Good Evening, Well we’re back to the oil thing again. At least that’s the excuse that the media is giving for today’s pullback. While stocks traded slightly down it was more like a breather than the beginning of a sell off. In my humble opinion it was just some healthy consolidation. More than likely we’ll see some more of it before next weeks Fed meeting. As usual the dip buyers showed up and drove us back up near the sessions highs. So it appears that their not overly concerned either.

The days trading left us with the following results: Our TSP allotment fell back -0.53%. For comparison, the Dow dropped -0.11%, the Nasdaq -0.32%, the S&P 500 -0.17%.

Wall Street retreats with oil prices after three-day rally

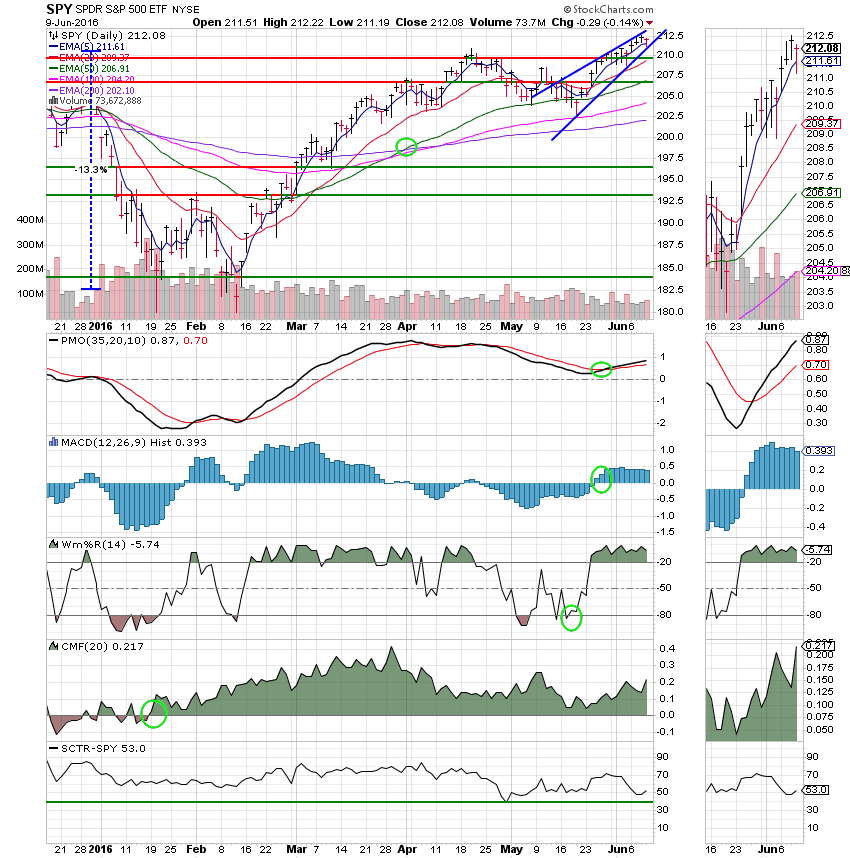

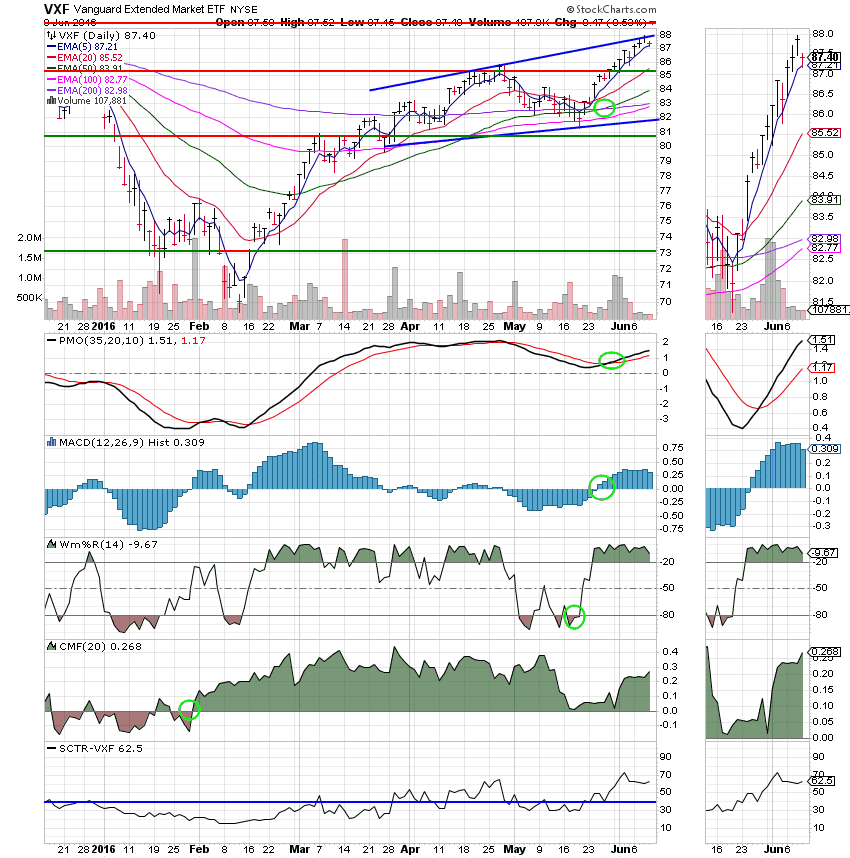

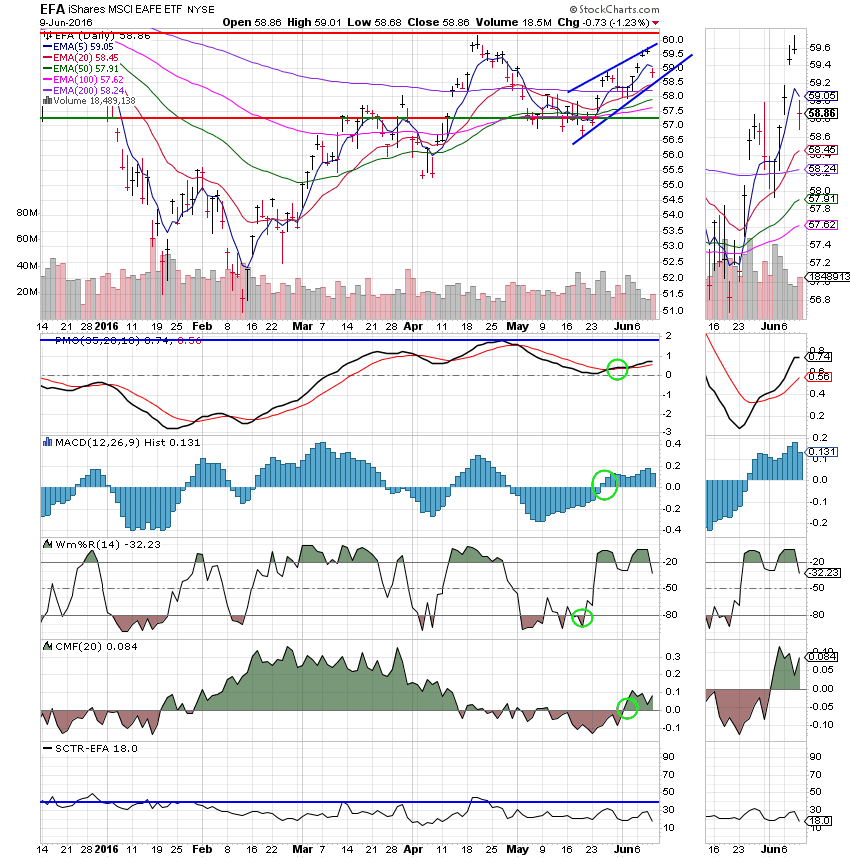

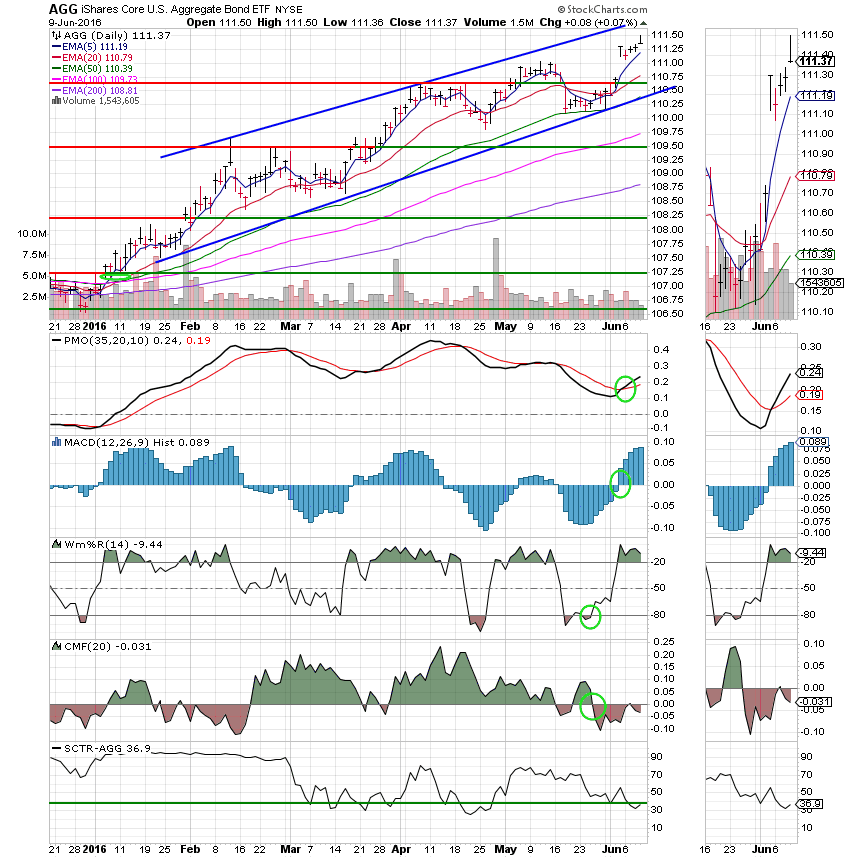

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +7.22% on the year. Here are the latest posted results.

| 06/09/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0381 | 17.713 | 28.823 | 36.9546 | 24.202 |

| $ Change | 0.0007 | 0.0266 | -0.0483 | -0.1989 | -0.3044 |

| % Change day | +0.00% | +0.15% | -0.17% | -0.54% | -1.24% |

| % Change week | +0.03% | +0.23% | +0.81% | +1.20% | +0.33% |

| % Change month | +0.05% | +0.81% | +0.94% | +1.98% | +0.56% |

| % Change year | +0.82% | +4.47% | +4.57% | +4.88% | +0.44% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.0636 | 23.7361 | 25.7576 | 27.373 | 15.5036 |

| $ Change | -0.0173 | -0.0564 | -0.0879 | -0.1101 | -0.0718 |

| % Change day | -0.10% | -0.24% | -0.34% | -0.40% | -0.46% |

| % Change week | +0.18% | +0.36% | +0.49% | +0.56% | +0.63% |

| % Change month | +0.28% | +0.52% | +0.69% | +0.80% | +0.89% |

| % Change year | +1.63% | +2.27% | +2.77% | +3.02% | +3.18% |

The S Fund took a little set back today and it’s always going to drop more than the S&P when the market pulls back. When you invest in small caps (the S Fund is a midcap blend that includes small caps) you are in effect betting on an uptrend. As I have often said, it’s like taking an elevator up and jumping out of a window to go down…. We’ll keep an eye on the charts for any changes. However, for now the uptrend is still intact! That’s all for tonight. Have a nice evening and may God continue to bless your trades.