Good Evening, The polls have now closed in Britain so the Brexit vote is now complete. The market decided to price in a victory for the stay camp with a big rally today. However, Mr. Market has been wrong before and he could be wrong again. While exit polls are not allowed in Britain several financial institutions hired pollsters to conduct their own private polls on whether the stay or the go voters will prevail. The results today tilted slightly toward the stay crowd, but those results were within the margin of error allowed by the polls. In other words the vote was too close to call definitively one way or the other. The final results won’t be known until midnight tonight. Wouldn’t it be interesting if we woke up tomorrow morning to news that Britain was leaving the EU? I don’t think that will be the case, but like I said, the market has been wrong before and it could be wrong again. Just think back to the summer before last when the market priced in a balanced buget and when congress failed to pass one it resulted in a sizeable selloff. One more thing to consider when trying to predict what might happen tomorrow is have you considered a possible sell the news reaction. You ask, is that when the market sells based on a piece of news? It must mean bad news then right?? Well not exactly, the phenomenon referred to as a sell the news reaction actually occurs when the market prices in an event before it happens and then sells off once the event takes place. Take today for instance, investors that made a nice profit during today’s rally would sell to take their profits once the news is announced tomorrow. The average bystander would ask why they were selling when the news was good. Well they sold because they actually made their profits before the news event, not the day of the event. Thus, it is termed a sell the news reaction. That could easily take place tomorrow. However, sell the news reactions are not as common as they once were due to high speed computer trading that seeks to take advantage of trader emotions. The bottom line is this. Nobody really knows what is going to happen and even if they do they can’t be certain how the market will react. That is why I prefer to be a reactive investor and trade the action as it unfolds before me.

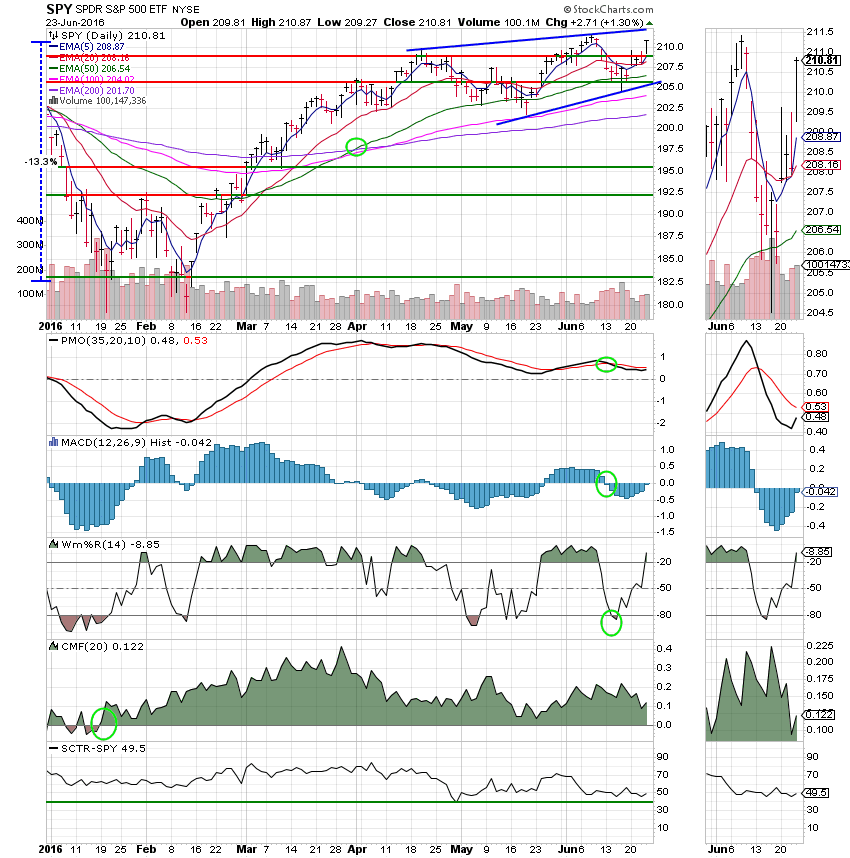

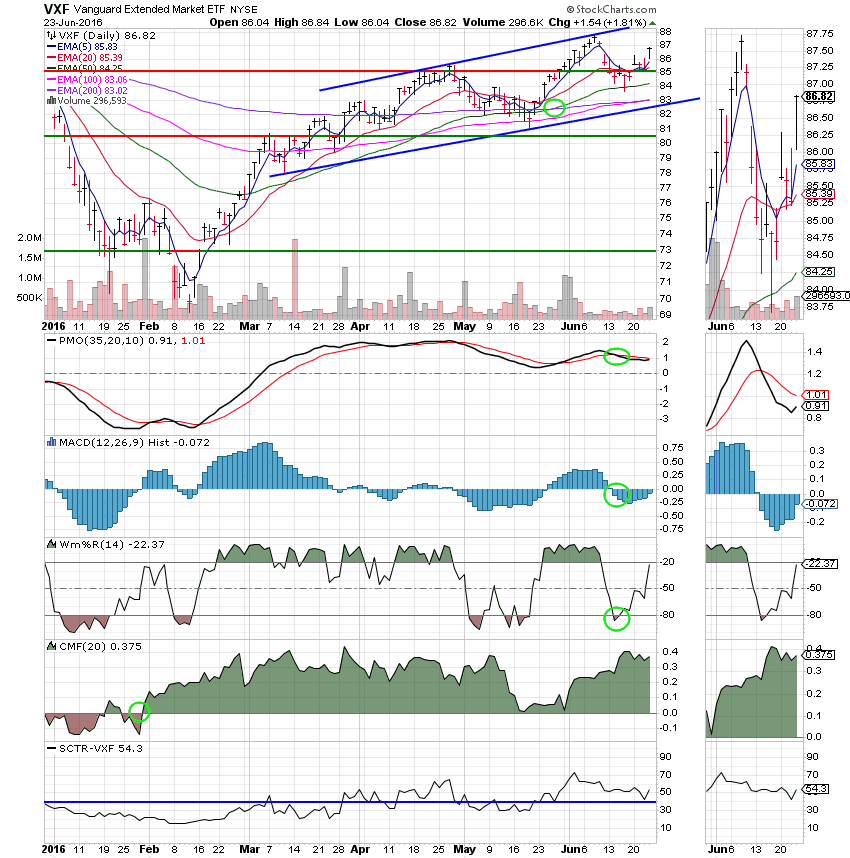

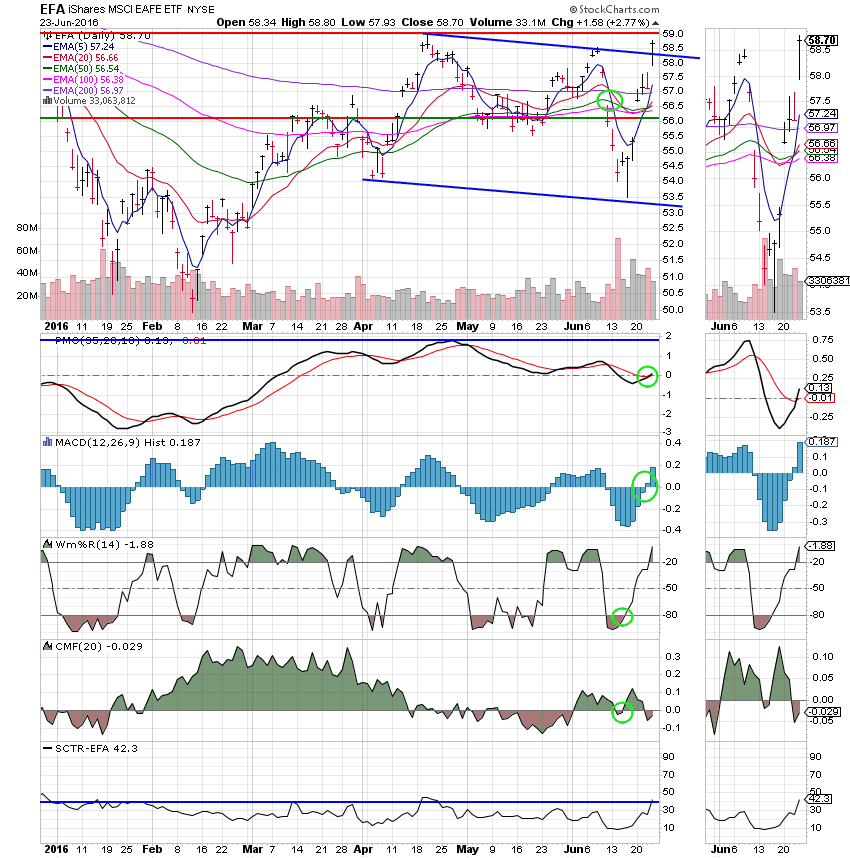

Today’s rally left us with the following results: Our TSP allotment outperformed the market with a nice gain of +1.81%. For comparison, the Dow added +1.29%, the Nasdaq +1.59%, and the S&P 500 +1.34%. Thank God for another great day!

Wall St. bets on Britain staying in EU; stocks rally

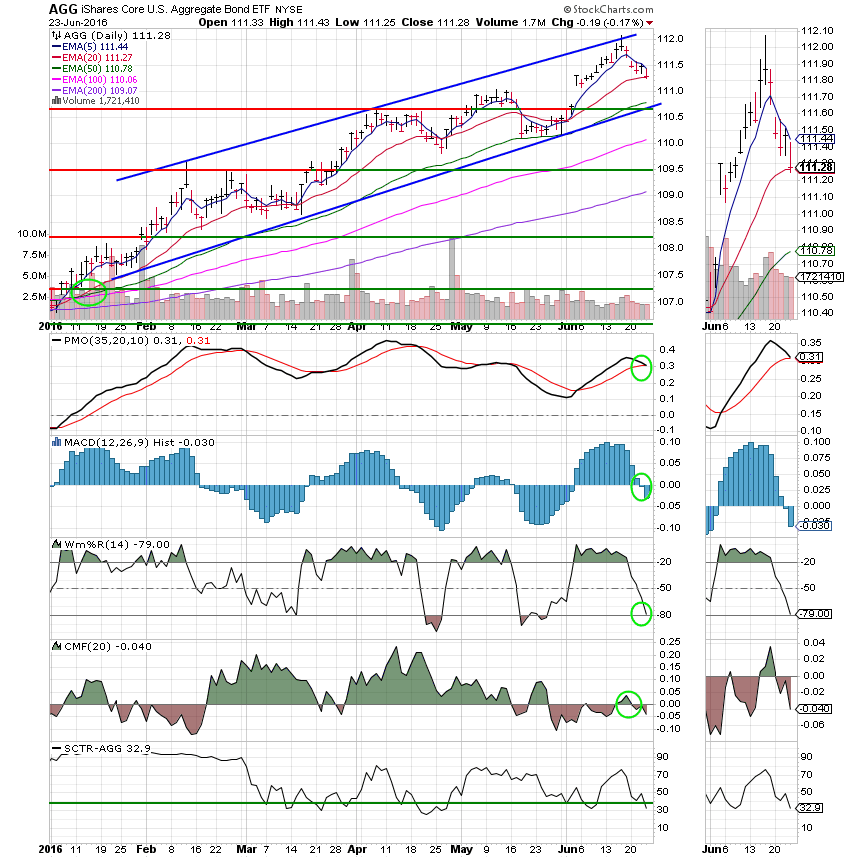

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allotment is now +4.80% on the year not including the days gains. Here are the latest posted results:

| 06/22/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0481 | 17.7206 | 28.435 | 36.1225 | 24.0214 |

| $ Change | 0.0007 | 0.0094 | -0.0467 | -0.1255 | 0.0362 |

| % Change day | +0.00% | +0.05% | -0.16% | -0.35% | +0.15% |

| % Change week | +0.03% | -0.17% | +0.70% | +0.62% | +4.19% |

| % Change month | +0.11% | +0.86% | -0.41% | -0.32% | -0.19% |

| % Change year | +0.89% | +4.52% | +3.17% | +2.52% | -0.31% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 18.0289 | 23.6105 | 25.5564 | 27.1187 | 15.3369 |

| $ Change | -0.0022 | -0.0091 | -0.0149 | -0.0190 | -0.0127 |

| % Change day | -0.01% | -0.04% | -0.06% | -0.07% | -0.08% |

| % Change week | +0.36% | +0.79% | +1.11% | +1.29% | +1.46% |

| % Change month | +0.09% | -0.02% | -0.09% | -0.14% | -0.20% |

| % Change year | +1.44% | +1.73% | +1.97% | +2.06% | +2.07% |