Good Evening, First of all I want to apologize for any difficulties you had with our website. It has down off and on for the past two days. I was unable to post during that time myself. Anytime that there are difficulties with the site you can always catch up with the news on our Facebook page. Be advised that I will always make you aware of any allocation changes there in the event that our website is down. On with today’s market. The Fed released it’s statement and to no one’s surprise left interest rates unchanged. Although the market loves to love the Fed, the announcement wasn’t enough to overcome the United Kingdom’s impending vote on whether or not to remain in the European Union. Many say that a Brexit (that’s what it’s commonly referred to) would have negative implications on the world market. I think that the current market is selling off on uncertainty which it hates. However, one has to ask if there might not be some positive effects for the market in the US when so much money will leave the British market and come here? Just a thought. I’m just wondering out loud if this Brexit thing might be a little over done. For that reason, I’m not ready to head for the hills just yet. Nevertheless, the market did end up selling off this afternoon. The ride will likely be a bumpy one ahead of next Thursday’s vote. We’ll see what happens then. I really don’t think Britain will leave the EU and if I’m right we could be setting up for a very nice relief rally…….If not, we may have to sell. Nobody said the stock market is risk free!

The days trading left us with the following results: Our TSP allotment outperformed the market with a small gain of +0.25%. For comparison, the Dow dropped -0.20%, the Nasdaq -0.18%,and the S&P -0.18%. Praise God for another good day!

Wall Street Loses Gains After Fed’s Unsurprising June Call

The days trading left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/S. Our allocation is now +4.18% on the year not including the days gains. Here are the latest posted results:

| 06/14/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.042 | 17.7468 | 28.2868 | 35.9079 | 22.7745 |

| $ Change | 0.0008 | -0.0070 | -0.0489 | -0.1188 | -0.3564 |

| % Change day | +0.01% | -0.04% | -0.17% | -0.33% | -1.54% |

| % Change week | +0.02% | +0.04% | -0.95% | -1.27% | -3.11% |

| % Change month | +0.07% | +1.00% | -0.93% | -0.91% | -5.37% |

| % Change year | +0.85% | +4.67% | +2.63% | +1.91% | -5.48% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9531 | 23.3941 | 25.2318 | 26.7199 | 15.0815 |

| $ Change | -0.0213 | -0.0641 | -0.0977 | -0.1209 | -0.0777 |

| % Change day | -0.12% | -0.27% | -0.39% | -0.45% | -0.51% |

| % Change week | -0.31% | -0.73% | -1.04% | -1.22% | -1.39% |

| % Change month | -0.34% | -0.93% | -1.36% | -1.61% | -1.86% |

| % Change year | +1.01% | +0.80% | +0.67% | +0.56% | +0.37% |

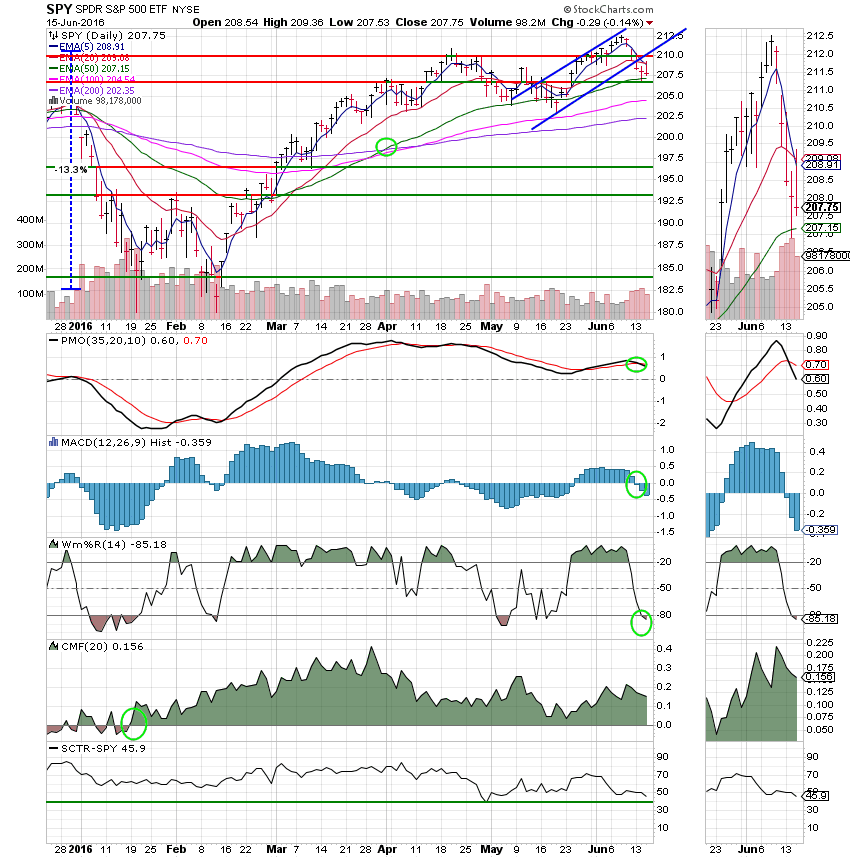

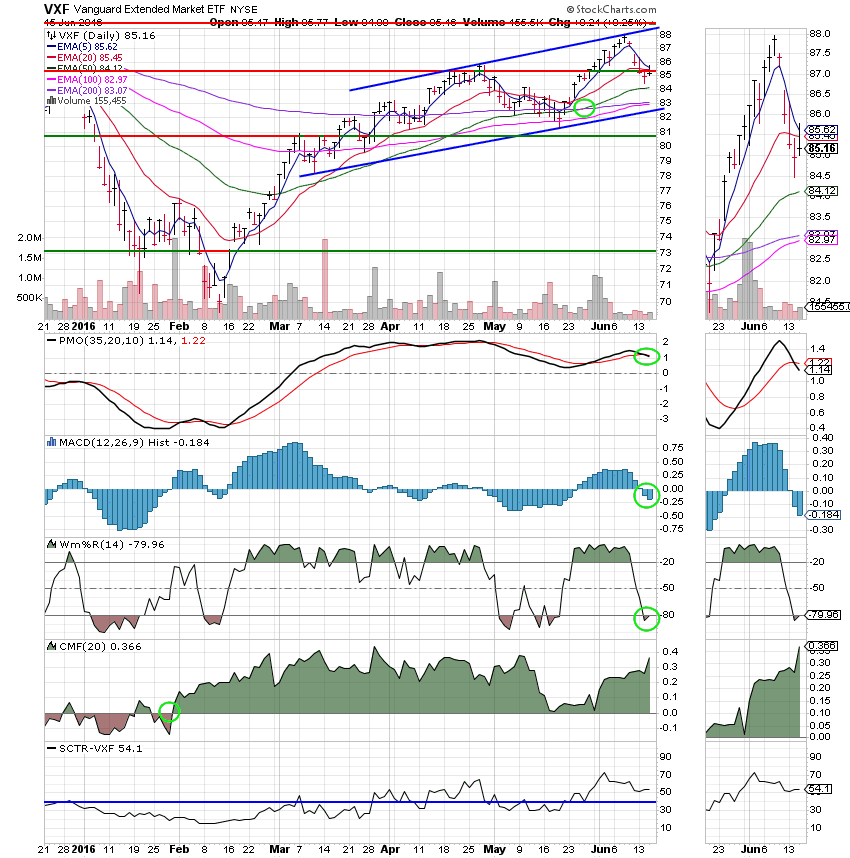

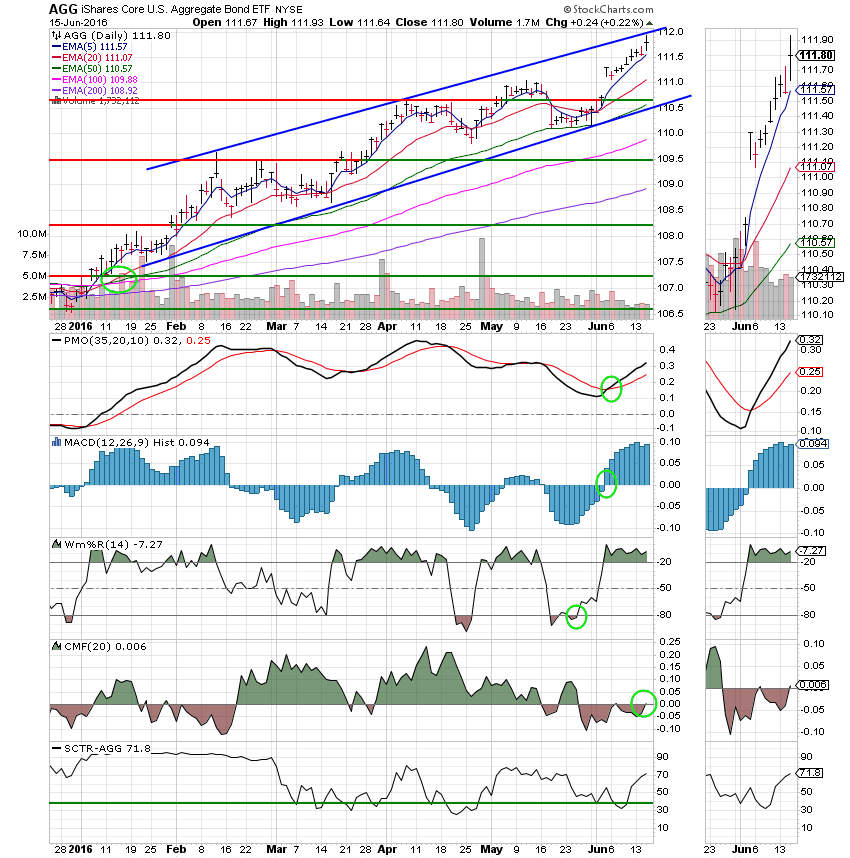

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund: Price is trading at resistance at around 85.50. It still remains within the ascending channel. So while the uptrend has a little pressure, it’s still in place and that’s why we’re still invested.

I Fund:

F Fund: This is a safe place to invest as long as the interest rates don’t rise. It’s a strong buy with an SCTR that has improved to 71.8.

For now we’ll keep a close eye on the S Fund. There’s a little stress there, but at the present we’re still in an uptrend! That’s all for now. Have a nice evening and may God continue to bless your trades!