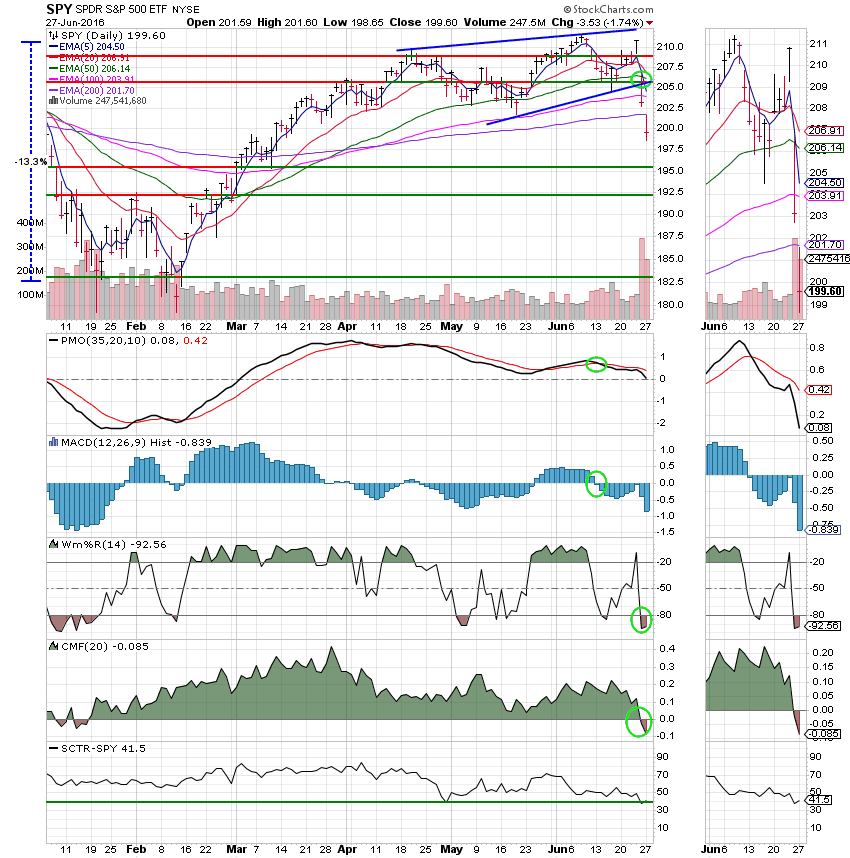

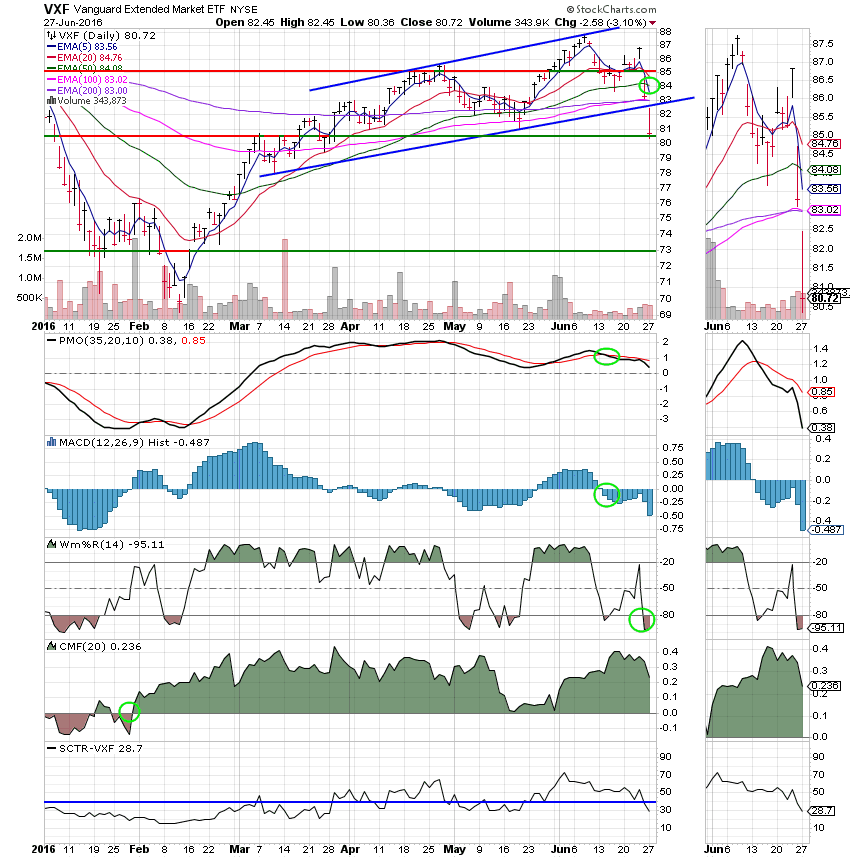

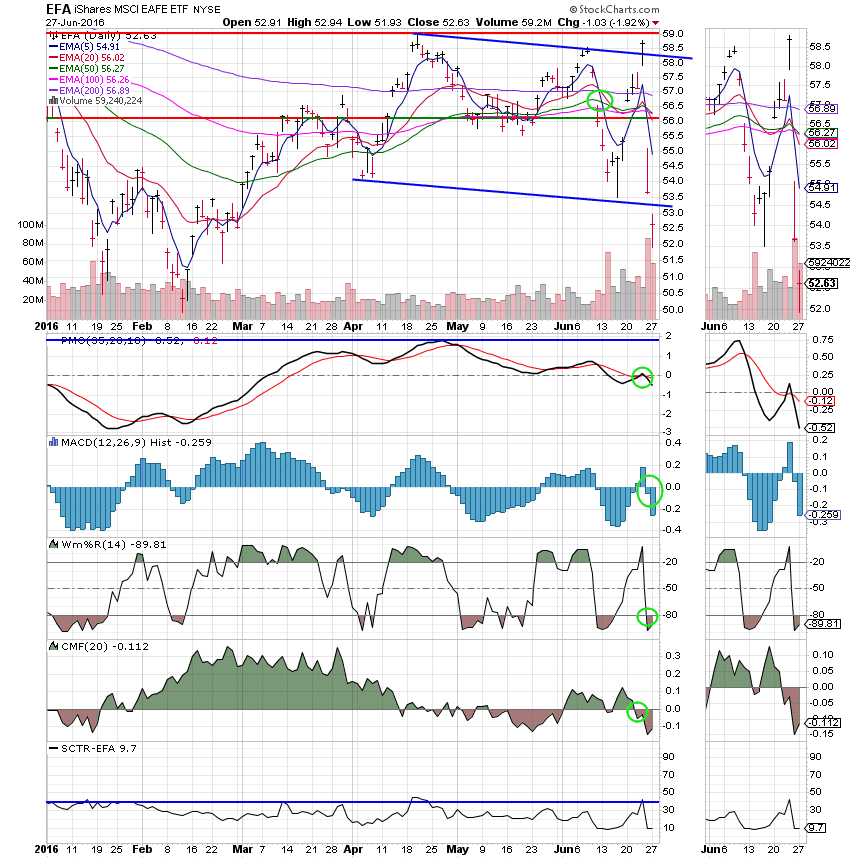

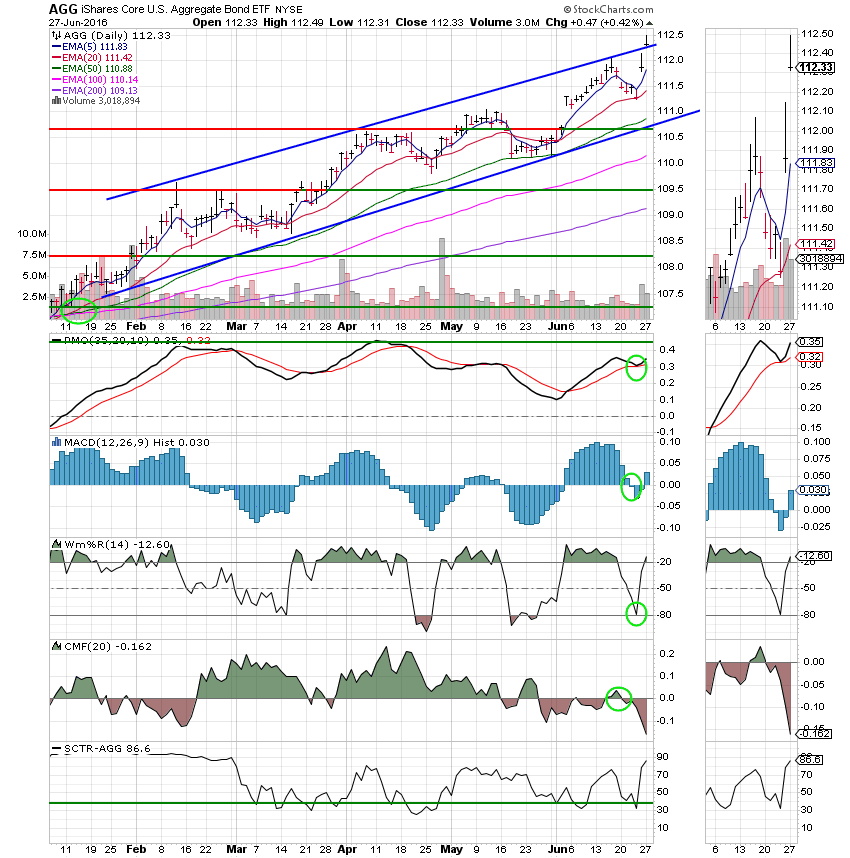

Good Evening, Day two post Brexit left us with follow through to Friday’s selling. No doubt about it, it was another ugly day. The Brexit effects were interesting. Some of them we anticipated and some we did not. The dollar strengthened which had a negative effect on commodities and multinational companies. The threat of an interest rate increase is now off the table for the foreseeable future. As a result of that and money starting to flow in from damaged world economies, bonds and high yielding stable stocks both considered safe havens are moving higher. Precious metals had a nice day during all the panic yesterday, but not so much today as a strong dollar started to put pressure on their rise. The bottom line is that the market has taken a downturn for the meantime as confirmed by our charts with sell signals in both the C and S Funds. The I fund was fried a few days ago!

The days selling left us with the following results: Our TSP allotment took a shot with a loss of -3.10%. No doubt about it, it was ugly. For comparison, the Dow dropped -1.50%, the Nasdaq -2.41%, and the S&P 500 -1.81%.

Stocks drop for second day after Brexit vote

The days action left us with the following signals: C-Sell, S-Sell (Which we did. Although I got my transfer request in late), I-Sell, F-Buy (Which we also did….). We are currently invested at 100/S, but have an interfund transfer in for 100/F that for you should be affective as of the close of business tomorrow. I spent so much time notifying everyone else of the change that I missed the 12:00PM deadline for my own transfer. That could be costly! Our allocation is now +2.43% for the year but that does not include today’s loss. That will put us in the red for the year. Here are the latest posted results:

| 06/24/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0497 | 17.7875 | 27.7791 | 35.3053 | 22.6615 |

| $ Change | 0.0008 | 0.1006 | -1.0364 | -1.4782 | -1.9385 |

| % Change day | +0.01% | +0.57% | -3.60% | -4.02% | -7.88% |

| % Change week | +0.04% | +0.21% | -1.62% | -1.66% | -1.71% |

| % Change month | +0.12% | +1.24% | -2.71% | -2.58% | -5.84% |

| % Change year | +0.90% | +4.91% | +0.79% | +0.20% | -5.95% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9151 | 23.2613 | 25.0229 | 26.459 | 14.912 |

| $ Change | -0.1747 | -0.5333 | -0.8146 | -1.0078 | -0.6496 |

| % Change day | -0.97% | -2.24% | -3.15% | -3.67% | -4.17% |

| % Change week | -0.28% | -0.70% | -1.00% | -1.18% | -1.35% |

| % Change month | -0.55% | -1.50% | -2.18% | -2.57% | -2.96% |

| % Change year | +0.80% | +0.23% | -0.16% | -0.42% | -0.76% |