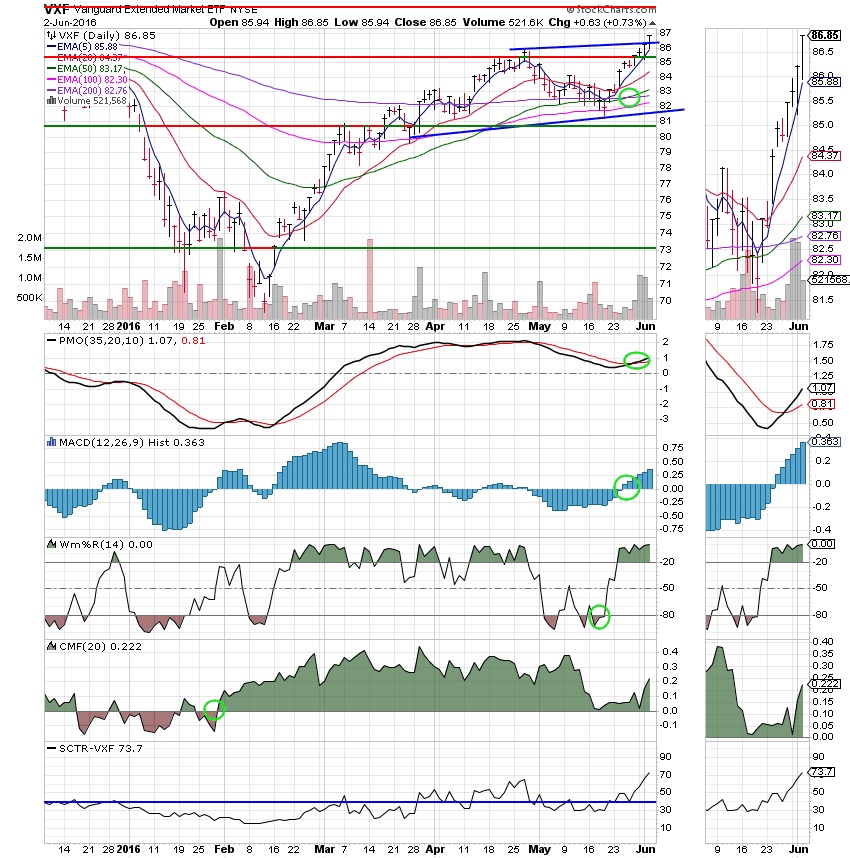

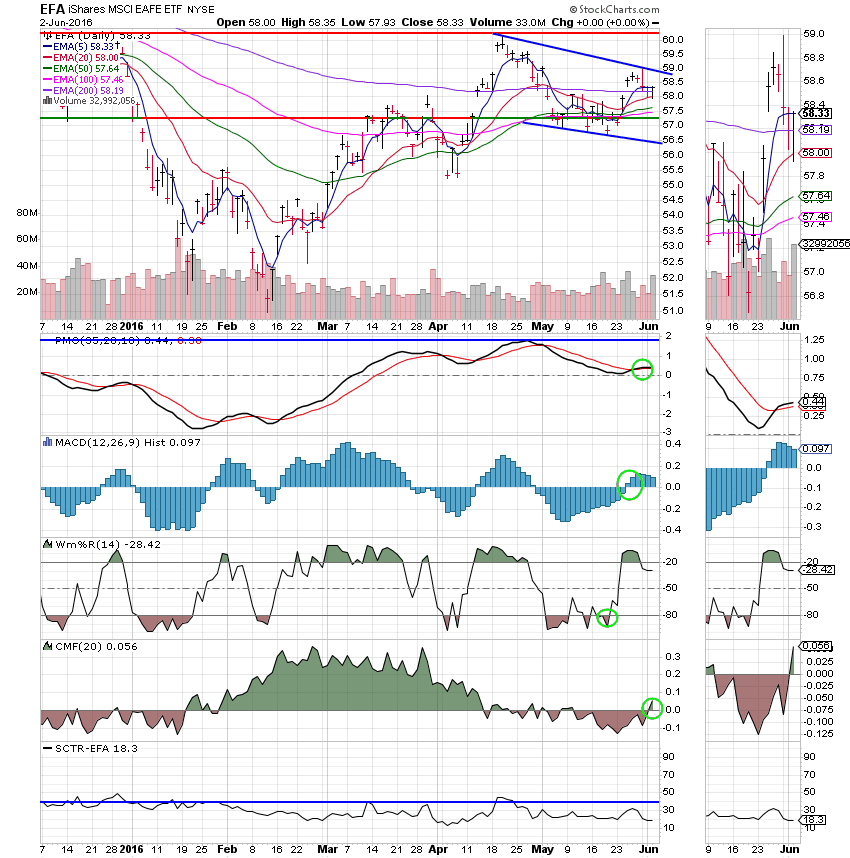

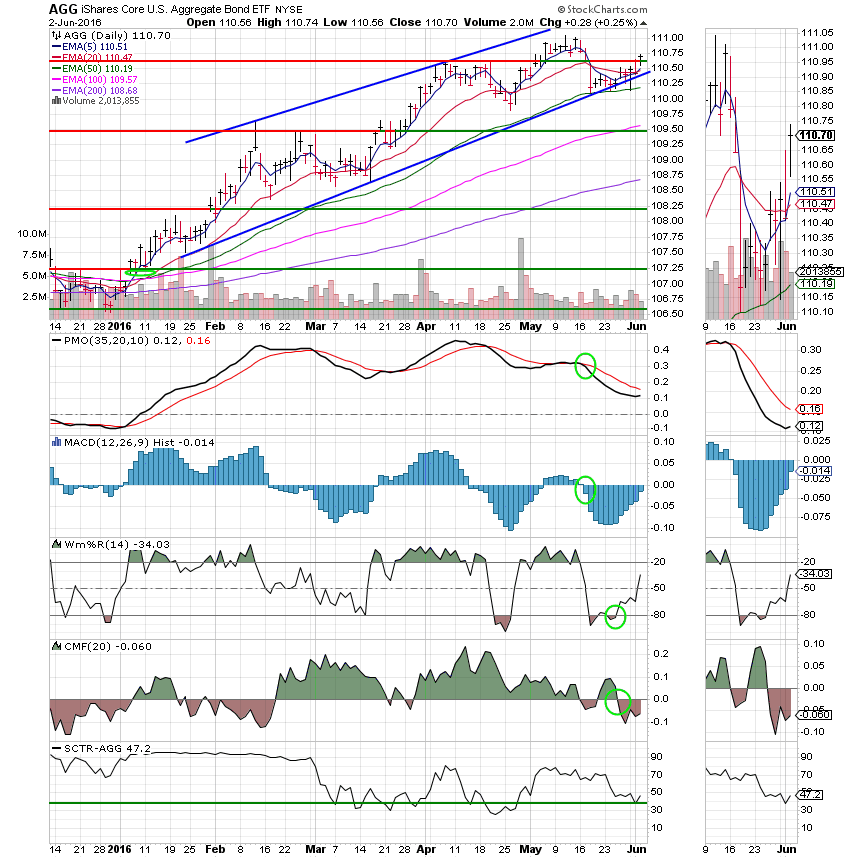

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price has now broken resistance at a little over 209. All indicators continue to strengthen! This is a good thing since the C Fund tracks the S&P 500 which is a leading market indicator.

S Fund: Price has clearly broken through resistance at 85.25. No doubt about it the S Fund is on fire! We need to look no further than the SCTR which is now the highest of any of our TSP funds at 73.7 to confirm that. We’ll ride this horse as far as it’ll go!

I Fund: The I Fund is improving but is still trading within a slight descending channel. The CMF turned positive today indicating that new money is flowing into this fund. That should help the fund to continue it’s improvement. However, with an SCTR of only 18.3, there is still a lot of work to be done here before we can consider investing in this fund.

F Fund: The F Fund continues to amaze me. The lower trend line just won ‘t break. As long as it holds, the F Fund will be a safe place to keep your money if safety is what you seek. However, if the lower trend line breaks (and I believe it could if interest rates increase) you will want to get out of here. Post haste!!!

God has blessed our group yet again! We are in the right place at the right time. Pray that he will continue to guide us as we move ahead in this difficult market. We will continue to watch the S Fund chart for any change in it’s trend. But for now, the trend is our friend! That’s all for tonight. Have a great evening.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.