Good Evening, The action was slow and unimpressive today, but given yesterday’s big run it’s exactly what we should have expected. By the matter of fact. it should even be considered healthy in nature. The fact that we were able to move forward at all was a good thing as some post run consolidation would not have come as a surprise. However, before we get too excited about yesterday’s run and today’s modest follow through, we need to realize that the gains merely put us right back into the middle of the same trading range that we have been in for months. It will be interesting to see if the bulls have enough juice to take us to new highs. Nevertheless, a gain is a gain and I’ll take it!

One other thought before we move on. As we have discussed a few times recently, with precious metals on the skids, there are really only two places to put your cash, either in stocks or bonds. Yes, bonds made a nice run today, (more on that in a moment) but for the most part they have been forced to circle the wagons as of late. I said it before and I’ll say it again. Where do you think that money will go? To equities of course. Now, more on today’s run in bonds. The run was a flight to the safe haven of US debt in response to the lack of deal on Greek Debt. Now I ask you another question. What do you think will happen to bonds if a Greek deal goes through? US stocks are safest bet when compared to bonds here or across the pond and every savvy trader knows it. This situation could provide the tail winds to get us to new highs in stocks. We’ll see……

The days trading left us with the following results: Our TSP allotment added +0.30%. For comparison the Dow gained +0.22%, the Nasdaq +0.11%, and the S&P 500 +0.17%. Praise God for another day of gains!

Stocks, dollar gain on strong U.S. retail sales

The days action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Sell. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +4.64% on the year not including today’s gains. Here are the latest posted results.

| 06/10/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7402 | 16.7001 | 28.0405 | 38.6612 | 26.4691 |

| $ Change | 0.0009 | -0.0500 | 0.3355 | 0.4385 | 0.4811 |

| % Change day | +0.01% | -0.30% | +1.21% | +1.15% | +1.85% |

| % Change week | +0.03% | -0.37% | +0.62% | +0.21% | +1.47% |

| % Change month | +0.06% | -1.72% | -0.03% | +0.76% | -0.27% |

| % Change year | +0.85% | -0.60% | +3.22% | +6.52% | +9.29% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7409 | 23.6303 | 25.7759 | 27.5385 | 15.6992 |

| $ Change | 0.0457 | 0.1613 | 0.2269 | 0.2778 | 0.1813 |

| % Change day | +0.26% | +0.69% | +0.89% | +1.02% | +1.17% |

| % Change week | +0.15% | +0.40% | +0.50% | +0.56% | +0.65% |

| % Change month | -0.05% | -0.05% | -0.05% | -0.04% | -0.02% |

| % Change year | +1.66% | +3.19% | +3.91% | +4.40% | +4.95% |

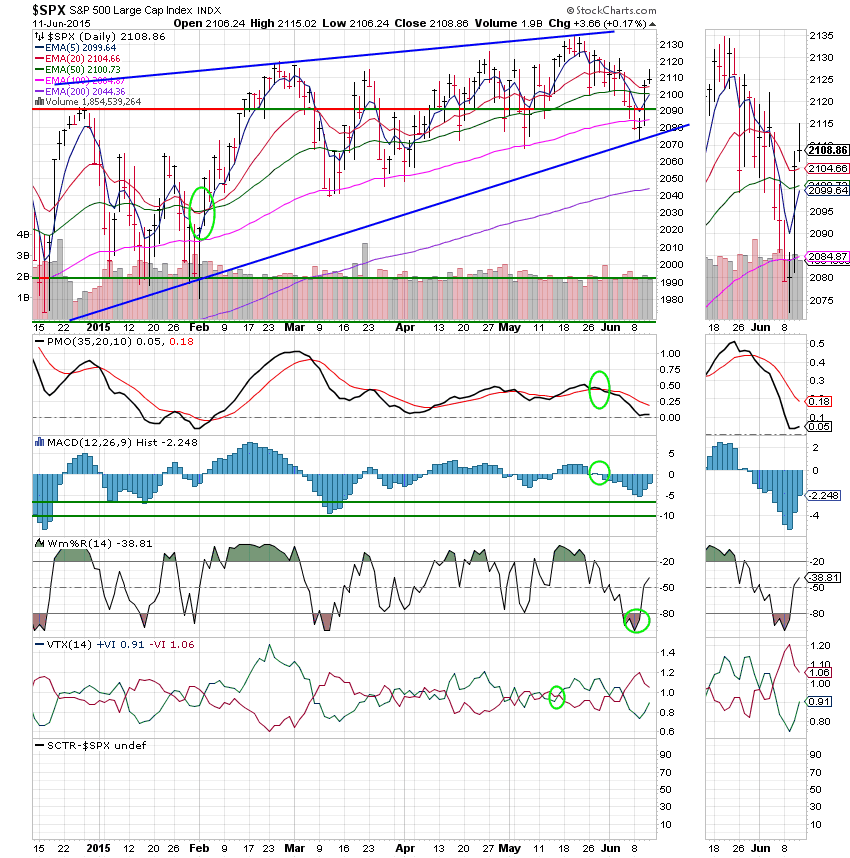

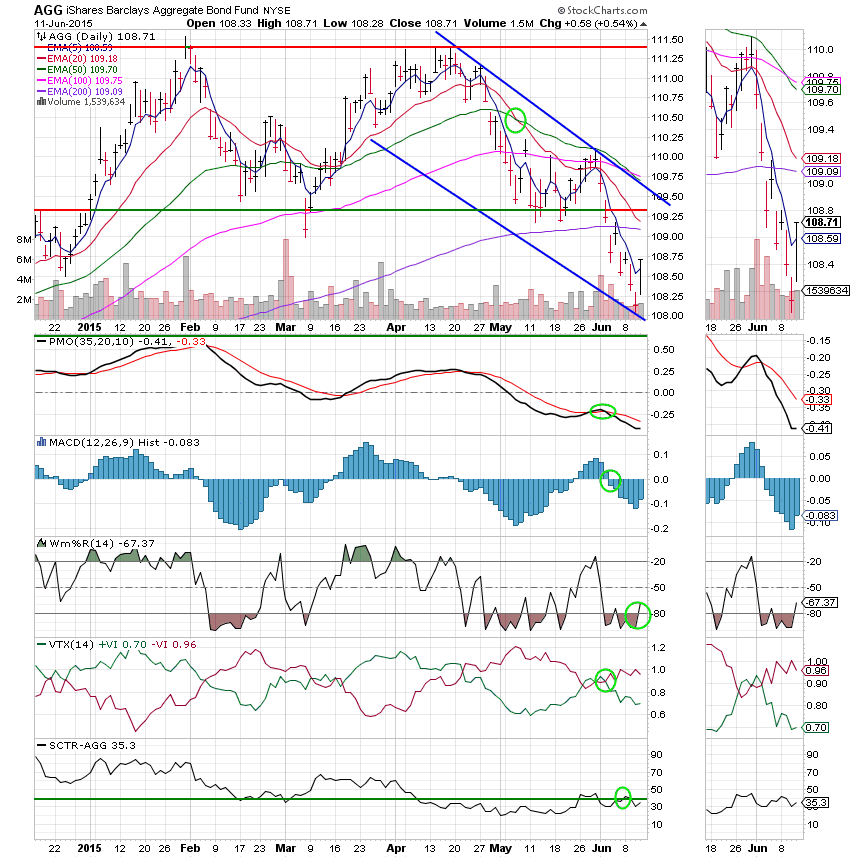

Lets take a look at the charts. (All signals are annotated with green circles)

C Fund: The C Fund held pretty steady on the day with price again closing above it’s 20 EMA.

S Fund: The S Fund generated a buy signal today when the PMO, MAC D, and VTX all moved into positive configurations. Resistance looms ahead at 94. If this fund is going to make any progress it will have to crack this resistance.

I Fund: The I Fund repaired some more technical damage today when price close above resistance at 66.70 and above it’s 20 EMA.

F Fund: Price made a big gain of +0.54% today. Bond prices in general were driven up as foreign investors flocked to the safety of US debt in response to the Greek situation. The Williams %R whipsawed back into a positive configuration. However, given the way it has been behaving of late, I’m not sure how much trust we can put in this signal. I don’t think we’ve found the long term bottom here just yet.

We remain in the same old trading range, but I’ll take today’s gain and be happy with it. So far so good! Thank God for His guidance in this tricky market! Give Him all the praise! That’s all for tonight. Have a nice evening and I’ll see you tomoorow.