Good Evening, I’m asked the question on a regular basis about whether or not I think we are going into a bear market. I guess it’s kind of like talking about the weather to some people. I would think that they would get tired of asking me the same question and getting the same answer, but they don’t. Maybe they think it’s like asking someone how they are doing when they greet them. They ask “How are you today” to which the reply is usually “good” or “great”. Maybe they aren’t really expecting an answer at all…… I’m really not sure. It’s kind of an enigma to me. So they ask something to the effect of “Is this a bear market?” or “Should I sell??” . My answer is always the same. I am not a prognosticator. You’d better stay away from anyone that claims to know the future! I’m a reactive trader. I watch my charts and react to whatever I see. All that said, a look at my charts now tell me that things are deteriorating. How far they will slide I don’t know. I can’t tell you if we are going down 7%, 10 % or 50%. Sorry, you got the wrong guy for that! What I can tell you is that my indicators will give me a sell signal when the chart I am watching drops in the 7 to 10% range. When that happens, I will sell and start looking for what if anything is working at that time. Sometimes the only thing that is working is cash. Or course, when operating in the realm of Thrift we use the G fund for that. After that, if the market turns back up we buy it back. If not, we listen to the so called experts cry while their portfolios drop 20-50%. When that’s over, we buy back in and ride it up. Why am I mentioning all this? The aforementioned questions prompted it, but my main reason is that I really think at some point we will have another correction and I want you to understand exactly how we will react to it. It’s really quit simple. We treat every pullback likes it’s a real correction so that we don’t get caught flat footed when one actually comes. We never panic! It’s not that we don’t take this seriously. It’s just that it’s counterproductive. The only thing it accomplishes is to influence us into making poor decisions. So we really don’t even get serious about it until the market drops in the neighborhood of 5 %. Then we raise or level of vigilance. That means we check our charts a little more and a little closer. When and if we do get that sell signal, we don’t hesitate, we don’t pass go and we don’t collect 200 dollars (That’s Monopoly in case you never played), we sell without hesitation. To sell without hesitation is to have discipline. As far as were concerned it’s just normal business. It’s just that business hasn’t been normal for a long time! So where are we at now? We’re starting to raise our level of vigilance. Especially in the I Fund…….

The market dipped again today. However the action was not really so much panicked as it was lackadaisical. I’m not making an inference by saying this, but markets often wear you out before they scare you out. This one kind of has that feel. I’m not even going to comment on today’s news. I’ll let you read that below. The day’s trading left us with the following results: Our TSP allotment fell back another -0.419%. For comparison, the Dow lost -0.46%, the Nasdaq -0.92%, and the S&P 500 -0.65%.

Wall Street ends lower, Dow slips into loss for 2015

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +3.86% on the year, not including the day’s results. Here are the latest posted results:

| 06/05/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7361 | 16.7622 | 27.8681 | 38.5809 | 26.0851 |

| $ Change | 0.0008 | -0.0737 | -0.0392 | 0.2101 | -0.5264 |

| % Change day | +0.01% | -0.44% | -0.14% | +0.55% | -1.98% |

| % Change week | +0.03% | -1.35% | -0.65% | +0.55% | -1.71% |

| % Change month | +0.03% | -1.35% | -0.65% | +0.55% | -1.71% |

| % Change year | +0.82% | -0.24% | +2.59% | +6.29% | +7.71% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7138 | 23.5361 | 25.6469 | 27.3845 | 15.5975 |

| $ Change | -0.0214 | -0.0740 | -0.0985 | -0.1122 | -0.0748 |

| % Change day | -0.12% | -0.31% | -0.38% | -0.41% | -0.48% |

| % Change week | -0.21% | -0.45% | -0.55% | -0.59% | -0.66% |

| % Change month | -0.21% | -0.45% | -0.55% | -0.59% | -0.66% |

| % Change year | +1.51% | +2.78% | +3.39% | +3.81% | +4.27% |

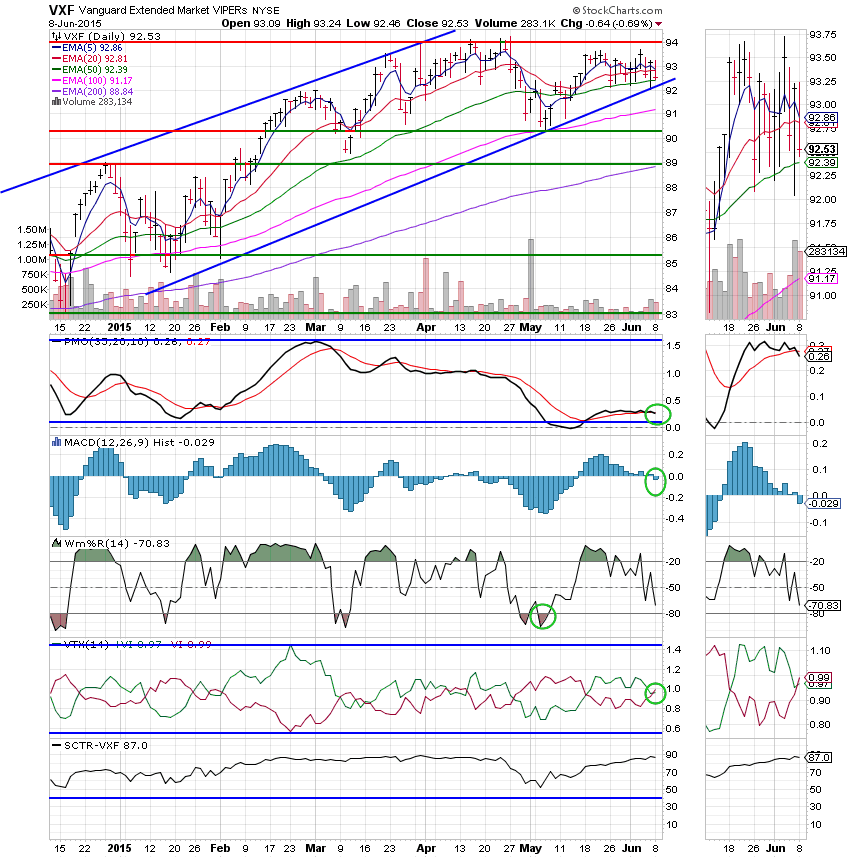

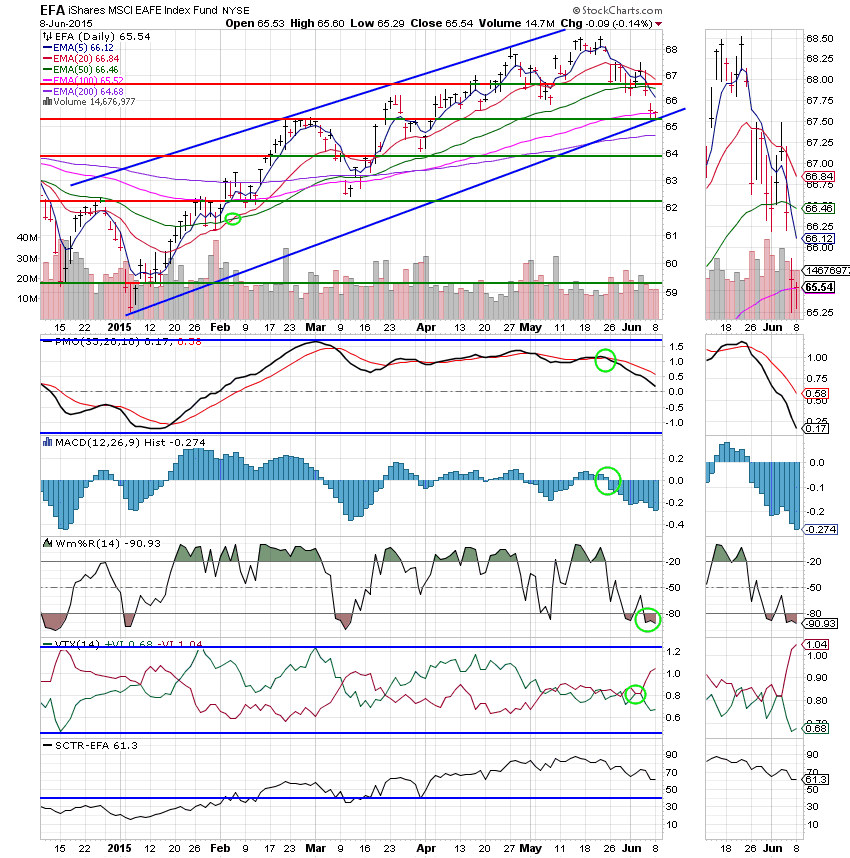

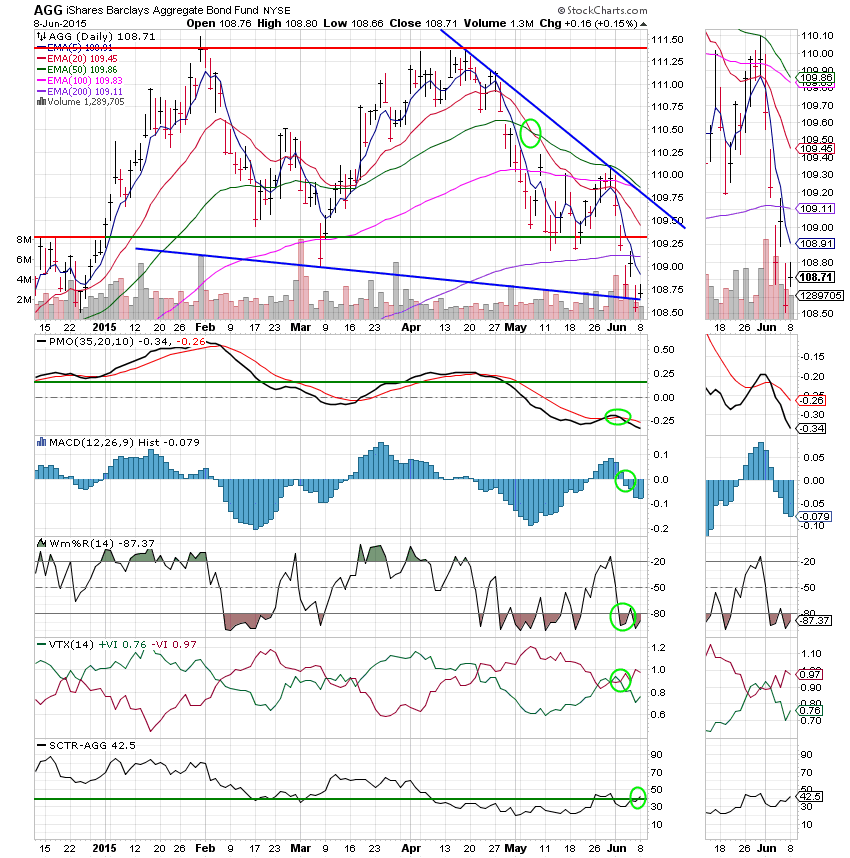

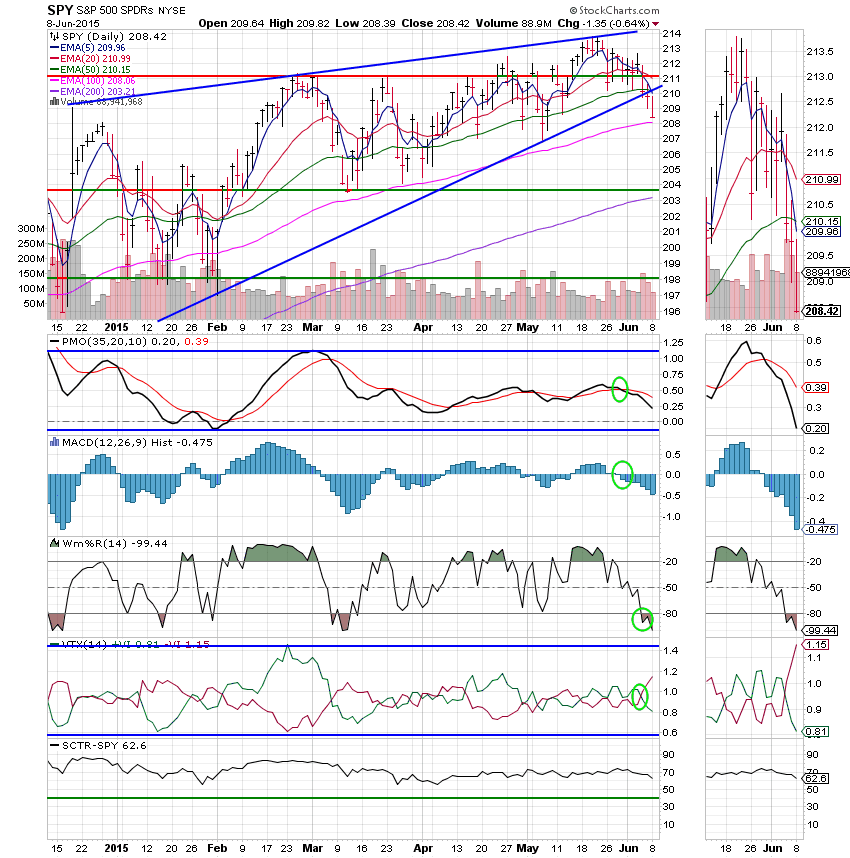

The charts: (All signals are annotated with Green Circles)

C Fund: This chart continues to weaken. Price is now approaching it’s 100 EMA.

S Fund: The PMO, MAC D, and VTX all went negative today moving the S fund to a Neutral signal. The SCTR is still a healthy 87.0.

I Fund: Price closed right on it’s 100 EMA today. The 20 EMA continues to move down toward the 50 EMA. If this pass through occurs and the rest of the indicators remain negative it will move the I Fund to a sell signal.

F Fund: Price moved back above the lower trend line and the SCTR improved slightly. This Fund is on a solid sell and the trend is still down.

All charts are getting weaker. I’m beginning to look at the possibility of some sell signals in the not too distant future without some better price action. I know it’s tough to take a half a step back. But maybe some sell signals wouldn’t be a bad thing as this market is clearly in need of a reset. Keep praying that God will guide our group. Give Him all the Praise! That’s all for tonight.