Good Evening, Brexit fears subsided and the market rallied for a third straight day bringing stocks back to where they were at the beginning of the month. Even less than ten years ago a recovery like this would never have taken place. However, in recent years high speed computer trading has almost made it a regular occurrence. I keep thinking that eventually the bears will win one, but most of the time when they take defensive measures they end up with egg in their face. Unfortunately, that’s the price we must pay for insurance as we can’t afford to gamble with retirement money.

The days action left us with the following results. Our TSP allotment gained +0.20%. For comparison, the Dow gained +1.33%, the Nasdaq +1.33%, and the S&P 500 +1.36%.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/F, but won’t hesitate to move back into stocks should we get a buy signal in any of our equity based funds. Our allocation is now +1.26% on the year not including today’s results. Here are the latest posted results:

| 06/30/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

15.0543 |

17.8874 |

28.6282 |

36.1915 |

23.2664 |

| $ Change |

0.0008 |

-0.0020 |

0.3827 |

0.5606 |

0.2164 |

| % Change day |

+0.01% |

-0.01% |

+1.35% |

+1.57% |

+0.94% |

| % Change week |

+0.03% |

+0.56% |

+3.06% |

+2.51% |

+2.67% |

| % Change month |

+0.15% |

+1.80% |

+0.26% |

-0.13% |

-3.33% |

| % Change year |

+0.93% |

+5.50% |

+3.87% |

+2.71% |

-3.44% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

18.0331 |

23.586 |

25.5015 |

27.04 |

15.278 |

| $ Change |

0.0465 |

0.1364 |

0.2058 |

0.2531 |

0.1620 |

| % Change day |

+0.26% |

+0.58% |

+0.81% |

+0.94% |

+1.07% |

| % Change week |

+0.66% |

+1.40% |

+1.91% |

+2.20% |

+2.45% |

| % Change month |

+0.11% |

-0.12% |

-0.31% |

-0.43% |

-0.58% |

| % Change year |

+1.46% |

+1.63% |

+1.75% |

+1.76% |

+1.68% |

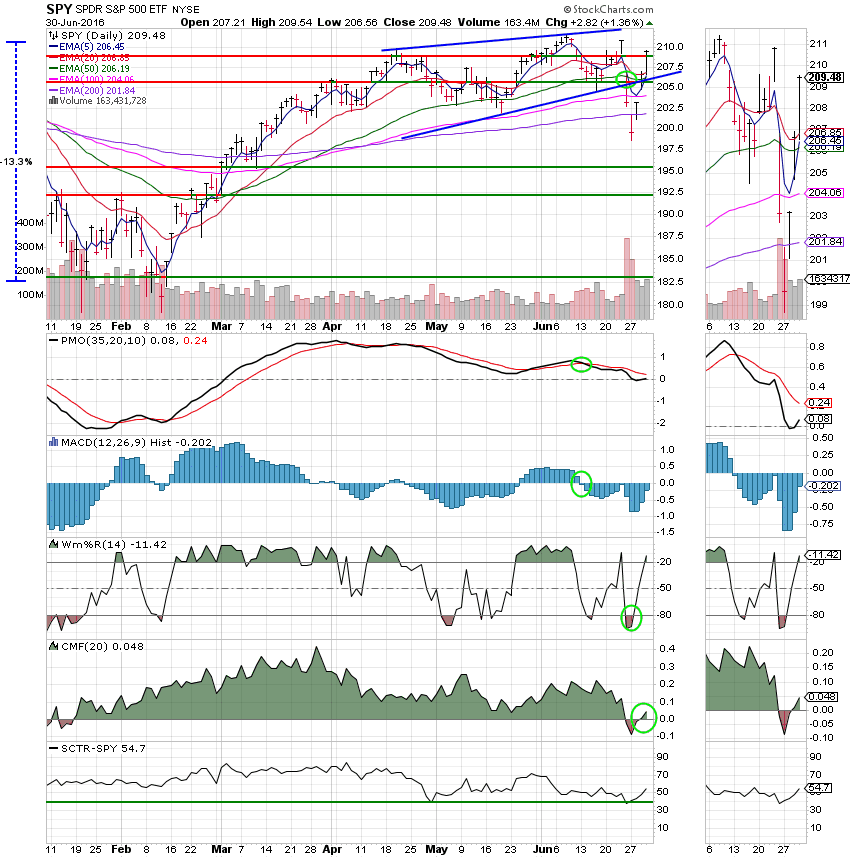

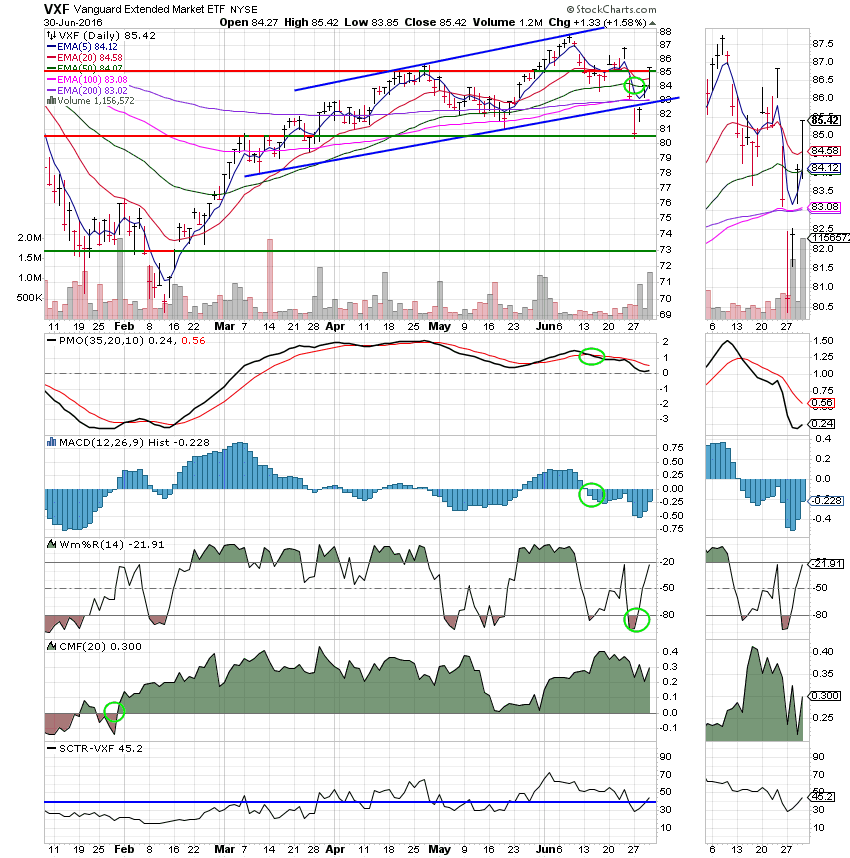

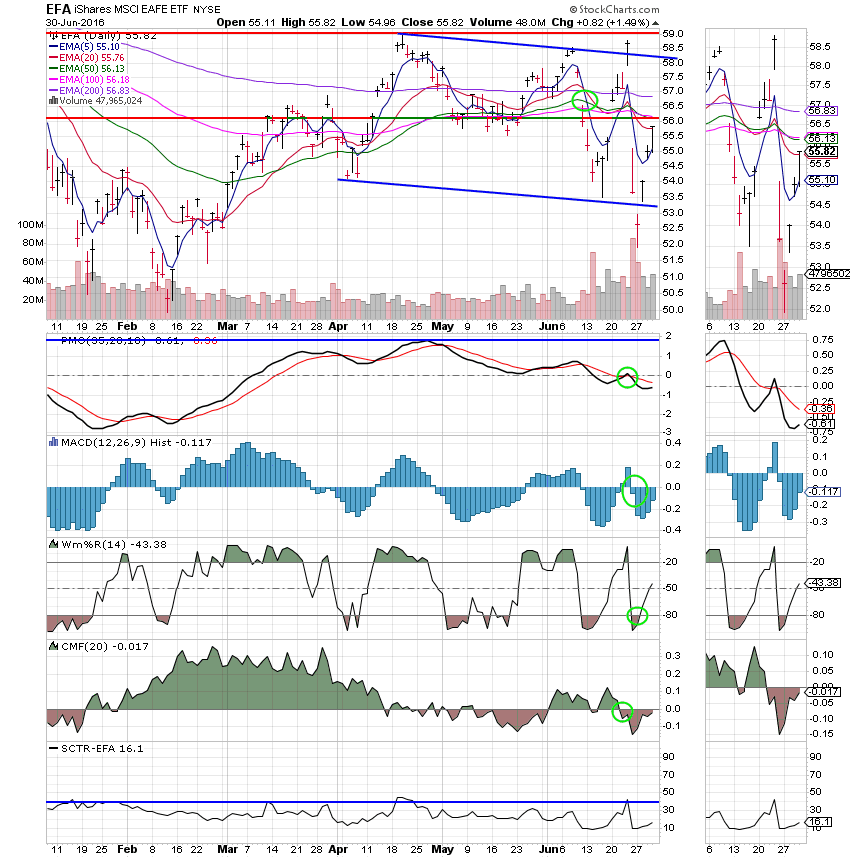

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The 5 EMA whipsawed back through the 50 EMA, but neither the PMO or MACD have confirmed the move. Therefore, we will remain on the sidelines until one or both of those indicators move into a positive configuration.

S Fund: The same situation here as in the C Fund. The 5 EMA whipsawed back through the 50 EMA, but neither the PMO or MACD have confirmed the move. Therefore, we will remain on the sidelines until one or both of those indicators move into a positive configuration.

I Fund: Still a sell for now. It is simple, there are no indicators in a positive configuration…..

F Fund: Price remains above the upper trend line. It may be starting a steeper rate of ascent. The PMO is running into resistance at a little over .4, but is showing no sign of slowing down. One has to ask, if bonds are so healthy then how long can stocks run or vici versa…….Something has to give! Could this be signaling more downside for stocks?????

We took defensive action moving into bonds and now the market appears to be moving back up without us. So why not jump right back in? There is no buy signal in the C, S , or I funds just yet. They simply have a lot of damage to repair before that can happen. That said, they have made a lot of progress in a short time and it appears that the C or S or both could generate a buy signal in the next few sessions. Perhaps as early as tomorrow. So again, why not jump in?? If there is no buy signal, the risk of some more downside is greater than if all the indicators were in positive configurations. Also, while the market is rising a lot of the stocks and ETF’s that are moving up are of a defensive nature such as utilities or bonds. Usually, when defensive issues move up, it is a signal that stocks will move down. They will never move together for long. One will move up and the other will move down. For this reason, I’m still a little nervous about moving money back into stocks ahead of solid buy signals. Perhaps tomorrow will give us some more clarity. Keep your eye’s on the charts and pray for God’s guidance. I said this many times before and I’ll probably say it many times again. He has never let this group down before. Not even once. Give Him all the praise! Have a nice 4th of July holiday and remember. Freedom isn’t free.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.