Good Evening, Today’s end of the quarter window dressing along with the re-balancing of the Russell counteracted negative sentiment over the lack of a deal between Greece and the EU leaving the market with modest losses on the day. To sum up the action in one sentence, the market continues to mark time while it is held hostage by the small insignificant country of Greece. We will likely gap up or gap down on Monday depending on how Saturday’s meeting between Greece and the EU goes. They say this is the last meeting, but this thing has been going on for five years. I’ll be pleasantly surprised if it is over, regardless of the outcome. If Greece leaves the Euro Zone, we’ll eventually recover. I believe it will not have the long term impact that many think it will. We will see.

The day’s trading left us with the following results: Our TSP allotment close slightly down at -0.075%. For comparison, the Dow gained +0.31%, the Nasdaq lost -0.62%, and the S&P 500 finished flat at -0.04%.

S&P 500 ends down week with flat session, semis fall

The weeks action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. As of the market close today we are invested at 30/C, 40/S, 30/I. Our allocation is now +4.61% on the year not including the days results. Here are the latest posted results:

| 06/25/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7523 | 16.7681 | 28.022 | 38.8572 | 26.7338 |

| $ Change | 0.0008 | -0.0157 | -0.0823 | -0.0798 | -0.0443 |

| % Change day | +0.01% | -0.09% | -0.29% | -0.20% | -0.17% |

| % Change week | +0.03% | -0.52% | -0.35% | -0.51% | +1.48% |

| % Change month | +0.14% | -1.31% | -0.10% | +1.27% | +0.73% |

| % Change year | +0.93% | -0.20% | +3.15% | +7.06% | +10.39% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7669 | 23.6868 | 25.8489 | 27.6245 | 15.7536 |

| $ Change | -0.0090 | -0.0292 | -0.0413 | -0.0508 | -0.0324 |

| % Change day | -0.05% | -0.12% | -0.16% | -0.18% | -0.21% |

| % Change week | +0.01% | +0.08% | +0.08% | +0.07% | +0.11% |

| % Change month | +0.09% | +0.19% | +0.23% | +0.28% | +0.33% |

| % Change year | +1.81% | +3.44% | +4.20% | +4.72% | +5.31% |

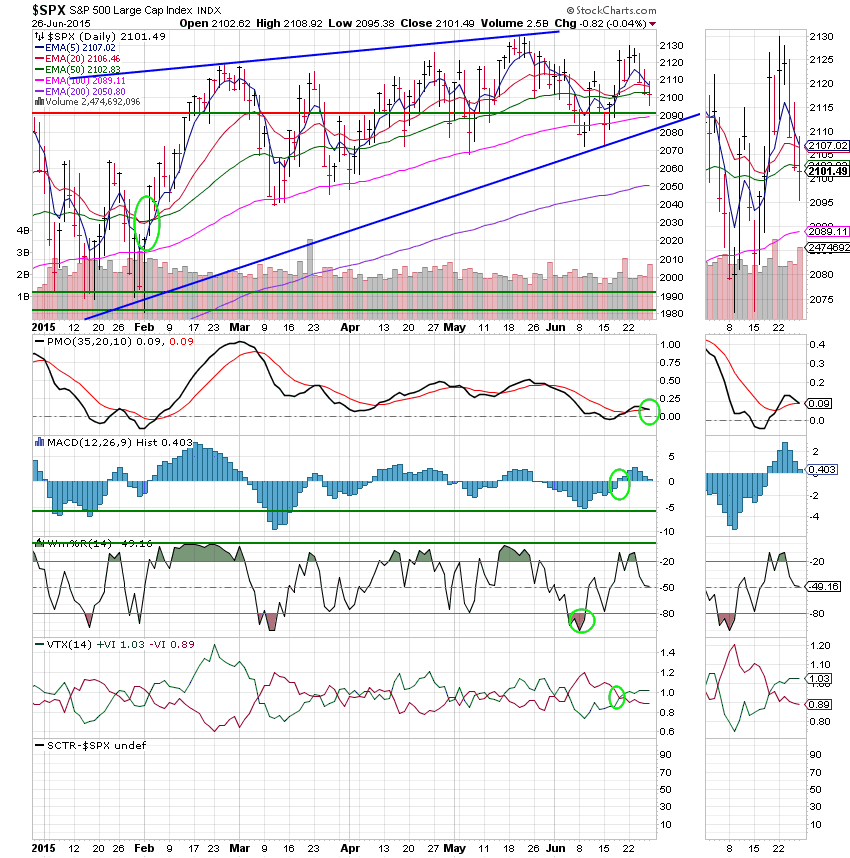

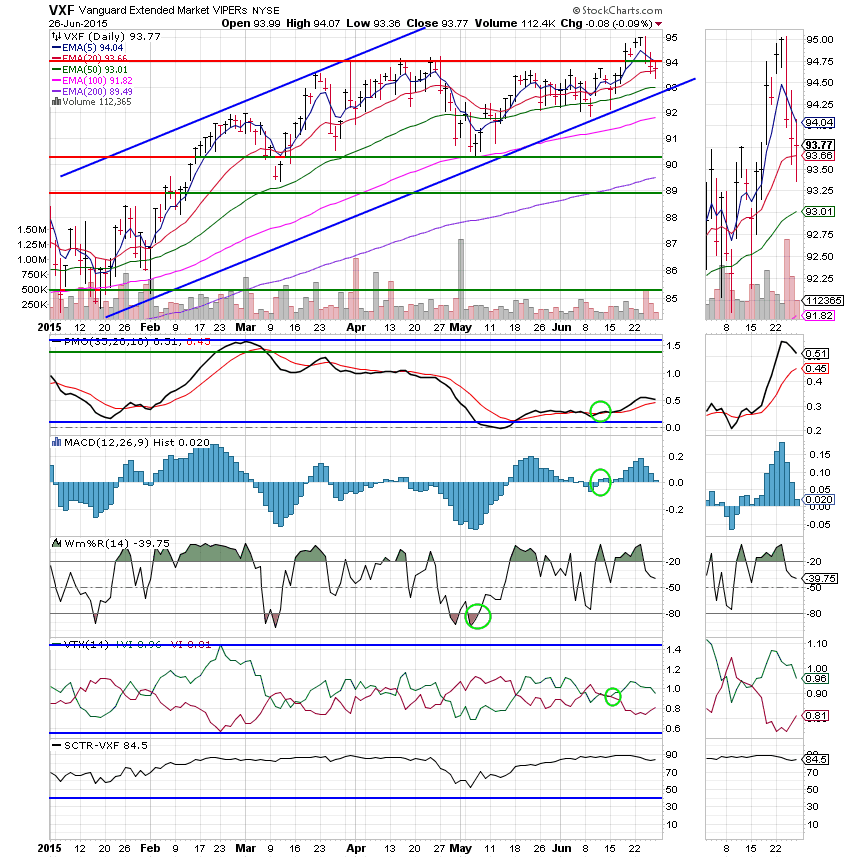

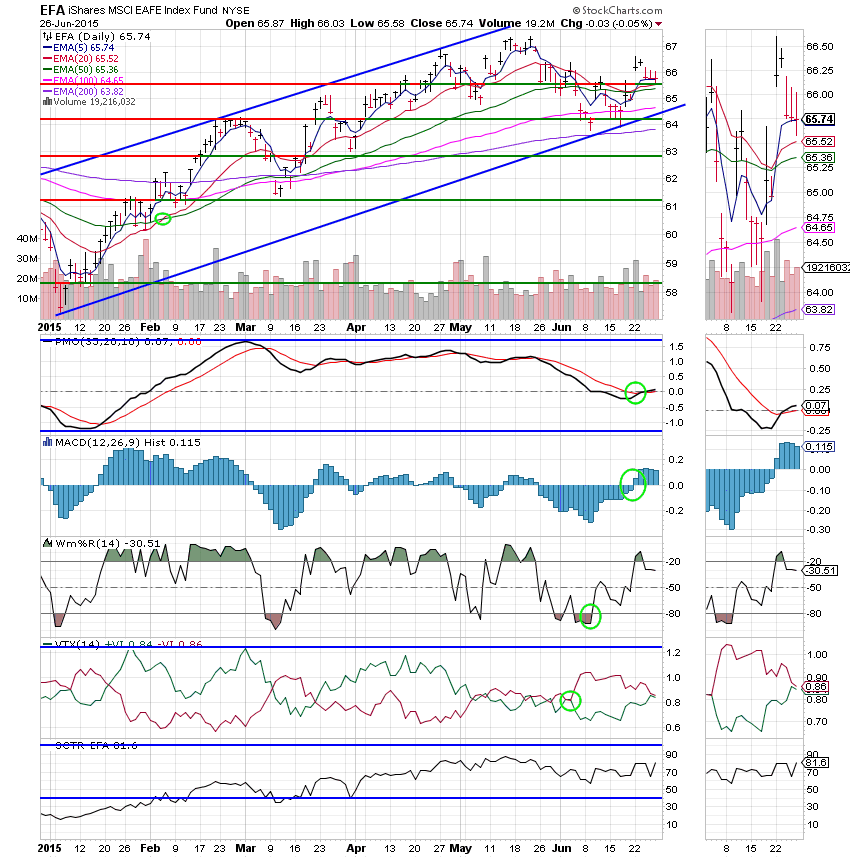

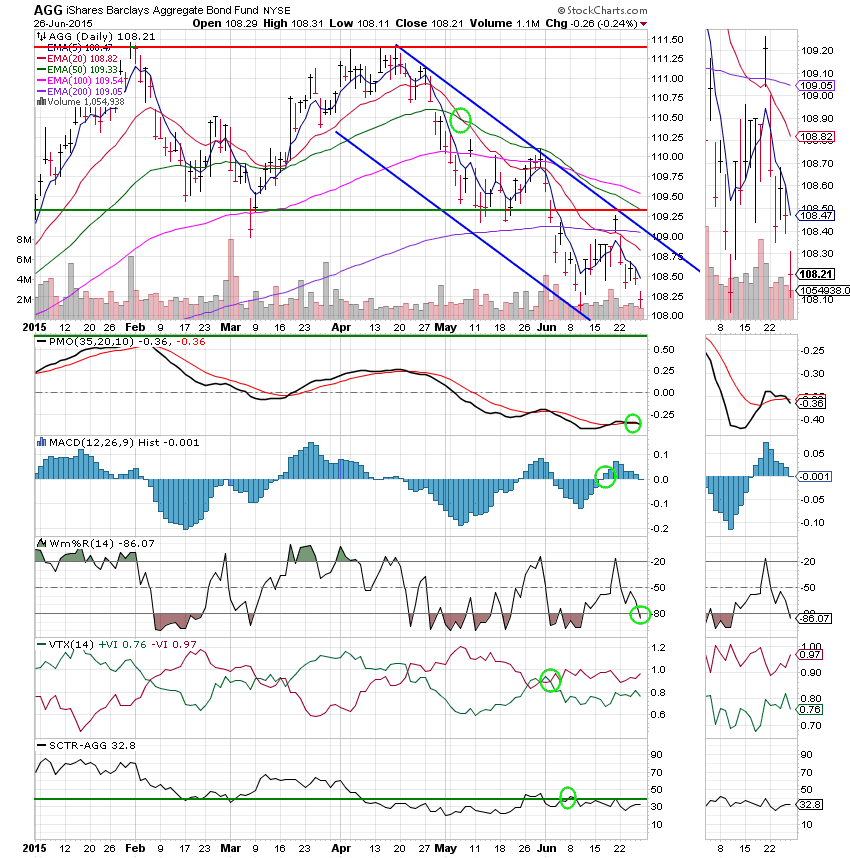

Lets take a look at the charts. (All signals annotated with Green Circles)

C Fund: Price finished the day just below the 50 EMA. The PMO made a cross through of it’s EMA and the MAC D is threatening to go negative. That would move the C Fund to an overall neutral signal. The PMO could easily whipsaw so I’m not sure how dependable that signal is.

S Fund: Price is still hanging around just above the 20 EMA. The remaining indicators are still positive but are weakening and could move the S Fund to Neutral in the coming week if conditions don’t improve.

I Fund: The I Fund tested resistance at 65.70 and again closed right on it’s 5 EMA. Right now, it is the strongest of our equity based funds and is primed to make a nice run with good news news out of Europe. We’re in good shape as long as support holds at 65.70. Should that break down, the next stop will likely be around 64.10.

F Fund: Price moved down the descending channel with today’s action and the MAC D moved into negative territory. I failed to mark that signal, but will do so for the next blog. This Fund is still on the slippery slope!

This market will probably resolve the current trading range with a big move one way or the other on Monday or Tuesday. Just watch the news about Greece over the weekend and you’ll have a pretty good idea where we are going. While your watching, don’t forget to pray for God’s guidance of our group! May He continue to bless our trades. Have a nice weekend. Go out and do something fun. None of us can change what Greece does so why worry about it. Our Heavenly Father’s with us regardless of the outcome! See you Monday.