Good Evening, News came out that the negotiations between Greece and it’s creditors is going badly again so the market sold off, again….. Greece has until June 30th to come up with a deal before it defaults in it’s payments to the IMF. Most investors believe that a deal will be struck, but their patience is starting to wear thin which was clearly evident in today’s sell off. We are all tired of being held hostage by a second tier country. When will this end????

The day’s selling left us with the following results: Our TSP allotment dropped -0.908%. For comparison, the Dow lost -0.98%, the Nasdaq -0.74%, and the S&P 500 -0.74%.

Wall Street ends broadly lower on Greek debt concerns

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 30/C, 70/S. We’ll check the balance of our allotment tomorrow. That is, if there is a such thing as being in balance in a market like this one! Our allocation is now +5.83% on the year not including the days results. Here are the latest posted results.

| 06/23/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7507 | 16.7507 | 28.3116 | 39.3314 | 26.8639 |

| $ Change | 0.0008 | -0.0343 | 0.0206 | 0.0797 | -0.0416 |

| % Change day | +0.01% | -0.20% | +0.07% | +0.20% | -0.15% |

| % Change week | +0.02% | -0.62% | +0.68% | +0.71% | +1.97% |

| % Change month | +0.13% | -1.42% | +0.93% | +2.51% | +1.22% |

| % Change year | +0.92% | -0.30% | +4.22% | +8.36% | +10.92% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7969 | 23.7911 | 25.9991 | 27.813 | 15.875 |

| $ Change | -0.0002 | 0.0010 | 0.0023 | 0.0045 | 0.0031 |

| % Change day | +0.00% | +0.00% | +0.01% | +0.02% | +0.02% |

| % Change week | +0.18% | +0.52% | +0.66% | +0.76% | +0.88% |

| % Change month | +0.26% | +0.63% | +0.81% | +0.96% | +1.10% |

| % Change year | +1.98% | +3.90% | +4.81% | +5.44% | +6.13% |

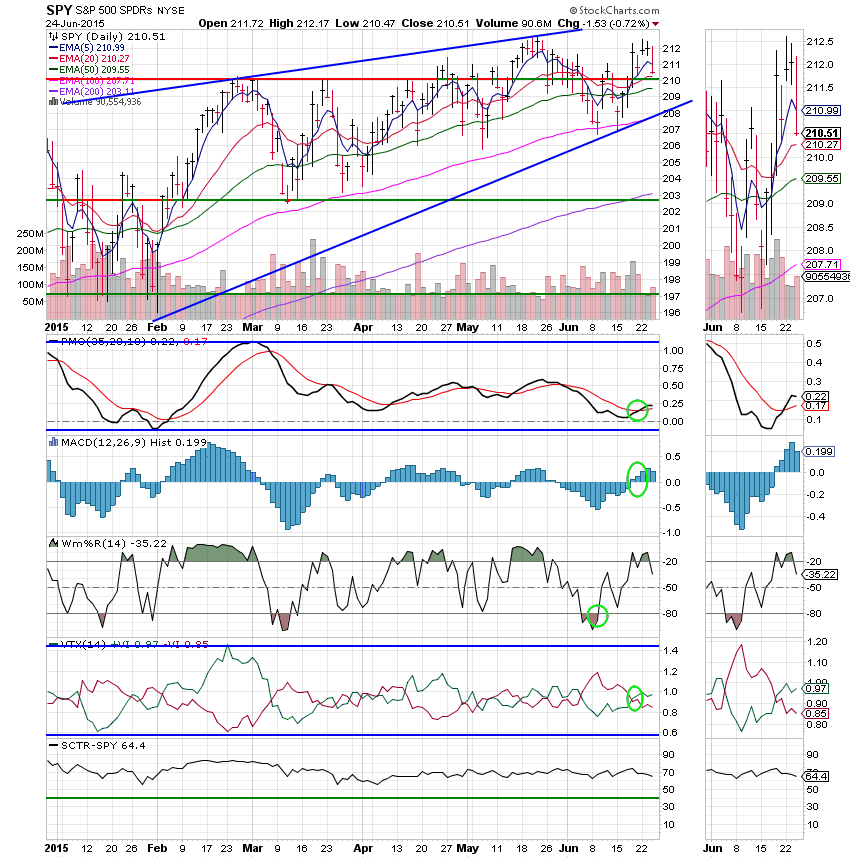

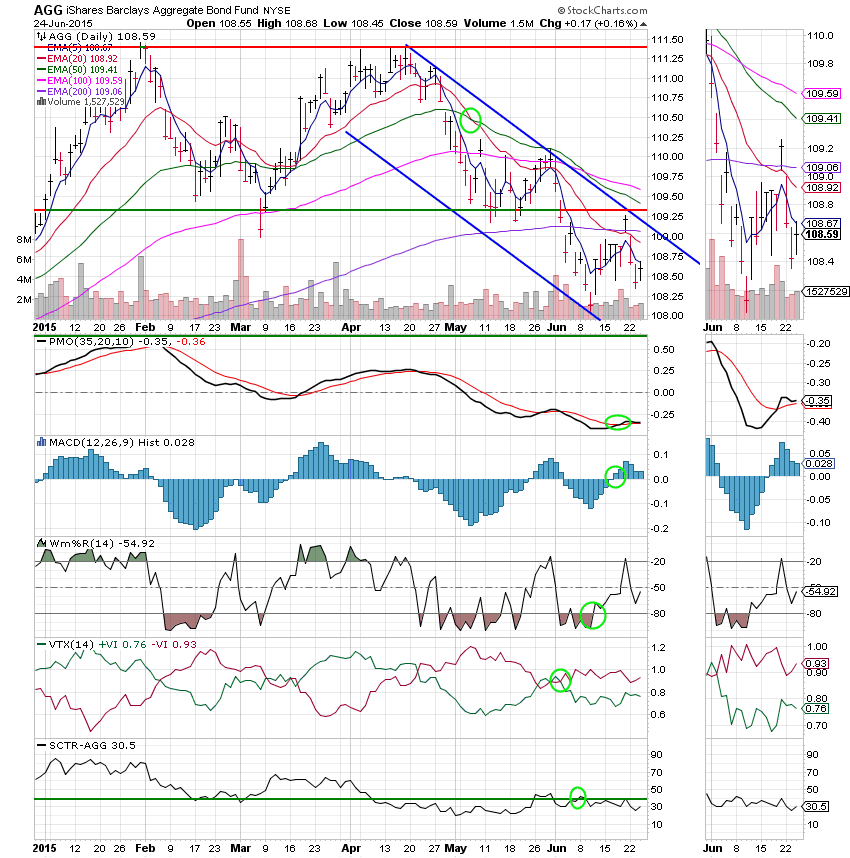

Lets take a look at the charts. (All signals annotated with Green Circles)

C Fund: Price remains in the same trading range just above support at a little over 210. This one’s still a buy.

S Fund: Price closed right on support at 94. We’ll see if support holds during tomorrows session. This one’s still a buy.

I Fund: As with our other equity based funds, price closed just above support at 66.70. The PMO is in danger of whipsawing back into a negative configuration. This one is still a buy for now.

F Fund: As expected, bonds got a little pop today as stocks were sold. However, price remains in the middle of a descending channel. The F Fund is in a clear down trend. This one is still a solid sell.

I know the majority of traders are very tired of being held hostage by the small country of Greece. I expect we’ll have a market moving piece of new in the next three days. I’m just not sure in which direction that move will be…. I’m going to keep praying that our Heavenly Father will guide our hand. Sooner or later this thing is going to sell off. Could this be the catalyst? I don’t think so, but one never knows. We’ll just keep an eye on the charts and play the action that we see before us. That’s all for tonight. Have a great evening and we’ll do it again tomorrow.