Good Evening, The market was spurred by a deal with Iran? Oil went up after a deal with Iran??? Strange but it works for me. There were a lot of investors sitting on the sidelines with pockets full of cash after the Greek situation and they were anxious to put it to work. They invited an old friend that hasn’t been around in a while for the ride. The V-shaped bounce has returned and he had the shorts covering and the under invested bulls scrambling. We’ll check the charts in a minute to see it we should get involved. One things for sure, it is advisable to tread lightly tomorrow as the Greeks Parliament will have to approve the austerity measures that the EU is trying to shove down their throats. Will they say uncle??? That’s anybodies guess.

Today’s action left us with the following results: Our TSP allotment added +0.17%. For comparison the Dow gained +0.42%, the Nasdaq +0.66%, and the S&P 500 +0.45%. I thank God for the gains in TSP and on the street.

Wall St. notches fourth straight advance as energy gains

The days action left us with the following signals: C-Neutral, S-Sell, I-Neutral, F-Neutral. We are currently invested at 100/F. Our allocation is now +1.21% on the year not including the days results. Here are the latest posted results:

| 07/13/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7683 | 16.7563 | 28.0154 | 38.4561 | 26.088 |

| $ Change | 0.0028 | -0.0017 | 0.3094 | 0.3775 | 0.1507 |

| % Change day | +0.02% | -0.01% | +1.12% | +0.99% | +0.58% |

| % Change week | +0.02% | -0.01% | +1.12% | +0.99% | +0.58% |

| % Change month | +0.08% | -0.32% | +1.84% | +0.94% | +1.13% |

| % Change year | +1.04% | -0.27% | +3.13% | +5.95% | +7.72% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7551 | 23.5943 | 25.708 | 27.4453 | 15.631 |

| $ Change | 0.0369 | 0.1125 | 0.1575 | 0.1935 | 0.1233 |

| % Change day | +0.21% | +0.48% | +0.62% | +0.71% | +0.80% |

| % Change week | +0.21% | +0.48% | +0.62% | +0.71% | +0.80% |

| % Change month | +0.35% | +0.78% | +0.98% | +1.10% | +1.24% |

| % Change year | +1.74% | +3.04% | +3.64% | +4.04% | +4.50% |

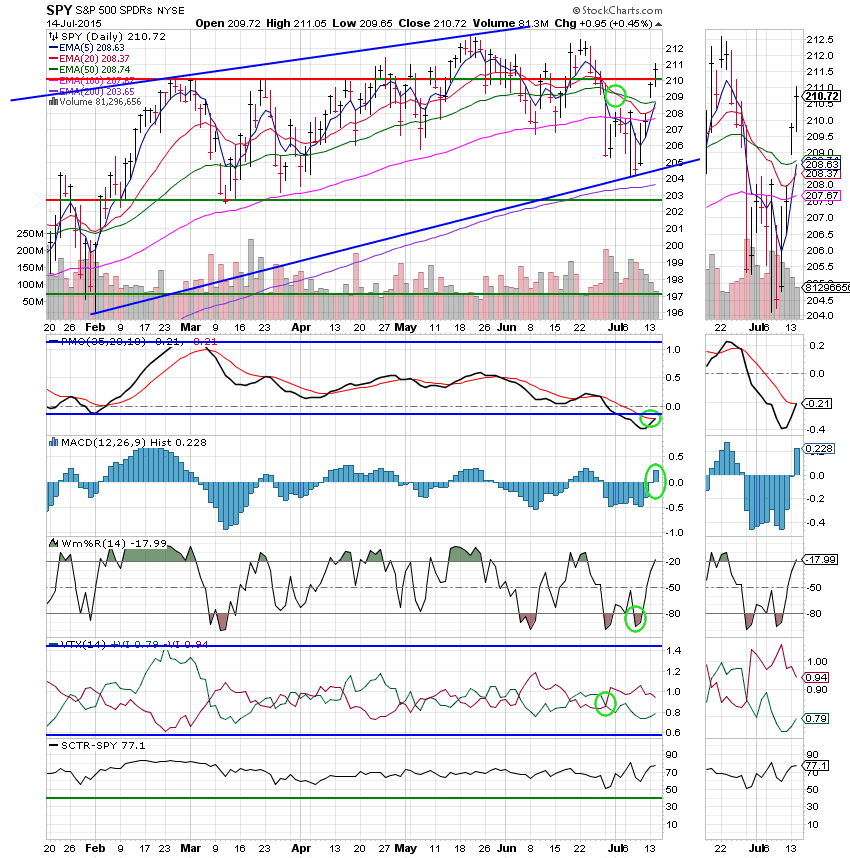

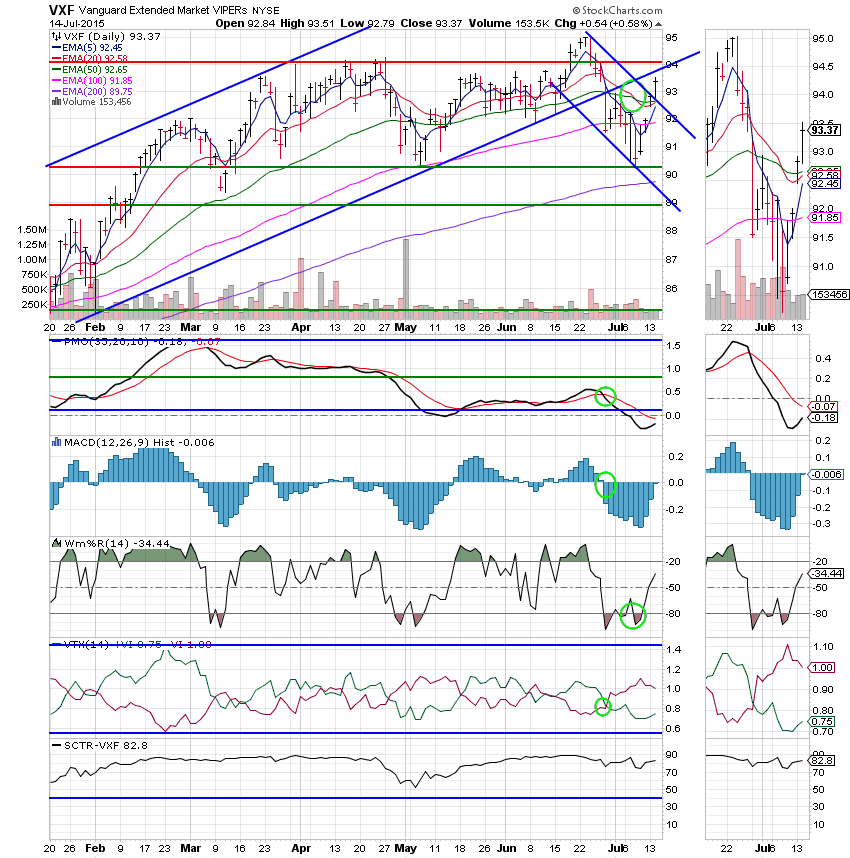

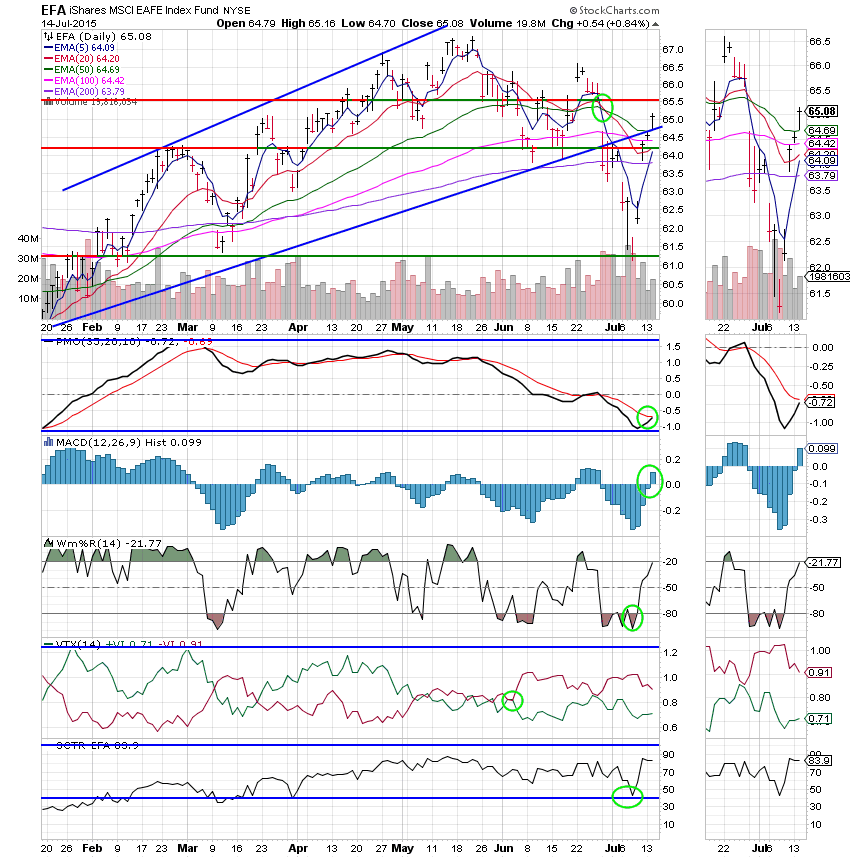

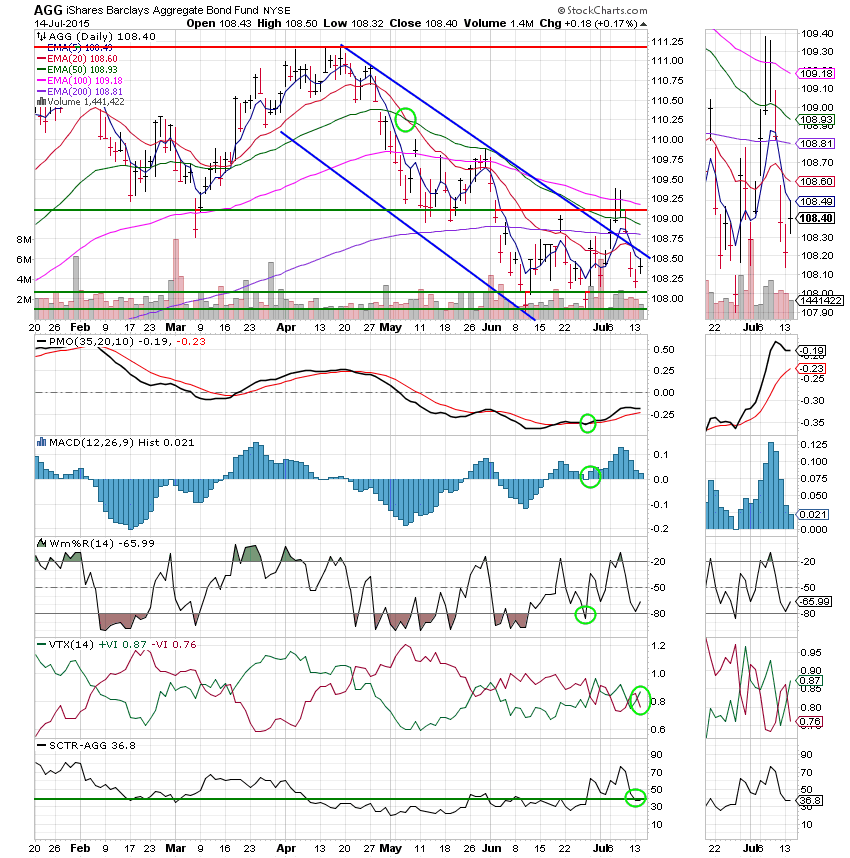

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: Now that’s a V pattern if I’ve ever seen one. Price blew right through resistance at 210 and the 5 EMA is threatening to passe through the 50. The PMO and MAC D both turned positive.

S Fund: This one still has a little work to do. However, it didn’t get in as bad a shape as the others. The 5 and 20 EMA’s are both close to passing through the 50.

I Fund: If you can’t see the V pattern on this one then your blind! Straight up. No question about it. Price has now regained the lower trend line and the 5 EMA is threatening to pass through the 20. The PMO and MAC D both went positive. This one has the most damage to repair, but it’s making great progress!

F Fund: Support at 108.10 continues to hold. Should stocks have a bad day when the Greeks vote tomorrow, the F Fund might be a nice place to be.

Once we get this Greek crisis truly behind us and the 5 EMA passes up through the 50 EMA on our equity based charts then we’ll jump back into equities. That’s all for tonight. May God continue to bless our trades!