Good Evening, The market took off and then tapered in the afternoon session posting modest gains on the day. Stocks rose on news of better than expected job gains in the private sector and more optimism of a Greek deal. I say that we’ll have another Greece is saved rally on or before Friday as that is the day that Greece must pay it’s creditors. The leftist government has taken this bluff about as far as they can go. The EU is now going to call and make them put their cards on the table. The deal may be a compromise, but I believe there will be a deal.

The market continues to remain in a tight trading range. Right now it’s a contest between the bulls that believe the current slow action is setting us up for another leg higher and the bears who believe that the market is topping and will ultimately be taken down by an interest rate increase. Also worth mentioning, is the ever increasing group of folks that think that the central banks will never let the market fall. To them I say, dream on! As far as the others, eventually the market will make a move one way or the other. It can’t stay in this tight trading range forever. It has been in the same range since the beginning of the year and that’s starting to get long in the tooth. When it finally does make it’s move, one side or the other will be quick to claim victory and say they told us so.

Our Job is simple, we must watch the charts and react to the action be it up or down. If we do that, we will stay on the right side of things regardless of who’s wrong or who’s right.

The days modest rally left us with the following results: Our TSP allotment gained +0.425%. For comparison, the Dow gained 0.36%, the Nasdaq +0.45%, and the S&P 500 +0.21%. Praise God for another good day!

Wall St ends up; financials gain with bond yields

The days action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +4.69% on the year not including the days results. Here are the latest posted results.

| 06/02/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7337 | 16.8563 | 28.0841 | 38.4882 | 26.6068 |

| $ Change | 0.0009 | -0.0545 | -0.0269 | 0.0445 | 0.1754 |

| % Change day | +0.01% | -0.32% | -0.10% | +0.12% | +0.66% |

| % Change week | +0.01% | -0.80% | +0.12% | +0.31% | +0.25% |

| % Change month | +0.01% | -0.80% | +0.12% | +0.31% | +0.25% |

| % Change year | +0.80% | +0.33% | +3.38% | +6.04% | +9.86% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7499 | 23.6561 | 25.8103 | 27.5765 | 15.7225 |

| $ Change | 0.0017 | 0.0161 | 0.0232 | 0.0285 | 0.0207 |

| % Change day | +0.01% | +0.07% | +0.09% | +0.10% | +0.13% |

| % Change week | +0.00% | +0.06% | +0.08% | +0.10% | +0.13% |

| % Change month | +0.00% | +0.06% | +0.08% | +0.10% | +0.13% |

| % Change year | +1.71% | +3.31% | +4.05% | +4.54% | +5.11% |

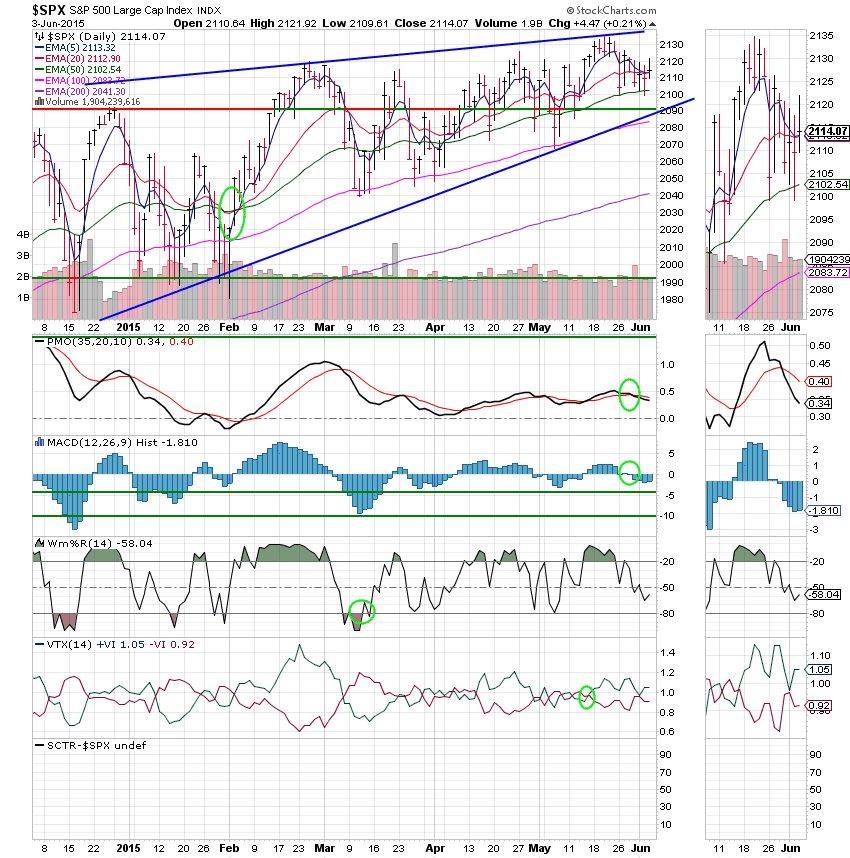

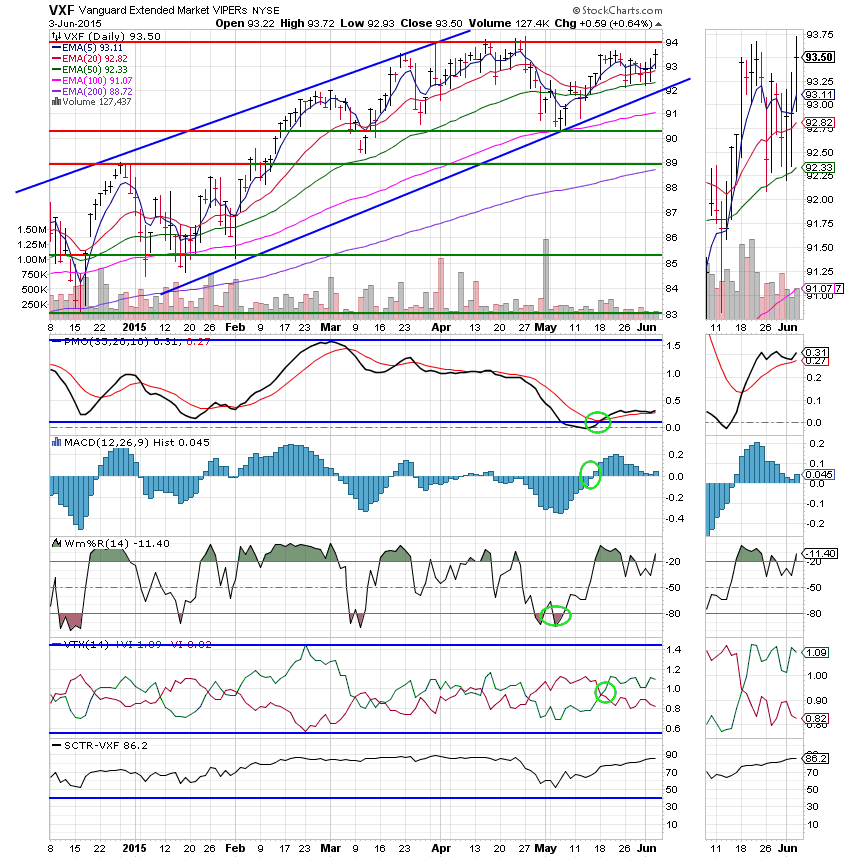

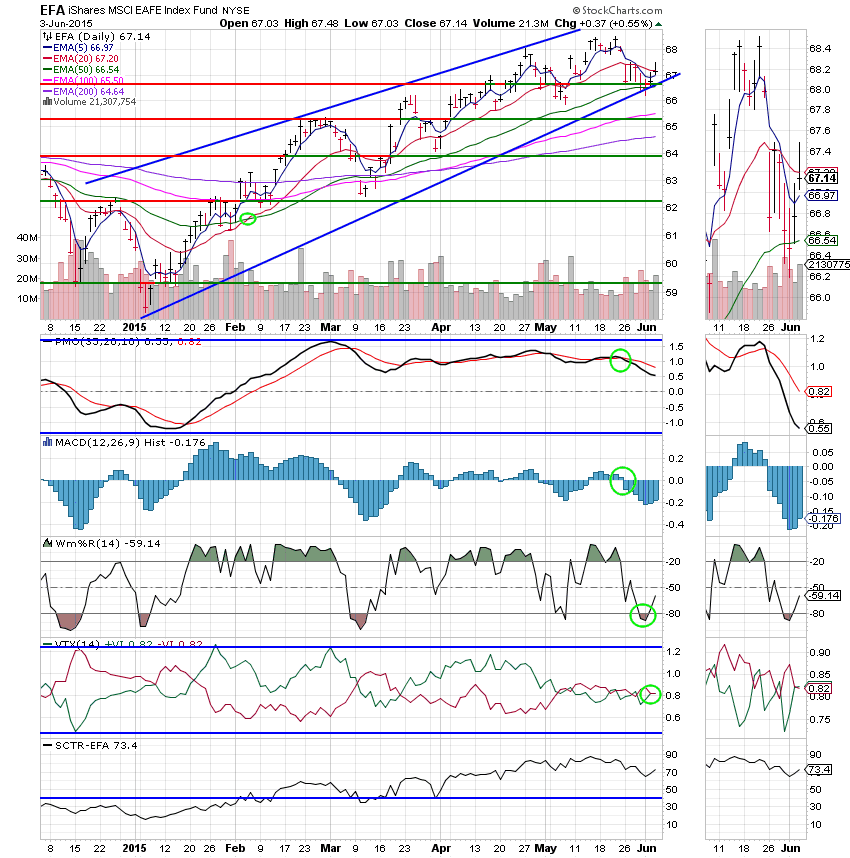

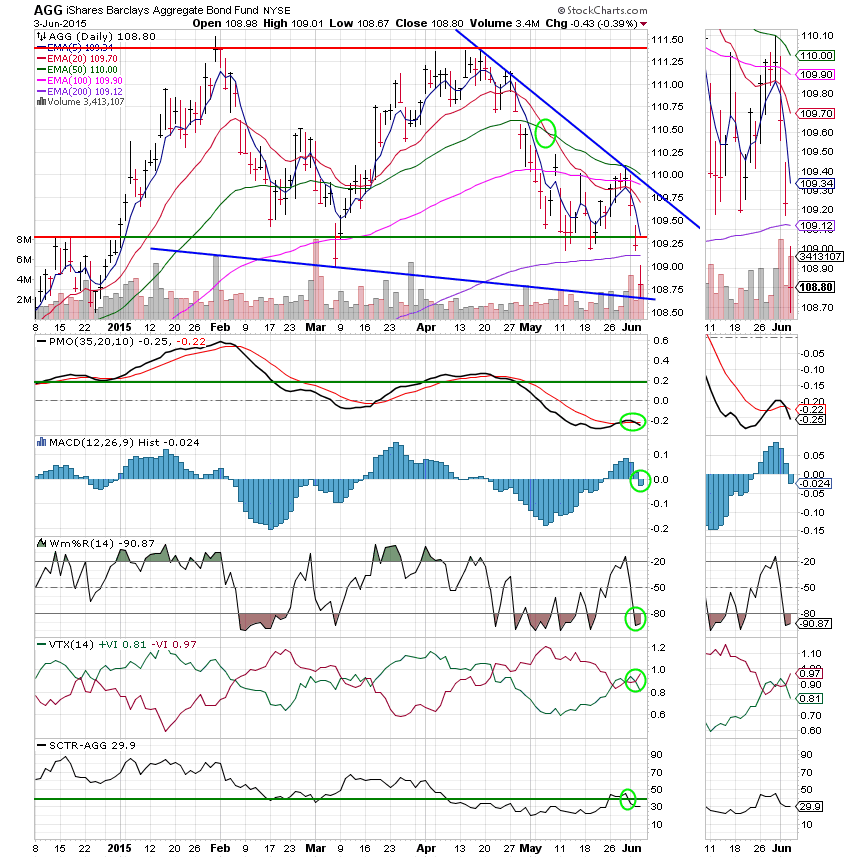

Lets take a look at the charts:

C Fund: I used the actual SPX today as it was a little more accurate. Price made a modest recovery closing just above it’s 20 EMA. The remainder of the indicators were unchanged. While it did manage a small gain, the C Fund is definitely the weakest of our equity based funds right now.

S fund: The S Fund continues to show strength with price moving closer to resistance at 94. It was unable to breach this resistance in April and appears poised to try again. If price passes through this resistance it has a lot of room to run. The PMO turned up in Neutral territory which supports this scenario. The SCTR has now risen to a strong 86.2.

I Fund: Price rebounded to it’s 20 EMA today with a nice gain of +0.55%. Support held at the lower trend line and an improving Williams %R indicates that there is likely more short term gain to be had. The SCTR shows that this fund has strengthened moving up to 73.4.

F Fund: Bonds are just not behaving well. Price suffered another big (for bonds) drop of -0.39% and has now fallen below it’s 200 EMA. That’s bear market territory should it stay there. The MAC D moved to negative territory putting all of our indicators in negative configurations. Nothing to do here but watch. If you haven’t already done so, you need to sell this one.

It’s all about Greece and it should come to a head Friday. Also on Friday are some key economic reports. We’ll see how things go tomorrow. More news of a possible Greek Deal could move us higher. We’ll also be watching bond yields to see what they do and how the effect the equity market. I know there’s a lot of negative talk, but like I said before. When bonds sell off that money has to go somewhere. That’s all for tonight. Have a great evening and may God continue to bless your trades!