Good Evening, Greece Strikes again. I continues to amaze me how a country with an economy no bigger than Procter and Gamble can have so much sway on world markets. One day everyone will wake up and figure out that Greece is not such a big deal after all! Really all we can do is focus on the price action. There’s no use in trying to forecast or predict anything. At this point all eyes remain on Greece and on the FED. Especially on the FED as next weeks meeting is the last meeting before September when most folks including myself think that they will raise rates. If and when they do, it will be the first time in a decade that they have done so. Encouraging economic news today will likely spur the Fed to move. It’s Friday and I have places to go and things to and I’m sure you do as well so you can read about the economic news in the link below. Today was just more of the choppy action that we have been discussing. It’s not likely to improve any time soon. The bottom line is that this market is in need of a reset (correction) …………

The days selling left us just about where we started the week which is not surprising since we have now been in the same trading zone for months. Here are the day’s results: Our TSP allotment dropped -0.638%. For comparison the Dow fell back -0.78%, the Nasdaq -0.62%, and the S&P 500 -0.70%. We finished the week with slightly more than we started it with. I thank God for that!

Wall Street falls as Greece crisis unresolved; energy shares dip

The weeks action left us with the following signals: C-Neutral, S-Buy, I-Neutral, and F Buy. We are currently invested at 29/C, 37/S, 34/I. Our allocation is now +4.90% on the year not including today’s results. Here are the latest posted results:

| 06/11/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.741 | 16.7764 | 28.0973 | 38.7938 | 26.5164 |

| $ Change | 0.0008 | 0.0763 | 0.0568 | 0.1326 | 0.0473 |

| % Change day | +0.01% | +0.46% | +0.20% | +0.34% | +0.18% |

| % Change week | +0.03% | +0.08% | +0.82% | +0.55% | +1.65% |

| % Change month | +0.06% | -1.27% | +0.17% | +1.10% | -0.09% |

| % Change year | +0.85% | -0.15% | +3.43% | +6.88% | +9.49% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7543 | 23.6629 | 25.8206 | 27.5931 | 15.7327 |

| $ Change | 0.0134 | 0.0326 | 0.0447 | 0.0546 | 0.0335 |

| % Change day | +0.08% | +0.14% | +0.17% | +0.20% | +0.21% |

| % Change week | +0.23% | +0.54% | +0.68% | +0.76% | +0.87% |

| % Change month | +0.02% | +0.09% | +0.12% | +0.16% | +0.20% |

| % Change year | +1.74% | +3.34% | +4.09% | +4.60% | +5.18% |

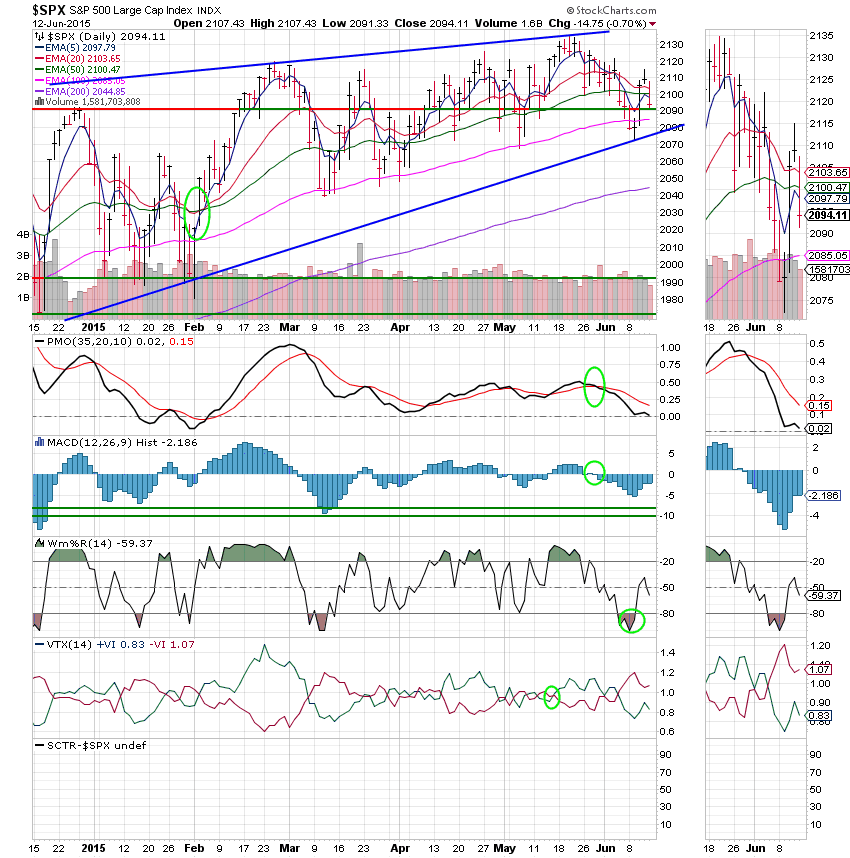

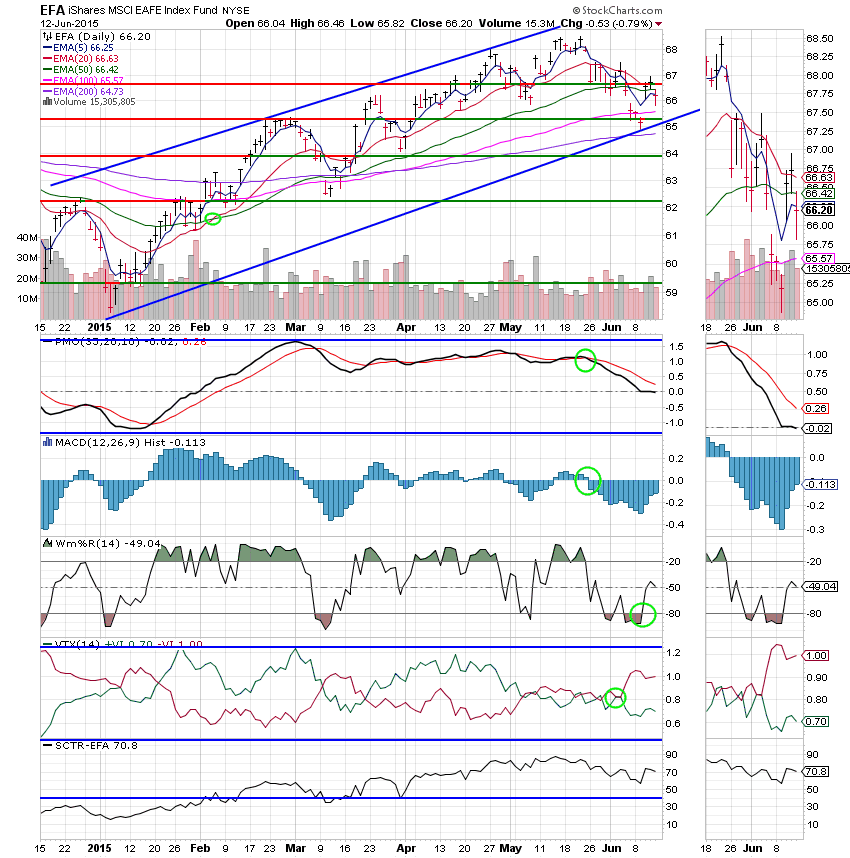

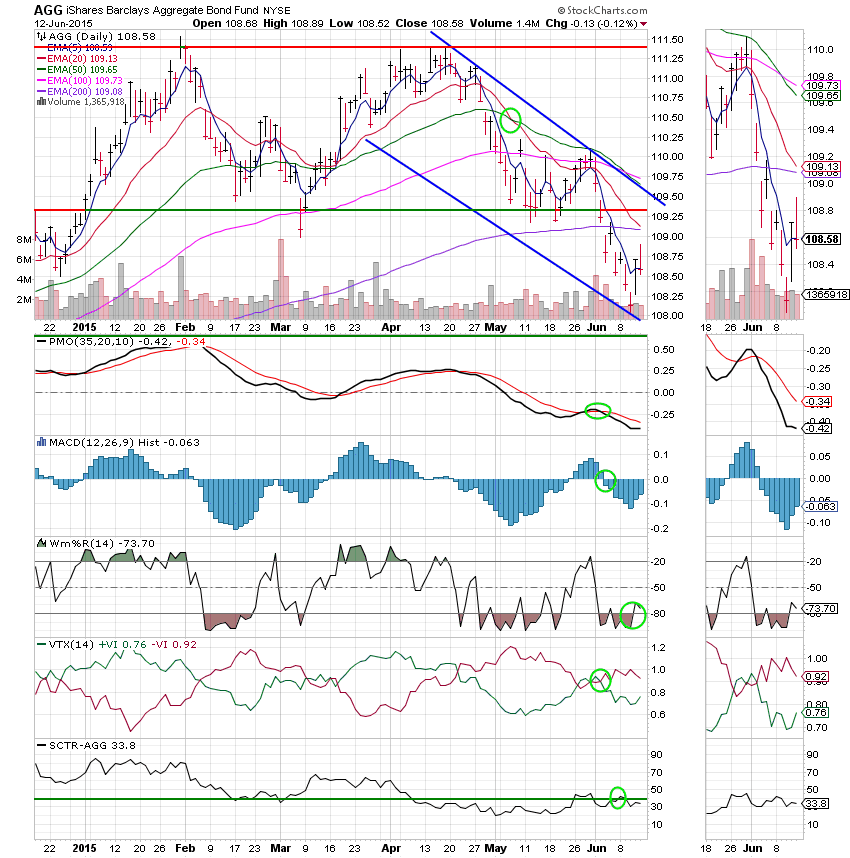

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: Price dropped back below the 50 EMA but remains above support at 2090. We will watch to see it this support holds.

S Fund: The S Fund is the place to be right now. Price held above it’s 5 EMA and all indicators with the exception of the VTX remain in positive configurations. The VTX has been whipsawing back and forth and is likely to cross back to a bullish signal with the next positive price action.

I Fund: Price dropped back below support and below the 20 EMA. The I Fund as the market seems unsure of which direction it wants to go.

F Fund: Price remains planted in the middle of the descending channel. Of particular concern is the 20 EMA which is approaching a negative crossover of the 200 EMA. This crossover looks immanent and is considered extremely bearish!

There was a lot of smoke, but only a little fire this week. Get use to it. There’s likely more of the same to come. We have the FOMC meeting next week. Maybe that will shake things up! That’s all for tonight. May God continue to bless your trades. Give Him all the Praise!