Good Evening. The jobs report came in better than expected, but instead of cheering traders began to worry anew about the Fed Increasing rates which have been near zero for a long time. The major banks think that there will be a rate increase in September and I am on record as agreeing with them. Now, here’s something earth shattering. The sooner they increase rates the better. Traders are basically just waiting to see whats going to happen when rates finally do start to rise. They hang on every piece of news and panic if they feel that it might lead to a rate increase. I will admit that I’m not sure what will happen myself when rates increase, but I’m inclined to believe that it won’t be a big deal. Money will still be cheap unless they raise rates drastically all at one time and who among us thinks that the FED is stupid enough to do something like that? As I have often said and will repeat now, rates will still be at historic lows. If a rate increase hurts us, it will be because of market players who panic, not because of the actual rate increase.

As far as today, the market followed it’s all too familiar pattern of fading the gap at the open until the machines started buying and drove things back up. Then we traded in a tight range until the close. The indices ended mixed and were really not off that bad considering the news. However, I think most of today’s reaction to the jobs report was priced into yesterday’s sell off. I really believe that it would be best for everyone concerned if we didn’t get a rate increase until 2016, but I just don’t think we can get out of this trading range that we’re in until we get one. So it we gotta have a correction then lets get it over with so we can all make some decent money again instead of staying in this same tight range. Who know’s? When the increase actually comes it may be a relief. Either way, I’m ready to get if over with! How about you?

The days trading left us with the following results: Our TSP allotment slipped back -0.245%. For comparison, the Dow lost -0.31%, the Nasdaq bucked the trend and gained +0.18%, and the S&P 500 fell back -0.14%.

Strong jobs report gives Wall St. second straight losing week

The weeks action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +4.39% on the year not including the days results. Here are the latest posted results:

| 06/04/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7353 | 16.8359 | 27.9073 | 38.3708 | 26.6115 |

| $ Change | 0.0008 | 0.0503 | -0.2421 | -0.3602 | -0.1869 |

| % Change day | +0.01% | +0.30% | -0.86% | -0.93% | -0.70% |

| % Change week | +0.02% | -0.92% | -0.51% | +0.00% | +0.27% |

| % Change month | +0.02% | -0.92% | -0.51% | +0.00% | +0.27% |

| % Change year | +0.81% | +0.20% | +2.73% | +5.72% | +9.88% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7352 | 23.6101 | 25.7454 | 27.4967 | 15.6723 |

| $ Change | -0.0257 | -0.0940 | -0.1346 | -0.1677 | -0.1090 |

| % Change day | -0.14% | -0.40% | -0.52% | -0.61% | -0.69% |

| % Change week | -0.09% | -0.14% | -0.17% | -0.19% | -0.19% |

| % Change month | -0.09% | -0.14% | -0.17% | -0.19% | -0.19% |

| % Change year | +1.63% | +3.11% | +3.79% | +4.24% | +4.77% |

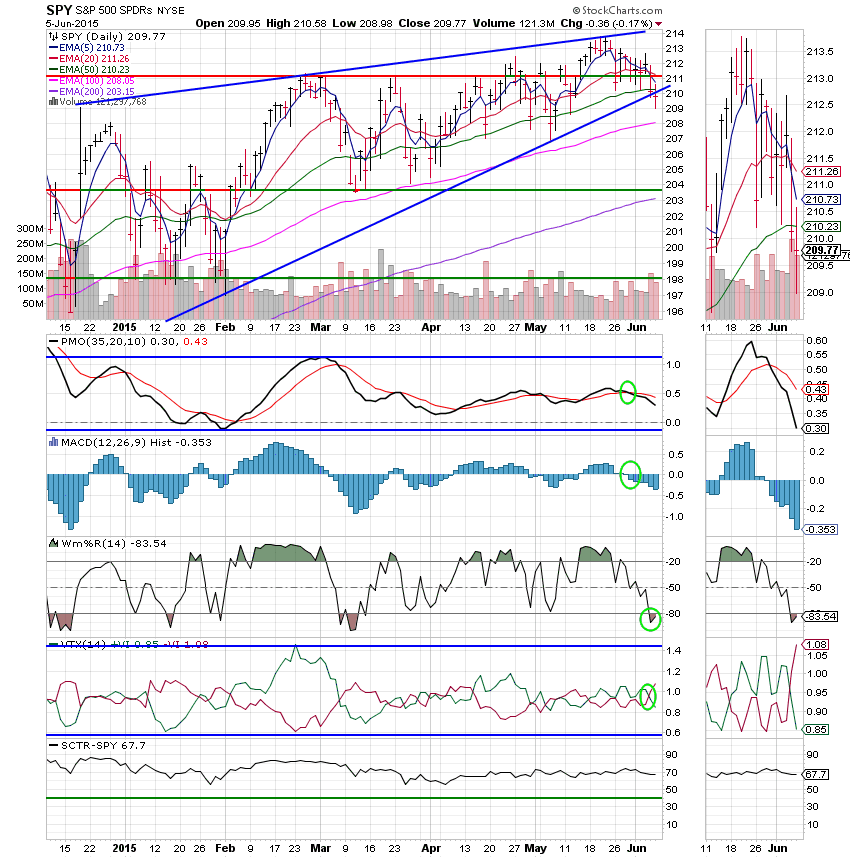

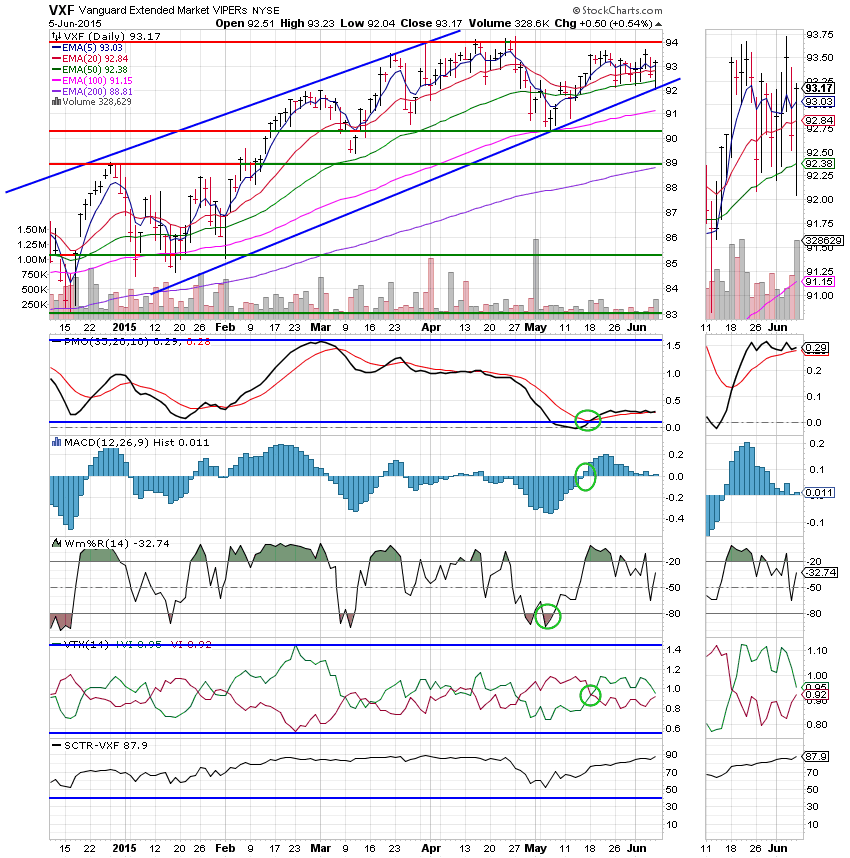

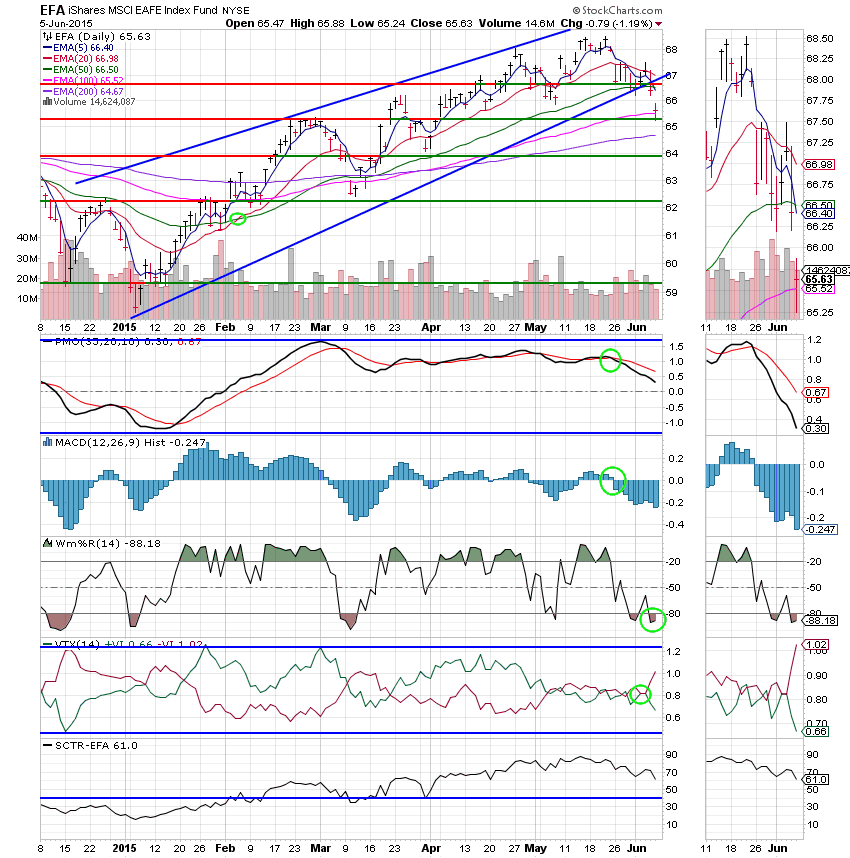

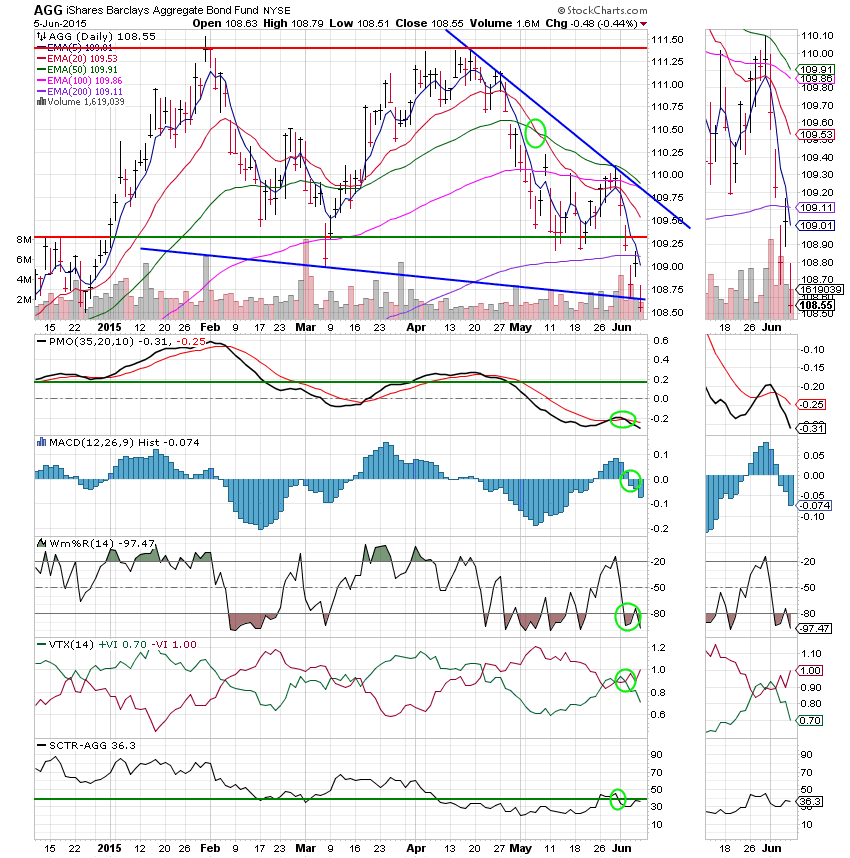

Let’s take a look at the charts. (All signals are annotated by green circles)

C Fund: Price closed down for the second consecutive day below the 50 EMA and today dropped below the lower trend line. All other indicators are pretty much unchanged.

S Fund: Small Caps out-performed today and that’s what it took to keep the S Fund at an overall buy signal. The recent underlying support on this fund has been impressive and is reflected by the SCTR that has now risen to 87.9!

I Fund: The I Fund continues to struggle with the strong dollar and the Greek situation in the EU. As tempting as it is to sell this one right now, it is necessary to hang in there as long as we can in order to maintain some diversity in our allotment. Today, price dropped below it’s 100 EMA, but struggled higher to finish the day just above it. The 5 EMA crossed down through the 50 EMA while the PMO and MAC D continue to weaken. The longer that price stays below the 50 EMA the closer it will drag the 20 EMA to a negative crossover that could trigger a sell signal. This chart is starting to get extended to the downside and will probably make a run before that takes place. Nevertheless, it is something that we need to keep and eye on.

F Fund: The F Fund is in a free fall. Price dropped below the lower trend line and is heading for parts unknown. The 5 EMA passed through the 200 EMA on the way down. That is pretty bearish. All indicators are currently in negative configurations. Is there anybody that still believes it’s necessary to keep some of your portfolio allocated to bonds at all times (i.e. Life Cycle Funds)? In our system we don’t believe it’s necessary to stay in anything all the time!

That’s it for this week. It was a loser, but they can’t all be winners. I just thank God for the small caps that are now working for us! It is a good sign when they out-perform so don’t give up on equities just yet. May God continue to guide our hand. Give Him all the praise! Have a great weekend and we’ll do it again on Monday.