Good Evening,

Greece strikes again! The rumor is out that Greece is close to a deal with its creditors. My, my , my, didn’t we just talk about that last night? Yes, I believe we did…… The news/rumor pushed the dollar to its biggest one day loss against the Euro since early March. The result….was exactly as we discussed. The I Fund had a good day and everything else? Not so much.

I had another thought today about surviving in the current trading environment. We’ve talked about it quite a bit, but I had some more thoughts that I think might keep you in the mind-set to survive. We’ve talked a lot about how the market has changed. I know that it sounded like an excuse for under-performance, but that’s not the case. There honestly has been a fundamental change in the market and in order to survive and prosper, you must adapt.

Intermediate-term investment styles just aren’t working in this market. That was my style as well as the style of many others prior to 2009. We all thought that what we now refer to as the “old way of trading” would return when all the FED Money disappeared. Now, we have become doubtful that it will ever change. So we have adapted as best we can. There are only two ways to make money in the current environment. The ultra short approach known to most as day trading and the long term style known as “buy and hold”. As you all know, I am no fan of buy and hold. I have gone as far in the past as to say that friends don’t let friends buy and hold. And you know what? I still don’t buy and hold, but what I do is very close to it. Too close for comfort. However, sometimes you just have to do what you have to do. So why then are only those two styles working? When you look at the charts going back to 2000 it’s very clear. Prior to the financial crisis, the market would have cycles of regular corrections. For those of you who are new to trading, the text book definition of a correction is a market pullback of 10 percent or more. The definition of a bear market is a pullback of 20 percent or more. Since 2009 we have not had a pullback of 20% or more. By the matter of fact, we have not had a pullback of 10% or more in over four years! For the intermediate style of trading to be successful, you must have corrections. They enable you to “short” the market. Put in simpler terms, you sell to avoid the dips and buy back at a lower price as the market rebounds. This strategy allows you to significantly out-perform the major indices. This explains why the profits have been limited in the years since the great recession.

In conclusion, the market has moved steadily up fueled by an almost endless supply of central bank money. Where this will end? I just don’t know. All I can do is watch the charts……..

The day’s trading left us with the following results: Our TSP allotment gained +0.142%. for comparison, the Dow lost -0.16%, the Nasdaq -0.13%, and the S&P 500 -0.10%. Thank God for our gain! Give Him all the praise!

U.S. stocks slip; utilities fall as bond yields jump

The day’s action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allotment is now +4.44% on the year not including the day’s results. Here are the latest posted results:

| 06/01/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7328 | 16.9108 | 28.111 | 38.4437 | 26.4314 |

| $ Change | 0.0008 | -0.0807 | 0.0607 | 0.0736 | -0.1088 |

| % Change day | +0.01% | -0.47% | +0.22% | +0.19% | -0.41% |

| % Change week | +0.01% | -0.47% | +0.22% | +0.19% | -0.41% |

| % Change month | +0.01% | -0.47% | +0.22% | +0.19% | -0.41% |

| % Change year | +0.80% | +0.65% | +3.48% | +5.92% | +9.14% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7482 | 23.64 | 25.7871 | 27.548 | 15.7018 |

| $ Change | -0.0023 | -0.0027 | -0.0020 | -0.0003 | 0.0002 |

| % Change day | -0.01% | -0.01% | -0.01% | +0.00% | +0.00% |

| % Change week | -0.01% | -0.01% | -0.01% | +0.00% | +0.00% |

| % Change month | -0.01% | -0.01% | -0.01% | +0.00% | +0.00% |

| % Change year | +1.70% | +3.24% | +3.95% | +4.43% | +4.97% |

Let’s hit the charts:

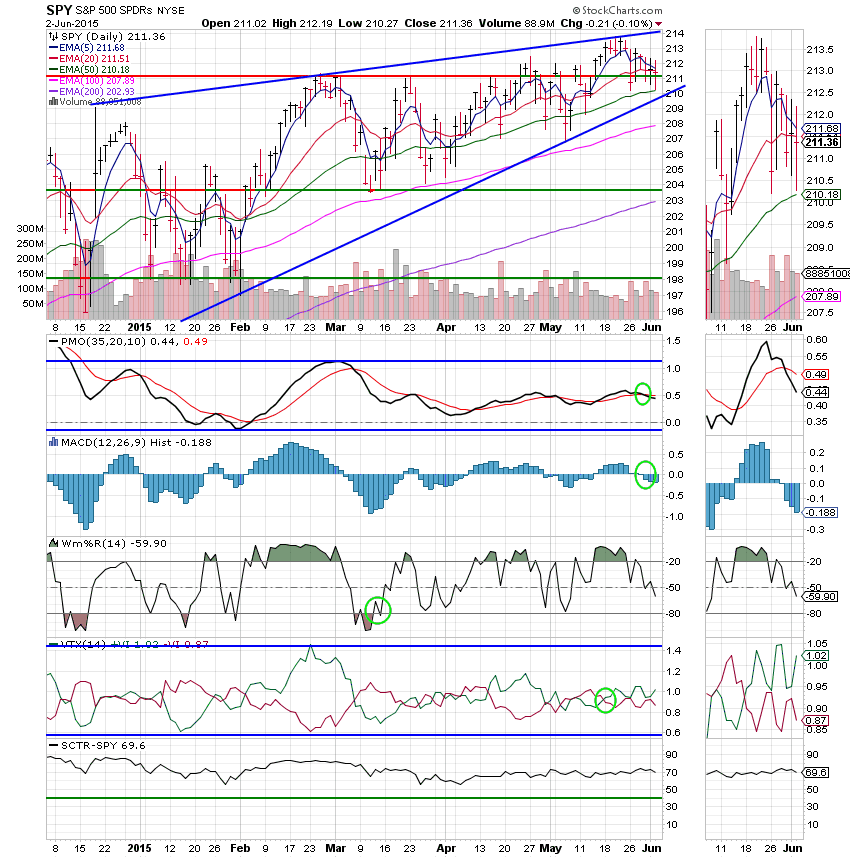

C Fund: Price closed slightly lower just below its 20 EMA, but still above resistance in the 211 area. Worth noting, the VTX has turned up and is looking bullish.

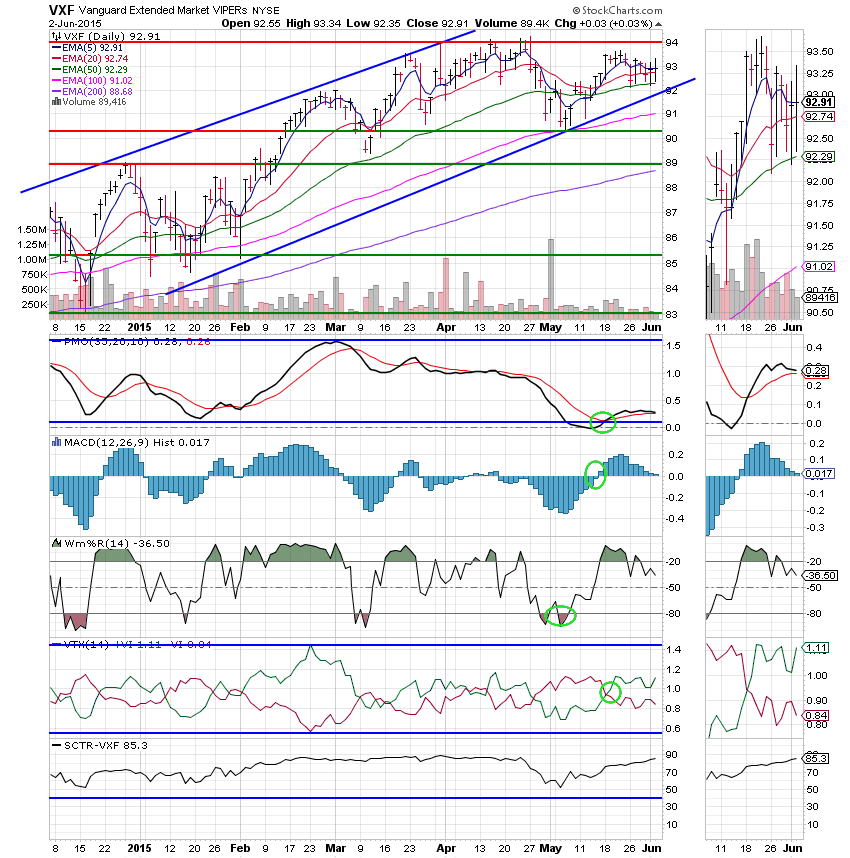

S Fund: The S Fund continues to show enough strength to hang onto its buy signal. Price closed right on its 5 EMA and the SCTR continues to strengthen at 85.3.

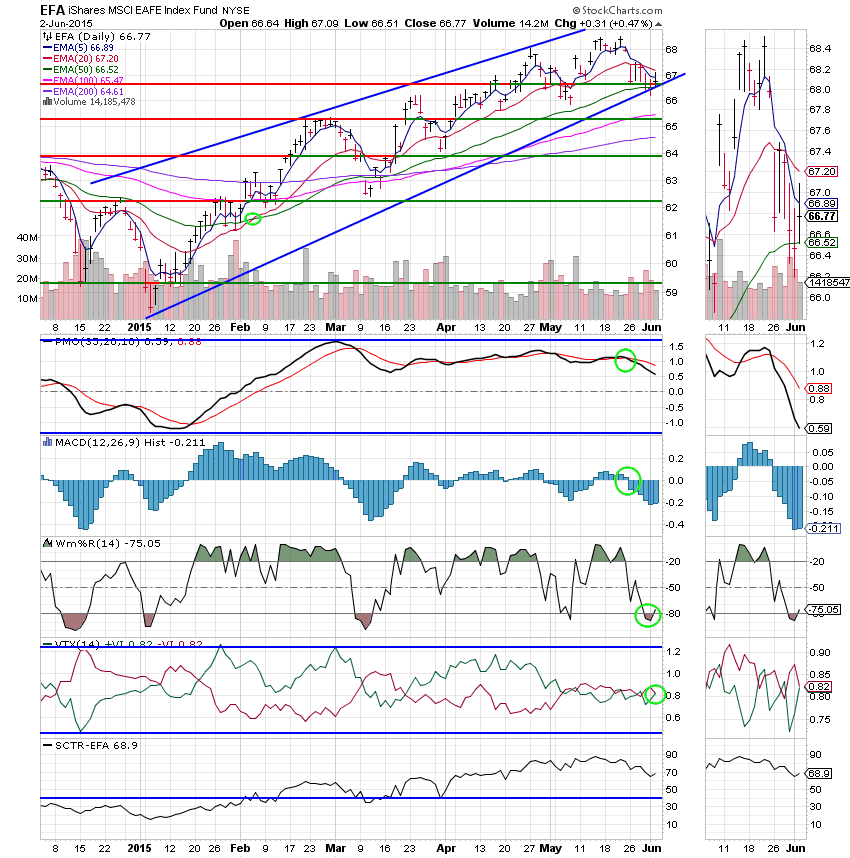

I Fund: The I Fund was the best of the rest today as the dollar plunged. The UUP (which is a measure of the dollar against a basket full of currencies) was down -1.52% resulting in out-performance by the I Fund. That is the reason that we kept some money allocated here. Should the dollar continue to weaken (and I think it will given a Greek deal with the EU) the I fund will make a nice run. Today’s strength was reflected by the WMs %R and VTX moving into positive configurations. The overall signal remains at Neutral.

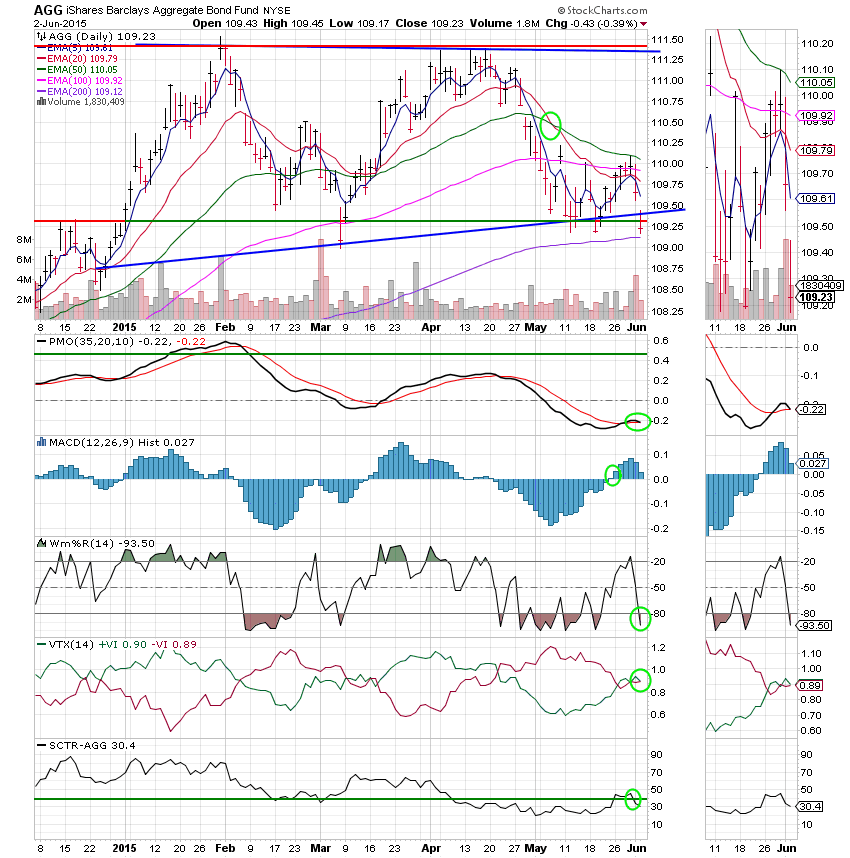

F Fund: Price fell below the lower trend line and support in the 109.30 area. With this key area of support wiped out it is likely that bonds are now in an intermediate- to long-term down trend. The PMO, Williams %R and VTX moved into negative configurations giving the chart an overall sell signal. Right now, it’s not looking good for bonds.

We’re making a little progress and I thank God for that, but there are a lot of headwinds and I don’t expect things to get any easier. That’s all for tonight. Have a great evening and I’ll see you tomorrow.